Quantum Key Distribution Market Size, Share, Trends, Industry Analysis Report: By Offering, Type, Transmission Medium (Fiber-Optic Cable Transmission and Satellite-Based Transmission), Organization Size, Application, Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Feb-2025

- Pages: 129

- Format: PDF

- Report ID: PM5384

- Base Year: 2024

- Historical Data: 2020-2023

Quantum Key Distribution Market Overview

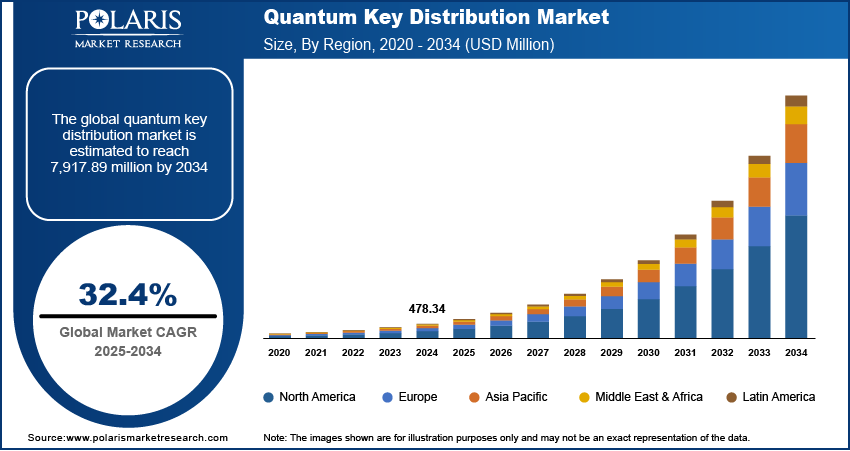

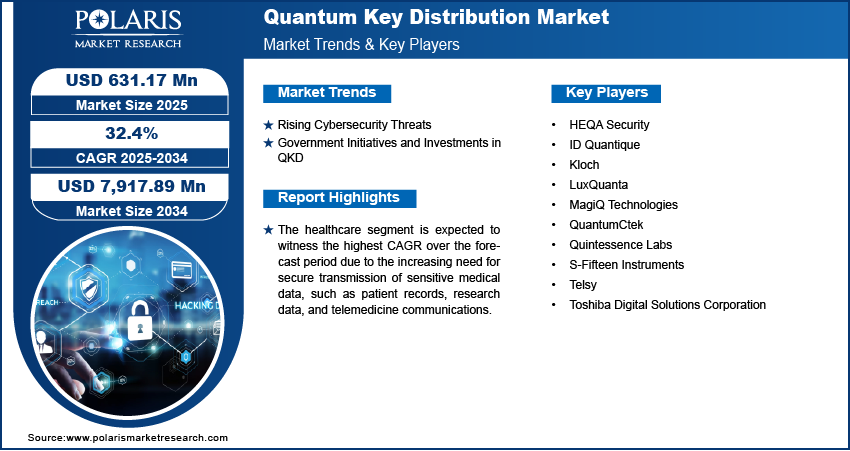

Quantum key distribution market size was valued at USD 478.34 million in 2024 and is expected to reach USD 631.17 million by 2025 and 7,917.89 million by 2034, exhibiting a CAGR of 32.4% during the forecast period.

The quantum key distribution (QKD) market focuses on technologies and solutions enabling secure communication through quantum mechanics principles. QKD ensures the transmission of encryption keys with enhanced security, making it crucial for protecting sensitive data in sectors such as finance, defense, and telecommunications.

The banking, financial services, and insurance (BFSI) sector, which requires high levels of data security, is increasingly adopting QKD to safeguard sensitive financial transactions. This is significantly propelling the quantum key distribution market expansion. National security concerns are also driving the adoption of QKD to ensure secure communication in defense and military applications, further driving market demand.

To Understand More About this Research: Request a Free Sample Report

The rollout of 5G networks, which require robust security measures, is creating opportunities for QKD integration into telecommunications infrastructure. This shift towards robust security measures is pivotal in the market growth. Furthermore, innovations in satellite-based quantum key distribution systems enable secure long-distance quantum communication, thereby fueling quantum key distribution market growth.

Quantum Key Distribution Market Dynamics

Rising Cybersecurity Threats

The rising frequency of cyberattacks is driving the demand for quantum-safe encryption, making quantum key distribution (QKD) a crucial solution for secure communication. In 2024, Russian cyberattacks on Ukraine surged by nearly 70%, totaling 4,315 incidents targeting critical infrastructure, including government services, the energy sector, and defense agencies. According to Ukraine’s cybersecurity agency, these attacks aimed at data theft and operational disruptions using tactics such as malware, phishing, and account compromises. This growing threat landscape is accelerating the adoption of QKD solutions across industries, expanding its market share. As organizations increasingly prioritize robust data security, the quantum key distribution market is experiencing substantial growth, shaping its overall market dynamics.

Government Initiatives and Investments in QKD

Governments globally are prioritizing quantum communication infrastructure and funding extensive research programs. For instance, in January 2025, the European Space Agency and the European Commission partnered on the European Quantum Communication Infrastructure, concluding negotiations and initiating development. EuroQCI is an advanced network utilizing quantum mechanics to secure personal data and critical infrastructure, employing techniques such as quantum key distribution to enhance the security of Europe's digital landscape. These efforts are enhancing national security initiatives and public-private partnerships and accelerating the adoption of QKD solutions across various sectors, thereby fueling the quantum key distribution market development.

Quantum Key Distribution Market Segment Insights

Quantum Key Distribution Market Assessment by Transmission Medium Outlook

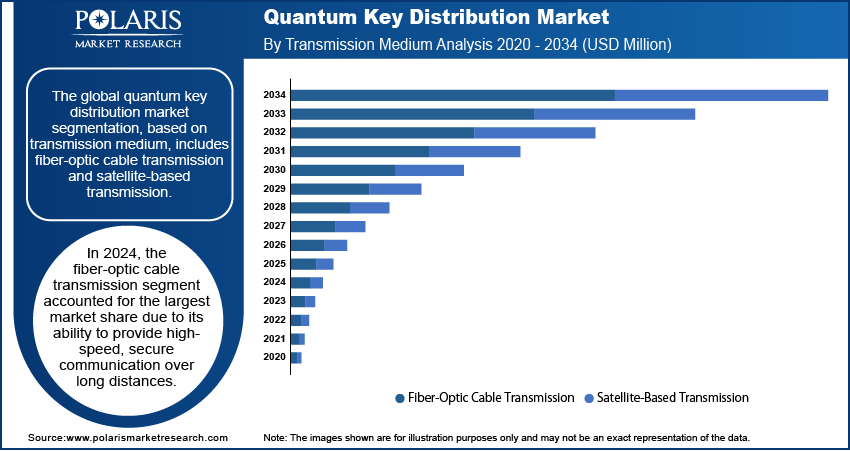

The global quantum key distribution market segmentation, based on transmission medium, includes fiber-optic cable transmission and satellite-based transmission. In 2024, the fiber-optic cable transmission segment accounted for the largest market share due to its ability to provide high-speed, secure communication over long distances. Fiber-optic cables offer low signal loss, high bandwidth, and immunity to electromagnetic interference, making them ideal for quantum key distribution systems. This reliability and efficiency in transmitting quantum keys securely have made fiber-optic cables the preferred choice for implementing QKD solutions in various industries.

Quantum Key Distribution Market Evaluation by Vertical Outlook

The global quantum key distribution market segmentation, based on vertical, includes BFSI, government & defense, healthcare, IT & ITES, automotive, energy & utilities, and other verticals. The healthcare segment is expected to witness the highest CAGR over the forecast period due to the increasing need for secure transmission of sensitive medical data, such as patient records, research data, and telemedicine communications. QKD offers robust encryption, ensuring that healthcare organizations protect confidential information from cyber threats. The increasing digital integration of healthcare systems and the growing volume of sensitive data are driving the importance of quantum key distribution in safeguarding data privacy and ensuring compliance with regulatory standards. This critical role of QKD is expected to lead to its rapid adoption within the healthcare sector.

Quantum Key Distribution Market Regional Analysis

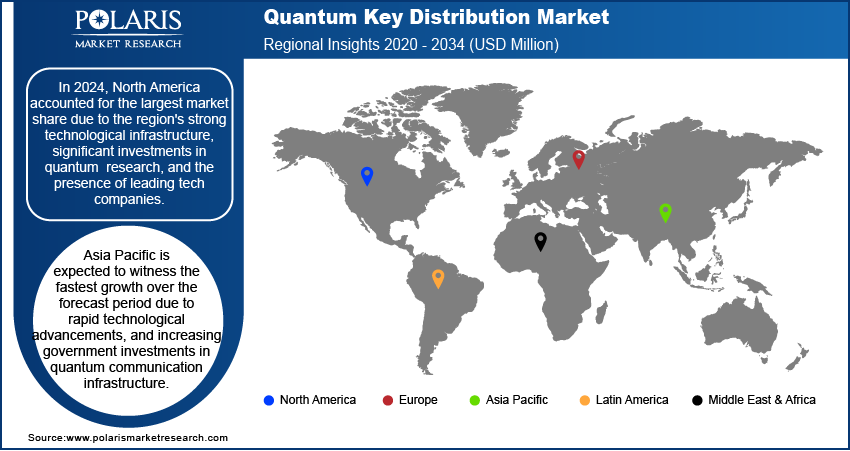

By region, the study provides quantum key distribution market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share due to the region's strong technological infrastructure, significant investments in quantum research, and the presence of leading tech companies. Additionally, increasing cybersecurity concerns, especially within sectors such as defense, finance, and healthcare, are propelling the demand for secure communication solutions including quantum key distribution. North America's supportive government initiatives, including funding for quantum technology development, further contribute to the region's dominance in the QKD market. For instance, in 2024, the US Senate launched the National Quantum Initiative Reauthorization Act, proposing USD 2.7 billion in grant over five years to offer practical quantum technology applications for national safety and economic competitiveness.

Asia Pacific is expected to witness the fastest growth over the forecast period due to rapid technological advancements, increasing government investments in quantum communication infrastructure, and a growing focus on enhancing cybersecurity across industries. Additionally, the region's strong emphasis on digital transformation, particularly in sectors such as banking, telecommunications, and defense, is driving the adoption of QKD solutions. For instance, Southeast Asia's digital transformation has led to an 82% rise in cybercrime from 2021 to 2022, significantly impacting the vulnerable underbanked population. The growing interest in securing critical communication networks, alongside the rise of quantum research initiatives, further accelerates quantum key distribution market in Asia Pacific.

Quantum Key Distribution Market Key Players & Competitive Analysis Report

The competitive landscape of the quantum key distribution industry is dynamic, with a blend of established industry leaders and emerging players striving to push the boundaries of quantum communication technologies. Major companies such as ID Quantique and Toshiba Corporation, dominate the market, leveraging their substantial R&D resources to develop advanced QKD solutions. These players are focused on improving the scalability, efficiency, and security of QKD systems while expanding their applications across industries such as defense, banking, and telecommunications. Additionally, established firms, a growing number of startups, and innovators are exploring niche solutions, such as satellite-based QKD, to capture emerging opportunities. Strategic partnerships and collaborations are key to accelerating innovation, with companies joining forces with governments, academic institutions, and tech firms to advance quantum research and infrastructure. The growing threat of quantum computing to traditional encryption methods is driving the demand for quantum-safe encryption, leading to heightened competition in the quantum key distribution market. Regions such as Asia Pacific are experiencing a surge in investments and expansions as stakeholders prioritize the development and deployment of secure quantum communication solutions. This evolving competitive landscape reflects the growing significance of QKD in securing critical communication networks and safeguarding sensitive data.

ID Quantique is engaged in quantum detection systems and quantum-safe security. The company was founded in 2001 and is headquartered in Geneva, Switzerland. ID Quantique's product portfolio includes quantum-safe network encryption, quantum key distribution systems, single photon counters, and hardware random number generators. The company provides services such as quantum-safe security solutions for data protection, photon counting solutions, and random number generation for various industries. ID Quantique is engaged in Quantum Key Distribution (QKD), upgrading existing network encryption products to ensure they are "quantum-safe." This protects sensitive data into the future, when quantum computers render conventional encryption algorithms vulnerable.

Toshiba Digital Solutions provides IT services for the manufacturing industry. The company was founded in 2003 and is based in Kanagawa, Japan. Toshiba Digital Solutions' service portfolio includes IoT services for the manufacturing industry, GridDB, factory IoT platform, and distributed co-simulation platform. Toshiba Digital Solutions utilizes IoT, artificial intelligence, and other digital technologies, as well as work in quantum technologies to support global business development.

Key Companies in Quantum Key Distribution Market

- HEQA Security

- ID Quantique

- Kloch

- LuxQuanta

- MagiQ Technologies

- QuantumCtek

- Quintessence Labs

- S-Fifteen Instruments

- Telsy

- Toshiba Digital Solutions Corporation

Quantum Key Distribution Market Developments

January 2025: Thales Alenia Space and Hispasat have initiated the development of a pioneering quantum key distribution (QKD) system specifically designed for operation from geostationary orbit. This innovative project aims to leverage the unique attributes of geostationary satellites to enhance secure communication by implementing advanced quantum cryptographic techniques.

September 2024: Boeing to launch the Q4S satellite in 2026 to present quantum entanglement changing in space. This mission aims to advance the development of a secure global quantum internet, enabling connectivity among quantum sensors and computers and paving the way for future innovations in quantum communication.

November 2023: The Infocomm Media Development Authority (IMDA) of Singapore engaged SpeQtral and SPTel to collaborate on the development of Singapore's inaugural nationwide quantum-safe network, designated NQSN+. SpeQtral and SPTel utilize advanced technology from Toshiba to enhance the network's security and resilience against quantum computing threats.

Quantum Key Distribution Market Segmentation

By Offering Outlook (Revenue USD Million 2020 - 2034)

- Solutions

- Services

By Type Outlook (Revenue USD Million 2020 - 2034)

- Multiplexed QKD Systems

- Long-Distance QKD Systems

By Transmission Medium Outlook (Revenue USD Million 2020 - 2034)

- Fiber-Optic Cable Transmission

- Satellite-Based Transmission

By Organization Size Outlook (Revenue USD Million 2020 - 2034)

- SMES

- Large Enterprises

By Application Outlook (Revenue USD Billion 2020 - 2034)

- Network Security

- Data Encryption

- Secure Communication

- Others

By Vertical Outlook (Revenue USD Million 2020 - 2034)

- BFSI

- Government & Defense

- Healthcare

- IT & ITES

- Automotive

- Energy & Utilities

- Other Verticals

By Regional Outlook (Revenue USD Million 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Quantum Key Distribution Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 478.34 million |

|

Market Size Value in 2025 |

USD 631.17 million |

|

Revenue Forecast in 2034 |

USD 7,917.89 million |

|

CAGR |

32.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global quantum key distribution market size was valued at USD 478.34 million in 2024 and is projected to grow to USD 7,917.89 million by 2034.

• The global market is projected to register a CAGR of 32.4% during the forecast period.

• In 2024, North America accounted for the largest market share due to the region's strong technological infrastructure, significant investments in quantum research, and the presence of leading tech companies.

• Some of the key players in the market are HEQA Security, ID Quantique, Kloch, LuxQuanta, MagiQ Technologies, QuantumCtek, Quintessence Labs, S-Fifteen Instruments, Telsy, Toshiba Digital Solutions Corporation.

• In 2024, the fiber-optic cable transmission segment accounted for the largest market share due to its ability to provide high-speed, secure communication over long distances.

• The healthcare segment is expected to witness the highest CAGR over the forecast period due to the increasing need for secure transmission of sensitive medical data, such as patient records, research data, and telemedicine communications.