Protein A Resin Market Share, Size, Trends, Industry Analysis Report, By Type (Recombinant Protein A, Natural Protein A); By Product; By Application; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3880

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

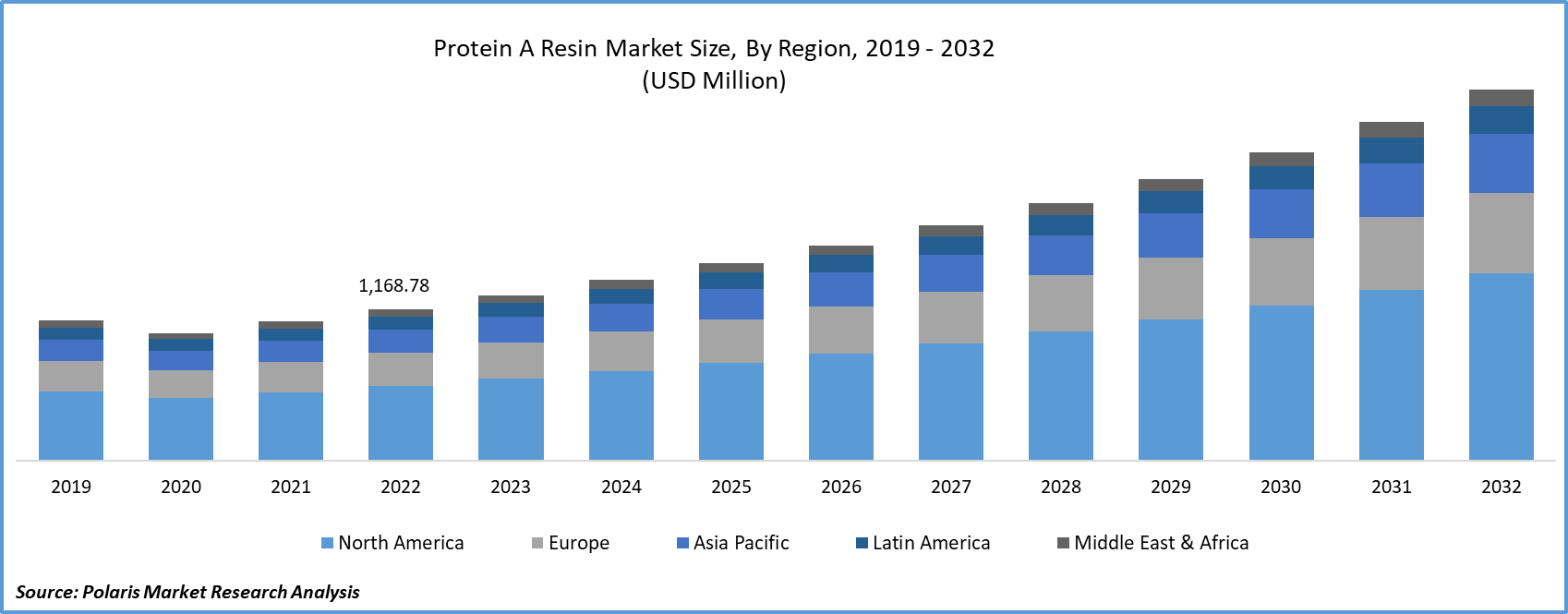

The global protein a resin market was valued at USD 1274.78 million in 2023 and is expected to grow at a CAGR of 9.40% during the forecast period.

The biopharmaceutical domain is experiencing remarkable growth, with a notable emphasis on advancing biologics, biosimilars, and gene therapies. This expanding sector heavily relies on Protein A Resin for the purification of antibodies, and the market has observed a surge in biopharmaceutical research and manufacturing facilities as a result. This surge further fuels the demand for Protein A Resin.

To Understand More About this Research: Request a Free Sample Report

Numerous countries are making substantial investments to expand their biomanufacturing capacities, with a specific focus on establishing cutting-edge bioprocessing facilities. These state-of-the-art facilities necessitate significant quantities of Protein A Resin to cater to the purification requirements of the burgeoning biopharmaceutical market. Consequently, the Protein A Resin market benefits significantly from this global expansion in biomanufacturing capabilities.

In addition, companies operating in the market are collaborating to develop new products to cater to the growing consumer demand.

- For instance, in September 2023, The University of Limerick's SPC, which stands for the Science Foundation Ireland (SFI) Research Centre for Pharmaceuticals, has initiated the second phase of its partnership with prominent industry leaders. This collaborative effort aims to tackle the expanding protein A resin market. This partnership involves five prominent biopharmaceutical companies, Pfizer, Eli Lilly, Janssen, BMS, and MSD. Together, they are addressing common challenges within the biopharmaceutical manufacturing sector.

The Protein A Resin market encountered initial difficulties due to the onset of the COVID-19 pandemic, primarily concerning disruptions in the supply chain. Nevertheless, the indispensable nature of biopharmaceuticals, the accelerated progress in vaccine development, amplified investments in biomanufacturing, and a more adaptable regulatory environment have collectively bolstered the market's durability and ongoing expansion. The Protein A Resin market will maintain a pivotal role in facilitating the manufacturing of biologics and monoclonal antibodies, solidifying its position as a crucial element in the advancement of the biopharmaceutical sector.

Growth Drivers

Increased demand for monoclonal antibodies is projected to spur the market demand

The Protein A Resin market is currently undergoing substantial expansion, primarily propelled by a confluence of factors. These factors encompass the growing demand for monoclonal antibodies, the expansion of biopharmaceutical manufacturing, and the continuous advancements in purification technologies.

The escalating prevalence of chronic ailments, autoimmune conditions, and cancer has fueled the demand for monoclonal antibodies. Monoclonal antibodies are at the forefront of pioneering medical treatments, and Protein A Resin assumes a crucial role in their purification process. As the therapeutic monoclonal antibody landscape continues to evolve with more options entering the market, the significance of efficient and high-capacity Protein A Resin becomes increasingly pronounced.

Report Segmentation

The market is primarily segmented based on type, product, application, end user, and region.

|

By Type |

By Product |

By Application |

By End User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Recombinant protein A resins segment accounted for a significant share in 2022

The recombinant Protein A resins segment accounted for a significant share in 2022. These resins are engineered through recombinant DNA technology, allowing for the production of Protein A ligands with specific characteristics optimized for protein purification. Recombinant Protein A resins provide high-purity antibody and protein purification due to their efficient binding and selective capture properties. These resins often exhibit improved performance characteristics, such as higher binding capacities and faster kinetics, compared to traditional Protein A resins. Recombinant Protein A resins are also valuable tools in research and development laboratories for antibody characterization, purification process development, and protein analysis.

By Product Analysis

Agarose-based protein A segment accounted for a significant share in 2022

The agarose-based protein A segment accounted for a significant share in 2022. Agarose-based Protein A resin has extensive utilization in various applications across the biopharmaceutical and biotechnology industries. Its widespread use can be attributed to its versatility, efficiency, and reliability. Agarose-based Protein A resin exhibits a high binding capacity for antibodies, enabling the purification of large quantities of proteins in a single run. It offers stability in a wide range of pH and salt conditions, making it adaptable to various purification protocols and allowing for robust and reliable results. Agarose-based Protein A resin can be regenerated and reused multiple times without a significant loss of performance, making it a cost-effective option for repeated purification cycles.

By Application Analysis

Antibody purification emerged as the largest segment in 2022

Antibody purification emerged as the largest segment in 2022. Protein A resin is engineered to capture and purify antibodies with remarkable specificity and efficiency. Its usage in antibody purification processes is a critical step in ensuring the production of high-quality, therapeutically effective monoclonal antibodies. Protein A resin achieves exceptional purity levels, removing contaminants and aggregates, resulting in antibodies with minimal impurities. The resin's rapid binding kinetics and high capacity enable efficient antibody capture, streamlining the purification process. It is well-suited for large-scale production, maintaining its performance consistency even in high-volume purification processes.

By End User Analysis

Pharmaceutical companies segment expected to experience significant growth during the forecast period

The pharmaceutical company's segment is expected to experience significant growth during the forecast period. The pharmaceutical industry has been witnessing a notable uptick in the utilization of Protein A resin. This trend can be attributed to its growing recognition as a valuable tool in the purification processes of biopharmaceutical products. Protein A resin's ability to efficiently capture and purify antibodies and other therapeutic proteins has made it indispensable for pharmaceutical companies. This heightened use aligns with the industry's commitment to ensuring the production of high-quality biologics, monoclonal antibodies, and other vital therapeutic agents, meeting the ever-increasing demand for innovative medical treatments.

Regional Insights

Asia-Pacific region is expected to experience highest growth during 2023-2032

The Asia-Pacific region is expected to witness a significant expansion during the forecast period. With the rising demand for biologics and monoclonal antibodies, the need for Protein A Resin as an essential purification tool has surged. This growth is attributed to the increasing prevalence of chronic diseases and the need for innovative therapies. Many countries in the Asia-Pacific region are actively expanding their biomanufacturing capabilities and infrastructure. Investments in state-of-the-art bioprocessing facilities and the establishment of biotech hubs are creating a conducive environment for the growth of the Protein A Resin market.

North America emerged as the largest region in 2022. North American pharmaceutical companies, research institutions, and government organizations are channeling substantial investments into research and development activities. This investment spurs the development of new biopharmaceuticals, driving the need for Protein A Resin. The growing biosimilars market in North America, driven by cost-effectiveness and healthcare affordability concerns, has created a surge in demand for Protein A Resin. The presence of a substantial number of Contract Manufacturing Organizations (CMOs) specializing in biologics production in North America contributes to the demand for Protein A Resin. These CMOs rely on advanced purification technologies.

Key Market Players & Competitive Insights

The protein A resin sector displays a fragmented landscape and has heightened competition due to the active involvement of numerous players. Key companies in this industry consistently introduce innovative products as a strategic move to strengthen their market position. These industry frontrunners prioritize initiatives such as forming partnerships, improving product portfolios, and nurturing collaborations to gain a competitive edge over their peers and establish a significant presence in the market.

Some of the major players operating in the global market include:

- Abcam PLC.

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- EMD Millipore

- Expedeon Ltd

- GE Healthcare

- GenScript Biotech Corp.

- Merck Millipore

- Novasep Holdings SAS

- PerkinElmer, Inc.

- Purolite Life Sciences

- Repligen Corp.

- Thermo Fisher Scientific Inc.

- Tosoh Bioscience

Recent Developments

- In March 2020, Danaher Corporation acquired the Biopharma business from General Electric Company's Life Sciences division. The new business will be named Cytiva operating within Danaher's Life Sciences segment.

- In March 2020, Avantor, Inc. introduced a new recombinant Protein A affinity chromatography resin, which is developed to be utilized for purifying antibodies during mAbs production.

Protein A Resin Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1391.17 million |

|

Revenue forecast in 2032 |

USD 2,854.41 million |

|

CAGR |

9.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Product, By Application, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |