Purging Compound Market Size, Share, Trends, Industry Analysis Report: By Type (Mechanical Purging, Chemical Purging, and Liquid Purging), Process, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 128

- Format: PDF

- Report ID: PM5217

- Base Year: 2024

- Historical Data: 2020-2023

Purging Compound Market Overview

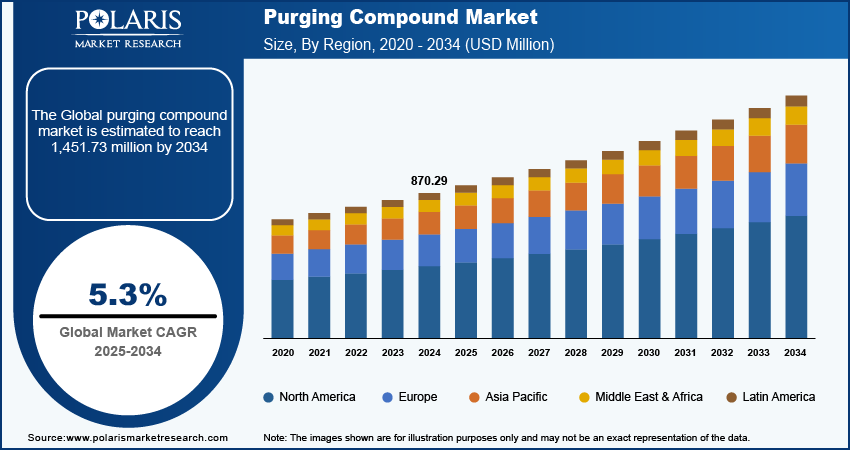

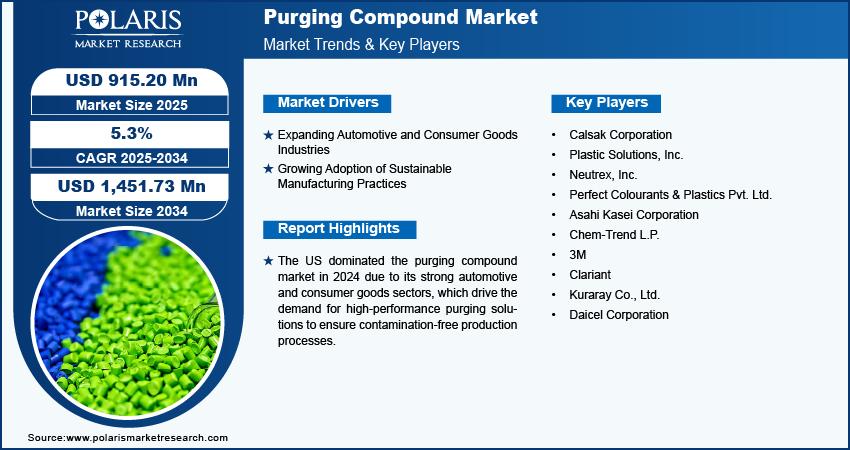

The purging compound market size was valued at USD 870.29 million in 2024. The market is projected to grow from USD 915.20 million in 2025 to USD 1,451.73 million by 2034, exhibiting a CAGR of 5.3% during 2025–2034.

A purging compound is a specialized cleaning material used to remove contaminants, residual polymers, carbon buildup, and color deposits from plastic processing equipment such as injection molding machines, extruders, and blow molding machines.

The increased use of multi-material and specialty polymers, such as polycarbonate, PEEK, and nylon, is driving demand for purging compounds. High-performance polymers require precise transitions to prevent contamination, buildup, or defects. Purging compounds ensure smooth operation by clearing residues, minimizing downtime, and maintaining product quality during frequent material changes, which contributes to the purging compound market growth. Furthermore, industries are embracing lightweight and customization, leading to frequent material changes and greater use of diverse polymers. This drives demand for purging compounds to prevent contamination; it ensures smooth transitions and reduces downtime, further fueling market expansion.

Growth in extrusion and blow molding applications is driving demand for purging compounds. Extrusion processes are more prevalent in packaging and industrial applications. Purging compounds are vital for preventing downtime caused by polymer deposits. Thus, there is a rising demand for purging compounds in extrusion and blow molding applications. Moreover, technological advancements and innovations in purging compounds, such as hybrid mechanical-chemical purging solutions, enable more thorough cleaning, even at higher temperatures, improving their efficiency across diverse applications. Thus, the increasing innovation is driving the purging compound market expansion.

To Understand More About this Research: Request a Free Sample Report

Purging Compound Market Driver Analysis

Expanding Automotive and Consumer Goods Industries

The expanding automotive sector relies heavily on advanced polymers for components such as dashboards, headlight covers, and trims, requiring contamination-free production. According to the Marklines, in the US, sales for passenger cars and light commercial vehicles combined reached 11.695 million units from January to September 2023, which increased to 11.766 million units sold in 2024. The expanding automotive sector is increasingly adopting purging compounds. Similarly, in the consumer goods sector, where frequent color and material changes are essential for customization, purging compounds play a crucial role in minimizing defects and waste. Thus, expanding automotive and consumer goods industries drive the purging compound market growth.

Growing Adoption of Sustainable Manufacturing Practices

The growing emphasis on sustainable manufacturing practices is significantly boosting the demand for purging compounds. In July 2024, the Healey-Driscoll administration allocated USD 10.28 million in grants to 13 enterprises as part of the Massachusetts Manufacturing Innovation Initiative, aimed at promoting sustainable alternatives to conventional manufacturing practices. Manufacturers are increasingly prioritizing waste reduction and carbon footprint minimization, aiming to lower material scrap during the purging process. Advanced purging compounds play a crucial role in this effort by reducing the amount of resin needed for effective cleaning, which enhances efficiency and supports sustainability goals. Additionally, the rise in popularity of biodegradable and recyclable purging compounds aligns with the industry’s environmentally responsible practices. As companies seek solutions that contribute to their sustainability initiatives, the market for purging compounds expands.

Purging Compound Market Segment Analysis

Purging Compound Market Breakdown by Type Outlook

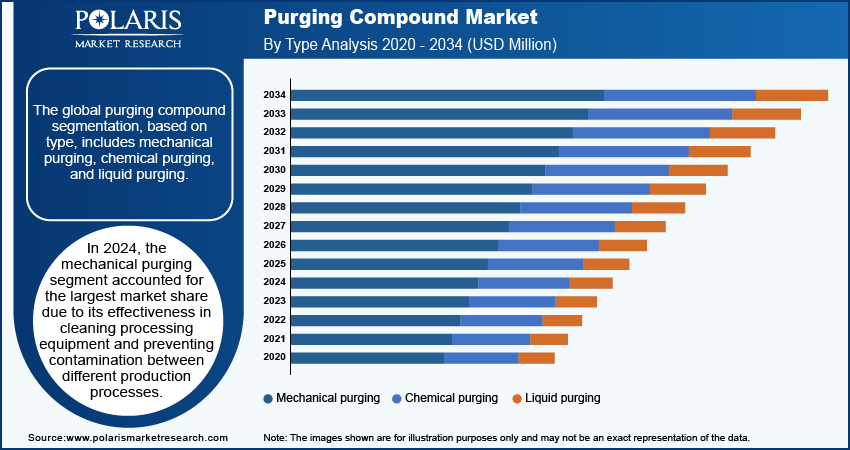

The global purging compound market segmentation, based on type, includes mechanical purging, chemical purging, and liquid purging. In 2024, the mechanical purging segment accounted for the largest market share due to its effectiveness in cleaning processing equipment and preventing contamination between different production processes. Mechanical purging compounds utilize harsh action to remove residual materials, ensuring a thorough cleanse of machinery used in various applications, such as injection molding and extrusion. Furthermore, the increasing demand for efficiency and quality in manufacturing processes, where minimizing downtime and maintaining product integrity is crucial, is propelling the segment growth.

Purging Compound Market Breakdown by Process Outlook

The global purging compound market, based on process, is segmented into extrusion, injection molding, and blow molding. The injection molding segment is expected to register the highest CAGR during the forecast period due to the rising demand for high-quality, precise plastic components across various industries, including automotive, consumer goods, and medical devices. This growth is fueled by advancements in injection molding technologies, which enable greater efficiency, reduced cycle times, and enhanced production capabilities. Additionally, the increasing trend toward customization and lightweighting is driving manufacturers to adopt injection molding for producing complex shapes and designs with reduced material waste. Companies strive to meet evolving consumer preferences and regulatory requirements, which propels the demand for purging compounds in injection molding.

Purging Compound Market Breakdown by Regional Outlook

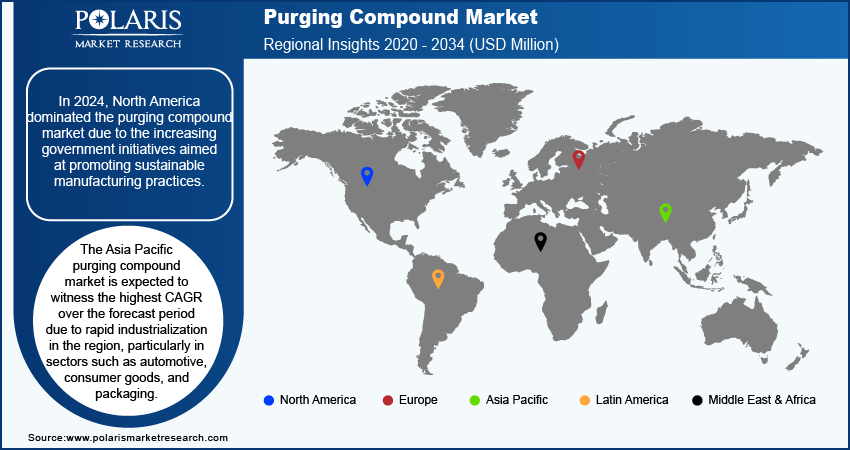

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the purging compound market due to the increasing government initiatives aimed at promoting sustainable manufacturing practices and reducing environmental impact. In September 2024, the US Department of Energy allocated USD 3 million to launch a new initiative aimed at enhancing and expanding the workforce dedicated to industrial decarbonization efforts across America. This funding is intended to support skilled labor in the transition to sustainable industrial practices, facilitating the reduction of carbon emissions in various sectors. These initiatives encourage industries to adopt efficient production methods that minimize waste and energy consumption, leading to increased adoption of purging compounds as a key component of operational efficiency.

The US dominated the North America purging compound market share due to its strong automotive and consumer goods sectors, which drive the demand for high-performance purging solutions to ensure contamination-free production processes.

The Asia Pacific purging compound market is expected to witness the highest CAGR during the forecast period. Rapid industrialization in the region, particularly in sectors such as automotive, consumer goods, and packaging, is driving increased manufacturing activities, which, in turn, boosts demand for efficient purging solutions to maintain production quality. Additionally, the growing demand for high-performance polymers necessitates effective purging compounds to prevent contamination and defects during production processes.

The China purging compound market is expected to grow significantly during the forecast period due to the growing automotive sector, particularly with the rising popularity of electric vehicles (EVs). According to the China Association of Automobile Manufacturers (CAAM), in 2023, China’s automotive exports experienced a remarkable year-on-year increase of 57.9%, reaching an unprecedented total of 4.91 million vehicles. As the automotive industry in China evolves, manufacturers are increasingly adopting advanced polymers and innovative production techniques to meet the growing demand for lightweight, efficient, and high-performance components. The shift toward EVs necessitates the use of specialized materials that require precise handling and cleaning during manufacturing processes, driving the demand for effective purging compounds across the country.

Purging Compound Market – Key Players and Competitive Insights

The competitive landscape of the purging compound market is characterized by a diverse range of manufacturers and suppliers competing for market share through innovation, product differentiation, and strategic partnerships. Major players in the industry focus on developing advanced formulations that enhance cleaning efficiency and minimize material waste, investing heavily in research and development to create high-performance solutions tailored for specific applications, such as high-temperature processing. Additionally, companies are differentiating their products by incorporating sustainable materials, such as biodegradable and recyclable purging compounds, to align with the growing emphasis on environmental responsibility and comply with emerging regulations. Strategic partnerships with raw material suppliers and technology providers enhance market presence, allowing companies to leverage specialized expertise and improve product quality.

Calsak Corporation; Plastic Solutions, Inc.; Neutrex, Inc.; Perfect Colourants & Plastics Pvt. Ltd.; Asahi Kasei Corporation; Chem‑Trend L.P.; 3M; Clariant; Kuraray Co., Ltd.; and Daicel Corporation are a few key purging compound market players.

Asahi Kasei is a Japanese company engaged in the manufacturing, development, and distribution of chemicals across the globe. The company operates in three major sectors—materials, healthcare, and household. These segments are further segmented into sub-segments such as material is further divided into basic materials, specialty solutions, electronics, and performance products. The household segment deals in construction materials and healthcare into pharmaceutical drugs. Asahi Kasei Plastics North America and Asahi Kasei Asaclean Americas, renowned suppliers of advanced purging compounds and concentrates, have officially merged. The newly formed entity operates under the name APNA and will be headquartered in Fowlerville, Michigan. This consolidation aims to enhance operational efficiencies and expand market reach in the purging solutions sector.

3M is a manufacturer and distributor of industrial products and solutions. The company’s portfolio of products includes advanced materials, display materials and systems, homecare, home improvement, stationery and office, personal safety, roofing granules, closure and masking systems, and others. 3M also offers various solutions such as medical, oral care, consumer health care, food safety, and health information systems. The company serves customers in various industries such as automotive, electronics, healthcare, safety, energy, and consumer. 3M Scotch-Weld Purge Material 3756 is an engineered hot melt designed specifically to purge polyurethane reactive thermoset adhesives from bulk dispensing systems. This formulation effectively cleans and clears the equipment, ensuring optimal performance and minimizing cross-contamination between different adhesive applications.

Key Companies in the Purging Compound Industry Outlook

- Calsak Corporation

- Plastic Solutions, Inc.

- Neutrex, Inc.

- Perfect Colourants & Plastics Pvt. Ltd.

- Asahi Kasei Corporation

- Chem‑Trend L.P.

- 3M

- Clariant

- Kuraray Co., Ltd.

- Daicel Corporation

Purging Compound Industry Developments

In March 2024, PolySource partnered with Asaclean to distribute their purging compounds in the US. The collaboration enhances the availability and technical support of Asaclean’s products, providing plastics manufacturers access to high-quality materials backed by PolySource’s renowned customer service.

Purging Compound Market Segmentation

By Type Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Mechanical Purging

- Chemical Purging

- Liquid Purging

By Process Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- Extrusion

- Injection Molding

- Blow Molding

By Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Purging Compound Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 870.29 Million |

|

Market Size Value in 2025 |

USD 915.20 Million |

|

Revenue Forecast by 2034 |

USD 1,451.73 Million |

|

CAGR |

5.3% from 2024 to 2032 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global purging compound market size was valued at USD 870.29 million in 2024 and is projected to grow to USD 1,451.73 million by 2034.

The global market is projected to register a CAGR of 5.3% during the forecast period

In 2024, North America dominated the market due to the increasing government initiatives aimed at promoting sustainable manufacturing practices.

A few key players in the market are Calsak Corporation; Plastic Solutions, Inc.; Neutrex, Inc.; Perfect Colourants & Plastics Pvt. Ltd.; Asahi Kasei Corporation; Chem?Trend L.P.; 3M; Clariant; Kuraray Co., Ltd.; and Daicel Corporation.

In 2024, the mechanical purging segment dominated the market share due to its effectiveness in cleaning processing equipment and preventing contamination between different production processes.

The injection molding segment is expected to witness highest CAGR over the forecast period due to the rising demand for high-quality, precise plastic components across various industries.