Protein Alternatives Market Size, Share, Trends, Industry Analysis Report: By Source (Plant Proteins, Microbe-based Protein, and Insect Protein), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM5111

- Base Year: 2023

- Historical Data: 2019-2022

Protein Alternatives Market Overview

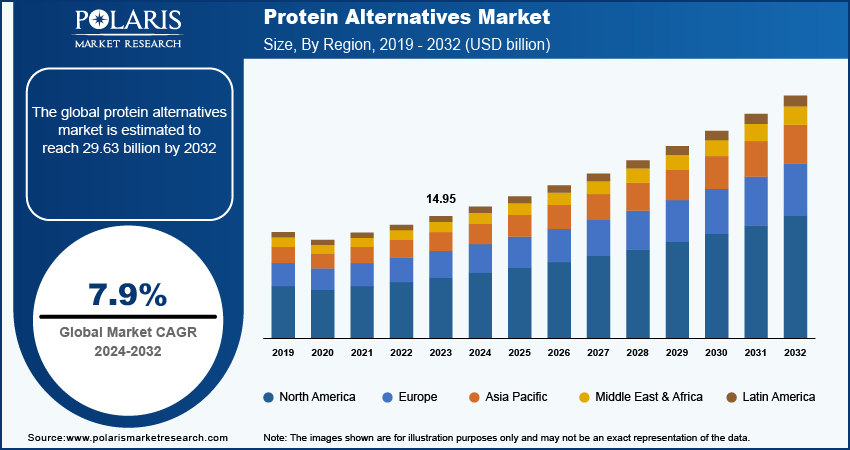

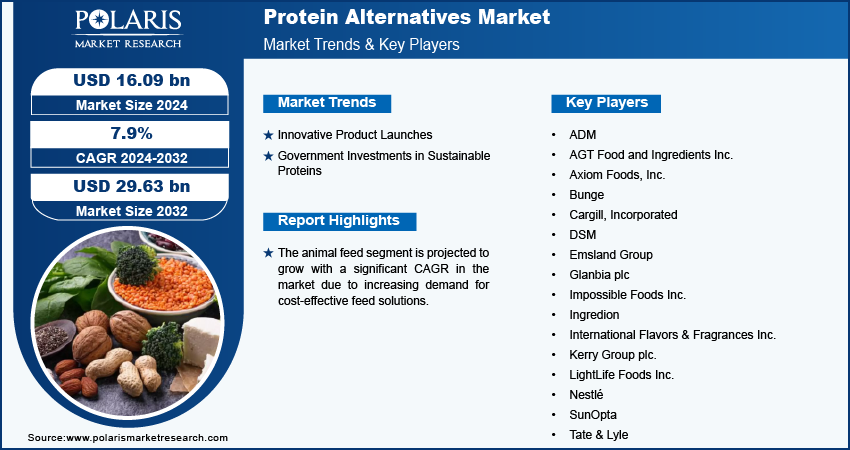

Global protein alternatives market size was valued at USD 14.95 billion in 2023. The market is projected to grow from USD 16.09 billion in 2024 to USD 29.63 billion by 2032, exhibiting a CAGR of 7.9% during the forecast period.

Protein alternatives are sources of protein that serve as substitutes for traditional animal-based proteins, such as meat, poultry, and dairy products. These alternatives are preferred for various reasons, including dietary preferences, health considerations, environmental concerns, and ethical issues related to animal welfare. The growth of the protein alternatives market is driven by the rising emphasis on plant-based proteins. Health-conscious consumers are turning to plant-based products that have lower levels of saturated fat and cholesterol, which align with dietary guidelines for reducing the risk of chronic diseases.

For instance, in 2021, a global survey performed by the National Science Foundation stated that 88% of food industry practitioners expected a rise in demand for plant-based products. Such growth in the consumption of these products is creating awareness and preference for plant proteins. Thus, the market for alternative protein is growing across the world due to the heightened demand and consumption of plant-based products.

To Understand More About this Research: Request a Free Sample Report

The protein alternative market is significantly driven by the expansion of production plants by key market players, which facilitates increased production capacity and innovation. For instance, in June 2024, Brevel, Ltd., a microalgae protein company, opened a new commercial production plant that boasts a substantial area of 27,000 square feet and is equipped with the capability to generate hundreds of tons of microalgae protein powder to meet the growing demand within the global protein alternative sector. These types of expansions in production plants enable companies to enhance their ability to produce a diverse range of protein alternatives, from plant-based proteins to lab-grown meats, at a larger scale. Thus, the protein alternatives market is bolstering globally because of the expansions by key players that maintain a competitive advantage in the market.

Protein Alternatives Market Drivers and Trends

Innovative Product Launches

Companies are offering a wider variety of protein alternatives that attract both new and existing customers by introducing new formulations and advanced technologies for several applications, including food and beverages and animal feed. For instance, in September 2020, Nestlé Purina introduced Purina Beyond Nature's Protein, a pet food product that utilizes alternative sources of proteins to optimize the planet's resources. The innovative line incorporates insect protein, along with plant protein derived from fava beans and millet. Such innovations enhance the attractiveness of protein alternatives, making them preferable as compared to regular sources of proteins, such as meat and milk. Consequently, the increasing product launches are driving consumer adoption, thereby contributing to the growth of the protein alternatives market.

Government Investments in Sustainable Proteins

Increasing investments by governments are providing essential financial support and resources for research, development, and commercialization of innovative products. Governments are recognizing the importance of sustainable food systems to address environmental concerns, enhance food security, and promote public health and allocating a substantial amount of funds to promote the sustainable protein sector. For instance, according to the Good Food Institute, the UK allocated USD 25.9 million to support the sustainable protein industry, focusing on research, innovation, capacity building, and business-led commercialization. Such financial support reduces the economic barriers for companies, fosters innovation, and encourages the adoption of sustainable practices within the food industry. Therefore, government investments to boost the production and availability of protein alternatives are driving alternative protein market expansion across the globe.

Protein Alternatives Market Segment Insights

Protein Alternatives Market Analysis by Source Insights

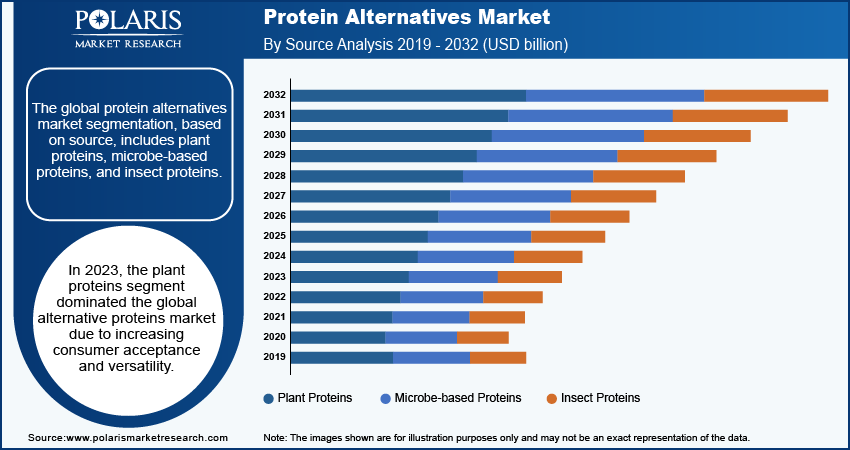

The global protein alternatives market segmentation, based on source, includes plant proteins, microbe-based proteins, and insect proteins. In 2023, the plant proteins segment dominated the global alternative proteins market due to increasing consumer acceptance and versatility. Plant-based proteins are gaining traction because of several benefits, including their nutritional value, environmental sustainability, and alignment with the growing trend of veganism. Thus, the manufacturers are launching plant-based proteins that align with the aforementioned benefits. For instance, in November 2023, Singapore's Relsus, a company specializing in plant-based protein concentrates and isolates, launched its high-grade plant-based proteins in the Indian market. These types of product launches are changing consumer preferences and increasing the adoption of plant proteins in their diet. Thus, the versatility and alignment of plant proteins with sustainability and veganism trends have positioned plant proteins as a dominating type in the alternative proteins market.

Protein Alternatives Market Analysis by Application Insights

The global protein alternatives market segmentation, based on application, includes food & beverages, animal feed, clinical nutrition, infant formulations, and others. The animal feed segment is projected to grow with a significant CAGR in the market due to increasing demand for cost-effective feed solutions. Regular animal feed ingredients, such as fishmeal and soybean, are becoming more expensive and less sustainable. Protein alternatives, including plant-based proteins, insect meal, and microbial proteins, offer an eco-friendlier and economical solution. Thus, protein alternatives assist in the expansion of the animal feed industry by offering cost-effective feed solutions, thereby contributing to the significant growth of the animal feed segment of the alternative protein market.

Protein Alternatives Analysis by Regional Insights

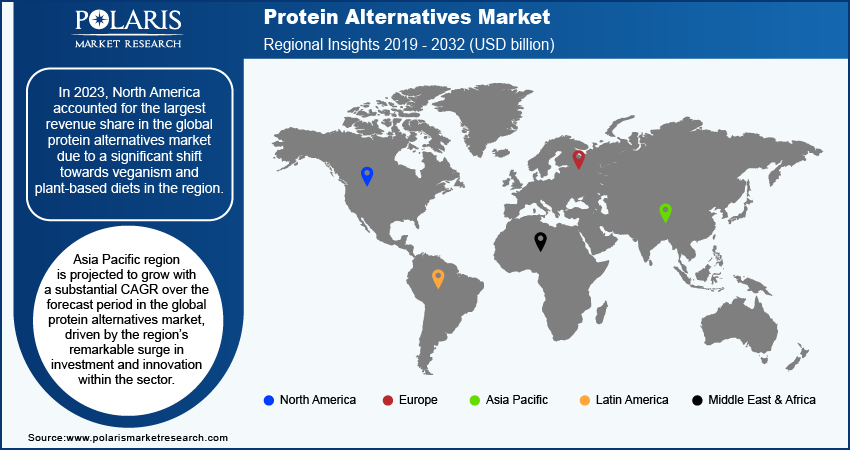

By region, the study provides the protein alternatives market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, North America accounted for the largest revenue share in the global protein alternatives market due to a significant shift towards veganism and plant-based diets in the region. For instance, in 2022, the number of American consumers following a completely vegan diet surged by 500%, reaching a total of 6% of the population. This shift reflects a growing consumer awareness and heightened demand for diverse and high-quality protein alternatives. Consequently, the increasing emphasis on a vegan diet by the significant population of North America has contributed to the dominance of the region in the global market.

Asia Pacific region is projected to grow with a substantial CAGR over the forecast period in the global protein alternatives market, driven by the region’s remarkable surge in investment and innovation within the sector. For instance, the Good Food Institute Asia Pacific’s data highlighted a 43% increase in investments in APAC-based alternative protein companies, reaching USD 562 million in 2022. Such investments in cultivated foods underscores the region's growing role in the advancement of alternative proteins. Therefore, the region's growing focus on alternative proteins, driven by consumer demand, technological advancements, and strategic investments, is expected to drive significant growth in Asia Pacific.

China's protein alternatives market is anticipated to grow significantly due to the nation's strategic focus on diversifying protein sources and enhancing food security. The country has established a robust industrial foundation in bio-manufacturing, fostering collaborations between alternative protein companies and local bio-manufacturers, such as CellX with Tofflon and Turtle Tree with JS Bio. Such collaborations are crucial in overcoming production challenges and scaling up alternative protein technologies. As a result, the market is expected to grow in China as it is well-positioned to become a global hub for manufactured protein alternatives.

Protein Alternatives Key Market Players & Competitive Insights

The protein alternatives market is experiencing rapid and dynamic evolution, characterized by intense competition among several companies. Global market players are leveraging robust research and development capabilities, advanced manufacturing technologies, and expansive distribution networks to maintain competitive advantage. Moreover, strategic initiatives such as partnerships, mergers and acquisitions, and collaborations are being actively pursued to enhance product offerings and broaden market reach. The market is witnessing the entry of startups introducing innovative protein solutions tailored for diverse applications.

Major players in the protein alternatives market include ADM; AGT Food and Ingredients Inc.; Axiom Foods, Inc.; Bunge, Cargill; Incorporated; DSM; Emsland Group; Glanbia plc; Impossible Foods Inc.; Ingredion, International Flavors & Fragrances Inc.; Kerry Group plc.; LightLife Foods Inc.; Nestlé, SunOpta; and Tate & Lyle.

Cargill, Incorporated is an agribusiness company that offers a wide range of products and services across various sectors, including food, agriculture, financial products, industrial, pharmaceutical, transportation & logistics, animal nutrition, meat & poultry, and risk management. The company processes, markets, and distributes grains, sugar, oilseeds, meat, cotton, and other food items. Furthermore, Cargill manufactures natural ingredients for use in the personal care industry and produces animal feed, pet food, and bio-industrial products. In addition, the company provides comprehensive support services, including technical assistance, transportation and logistics solutions, data asset management, marketing support, and risk management services. In August 2019, Cargill increased its investment in PURIS by USD 75 million, which allowed PURIS to expand its pea protein production significantly. The investment enabled PURIS to double its pea protein output using its current 200,000-square-foot facility in Dawson, Minn.

Bunge is an agribusiness and food company with a global presence. The company operates through four segments, including agribusiness, milling, refined and specialty oils, and sugar and bioenergy. The agribusiness segment engages in the purchase, transportation, storage, processing, and sale of various agricultural commodities and commodity products. It includes oilseeds such as canola, soybeans, rapeseed, and sunflower seeds, as well as grains. The refined and specialty oils division focuses on the sale of packaged and bulk oils and fats, including cooking oils, margarine, shortenings, and renewable diesel feedstocks. The milling segment provides a wide range of products, including wheat flour, corn milling products, die-cut pellets, fiber ingredients, bakery mixes, as well as non-GMO products. Moreover, the sugar and bioenergy segment are involved in the production of sugar and ethanol, as well as electricity generation from burning sugarcane bagasse. In December 2022, Bunge allocated approximately USD 550 million for the establishment of a comprehensive facility dedicated to the production of textured soy protein concentrate (TSPC) and soy protein concentrate (SPC).

Key Companies in Protein Alternatives Market

- ADM

- AGT Food and Ingredients Inc.

- Axiom Foods, Inc.

- Bunge

- Cargill, Incorporated

- DSM

- Emsland Group

- Glanbia plc

- Impossible Foods Inc.

- Ingredion

- International Flavors & Fragrances Inc.

- Kerry Group plc.

- LightLife Foods Inc.

- Nestlé

- SunOpta

- Tate & Lyle

Protein Alternatives Industry Developments

May 2024: Roquette, a global plant-based ingredients company, introduced NUTRALYS Fava S900M in Europe and North America. The innovative product is Roquette's new protein isolate sourced from fava beans and represents the newest offering in its NUTRALYS pea protein range and other rice F&B solutions.

September 2021: Ingredion Incorporated introduced an innovative new range of high-performance pulse-based ingredient solutions designed to meet the rising consumer demand for flavorful, nutritionally dense plant protein-rich foods in the US and Canada.

April 2024: HiProMine, a Polish producer of insect-based protein, finished building the second phase of its new genetic center and has started operations to become a protein supplier in Europe's pet food industry.

Protein Alternatives Market Segmentation

By Source Outlook

- Plant Proteins

- Cereals

- Wheat

- HMEC/HMMA Wheat Protein

- Hydrolyzed Wheat Protein

- Textured Wheat Protein

- Wheat Protein Concentrates

- Wheat Protein Isolates

- Rice

- Hydrolyzed Rice Protein

- Rice Protein Concentrates

- Rice Protein Isolates

- Others

- Oats

- Hydrolyzed Oat Protein

- Oat Protein Concentrates

- Oat Protein Isolates

- Others

- Wheat

- Legumes

- Soy

- HMEC/HMMA Soy Protein

- Hydrolyzed Soy Protein

- Soy Protein Concentrates

- Soy Protein Isolates

- Textured Soy Protein

- Pea

- HMEC/HMMA Pea Protein

- Hydrolyzed Pea Protein

- Pea Protein Concentrates

- Pea Protein Isolates

- Textured Pea Protein

- Lupine

- Chickpea

- Others

- Soy

- Roots

- Potato

- Potato Protein Concentrate

- Potato Protein Isolate

- Maca

- Others

- Potato

- Ancient Grains

- Amaranth

- Ancient Wheat

- Chia

- Millet

- Quinoa

- Sorghum

- Others

- Nuts & Seeds

- Canola

- Canola Protein Isolates

- Hydrolyzed Canola Protein

- Others

- Almond

- Flaxseeds

- Others

- Canola

- Microbe-based Protein

- Algae

- Bacteria

- Fungi

- Yeast

- Insect Protein

- Coleoptera

- Diptera

- Hemiptera

- Hymenoptera

- Lepidoptera

- Orthoptera

- Others

By Application Outlook

- Food & Beverages

- Bakery & Confectionary

- Beverages

- Breakfast Cereals

- Dairy Alternatives (cheese, desserts, snacks, others)

- Dietary Supplements/Weight Management

- Meat Alternatives & Extenders

- Snacks

- Sports Nutrition

- Others

- Animal Feed

- Clinical Nutrition

- Infant Formulations

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Protein Alternatives Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 14.95 billion |

|

Market Size Value in 2024 |

USD 16.09 billion |

|

Revenue Forecast in 2032 |

USD 29.63 billion |

|

CAGR |

7.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global protein alternatives market size was valued at USD 14.95 billion in 2023 and is projected to grow to USD 29.63 billion by 2032

The global market is projected to grow at a CAGR of 7.9% during the forecast period, 2024-2032

North America had the largest share of the global market

The key players in the market are ADM; AGT Food and Ingredients Inc.; Axiom Foods, Inc.; Bunge; Cargill; Incorporated; DSM; Emsland Group; Glanbia plc; Impossible Foods Inc.; Ingredion; International Flavors & Fragrances Inc.; Kerry Group plc.; LightLife Foods Inc.; Nestlé; SunOpta; and Tate & Lyle.

In 2023, the plant proteins segment held the dominant revenue share of the alternative proteins market because of the increasing consumer adoption and versatility.

The animal feed segment is anticipated to grow with a significant CAGR over the forecast period in the market due to increasing demand for cost-effective feed solutions.