Quantum Computing Software Market Share, Size, Trends, Industry Analysis Report, By Component (Solutions, Services); By Technology (Superconducting Qubits, Trapped Ions, Quantum Annealing, Other Technologies); By Application; By End-Use, By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2202

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

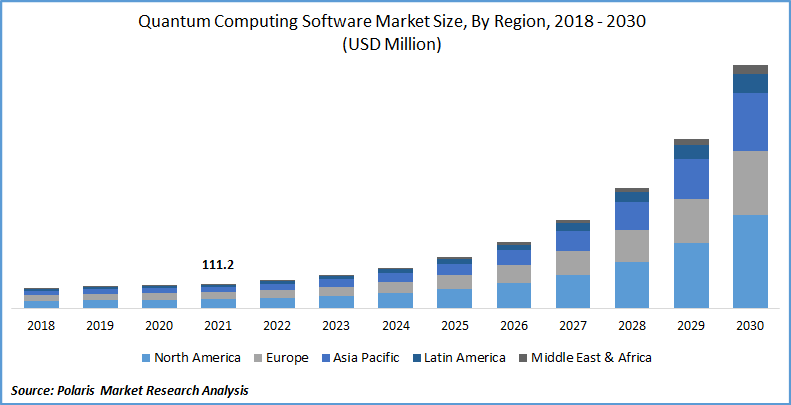

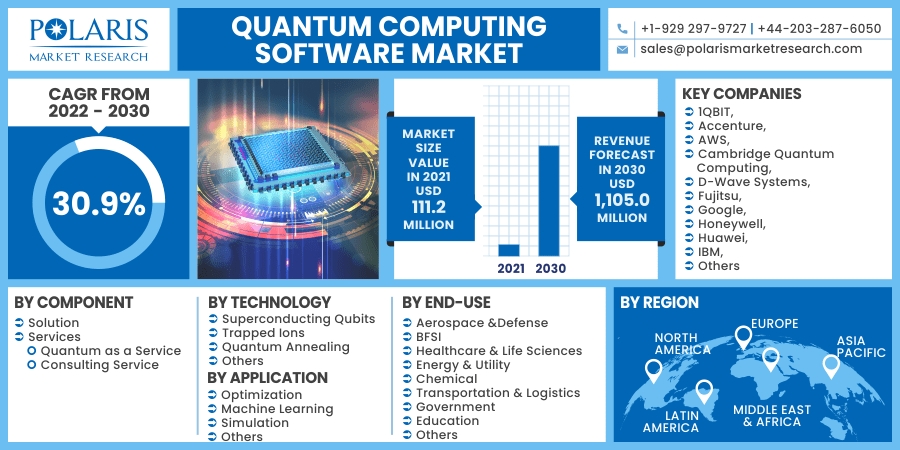

The global quantum computing software market was valued at USD 111.2 million in 2021 and is expected to grow at a CAGR of 30.9% during the forecast period. The market is primarily driven by technical innovations. Due to the obvious increased use of computing software’s in drug development, demand for this equipment and services is likely to rise after COVID-19. Besides, the growth in the quantum computing software market is being driven by the rising adoption of this software in the BFSI segment.

Know more about this report: request for sample pages

The industry is rising exponentially in the banking, financial services, and insurance (BFSI) sector, where corporations concentrate their efforts on accelerating commercial activity, transactions, and data management. This technology contributes to the identification of effective and efficient risk management strategies. When traditional computers are employed in financial institutions, large solutions' processing time and costs can rise massively. At the same time, supercomputers can carry out operations faster and at lower costs, resulting in cost savings and the creation of new income opportunities.

Further, financial institutions using these technologies are likely to see huge gains. Quantum computing's potential value in the financial services sector involves offering appropriate and essential cybersecurity solutions to protect users' financial data utilizing next-generation cryptography. Additionally, with the help of these software’s, detecting fraudulent actions by detecting consumer behavior patterns is improving, leading to proactive fraud risk management.

However, these systems in real-time applications face various technological obstacles. As any interaction with the environment can shut down the state function, these computers are vulnerable. These factors have caused a split between research laboratories, investment firms, and the enterprise environment, which is projected to impede the global market's growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The quantum computing software market has observed extensive developments in the last few decades, supported by various factors such as the rising demand for these software and solutions by various industries and the major players' strategies. The major players' strategies include partnerships, collaborations, mergers and acquisitions, product launches, R&D investment, expansion of geographical location, and technology-based software launches, which drive the quantum computing software market growth.

Further, in July 2021, QuantWare, a Dutch organization, has introduced its commercial superconductivity processor for quantum computers (QPU). This software can dramatically increase the quantity of data that computers can handle, which might have tremendous consequences in industries like artificial intelligence, medicine, business intelligence, and cybersecurity.

Besides, in the same month, Zapata Computing, a premier corporate software company specializing in quantum-classical applications, has announced the establishment of a legal entity in the United Kingdom (UK). With this, Zapata is expected to work coherently with the Industrial Strategy Challenge Fund (ISCF), the Department of Trade and Industry, and the National Quantum Computing Centre (NQCC), as well as local universities and enterprise customers, which are restricted by export control legislation or driven by the UK government. Thus, the various strategies adopted by the major players across the globe have boosted the industry growth during the forecast period.

Report Segmentation

The market is primarily segmented based on component, technology, application, end-use, and region.

|

By Component |

By Technology |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by End-Use

Based on the end-use, the healthcare and life sciences segment is expected to be the most significant revenue contributor in the global industry in 2021 and is expected to retain its dominance in the foreseen period. The benefits associated with the healthcare solution is the factor driving the industry growth. Scientists can use this software to create ultra-precise and individualized medicinal and diagnostic instruments. These sensors can also make ultra-precise measurements in magnetic resonance imaging (MRI) devices. These advancements have the potential to improve the quality of healthcare services.

Geographic Overview

In terms of geography, North America had the largest revenue share. The expansion in North America can be ascribed to the presence of the market's top companies; quantum computing solutions and services are also seeing greater use in the region's aerospace and defense, chemical, and financial services industries. The significant player's adoption of various strategies in the North American market, such as partnerships, rising investments in software launches, collaborations, mergers and acquisitions, and product launches, is also a factor driving the market's growth.

For instance, in November 2021, Quantinuum, a product of a collaboration between Cambridge Quantum, a British business specializing in quantum software and operating systems, and Honeywell Quantum Solutions (HQS), a division of Honeywell that specializes in creating these computers, has been launched. Quantinuum will be owned by Honeywell to the tune of 54%, with the rest held by Cambridge Quantum's investors. In addition, the American giant would invest USD 270 million in the company. Thus, the region's major players' presence and strategies drive market growth during the forecast period.

Moreover, APAC has projected to witness a high CAGR in the global market. This increase can be attributed to the rise in the investment for digital transformation, adoption of advanced technologies, and the private, public players initiatives in the emerging economies.

Emerging-market governments are aggressively supporting advances in these applications. The country's government is expected to use these software to address large and complicated problems and challenges in molecular modeling, machine learning, physics, material sciences, chemical simulations, data finding, and other areas.

Competitive Insight

Some of the major players operating in the global market include 1QBIT, Accenture, AWS, Cambridge Quantum Computing, D-Wave Systems, Fujitsu, Google, Honeywell, Huawei, IBM, Microsoft, QC Ware, Rigetti Computing, Riverlane, Zapata Computing, among others.

Quantum Computing Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 111.2 million |

|

Revenue forecast in 2030 |

USD 1,105.0 million |

|

CAGR |

30.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Technology, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

1QBIT, Accenture, AWS, Cambridge Quantum Computing, D-Wave Systems, Fujitsu, Google, Honeywell, Huawei, IBM, Microsoft, QC Ware, Rigetti Computing, Riverlane, Zapata Computing |