Protein A, G and L Resins Market Size, Share, Trends, Industry Analysis Report: By Type (Protein G Resin, Protein L Resin, and Protein A Resin), By Application, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 118

- Format: PDF

- Report ID: PM5051

- Base Year: 2023

- Historical Data: 2019-2022

Protein A, G and L Resins Market Overview

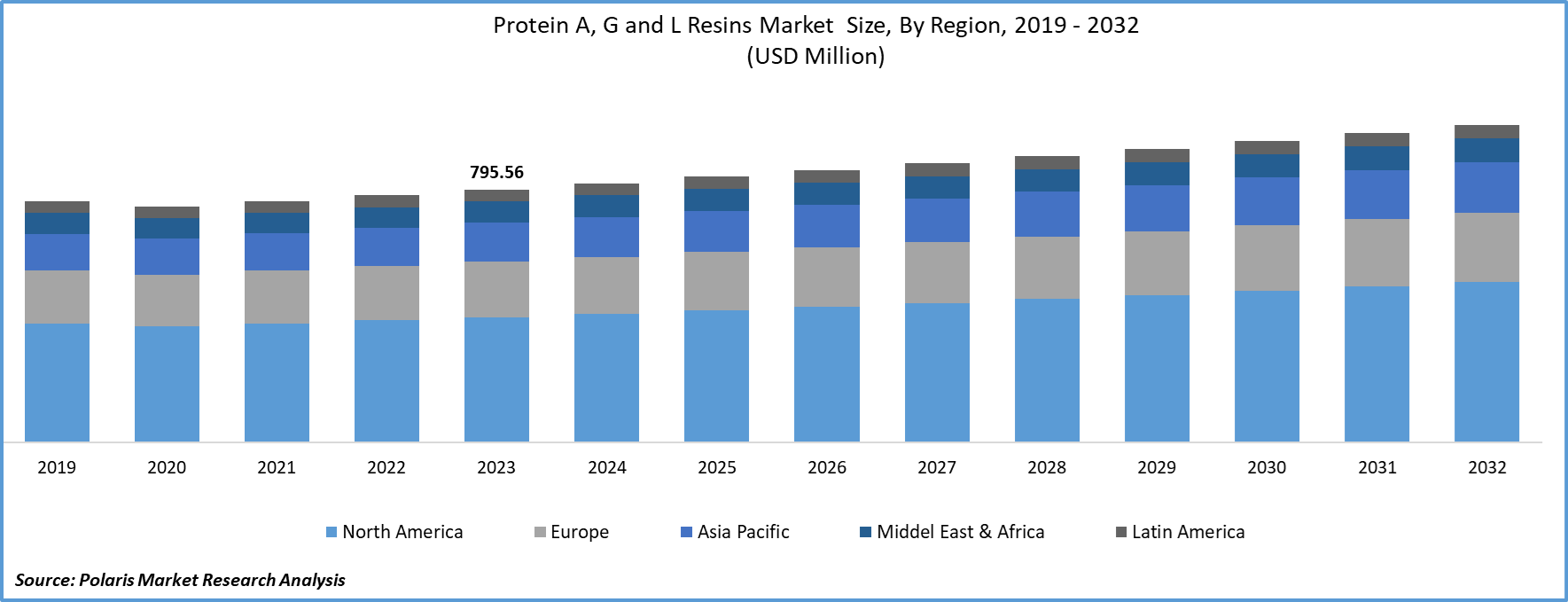

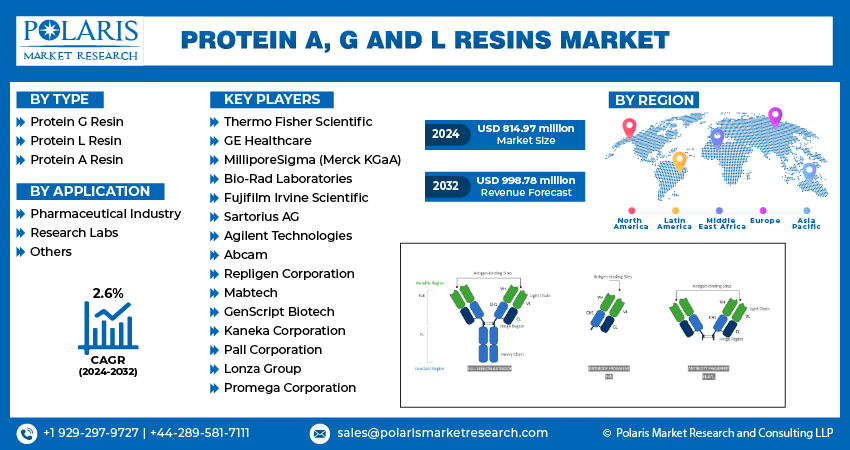

The global protein A, G and L resins market size was valued at USD 795.56 million in 2023. The market is projected to grow from USD 814.97 million in 2024 to USD 998.78 million by 2032, exhibiting a CAGR of 2.6% during the forecast period.

Protein A, G, and L resins are affinity chromatography materials used for purifying proteins and antibodies. Each resin specifically binds to different protein or antibody classes, facilitating their separation and purification in research, clinical, and industrial applications. The biopharmaceutical industry’s increasing need for advanced purification methods is driving a notable surge in the protein A, G and L resins market globally. The increasing incidence of chronic illnesses, the growth of biologics, and the manufacturing of monoclonal antibodies are the key factors driving the market that require effective protein purification techniques. Additionally, the market is expanding due to the growing focus on personalized medicine and advancements in bioprocessing technologies. Trends such as the development of high-capacity and cost-effective resins, along with the integration of automation in purification processes, are further shaping the market dynamics. As biopharmaceutical research and production continue to evolve, the need for high-performance resins to ensure product purity and quality remains critical, driving ongoing innovation and investment in the field.

To Understand More About this Research: Request a Free Sample Report

Protein A, G and L Resins Market Trends

Shift Towards High-Capacity Resins

As the demand for monoclonal antibodies and other biopharmaceuticals increases, there is a growing need for resins that can handle larger volumes and higher concentrations of proteins. High-capacity resins offer improved efficiency in purification processes by reducing the number of purification steps required and minimizing processing time. This trend is driven by the need to streamline production workflows and lower operational costs. Manufacturers are investing in the development of resins with enhanced binding capacities and increased throughput to meet the demands of large-scale biopharmaceutical production.

Integration of Automation in Purification Processes

Automation technologies are increasingly being adopted to improve the precision, reproducibility, and efficiency of protein purification. Automated systems streamline workflow by reducing manual intervention, minimizing human error, and enhancing consistency in purification outcomes. This trend is driven by the need for higher throughput and scalability in biopharmaceutical manufacturing. Also, the adoption of robotic systems, automated chromatography systems, and integrated data management solutions is transforming traditional purification processes, leading to faster and more reliable production of therapeutic proteins.

Focus on Cost-Effective Solutions

With the increasing pressure to reduce production costs while maintaining high-quality standards, there is a growing emphasis on developing resins that offer better cost-performance ratios. Innovations in resin chemistry and manufacturing processes are leading to the development of more affordable options that do not compromise on performance. This trend is driven by the need to balance the high costs associated with biopharmaceutical production with the growing demand for affordable therapeutics. Additionally, manufacturers are exploring ways to optimize resin usage, enhance durability, and improve overall cost-efficiency to stay competitive in the protein A, G and L resins market.

Protein A, G and L Resins Market Segment Insights

Protein A, G and L Resins Market Breakdown by Type Insights

In terms of type, the global protein A, G and L resins market is categorized into protein G resin, protein L resin, and protein A resin. In the market for protein A, G, and L resins, protein A resins dominate due to their essential role in purifying monoclonal antibodies and other high-value biopharmaceuticals. These resins are highly effective at capturing and purifying proteins with great specificity, making them the preferred choice for large-scale biopharmaceutical production. Their established use in commercial antibody production contributes to their leading market share.

In contrast, protein G resins are significant for their ability to bind a broader range of antibodies, which makes them valuable in research and diagnostic applications. While protein G resins play an important role, protein L resins are less commonly used but are gaining attention. This is because protein L resins have a unique ability to bind antibodies of various isotypes, which proves advantageous for specific applications.

Protein L resins represent one of the fastest-growing sectors in the market, driven by the increasing demand for versatile and adaptable purification solutions in research and diagnostics. This growth is fueled by advancements in antibody engineering and the need for resins capable of handling a wide variety of antibody types. The trend towards developing resins with broader binding capabilities and enhanced performance is accelerating the adoption of protein L resins.

Protein A, G and L Resins Market Breakdown by Application Insights

In terms of application, the global protein A, G and L resins market is categorized into pharmaceutical industry, research labs, and others. In the Protein A, G, and L resins market, the pharmaceutical industry is the dominating segment, primarily due to its extensive use in the purification of biopharmaceuticals such as monoclonal antibodies and other therapeutic proteins. This segment benefits from the high demand for advanced purification technologies to meet stringent regulatory standards and ensure product quality in large-scale production processes. The pharmaceutical industry's need for efficient, high-capacity purification solutions drives significant investment and innovation in resins tailored for this sector, maintaining its position as the largest market segment.

Research labs segment is also growing at the fastest growth rate, due to the increasing focus on advanced scientific research and development in biotechnology and life sciences. Research labs are adopting Protein A, G, and L resins for various applications, including antibody characterization, protein engineering, and small-scale protein purification. This growth is fueled by the rise in research activities and the need for versatile and high-performance resins to support diverse experimental requirements. The expanding scope of research applications and the continuous advancements in biotechnological methods are contributing to the rapid growth of this segment, reflecting the broader trend of innovation and exploration in the life sciences field.

Protein A, G and L Resins Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Protein A, G and L Resins Market Regional Insights

By region, the study provides market insights into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In the regional analysis of the Protein A, G, and L resins market, North America emerges as the dominating region due to its well-established biopharmaceutical industry, advanced research infrastructure, and significant investment in healthcare and biotechnology. The presence of major pharmaceutical and biotechnological companies, coupled with robust R&D activities, drives the high demand for advanced purification technologies in this region. Additionally, North America's stringent regulatory standards and emphasis on high-quality therapeutic production further contribute to its leading position in the market.

Protein A, G and L Resins Market Share, Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

The Protein A, G, and L resins market in Europe is driven by a strong pharmaceutical and biotechnology sector characterized by advanced research and development capabilities. Europe is home to several leading biopharmaceutical companies and research institutions, which foster high demand for sophisticated purification technologies. The region's stringent regulatory environment ensures that only high-quality resins are used in drug production, further supporting the market's growth. Additionally, the presence of well-established market players and a growing emphasis on biopharmaceutical innovation and personalized medicine are contributing to Europe's significant share in the market.

The Asia Pacific region is experiencing rapid growth in the rotein A, G and L resins market, primarily due to increasing investments in the healthcare and biotechnology sectors. Countries such as China and India are expanding their pharmaceutical manufacturing capabilities and investing heavily in research and development, leading to a higher demand for advanced purification technologies. The region's growing focus on improving healthcare infrastructure and rising biopharmaceutical production are key factors driving market expansion. Additionally, the burgeoning number of research labs and the shift towards high-quality biopharmaceuticals are further fueling the growth of the market in this dynamic and fast-evolving region.

Protein A, G and L Resins Market Key Market Players & Competitive Insights

Key players in the protein A, G and L resins market include prominent companies such as Thermo Fisher Scientific, GE Healthcare, and MilliporeSigma (Merck KGaA), which are leading providers of high-performance resins for various biopharmaceutical applications. Other significant players include Bio-Rad Laboratories, Fujifilm Irvine Scientific, and Sartorius AG, known for their innovative solutions and extensive product portfolios. Companies incusing Agilent Technologies, Abcam, and Repligen Corporation also play crucial roles by offering specialized resins for advanced protein purification. Additionally, firms such as Mabtech, GenScript Biotech, and Kaneka Corporation contribute to the market with their unique resin technologies and applications.

In terms of competitive analysis, the market is characterized by intense competition among these key players, who are continually striving to enhance resin performance and expand their product offerings. Companies are investing in research and development to innovate and improve resin capabilities, such as increasing binding capacities and optimizing resin longevity. Strategic partnerships, mergers, and acquisitions are common in this sector as firms seek to strengthen their market presence and leverage complementary technologies. Additionally, the focus on cost-effectiveness and scalability is driving competitive dynamics, with players aiming to provide high-quality resins at competitive prices to attract a broader customer base.

Overall, the Protein A, G and L resins market is highly dynamic, with crucial players focusing on technological advancements and customer-centric solutions to maintain their competitive edge. The rapid evolution of biopharmaceuticals and increasing demand for high-purity protein products are pushing companies to innovate and adapt. As the market grows, key players will continue to enhance their offerings and explore new opportunities to meet the diverse needs of the pharmaceutical and research industries, driving further competition and growth in the sector.

Thermo Fisher Scientific is a major player in the protein A, G, and L resins market, renowned for its extensive range of high-quality resins and purification products. The company’s robust portfolio includes protein A resins used for large-scale biopharmaceutical production and protein G and L resins for various research applications. Thermo Fisher’s strong focus on innovation and customer support positions it as a leading provider in the market.

GE Healthcare is another significant player in the market, offering a comprehensive selection of protein A, G, and L resins tailored for various biopharmaceutical and research applications. Known for its advanced technologies and global reach, GE Healthcare’s resins are integral to efficient protein purification processes across multiple industries.

List of Key Companies in Protein A, G and L Resins Market

- Thermo Fisher Scientific

- GE Healthcare

- MilliporeSigma (Merck KGaA)

- Bio-Rad Laboratories

- Fujifilm Irvine Scientific

- Sartorius AG

- Agilent Technologies

- Abcam

- Repligen Corporation

- Mabtech

- GenScript Biotech

- Kaneka Corporation

- Pall Corporation

- Lonza Group

- Promega Corporation

Protein A, G and L Resins Industry Developments

- June 2024: GE Healthcare announced the expansion of its resin manufacturing capabilities with a new facility in Singapore, which aims to boost production capacity and support growing demand in the Asia-Pacific region.

- April 2024: Thermo Fisher launched their new Protein A resin, designed to enhance productivity and reduce costs in monoclonal antibody production.

Protein A, G and L Resins Market Segmentation

By Type Outlook, (Revenue USD million, 2019–2032)

- Protein G Resin

- Protein L Resin

- Protein A Resin

By Application Outlook, (Revenue USD million, 2019–2032)

- Pharmaceutical Industry

- Research Labs

- Others

By Regional Outlook, (Revenue USD million, 2019–2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Protein A, G and L Resins Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 795.56 million |

|

Market Size Value in 2024 |

USD 814.97 million |

|

Revenue Forecast in 2032 |

USD 998.78 million |

|

CAGR |

2.6% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How the report is valuable for an organization?

Workflow/Innovation Strategy: The protein A, G and L resins market has been segmented into detailed segments of type, application, and global and regional levels segmentation.

Growth/Marketing Strategy: The growth and marketing strategy for the protein A, G, and L resins market focuses on innovation, strategic partnerships, and expanding global reach. Key players are investing heavily in research and development to enhance resin performance and introduce novel solutions that meet evolving industry demands. Strategic alliances and collaborations with biopharmaceutical companies and research institutions are crucial for market penetration and expanding application areas. Additionally, companies are leveraging digital marketing and targeted outreach to enhance brand visibility and drive customer engagement. Emphasizing cost-effective and scalable solutions also helps to capture a broader customer base and address diverse market needs.

FAQ's

The global protein A, G and L resins market size was valued at USD 795.56 million in 2023 and is projected to grow to USD 998.78 million by 2032.

The global market is projected to exhibit a CAGR of 2.6% during the forecast period of 2023-2032.

North America had the largest share of the global market.

Key players in the Protein A, G, and L resins market include prominent companies such as Thermo Fisher Scientific, GE Healthcare, and MilliporeSigma (Merck KGaA), which are leading providers of high-performance resins for various biopharmaceutical applications.

The protein A resin dominated the market in 2023.

The pharmaceutical industry segment had the largest share of the global market.

Protein A, G, and L resins are specialized chromatography media used for the purification of proteins and antibodies in biopharmaceutical and research applications. Protein A resins are highly effective for isolating monoclonal antibodies, while protein G and L resins offer broader binding capabilities for various antibody types and other proteins. These resins play a crucial role in ensuring the purity and quality of therapeutic proteins and in advancing scientific research.

Here are some key trends observed in this market: Shift Towards High-Capacity Resins: Increasing demand for larger-scale biopharmaceutical production drives the need for resins with higher binding capacities. Integration of Automation: Adoption of automated purification systems enhances precision, reproducibility, and efficiency in protein purification processes. Focus on Cost-Effective Solutions: Development of affordable yet high-performance resins to balance production costs with quality requirements. Advancements in Resin Chemistry: Innovation in resin materials and structures to improve performance and expand application ranges

A new company entering the Protein A, G, and L resins market should focus on developing high-performance, cost-effective resins that address current industry challenges, such as high binding capacity and scalability for large-scale production. Investing in automation and integrating advanced purification technologies can offer a competitive edge by enhancing efficiency and consistency. Additionally, targeting niche applications, such as personalized medicine and specialized research needs, can differentiate the company from established players. Building strong partnerships with biopharmaceutical companies and research institutions can also facilitate market entry and expansion. Emphasizing innovation and customer-centric solutions will help the company stay ahead in a rapidly evolving market

Companies producing protein A, G and L resins and related products, healthcare providers, and other consulting firms.