Quantum-Behavior AI Training Market Size, Share, Trends, Industry Analysis Report: By Component (Hardware, Software, and Services), Technology, Deployment Mode, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5447

- Base Year: 2024

- Historical Data: 2020-2023

Quantum-Behavior AI Training Market Overview

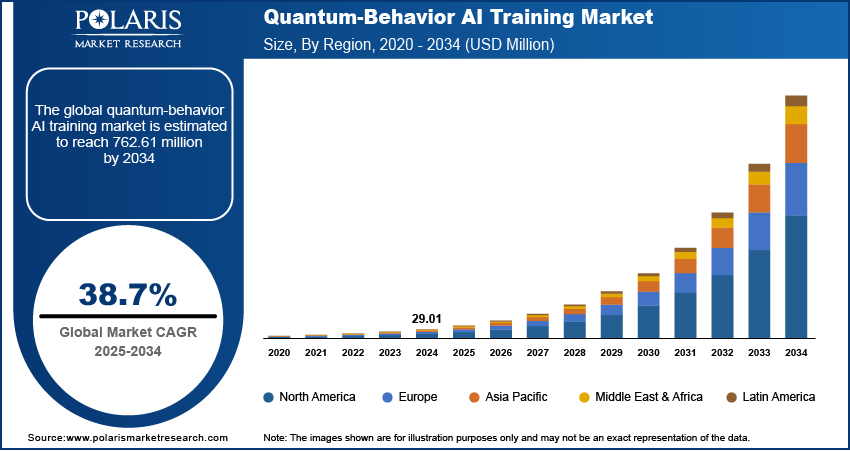

The global quantum-behavior AI training market size was valued at USD 29.01 million in 2024 and is expected to reach USD 40.14 million by 2025 and 762.61 million by 2034, exhibiting a CAGR of 38.7% during 2025–2034.

The quantum-behavior AI training market focuses on integrating quantum computing with behavioral AI training to enhance machine learning models, optimize decision-making processes, and improve AI adaptability. This market encompasses hardware, software, and services that leverage quantum mechanics to advance AI training methodologies.

Growing investments in quantum AI research & development contribute to the quantum-behavior AI training market expansion. Additionally, the rising demand for high-speed AI model training is boosting the market demand. Traditional AI models face scalability challenges as datasets are growing exponentially. Quantum computing reduces training times for deep learning models from weeks to hours, improving AI efficiency, which propels the quantum-behavior AI training market demand.

To Understand More About this Research: Request a Free Sample Report

The growing application of Quantum AI in cybersecurity and fraud prevention is significantly influencing the quantum-behavior AI training market development. Additionally, AI-driven behavioral insights play a vital role in financial risk assessment, fraud detection, and the analysis of consumer behavior. As a result, the increased adoption of AI in behavioral analysis and decision intelligence is contributing to the market growth.

Quantum-Behavior AI Training Market Dynamics

Government Initiatives & Regulations Supporting Quantum AI Development

Several countries are recognizing the strategic importance of quantum computing and AI and are actively investing in research, infrastructure, and policy frameworks to establish a competitive edge in this emerging sector. Governments across the globe are allocating multi-billion-dollar budgets toward Quantum AI research and development (R&D) through national strategies such as the US National Quantum Initiative, the European Quantum Flagship, China’s Quantum Infrastructure Plan, and Japan’s Moonshot AI Project. These large-scale funding efforts are significantly supporting startups, research institutions, and tech giants in developing next-generation quantum-powered AI models. Thus, the rising government initiatives and regulation supporting Quantum AI development boost the quantum-behavior AI training market development.

Technological Advancements in Quantum Computing

Businesses and research institutions continue to push the boundaries of quantum mechanics. The next-generation AI training models are becoming more powerful, efficient, and capable of mimicking human behavior with exceptional accuracy. Moreover, developments in quantum processors, qubit stability, and hybrid quantum-classical computing systems are enabling faster, more complex AI model training. Companies such as IBM, Google, Rigetti, and D-Wave are making substantial investments in quantum chip innovation, leading to higher qubit counts, improved coherence times, and reduced error rates, all of which are essential for real-world AI applications. In November 2024, IBM launched its most sophisticated Quantum Computing Systems, accelerating scientific advancements and progress toward achieving quantum advantage. Therefore, the rapid technological advancements in quantum computing are expected to provide lucrative quantum-behavior AI training market opportunities during the forecast period.

Quantum-Behavior AI Training Market Segment Insights

Quantum-Behavior AI Training Market Assessment by Component Outlook

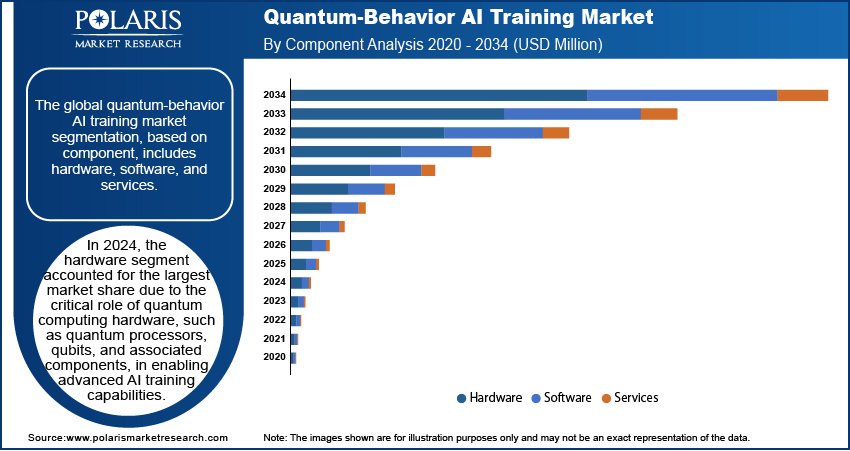

The global quantum-behavior AI training market segmentation, based on component, includes hardware, software, and services. In 2024, the hardware segment accounted for the largest share due to the critical role of quantum computing hardware, such as quantum processors, qubits, and associated components, in enabling advanced AI training capabilities. Significant investments and technological advancements by leading companies such as IBM, Google, and Rigetti Computing have propelled the development of powerful quantum processors, enhancing qubit stability, coherence, and scalability. These developments have been pivotal in executing complex quantum computations, thereby significantly influencing the performance and capabilities of Quantum AI systems.

Quantum-Behavior AI Training Market Evaluation by End-Use Industry Outlook

The global quantum-behavior AI training market segmentation, based on end-use industry, includes BFSI, healthcare, aerospace, manufacturing, government & public sector, and others. In 2024, the BFSI segment accounted for the largest market share due to the industry's urgent need for advanced risk assessment, fraud detection, and high-frequency trading optimization. Financial institutions are leveraging Quantum AI-powered behavioral analysis to detect anomalous transaction patterns, predict market fluctuations, and improve personalized customer services. Banks and insurers are investing heavily in quantum-trained AI models to enhance security, fraud prevention, and regulatory compliance with cyber threats evolving rapidly. Thus, the significant demand for real-time behavioral AI analytics and sophisticated financial modeling is propelling the growth of the BFSI segment.

Quantum-Behavior AI Training Market Regional Analysis

By region, the study provides quantum-behavior AI training market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share due to its strong technological infrastructure, significant government funding, and dominance of key industry players. The region is home to leading quantum computing companies, such as IBM, Google, Microsoft, and Rigetti Computing, which are driving rapid advancements in Quantum AI research, hardware development, and cloud-based quantum services. Additionally, substantial investments from both the public and private sectors are accelerating the adoption of Quantum AI technologies across industries, including finance, healthcare, and defense.

The US government’s National Quantum Initiative Act and multi-billion-dollar funding programs are supporting research institutions and businesses in developing quantum-enhanced AI models for behavioral analysis, cybersecurity, and predictive analytics. For instance, in December 2024, four senators introduced legislation to allocate USD 2.7 billion in federal funding through fiscal year 2029 for quantum research and development at agencies such as the National Institute of Standards and Technology, the National Science Foundation, and NASA. Thus, such initiatives boost the North America quantum-behavior AI training market expansion.

The Asia Pacific quantum-behavior AI training market is expected to witness significant growth during the forecast period due to increasing government investments, rapid advancements in AI and quantum computing, and rising adoption across key industries. Countries such as China, Japan, South Korea, and India are heavily investing in quantum research and AI-driven technologies, aiming to establish global leadership in the field. China, in particular, has launched multi-billion-dollar quantum initiatives, such as the Quantum Science Satellite (Micius) and the National Laboratory for Quantum Information Sciences, which are accelerating the integration of Quantum AI in cybersecurity, finance, and smart city development. Moreover, Japan and South Korea are leading in quantum semiconductor innovations, while India is making progress through its National Quantum Mission and partnerships with global tech firms. The expansion of cloud-based Quantum AI services, supported by companies such as Alibaba, Baidu, and Fujitsu, is also lowering barriers to entry in the market, enabling more businesses to leverage quantum-powered AI training solutions.

Quantum-Behavior AI Training Market – Key Players & Competitive Analysis Report

The quantum-behavior AI training market is characterized by intense competition, with major technology giants, quantum computing startups, and AI-driven enterprises investing heavily in research, development, and commercialization of quantum-powered AI training solutions. The market is dominated by a few key players, including IBM, Google Quantum AI, Microsoft, D-Wave, Rigetti Computing, and Amazon Web Services (AWS), all of which are pioneering advancements in Quantum Machine Learning (QML), hybrid quantum-classical AI systems, and cloud-based quantum services. Additionally, a growing number of startups and specialized AI firms are entering the market, focusing on quantum-assisted behavioral AI models, predictive analytics, and cybersecurity applications. Companies such as Xanadu, IonQ, Zapata Computing, and QC Ware are actively developing Quantum AI software platforms that integrate cognitive AI, emotion recognition, and behavioral learning algorithms. These firms are increasingly forming strategic partnerships with cloud providers and research institutions to expand their reach and enhance technological capabilities. The market is also witnessing a surge in government-backed collaborations, where national research institutes and AI firms are working together to accelerate Quantum AI adoption. Public-private partnerships (PPPs) and venture capital (VC) investments are fueling the quantum-behavior AI training market growth, allowing emerging players to compete with established tech giants. Competitive strategies include innovations in qubit technology, quantum neural networks, and AI-driven quantum security solutions, which are expected to shape the future of the industry.

International Business Machines Corp. (IBM) is a multinational technology company engaged in providing hybrid cloud, AI, and consulting solutions and services. IBM’s specialties include system hardware and software, along with infrastructure, hosting, and consulting services. The company was founded in 1911 and headquartered in New York, US, and has a presence in over 175 countries. Its product portfolio includes mainframe computers (IBM z series), microprocessors, and quantum computers. The services provided by IBM encompass cloud, networking, security, technology consulting, application services, business resilience services, and technology support services. IBM serves various industries, including automotive, banking and financial markets, healthcare, and manufacturing. It is also involved in Quantum Computing, introducing its first commercial quantum computer, the IBM Q System One, in January 2019. Furthermore, in March 2020, IBM announced the construction of Europe’s first quantum computer in Ehningen, Germany. The company is investing in the design of neural chips that mimic the human brain. IBM offers a course titled "An Introduction to Quantum Machine Learning" for its Quantum Network partners, focusing on integrating quantum computing with AI training.

Rigetti Computing, Inc., is engaged in creating the next generation of computing technology by combining quantum computing with classical computing. The company is headquartered in California, US. Rigetti specializes in designing, manufacturing, and deploying full-stack quantum computing systems. These systems offer an integration of quantum and classical computing resources, allowing for hybrid solutions. The company’s processor components improved readout abilities that contribute to better overall circuit fidelities. The computing platform is based on Quil, Rigetti’s custom instruction language. Rigetti has operated quantum computers and serves global customers in finance, pharmaceuticals, insurance, defense, and energy. Its newest flagship quantum computer, the 84-qubit Ankaa-3, features a hardware redesign that enables performance. Rigetti Computing, Inc. offers quantum-behavior AI training, leveraging quantum computing to enhance machine learning models. This approach improves optimization, pattern recognition, and problem-solving capabilities beyond classical AI techniques, driving advanced computational efficiencies.

List of Key Companies in Quantum-Behavior AI Training Market

- Alibaba Cloud

- Amazon Web Services (AWS)

- D-Wave Systems

- Fujitsu

- Google Quantum AI

- Honeywell Quantum Solutions

- IBM

- IonQ

- Microsoft

- QC Ware

- Rigetti Computing

- Xanadu

- Zapata Computing

Quantum-Behavior AI Training Industry Developments

In October 2024, ORCA Computing launched the PT-2, an advanced photonic quantum system that enhances its PT Series.

In November 2024, NVIDIA enhanced the design of Google’s Quantum AI processor through advanced quantum device physics simulation.

Quantum-Behavior AI Training Market Segmentation

By Component Outlook (Revenue – USD Million, 2020–2034)

- Hardware

- Software

- Services

By Technology Outlook (Revenue – USD Million, 2020–2034)

- QML

- Behavioral AI Modeling

- Hybrid AI-Quantum Computing

By Deployment Mode Outlook (Revenue – USD Million, 2020–2034)

- On-Premises

- Cloud-Based

By End-Use Industry Outlook (Revenue – USD Million, 2020–2034)

- BFSI

- Healthcare

- Aerospace

- Manufacturing

- Government & Public Sector

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Quantum-Behavior AI Training Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 29.01 million |

|

Market Size Value in 2025 |

USD 40.14 million |

|

Revenue Forecast by 2034 |

USD 762.61 million |

|

CAGR |

38.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 29.01 million in 2024 and is projected to grow to USD 762.61 million by 2034.

The global market is projected to register a CAGR of 38.7% during the forecast period.

In 2024, North America accounted for the largest share due to its strong technological infrastructure, significant government funding, and dominance of key industry players.

A few of the key players in the market are Alibaba Cloud, Amazon Web Services (AWS), D-Wave Systems, Fujitsu, Google Quantum AI, Honeywell Quantum Solutions, IBM, IonQ, Microsoft, QC Ware, Rigetti Computing, Xanadu, and Zapata Computing.

In 2024, the hardware segment accounted for the largest market share due to the critical role of quantum computing hardware, such as quantum processors, qubits, and associated components, in enabling advanced AI training capabilities.

In 2024, the BFSI segment accounted for the largest market share due to the industry’s urgent need for advanced risk assessment, fraud detection, and high-frequency trading optimization.