Quantum Networking Market Size, Share, Trends, Industry Analysis Report: By Offering (Hardware, Software, Quantum Key Distribution (QKD) System, Quantum Random Number Generator (QRNG), Quantum Memory, Quantum Repeater, and Others), End-user Industry, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 117

- Format: PDF

- Report ID: PM5059

- Base Year: 2023

- Historical Data: 2019-2022

Quantum Networking Market Overview

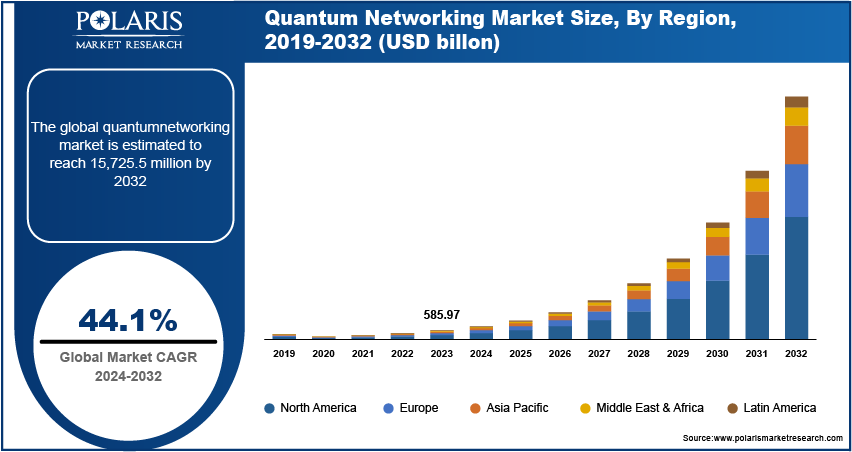

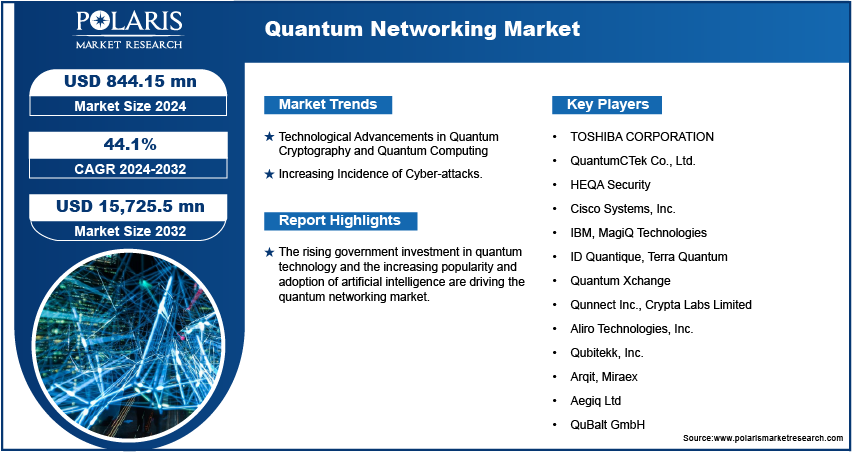

Global quantum networking market size was valued at USD 585.97 million in 2023. The market is projected to grow from USD 844.15 million in 2024 to USD 15725.5 million by 2032, exhibiting a CAGR of 44.1% during the forecast period.

Quantum networking is a field that utilizes the principles of quantum mechanics to offer computation and secure communication across distributed systems. This emerging technology is used to enable the transmission of quantum information, or qubits, over long distances, creating a "quantum internet."

The rising government investment in quantum technology is driving the quantum networking market. Governments worldwide are increasingly recognizing the strategic importance of quantum technologies for national security, economic competitiveness, and technological leadership, which encourages them to allocate funds to quantum research programs. This financial support fills the gap between theoretical research and practical applications, making it easier for companies and institutions to develop and deploy quantum networking solutions. For instance, the US National Science Foundation announced that it is investing USD 39 million to help grow quantum research activities at more institutions across America.

To Understand More About this Research: Request a Free Sample Report

The quantum networking market is driven by the increasing popularity and adoption of artificial intelligence. AI applications generally involve processing and analyzing vast amounts of data to train models and make predictions. This data-intensive nature of AI requires high computational power and efficient data-handling capabilities. Quantum computing, with its potential to perform complex calculations at faster speeds, significantly accelerates AI model training and data analysis. Quantum networks play a crucial role in facilitating these advanced computations by enabling distributed quantum computing. Thus, the rising popularity and adoption of artificial intelligence are expanding the global market.

Quantum Networking Market Drivers

Technological Advancements in Quantum Cryptography and Quantum Computing

Market CAGR for quantum networking is being driven by technological advancements in quantum cryptography and quantum computing. Advancements in quantum cryptography and quantum computing enhance the capabilities and applications of quantum networks, driving innovation and addressing new challenges in data security and computational power. These advancements create a need for robust, high-performance quantum networks that support and leverage the benefits of these emerging technologies.

Increasing Incidence of Cyber-attacks

Increasing incidence of cyber-attacks across the globe is estimated to expand the market in the coming years. Cyber-attacks highlight the urgent need for more secure and resilient communication systems. This encourages organizations to seek advanced technologies that offer enhanced protection against data breaches, interception, and unauthorized access. Quantum networking, with its tight security through quantum key distribution (QKD) and other quantum encryption methods, directly addresses these growing concerns. Therefore, as the number of cyber-attacks rises, the demand for quantum networking also increases. For instance, according to a published report, around 236.1 million ransomware attacks occurred globally in the first half of 2022.

Quantum Networking Market Segment Insights

Quantum Networking Market Breakdown by Offering Insights

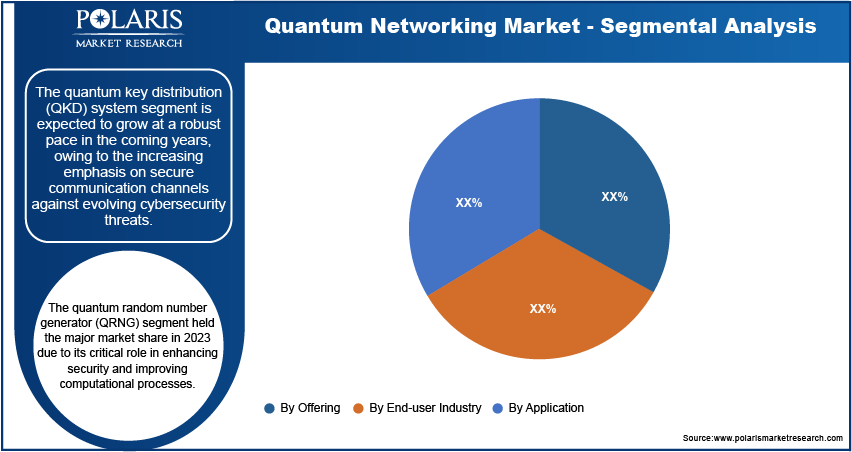

Based on the offering, the global quantum networking market is categorized into hardware, software, quantum key distribution (QKD) systems, quantum random number generators (QRNG), quantum memory, quantum repeaters, and others. The quantum random number generator (QRNG) segment held the major market share in 2023. It holds the largest share due to its critical role in enhancing security, improving computational processes, and supporting advancements in various technology sectors such as information technology, telecommunications, consumer electronics, cybersecurity, and others. Additionally, the rising popularity of quantum computing and the associated need for advanced cryptographic techniques further fuels the demand for QRNGs. Quantum computers potentially break classical encryption algorithms, necessitating new approaches to secure data transmission and storage. QRNGs offer a solution by enabling the generation of cryptographic keys that are secure against quantum attacks.

The quantum key distribution (QKD) system segment is also expected to grow at a robust pace in the coming years, owing to the increasing emphasis on secure communication channels against evolving cybersecurity threats. QKD systems offer superior security by utilizing quantum principles to create encryption keys that are difficult to duplicate and intercept. Moreover, the development of cost-effective and scalable QKD solutions is driving the segment growth.

Quantum Networking Market Breakdown by End-User Industry Insights

In terms of end-user industry, the global quantum networking market is divided into aerospace & defense, banking & finance, government & defense, healthcare & life sciences, IT & telecom, energy & utilities, manufacturing, and others. The government & defense segment accounted for a largest market share in 2023. Quantum networking offers wide security features that are highly attractive to government and defense organizations. It utilizes quantum key distribution (QKD), which enables the secure transmission of encryption keys based on the principles of quantum mechanics. This level of security encourages the government & defense sector to adopt quantum networking for protecting classified information and sensitive national security data from cyber threats.

The IT & telecom segment is projected to grow at a significant CAGR during the forecast period owing to the critical need for advanced communication technologies to support its vast and growing infrastructure. The IT and telecom industries benefit from the advanced security features provided by quantum communication technologies, such as quantum key distribution, which offers a high level of protection against data breaches and cyber threats.

Quantum Networking Regional Insights

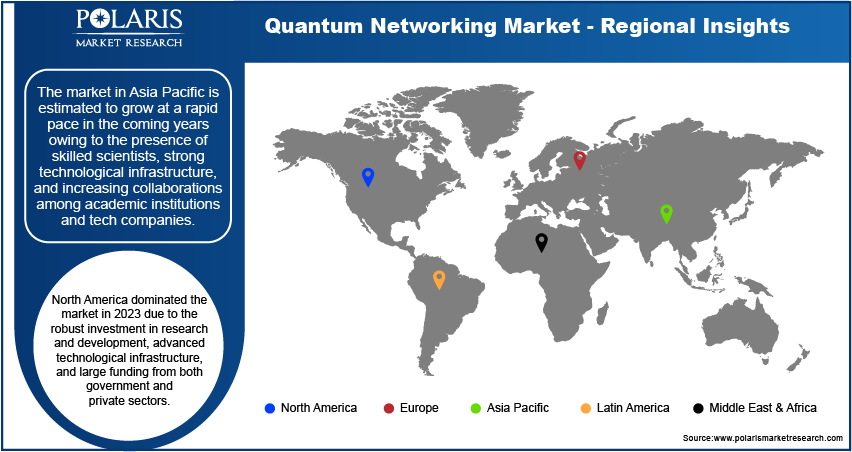

By region, the study provides the quantum networking market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2023 due to the robust investment in research and development, advanced technological infrastructure, and large funding from both government and private sectors. The US emerged as the dominant country in the region owing to its major role in developing quantum technologies, bolstered by significant contributions from both Silicon Valley-based tech giants and prestigious research institutions such as MIT and Harvard. Additionally, a highly skilled workforce has propelled rapid advancements and implementations of quantum networking solutions in the region.

The market in Asia Pacific is estimated to grow at a rapid pace in the coming years owing to the presence of skilled scientists, strong technological infrastructure, and increasing collaborations among academic institutions and tech companies. China’s aggressive quantum technology strategy, represented by its national plan to lead in quantum research and its substantial financial commitments, positions it as a key player in the evolving landscape. Additionally, the growing interest and investments in quantum technologies from both government and private sectors across several countries, such as India, Japan, and Australia, are expected to enhance the region's market share. For instance, the government of India approved the investment of Rs 6003.65 crore on April 19, 2023, in the National Quantum Mission (NQM) for eight years.

Quantum Networking Key Market Players & Competitive Insights

Key market players are investing heavily in research and development in order to expand their offerings, which will help the quantum networking market grow even more. These market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the quantum networking industry must offer innovative solutions.

The quantum networking market is fragmented, with the presence of numerous global and regional market players. The players are leveraging extensive resources and customer bases to enhance quantum networking capabilities. Major players in the quantum networking market include TOSHIBA CORPORATION; QuantumCTek Co., Ltd.; HEQA Security; Cisco Systems Inc.; IBM, MagiQ Technologies; ID Quantique; Terra Quantum; Quantum Xchange; Qunnect Inc.; Crypta Labs Limited; Aliro Technologies, Inc.; Qubitekk, Inc.; Arqit, Miraex; Aegiq Ltd; and QuBalt GmbH.

HEQA Security, formerly known as QuantLR, is an Israel-based cybersecurity company that specializes in securing data communication using quantum key distribution (QKD) technology. The company operates at the intersection of quantum computing and cybersecurity, aiming to provide robust defenses against both current and emerging cyber threats. In April 2024, HEQA Security signed a major collaboration agreement with Bezeq, Israel's major telecommunications group, to address future quantum hacking threats.

TOSHIBA CORPORATION, founded in 1939 through the merger of Shibaura Seisaku-sho and Tokyo Denki, is a Japan-based multinational conglomerate headquartered in Minato, Tokyo. Toshiba started research into quantum cryptography in 1999 at its Cambridge research laboratory in the UK. The company was the first to announce successful quantum key distribution over 100 km of fiber. In September 2023, Toshiba officially opened a cutting-edge Quantum Technology Centre in the UK.

List of Key companies in Quantum Networking Market

- TOSHIBA CORPORATION

- QuantumCTek Co., Ltd.

- HEQA Security

- Cisco Systems, Inc.

- IBM

- MagiQ Technologies

- ID Quantique

- Terra Quantum

- Quantum Xchange

- Qunnect Inc.

- Crypta Labs Limited

- Aliro Technologies, Inc.

- Qubitekk, Inc.

- Arqit

- Miraex

- Aegiq Ltd

- QuBalt GmbH

Quantum Networking Industry Developments

January 2024: Cisco Systems, Inc., a US-based multinational digital communications technology conglomerate, announced a new quantum networking collaboration with Nu Quantum, a UK startup. The collaboration will help Cisco become a prospective end-user for “Lyra,” a project that aims to deliver the world's first “Quantum Networking Unit” (QNU.)

August 2024: Terra Quantum, a major quantum technology company based in Germany and Switzerland, announced the launch of TQ42 cryptography, an open-source post-quantum cryptography library for secure data transmission, storage, and authentication.

December 2023: IBM, a multinational corporation specializing in computer technology and information technology consulting, expanded its quantum network with the launch of IBM Quantum Heron and IBM Quantum System Two.

Quantum Networking Market Segmentation

By Offering Outlook (Revenue, USD billion, 2019 - 2032)

- Hardware

- Software

- Quantum Key Distribution (QKD) System

- Quantum Random Number Generator (QRNG)

- Quantum Memory

- Quantum Repeater

- Others

By End-user Industry Outlook (Revenue, USD billion, 2019 - 2032)

- Aerospace & Defense

- Banking & Finance

- Government & Defense

- Healthcare & Life Sciences

- IT & Telecom

- Energy & Utilities

- Manufacturing

- Others

By Application Outlook (Revenue, USD billion, 2019 - 2032)

- Secure Communication

- Distributed Quantum Computing

- Quantum Sensing and Metrology

- Quantum Clock Synchronization

- Secure Voting

- Secure Financial Transaction

By Regional Outlook (Revenue, USD billion, 2019 - 2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Quantum Networking Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 585.97 million |

|

Market Size Value in 2024 |

USD 844.15 million |

|

Revenue Forecast in 2032 |

USD 15,725.58 million |

|

CAGR |

44.1% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global quantum networking market size was valued at USD 585.97 million in 2023 and is projected to grow to USD 15,725.5 million by 2032.

The global market is expected to exhibit a CAGR of 44.1% during the forecast period.

North America had the largest share of the global market.

The key players in the market are TOSHIBA CORPORATION; QuantumCTek Co., Ltd.; HEQA Security; Cisco Systems, Inc.; IBM, MagiQ Technologies; ID Quantique; Terra Quantum; Quantum Xchange; Qunnect Inc.; Crypta Labs Limited; Aliro Technologies, Inc.; Qubitekk, Inc.; Arqit; Miraex; Aegiq Ltd; and QuBalt GmbH.

The quantum key distribution (QKD) system segment is projected for significant growth in the global market.

The government & defense segment dominated the quantum networking market in 2023.