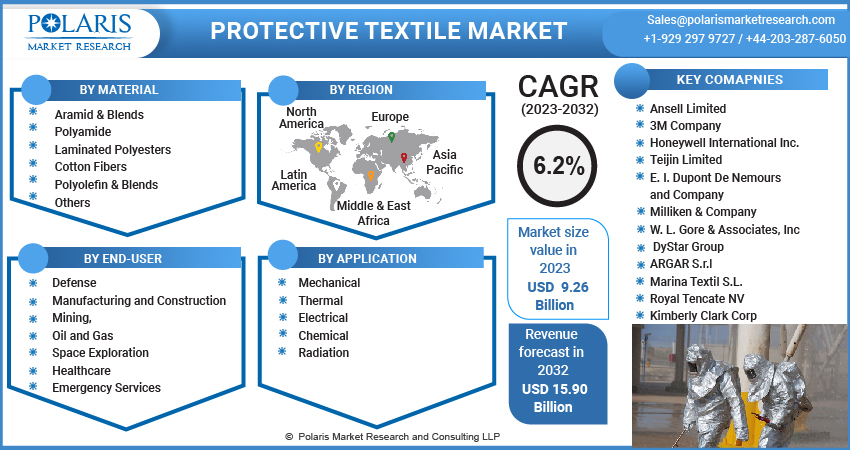

Protective Textile Market Share, Size, Trends, Industry Analysis Report, By Material; By Application (Mechanical, Thermal, Electrical, Chemical, Radiation, Others); By End-Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:May-2023

- Pages: 118

- Format: PDF

- Report ID: PM1044

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

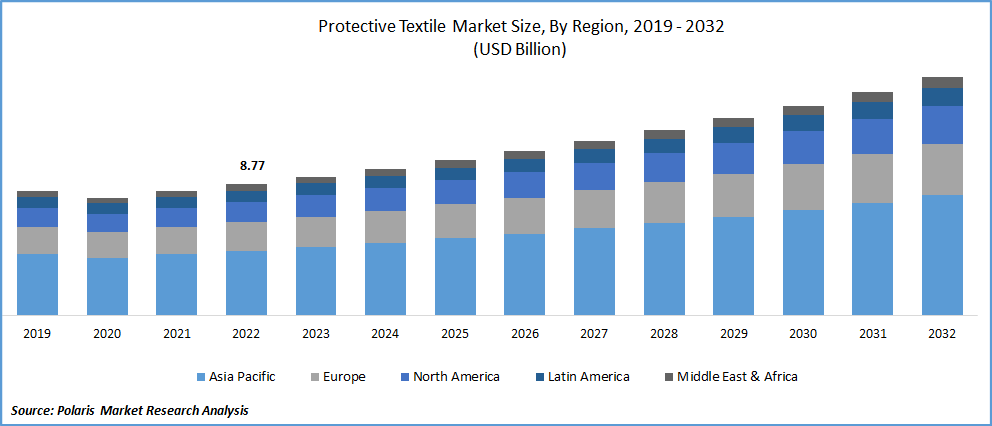

The global protective textile market was valued at USD 8.77 billion in 2022 and is expected to grow at a CAGR of 6.2% during the forecast period. Increasing concerns regarding the safety of the workforce and stringent government regulations concerning workplace safety. Protective textile has registered a rising demand from various industries such as construction, oil and gas, and mining, among others, thereby accelerating the market's growth. Other factors driving the growth of this market include growing investments in R&D and technological advancements. However, the high costs associated with them would limit the market's growth to a certain extent. The expansion of established companies into emerging economies and the growing adoption of phase change materials would provide numerous growth opportunities in the market.

Know more about this report: Request for sample pages

Protective textile refers to garments and other fabrics developed to sustain harsh environmental conditions while providing protection and safety to the user. These garments protect the user from extreme heat, radiation, electrostatic, and mechanical forces, which may otherwise lead to injury. Protective textile is used by personnel in defense and military, emergency services, hospitals, manufacturing, and space exploration, among others.

Furthermore, the increasing focus on health and workplace safety in manufacturing facilities and medical centers. People are becoming more aware of the need to protect themselves against heat, flames, microorganisms, and other hazardous work environments, driving the demand for protective textiles and other wearables. Additionally, the demand for performance clothing is increasing in industries such as oil fields and chemical production facilities, which will likely drive the protective textile market growth in the forecast period.

The market has been significantly impacted by the COVID-19 pandemic, as the outbreak of the virus has led to a surge in demand for personal protective equipment (PPE). The medical industry has been particularly affected, with healthcare workers requiring PPE to protect themselves from exposure to the virus, resulting in a shortage of supplies in many parts of the world. Other industries, such as manufacturing, have also seen increased demand for protective textiles as workers require PPE to protect themselves from the virus. As a result, many countries have increased their production of protective textiles to meet the growing demand. The high demand for protective textiles will continue even after the pandemic subsides as people prioritize health and safety in their workplaces and daily lives.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increase in awareness about workplace safety and the need for protective clothing, especially in industries such as construction, manufacturing, and mining, where workers are exposed to hazards such as chemicals, heat, and flames. This drives the demand for protective textiles, which can protect against these hazards.

Governments worldwide have implemented regulations to ensure worker safety in various industries. Compliance with these regulations has led to an increase in the demand for protective textiles. This is because protective textiles can help companies meet these regulations and ensure the safety of their workers.

The COVID-19 pandemic has increased demand for personal protective equipment (PPE), including protective textiles. The healthcare industry, in particular, is a major consumer of PPE, and the pandemic has led to a significant increase in demand for protective textiles. In addition, emerging economies such as India, China, and Brazil are experiencing significant growth in their manufacturing and construction sectors, driving the demand for protective textiles in these regions.

For instance, Kimberly-Clark is a supplier of personal protective equipment, including protective textiles such as disposable coveralls, gowns, and masks. The company's products are used in the healthcare, pharmaceutical, and food processing industries.

In addition, technological advancements, such as developing new materials and technologies for protective textiles, are also driving the market's growth. These advancements have created more durable, comfortable, and effective protective clothing, increasing the demand for protective textiles.

Report Segmentation

The market is primarily segmented based on material, application, end-use, and region.

|

By Material |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Aramid and Blends Segment Dominated the Market in 2022

The aramid and blends segment has shown high growth and dominance in the market and will continue its dominance over the forecast period. Aramid fibers offer exceptional strength, heat resistance, and durability, making them ideal for protective clothing in high-risk industries such as firefighting, military, and aerospace.

Moreover, the market for polyolefin and blends is also expected to grow rapidly due to the increasing demand from industries such as oil and gas, chemical processing, and wastewater treatment. Polyolefin fibers offer excellent chemical resistance, UV resistance, and durability, making them ideal for protective clothing in hazardous environments.

Thermal Segment Holds the Highest Shares of the Market in 2022

The thermal segment has emerged as dominant and holds the highest shares in the market, with the increasing demand for durable and breathable flame-resistant clothing across various sectors. With the rise in industrial accidents and the need for stringent fire safety regulations, the demand for thermal protective clothing has grown significantly worldwide.

In addition to flame-resistant properties, thermal protective clothing provides insulation and protects workers from extreme heat and cold temperatures. The demand for thermal protective clothing is expected to be particularly high in industries such as oil and gas, chemical, and manufacturing, where workers are exposed to high-temperature environments and thermal hazards.

Healthcare Segment is Anticipated to Grow at the Fastest Rate

The healthcare segment is anticipated to grow at the fastest rate in the market. The increasing medical hygiene standards and the need to protect healthcare workers and patients from infectious diseases have driven this sector's demand for protective clothing. The COVID-19 pandemic has further accelerated the demand for protective textiles in the medical industry, with healthcare workers requiring personal protective equipment (PPE) to protect themselves from exposure to the virus.

Moreover, the growing prevalence of chronic diseases and the increasing demand for advanced medical treatments and devices have driven the demand for specialized protective textiles in the pharmaceutical industry. These textiles are designed to protect against biological and chemical hazards and prevent contamination of medicines and equipment.

Asia Pacific Dominated the Global Market in 2022

The Asia-Pacific region dominated the market and is likely to continue its dominance over the projected period. The region is witnessing a surge in demand for protective textiles due to the presence of emerging countries such as China, India, and Japan. These countries are experiencing a rapid increase in industrial activities, which is expected to boost the demand for protective textiles during the forecast period.

North America accounted for the largest market share in 2022. This can be attributed to the implementation of stringent regulations for ensuring the safety of workers in various sectors such as oil & gas, construction, and manufacturing. The presence of established players and advanced technologies for producing protective textiles has also contributed to the dominance of North America in the market.

Competitive Insight

Some of the major players operating in the global protective textile market include Ansell Limited, 3M Company, Honeywell International Inc., Dow, Keppler Inc, Sion Industries NV, Teijin Limited, E. I. Dupont De Nemours and Company, SOLVAY, Milliken & Company, W. L. Gore & Associates, Inc., Respirex, DyStar Group, ARGAR S.r.l, Marina Textil S.L., International Envirogaurd, Royal Tencate NV, and Kimberly Clark Corp.

Recent Developments

- In March 2023, Carrington Textiles launched a new product, Spartan HT Flex Lite, to its Defence Range of products.

- In May 2022, Honeywell announced the launch of two new respiratory products that were NIOSH-certified. The latest products build and added to its personal protective equipment (PPE) line for healthcare workers.

Protective Textile Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 9.26 billion |

|

Revenue forecast in 2032 |

USD 15.90 billion |

|

CAGR |

6.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Material, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Ansell Limited, 3M Company, Honeywell International Inc., Dow, Keppler Inc, Sion Industries NV, Teijin Limited, E. I. Dupont De Nemours and Company, SOLVAY, Milliken & Company, W. L. Gore & Associates, Inc., Respirex, DyStar Group, ARGAR S.r.l, Marina Textil S.L., International Envirogaurd, Royal Tencate NV, and Kimberly Clark Corp. |

FAQ's

The protective textile market report covering key segments are material, application, end-use, and region.

Protective Textile Market Size Worth $15.90 Billion By 2032.

The global protective textile market expected to grow at a CAGR of 6.2% during the forecast period.

Asia Pacific is leading the global market.

key driving factors in protective textile market are growing importance of safety and security at workplaces.