Public Safety and Security Market Size, Share, Trends, Industry Analysis Report: By Solution; Service; Application; Deployment (On-premises and Cloud); Software Type; and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 114

- Format: PDF

- Report ID: PM5119

- Base Year: 2023

- Historical Data: 2019-2022

Public Safety and Security Market Overview

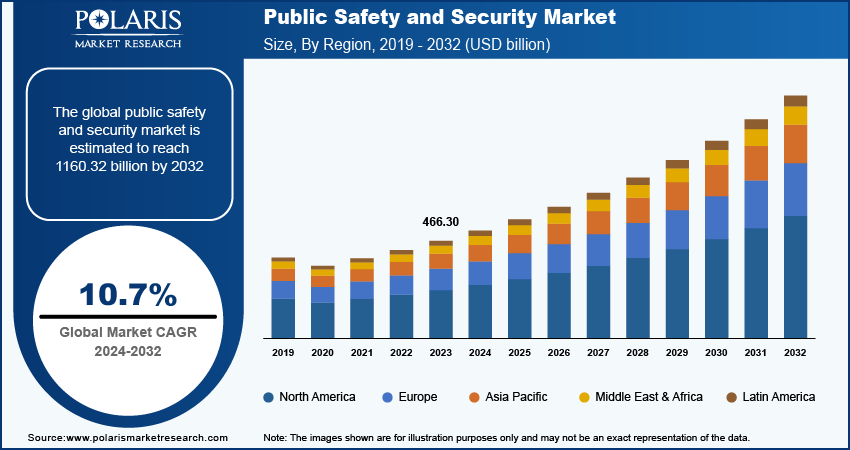

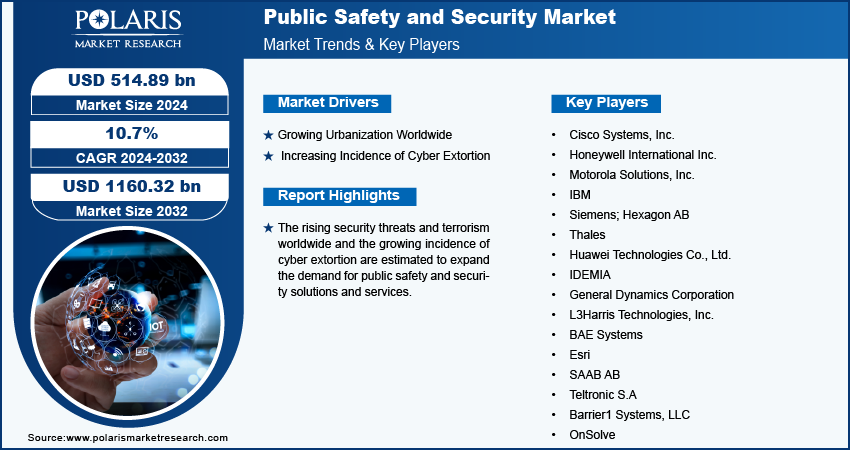

The public safety and security market size was valued at USD 466.30 billion in 2023. The market is projected to grow from USD 514.89 billion in 2024 to USD 1,160.32 billion by 2032, exhibiting a CAGR of 10.7% from 2024 to 2032.

Public safety and security are fundamental components of societal stability, encompassing a broad range of measures designed to protect individuals and communities from harm. These concepts primarily focus on the prevention of events that could endanger public well-being, including crime, natural disasters, and health emergencies. Public safety is often managed by governmental bodies at various levels, such as local, regional, and national, ensuring that citizens are safeguarded against threats that may lead to injury or property damage.

The growing digitalization across the globe is driving the public safety and security market. The potential for cyberattacks and data breaches rises as more systems and devices become interconnected through the Internet of Things (IoT). This necessitates enhanced security measures to protect sensitive information, propelling the adoption of safety and security solutions or tools.

The rising security threats and terrorism worldwide are anticipated to expand the demand for public safety and security solutions and services. Rising threats necessitate comprehensive emergency response plans and drills, which include training for first responders, developing crisis communication strategies, and establishing protocols for various scenarios. This increases the adoption of public safety and security solutions, such as critical communication networks and others, to protect public spaces and critical infrastructure.

To Understand More About this Research: Request a Free Sample Report

The public safety and security market is further propelled by the rising advancements in technology. Innovations in video surveillance, such as high-definition cameras and facial recognition systems, enable real-time monitoring and identification of suspects, deterring criminal activity. Additionally, advanced data analytics and artificial intelligence process large volumes of data to identify patterns, predict criminal behavior, and optimize resource allocation for law enforcement and emergency services. This encourages law enforcement and emergency services agencies to adopt technologically advanced solutions.

Public Safety and Security Market Drivers

Growing Urbanization Worldwide

Market CAGR for public safety and security is being driven by the growing urbanization worldwide. As per a report published by the World Bank, 56% of the world's population lives in cities today, and the number is expected to reach 68% by 2050. Increased population density in urban areas often leads to higher crime rates. This necessitates enhanced policing and security measures to ensure safety and maintain order. Urban environments are further hotspots for protests, demonstrations, and other public gatherings. Effective crowd control and emergency response measures become essential in this environment, driving demand for specialized training and solutions.

Increasing Incidence of Cyber Extortion

The rising incidence of cyber extortion is expected to drive market growth in the coming years. Companies and governments are increasingly prioritizing employee and public training to help recognize phishing attempts and other tactics employed by cybercriminals. This heightened threat is leading to a growing demand for training programs and resources. For instance, a report from the Internet Crime Complaint Center (IC3) revealed that a new extortion tactic emerged in 2022, where threat actors pressured victims to pay by threatening to publish stolen data if the ransom was not paid.

Public Safety and Security Market Segment Insights

Public Safety and Security Market Breakdown by Solution Insights

Based on solution analysis, the public safety and security market is divided into critical communication networks, C2/C4isr system, biometric security and authentication system, surveillance system, scanning and screening system emergency and disaster management, cyber-security, public address and general alarm, and backup and recovery system. The critical communication networks segment accounted for a major market share in 2023 due to the increasing demand for reliable and resilient communication systems among public safety agencies. Organizations prioritize the need for uninterrupted communication channels as urbanization continues to rise and natural disasters become more frequent. The advancements in LTE (Long-Term Evolution) technology and the growing adoption of 5G networks significantly enhance the efficiency and speed of communication, enabling first responders to coordinate effectively during emergencies. Furthermore, governments and agencies worldwide are investing heavily in modernizing their infrastructure to meet stringent safety regulations, leading to substantial growth in this segment.

The cyber-security segment is estimated to grow at a robust pace in the coming years, owing to the ongoing digital transformation across various sectors. The rise in data breaches and ransomware attacks underscores the urgent need for robust cybersecurity solutions to protect sensitive information and critical infrastructure. Additionally, regulatory frameworks such as the General Data Protection Regulation (GDPR) and the increasing emphasis on data privacy are compelling organizations to adopt advanced cybersecurity measures. Investments in AI-driven threat detection and response systems further enhance the capability to mitigate risks, positioning cybersecurity as a base of future public safety strategies.

Public Safety and Security Market Breakdown by Deployment Insights

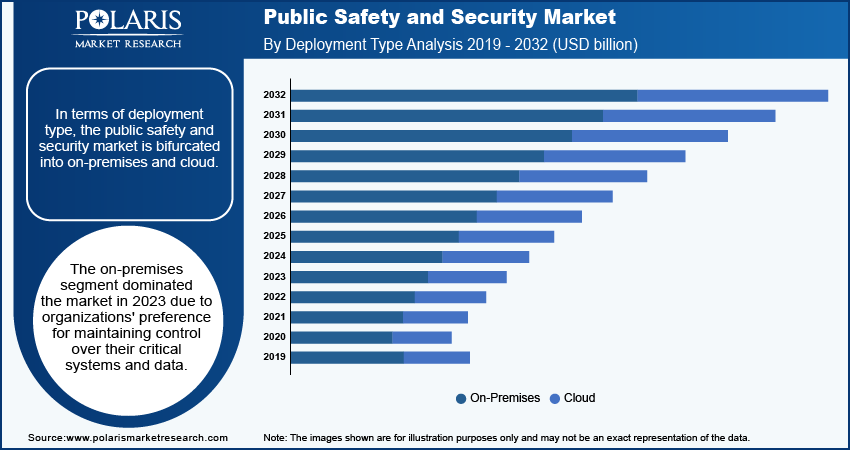

In terms of deployment, the public safety and security market is bifurcated into on-premises and cloud. The on-premises segment dominated the market in 2023 due to organizations' preference for maintaining control over their critical systems and data. Many public safety agencies prioritize security and reliability, which often leads them to favor on-premises solutions that provide greater oversight and reduced vulnerability to external threats. The ongoing need for real-time data processing and communication during emergencies further contributes to the demand for on-premises systems, as these setups offer enhanced performance and stability in high-pressure situations.

The cloud segment is projected to grow at a rapid pace from 2024 to 2032, owing to its scalability, cost-effectiveness, and ease of access. Cloud technologies facilitate collaboration among various agencies and departments, improving response times and coordination. Public safety organizations recognize the advantages of integrating cloud capabilities, such as advanced analytics and AI-driven insights, into their operations as they embrace digital transformation. This trend, combined with the increasing emphasis on remote work and data sharing, positions cloud deployment as a vital component of future strategies in the market.

Public Safety and Security Market Breakdown by Regional Insights

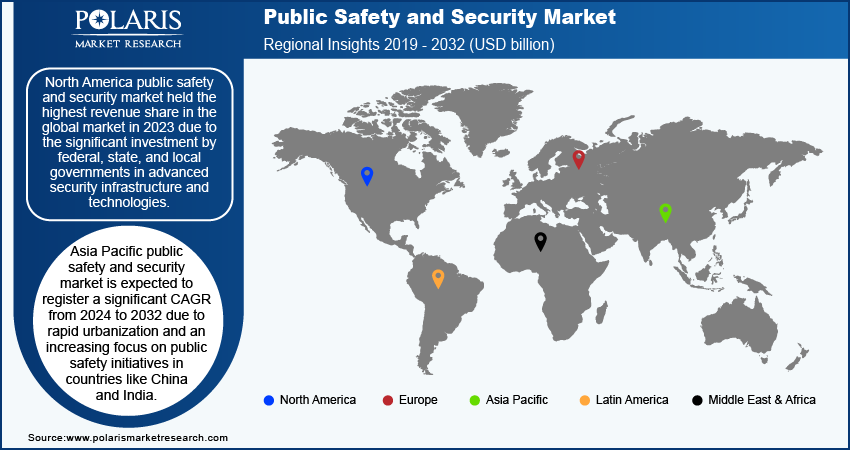

By region, the study provides public safety and security market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America public safety and security market held the highest revenue share in the global market in 2023 due to the significant investment by federal, state, and local governments in advanced security infrastructure and technologies. Rising concerns over national security, along with the increasing frequency of natural disasters and public safety incidents, have prompted agencies to enhance their preparedness and response capabilities, expanding the demand for public safety and security solutions in the region. Moreover, the rapid adoption of innovative technologies, such as artificial intelligence and IoT, in critical communication systems improves operational efficiency and situational awareness, further contributing to North America’s leadership in the market.

Asia Pacific public safety and security market is expected to register a significant CAGR during the forecast period due to rapid urbanization and an increasing focus on public safety initiatives in countries like China and India. The region faces unique challenges, including a rising population and a growing number of large-scale events, which necessitate enhanced security measures. The push for digital transformation in public safety operations, combined with the need for integrated systems that improve emergency response times, positions Asia Pacific as a key region in the evolving environment of the safety and security market. Additionally, government investments in smart city projects and advanced surveillance technologies significantly contribute to the adoption of public safety and security solutions. For instance, as per a report published by the Ministry of Housing and Urban Affairs under the Government of India, a total investment of USD 24,056 million has been proposed by the 99 cities under their smart city plans in 2024.

Public Safety and Security Market – Key Players & Competitive Insights

Major market players are investing heavily in research and development in order to expand their offerings, which will help the public safety and security market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the public safety and security industry must offer innovative solutions.

The public safety and security market is fragmented, with the presence of numerous global and regional market players. Major players in the public safety and security market include Cisco Systems, Inc.; Honeywell International Inc.; Motorola Solutions, Inc.; IBM; Siemens; Hexagon AB; Thales; Huawei Technologies Co., Ltd.; IDEMIA; General Dynamics Corporation; L3Harris Technologies, Inc.; BAE Systems.; Esri; SAAB AB; Teltronic S.A.; Barrier1 Systems, LLC; and OnSolve.

IDEMIA is a prominent multinational technology company specializing in identity-related security services, particularly in the fields of public safety and security. Headquartered in Courbevoie, France, IDEMIA has established itself as a leader in biometric identification and secure payment solutions, serving both governmental and private sectors globally. The company’s technologies are deployed in over 150 criminal identification systems worldwide, reflecting its significant impact on global public safety efforts. The company’s mission is to enhance safety and security through innovative technologies that streamline identification processes, enabling more efficient interactions between citizens and authorities. In October 2024, IDEMIA Public Security North America was selected by NIST National Cybersecurity Center of Excellence (NCCoE) to take part in its Mobile Driver's License (mDL) project.

OnSolve is a major provider of critical event management solutions, specializing in enhancing public safety and security through innovative communication technologies. OnSolve has developed a robust platform that integrates risk intelligence, critical communications, and incident management to safeguard people, assets, and operations. The company’s solutions are designed to empower government agencies, businesses, and emergency management teams to respond swiftly and efficiently in the face of various threats, including natural disasters, civil unrest, and other emergencies. In June 2023, OnSolve announced OnSolve Risk Insights, a new product that provides historical physical threat data and statistics for organizations to uncover risk trends across specific geographies.

Major Companies in Public Safety and Security Market

- Cisco Systems, Inc.

- Honeywell International Inc.

- Motorola Solutions, Inc.

- IBM

- Siemens

- Hexagon AB

- Thales

- Huawei Technologies Co., Ltd.

- IDEMIA

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- BAE Systems

- Esri

- SAAB AB

- Teltronic S.A

- Barrier1 Systems, LLC

- OnSolve

Public Safety and Security Market Developments

September 2024: IDEMIA Public Security North America, the major provider of convenient and trusted biometric-based solutions, launched its newest product, ID2Issuance, a cloud-native credential issuance and management system for motor vehicle agencies to quickly validate applicants' photos and signatures, perform one-to-many facial and fingerprint biometric matching, and document management for driver licenses or ID cards, all while keeping individuals' personal identifiable information (PII) safe, secure, and private.

April 2024, OnSolve, a global critical event management provider that helps organizations mitigate physical threats and remain agile when a crisis strikes, announced the release of the first-ever guide designed to help public safety officials during high-stress emergencies.

March 2023: Honeywell announced it has successfully implemented phase one of the Bangalore Safe City project, which aims to create a safe, efficient, and empowering environment for women and girls through Honeywell’s smart and connected safety and security technology. The deployed solutions aid in improving detection and response times for incidents through remote monitoring of public spaces and real-time data collection for future analysis.

Public Safety and Security Market Segmentation

By Solution Outlook

- Critical Communication Network

- C2/C4isr System

- Biometric Security and Authentication System

- Surveillance System

- Scanning and Screening System

- Emergency and Disaster Management

- Cyber-security

- Public Address and General Alarm

- Backup and Recovery System

By Service Outlook

- Managed Services

- Managed Security Services

- Managed Network Services

- Professional Services

- Design and Consulting

- Installation and Integration

- Support and Maintenance

- Training and Education

By Application Outlook

- Homeland Security

- Law Enforcement and Intelligent Agencies

- Border Control

- Emergency Services

- Transportation Systems

By Deployment Outlook

- On-premises

- Cloud

By Software Type Outlook

- Record Management Software

- Investigation Management

- Locations Management

- Crime Intelligence and Crime Analysis

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Public Safety and Security Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 466.30 billion |

|

Market Size Value in 2024 |

USD 514.89 billion |

|

Revenue Forecast in 2032 |

USD 1160.32 billion |

|

CAGR |

10.7% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019-2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The public safety and security market size was valued at USD 466.30 billion in 2023 and is projected to grow to USD 1,160.32 billion by 2032.

The market is projected to register a CAGR of 10.7% from 2024 to 2032

North America held the largest share of the global market in 2023.

The key players in the market are Cisco Systems, Inc.; Honeywell International Inc.; Motorola Solutions, Inc.; IBM; Siemens; Hexagon AB; Thales; Huawei Technologies Co., Ltd.; IDEMIA; General Dynamics Corporation; L3Harris Technologies, Inc.; BAE Systems.; Esri; SAAB AB; Teltronic S.A.; Barrier1 Systems, LLC; and OnSolve

The cloud segment is projected for significant growth in the market.

The critical communication network segment dominated the public safety and security market in 2023