Protein Ice Cream Market Size, Share, Trends, Industry Analysis Report: By Source (Whey Protein, Casein Protein, Plant-Based Proteins, Milk Protein, and Others), Flavor, Packaging Type, Packing Size, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 120

- Format: PDF

- Report ID: PM5337

- Base Year: 2024

- Historical Data: 2020-2023

Protein Ice Cream Market Overview

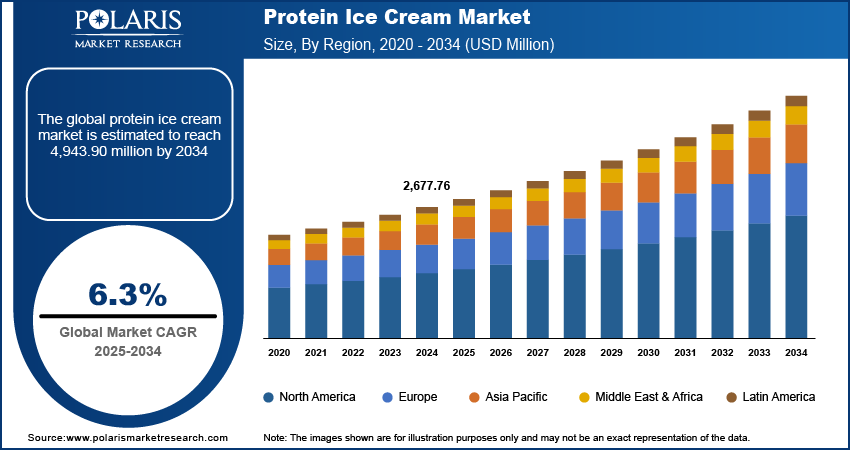

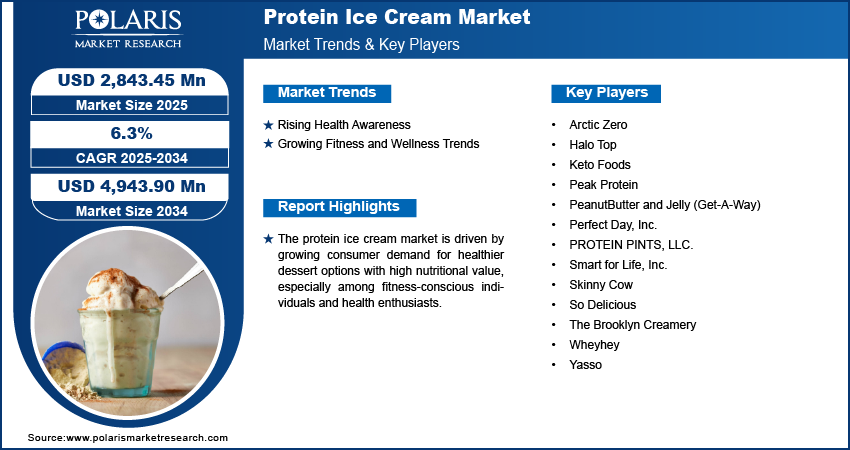

The global protein ice cream market size was valued at USD 2,677.76 million in 2024. The market is projected to grow from USD 2,843.45 million in 2025 to USD 4,943.90 million by 2034, exhibiting a CAGR of 6.3% during 2025–2034.

Protein ice cream is a frozen dessert that is formulated to have a higher protein content compared to traditional ice cream. It often incorporates protein-rich ingredients such as whey protein, casein, or plant-based proteins to boost its nutritional profile. This type of ice cream aims to provide a healthier alternative for those looking to increase their protein intake, whether for muscle recovery, weight management, or general health benefits. Protein ice cream is often marketed as being lower in sugar and fat compared to conventional ice cream, catering to health-conscious consumers.

The protein ice cream market trend is driven by continuous innovation and flavor diversity, catering to evolving consumer preferences. Furthermore, the rising popularity of high-protein diets, such as ketogenic, is driving the protein ice cream market demand.

To Understand More About this Research: Request a Free Sample Report

As consumers increasingly prioritize their health and seek convenient, nutritious alternatives to traditional treats, protein ice cream has emerged as a popular choice. This growing demand presents significant opportunities for key players in the market. Key players capitalize on the demand by diversifying their product lines to include a variety of flavors, textures, and formulations. Offering options that cater to different dietary preferences, such as vegan or lactose-free varieties, meets diverse consumer needs and propels the protein ice cream market development.

Protein Ice Cream Market Trends

Rising Health Awareness

As more people become educated about nutrition and its impact on health, they are making more informed food choices. Protein ice cream aligns with this shift as it offers a healthier alternative to traditional ice cream, which is often high in sugar and fat. Also, consumers are increasingly aware of the benefits of protein, such as its role in muscle repair, satiety, and metabolism. Protein ice cream offers these benefits in a convenient, enjoyable format.

There is a rising demand for foods that contribute to a balanced diet without excessive calories or unhealthy ingredients. Protein ice cream fits this demand by providing a higher protein option that can help balance nutritional intake.

In May 2022, the International Food Information Council (IFIC) stated that Americans are adopting various strategies to manage or reduce stress, including improving sleep (41%), exercising (40%), focusing on mental health (30%), and enhancing diet and nutrition (30%). Among those who have adjusted their diet, the most common changes include aiming to eat healthier (54%), prioritizing healthy behaviors over weight loss (38%), and adhering to specific eating patterns or diets (37%). These trends highlight a growing consumer focus on health, which is driving the demand for healthier food options, such as protein ice cream. Thus, increasing health awareness among consumers boosts the protein ice cream market expansion.

Growing Fitness and Wellness Trends

There is a higher demand for products that support muscle recovery and repair with an increasing number of people participating in fitness and wellness activities. Thus, the preference for foods that offer health benefits, such as higher protein content, while still being enjoyable is growing. Protein ice cream addresses this need by combining acceptance with nutritional value.

According to the Survey of Health & Fitness Association, Planet Fitness, a US based gym chain, topped the membership rankings with 17 million members at the end of 2022, marking a 12% increase from 15.2 million in 2021. By the end of the second quarter of 2023, membership had risen to 18.4 million. Meanwhile, Basic-Fit in the Netherlands registered a 51% membership surge from 2021 to 2022, the highest reported increase in the survey, growing from 2.22 million to 3.35 million members. These trends reflect a growing interest in fitness, which is driving the demand for healthier food options and boosting the protein ice cream market growth.

Protein Ice Cream Market Segment Analysis

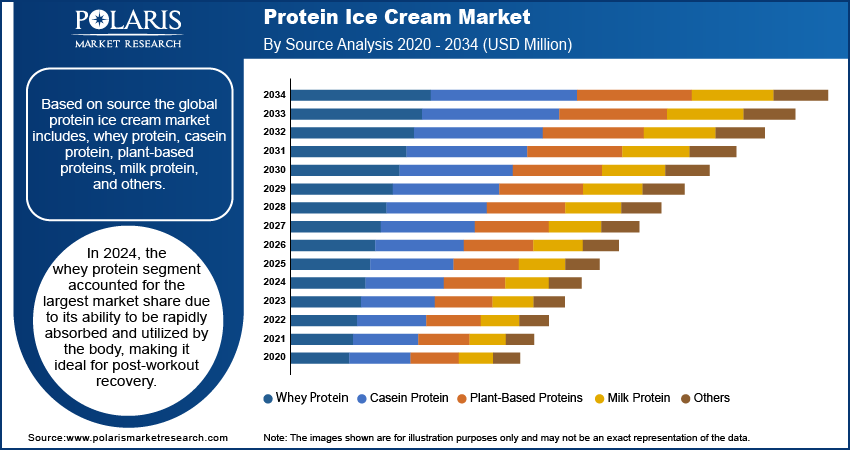

Protein Ice Cream Market Evaluation by Source Insights

The global protein ice cream market segmentation, based on source, includes whey protein, casein protein, plant-based proteins, milk protein, and others. In 2024, the whey protein segment accounted for the largest market share due to its ability to be rapidly absorbed and utilized by the body, making it ideal for post-workout recovery. This quick digestion is particularly appealing to consumers who need an efficient source of protein to support their fitness goals. Whey protein has excellent solubility in liquids, which makes it easy to incorporate into ice cream formulations without affecting texture or taste. This versatility allows manufacturers to create smooth, creamy products with consistent protein content.

Various articles and industry reports highlight the benefits of whey protein, consumer preferences for healthier indulgent options, and successful product innovations. This growing interest in whey protein as an ingredient underscores its significant role in the expanding protein ice cream market.

In June 2022, the DOAJ Organization, recognizing the significant demand for ice cream, incorporated a study on protein supplementation. The research involved using whey protein isolates to boost the protein content of buffalo milk ice cream to 6%, 8%, and 10%. This study highlights the growing trend of using whey protein in desserts.

Protein Ice Cream Market Assessment by Flavor Insights

The global protein ice cream market segmentation, based on flavor, includes chocolate, strawberry, vanilla, peanut butter, caramel, nuts, and others. In 2024, the vanilla segment held the largest market share and is anticipated to experience the highest CAGR during the forecast period.

Vanilla is one of the most popular and universally accepted ice cream flavors. Its classic and versatile taste appeals to a broad demographic, from children to adults. This widespread appeal is driving its significant share in the protein ice cream market.

In May 2024, the International Dairy Foods Association (IDFA) collaborated with Morning Consult to explore American preferences for ice cream and frozen desserts. The survey, which included over 2,200 US adults, investigated popular flavors, toppings, and other preferences. The results revealed a strong preference for vanilla, with 38% of respondents favoring it. Chocolate followed with 32%, strawberry at 25%, butter pecan at 21%, peanut butter at 15%, and other flavors at lower percentages. These findings underscore the growing popularity of the vanilla segment.

Protein Ice Cream Market Regional Insights

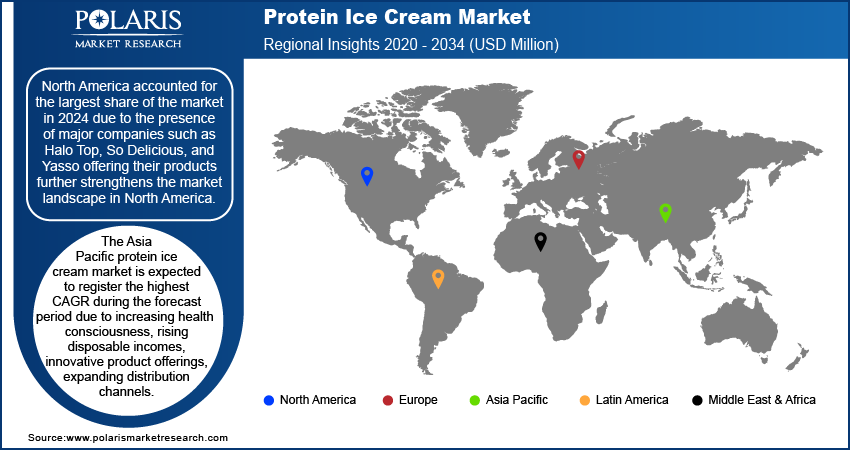

By region, the study provides the protein ice cream market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the market in 2024 due to the presence of major companies such as Halo Top, So Delicious, and Yasso offering their products further strengthens the market landscape in North America.

The key market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in North America, further driving the protein ice cream market development.

The US held the largest share of the protein ice cream market revenue, driven by innovation and increasing consumer interest in protein-enriched foods. The market benefits from a large consumer base that values both health and indulgence. Also, the rising production of ice cream is driving the protein ice cream industry growth in the country. In 2023, the IDFA reported that ice cream makers in the US produced 1.30 billion gallons of ice cream, which also increased the protein ice cream market share.

The protein ice cream market in Canada held a significant share in 2024. The growing emphasis on health and wellness among Canadian consumers is contributing to increased interest in protein-enriched products, fueling the market growth in Canada.

The Asia Pacific protein ice cream market is expected to register the highest CAGR during the forecast period due to increasing health consciousness, rising disposable incomes, innovative product offerings, expanding distribution channels, and a strong emphasis on fitness and wellness. These factors boost demand for protein-enriched desserts across the region.

The Japan protein ice cream market held the largest market share in 2024, driven by the rising number of companies introducing a wide range of protein ice cream flavors and formulations to cater to diverse consumer preferences. Innovations in product development, such as the inclusion of local flavors and functional ingredients, are attracting a broader customer base.

In June 2022, Thai Glico introduced its new ice cream brand, 'SUNAO,' in Thailand. The launch features the Macadamia & Almond flavor in a cup format and is the first SUNAO product to be launched outside Japan. Notably, SUNAO ice cream is free from added sucrose, emphasizing taste and healthier ingredients. Further, in 2024, the China's protein ice cream market accounted for significant growth.

Protein Ice Cream Market – Key Players & Competitive Insights

Leading market players are actively shaping the competitive landscape through innovation, strategic partnerships, and targeted marketing efforts. Understanding the strategies of these leading companies and the opportunities available in the market is crucial for navigating this dynamic sector.

Key players are focusing on expanding their flavor offerings and introducing unique combinations to attract diverse consumer preferences. For instance, brands such as Halo Top and Enlightened frequently update their flavor profiles to stay ahead in the market. Companies are incorporating additional nutrients such as vitamins, minerals, and fiber to enhance the health benefits of their market developments. This focus on nutritional value helps differentiate their offerings from traditional ice cream.

To expand and survive in a more competitive and rising market climate, protein ice cream industry players must leverage social media and digital marketing to engage with consumers, gather feedback, and promote new product launches. Also, effective marketing campaigns highlight these attributes to attract health-conscious consumers, result to rise in protein ice cream industry demand.

Arctic Zero; Peanut Butter and Jelly (Get-A-Way); Halo Top; Keto Foods; Peak Protein; PROTEIN PINTS, LLC; Smart for Life, Inc.; Skinny Cow; So Delicious; Wheyhey; Yasso; The Brooklyn Creamery; and Perfect Day, Inc. are a few major players in the protein Ice cream market.

The Brooklyn Creamery, founded in 2016 in Brooklyn, New York, began with a straightforward mission: to let consumers satisfy their sweet cravings without guilt. The company has expanded its product line to include low-calorie, vegan, high-protein, and keto-friendly ice creams, which are available in over seven countries. In June 2024, Brooklyn Creamery introduced a new line of protein ice cream bars in its home market and the UAE. This launch is supported by a strategic partnership with a quick-commerce platform to cater to the increasing demand for protein-rich desserts.

Perfect Day, Inc. developed the innovative dairy ingredient ProFerm through a refined process of precision fermentation. This offers a superior whey protein solution that replicates the taste, functionality, and nutrition of traditional dairy, all while being more sustainable, pure, and consistent—without using cows. The company collaborates with retail brands and food service manufacturers to create a diverse range of desserts. In February 2024, Perfect Day teamed up with Unilever’s Breyers to launch Breyers Lactose-Free Chocolate ice cream, featuring Perfect Day’s dairy protein derived from fermentation.

List of Key Companies in Protein Ice Cream Market

- Arctic Zero

- Halo Top

- Keto Foods

- Peak Protein

- PeanutButter and Jelly (Get-A-Way)

- Perfect Day, Inc.

- PROTEIN PINTS, LLC.

- Smart for Life, Inc.

- Skinny Cow

- So Delicious

- The Brooklyn Creamery

- Wheyhey

- Yasso

Protein Ice Cream Market Development

June 2022: Get-A-Whey unveiled its new ice cream product line, which includes high-protein ice creams, low-calorie ice cream sandwiches, and indulgent yet guilt-free waffle bites.

June 2023: Myprotein launched a protein-enriched ice cream range in Iceland featuring three flavors: salted caramel, chocolate, and vanilla.

August 2023: Smart for Life, Inc. introduced its high-protein, high-fiber Ice Kreem bars in the greater New York City area. These new bars are available for purchase through delivery apps such as Uber Eats, DoorDash, and Grubhub.

Protein Ice Cream Market Segmentation

By Source Outlook (Revenue, USD Million; 2020–2034)

- Whey Protein

- Casein Protein

- Plant-Based Proteins

- Milk Protein

- Others

By Flavor Outlook (Revenue, USD Million; 2020–2034)

- Chocolate

- Strawberry

- Vanilla

- Peanut Butter

- Caramel

- Others

By Packaging Type Outlook (Revenue, USD Million; 2020–2034)

- Single Serve Cups

- Bars

- Cone

- Sticks

- Others

By Packing Size Outlook (Revenue, USD Million; 2020–2034)

- Less Than 125 ml

- 125 ml–250 ml

- More Than 250 ml

By Distribution Channel Outlook (Revenue, USD Million; 2020–2034)

- Ice Cream Shops

- Hypermarket/Supermarkets

- Convenience Stores

- Grocery Stores

- Online

- Others

By Regional Outlook (Revenue, USD Million; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Protein Ice Cream Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,677.76 million |

|

Market Size Value in 2025 |

USD 2,843.45 million |

|

Revenue Forecast by 2034 |

USD 4,943.90 million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global protein ice cream market size was valued at USD 2,677.76 million in 2024 and is expected to reach USD 4,943.90 million in 2034.

The global market is projected to register a CAGR of 6.3% during 2025–2034.

North America accounted for the largest market share in 2024

A few key players in the market are Arctic Zero; Get-A-Way; Halo Top; Keto Foods; Peak Protein; PROTEIN PINTS, LLC; Smart for Life, Inc.; Skinny Cow; So Delicious; Wheyhey; Yasso; The Brooklyn Creamery; and Perfect Day, Inc.

In 2024, the whey protein segment accounted for the largest share.

In 2024, the vanilla segment held the largest share and is anticipated to experience the highest CAGR during the forecast period.