Protective Relay Market Size, Share, Trends, Industry Analysis Report: By Voltage (Low Voltage, Medium Voltage, and High Voltage); Technology; Application; End Use; and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 - 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5178

- Base Year: 2024

- Historical Data: 2020-2023

Protective Relay Market Overview

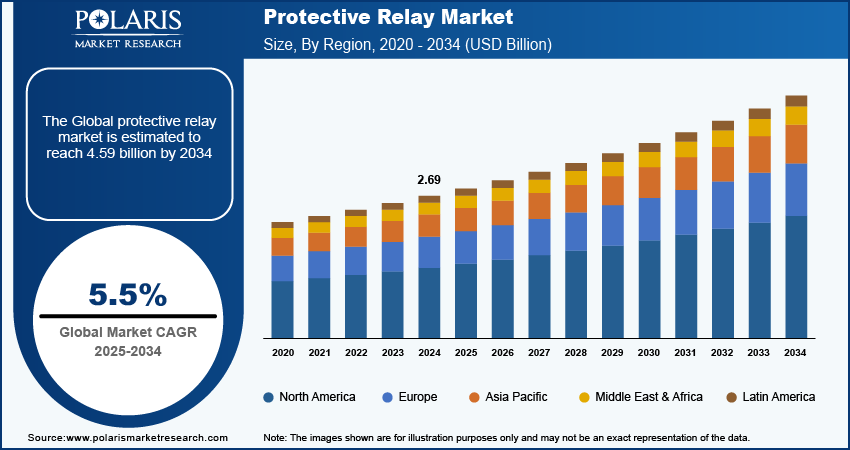

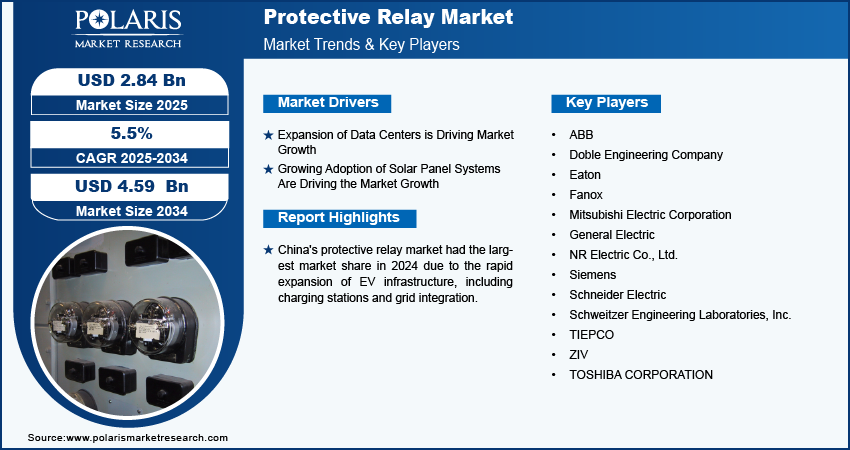

Global protective relay market size was valued at USD 2.69 billion in 2024. The market is projected to grow from USD 2.84 billion in 2025 to USD 4.59 billion by 2034, exhibiting a CAGR of 5.5% during the forecast period.

A protective relay is an automated apparatus that detects abnormal electrical circuit conditions and initiates responses to isolate faults.

The increasing demand for power system reliability, driven by the heavy dependence of modern societies on electricity for residential and industrial use, is driving demand for protective relays, which is further contributing to the market growth. Additionally, the expansion of industries globally, particularly in emerging economies, is driving demand for dependable electrical systems in industrial plants and manufacturing facilities, thereby increasing demand for protective relays. This is further fueling the protective relay market growth.

To Understand More About this Research: Request a Free Sample Report

Continuous advancements in protective relay technologies, such as the development of digital, microprocessor-based, and numerical relays, are driving market growth. These advanced relays offer better accuracy, faster fault detection, self-diagnosis, and integration with communication networks, making them more attractive to utilities and industries. Moreover, stringent regulations and standards imposed by governments and regulatory bodies to ensure the safety and reliability of electrical systems are driving the adoption of protective relays, which is contributing to the growth of the protective relay market.

Protective Relay Market Derivers and Trends Analysis

Expansion of Data Centers

The rapid expansion of data centers worldwide due to the rise of cloud computing and digitalization is creating a heightened need for dependable electrical systems. For instance, in March 2024, Amazon’s cloud division, Amazon Web Services, launched its new data centers in Saudi Arabia, with an investment of around USD 5.3 billion in the country. Thus, the expansion of data centers is fueling demand for protective relays, which play a crucial role in preserving the stability of these vital infrastructures by swiftly identifying faults and safeguarding delicate equipment, which in turn fuels the market growth.

Growing Adoption of Solar Panel Systems

The growing adoption of solar panel systems and green energy is significantly driving the demand for protective relays. For instance, Tata Power Solar has commissioned a 2.67 MW solar carport at Cochin International Airport, featuring 8472 solar panels on 27 carports covering 20289.9 square meters. The plant aims to reduce CO2 emissions by 1868 tons annually. Thus, as the world shifts towards renewable energy sources to meet environmental goals and reduce carbon emissions, the integration of solar power into existing electrical grids has increased exponentially, thereby fueling the protective relay market. Additionally, the variability of solar power generation, due to factors such as fluctuating sunlight, demands advanced relay systems to detect and isolate faults rapidly, preventing equipment damage and ensuring uninterrupted power supply. Therefore, the continuous adoption of renewable energy is a rising demand for protective relays in solar installations, which is contributing to the market growth.

Protective Relay Market Segment Analysis

Protective Relay Market Breakdown by Voltage Insights

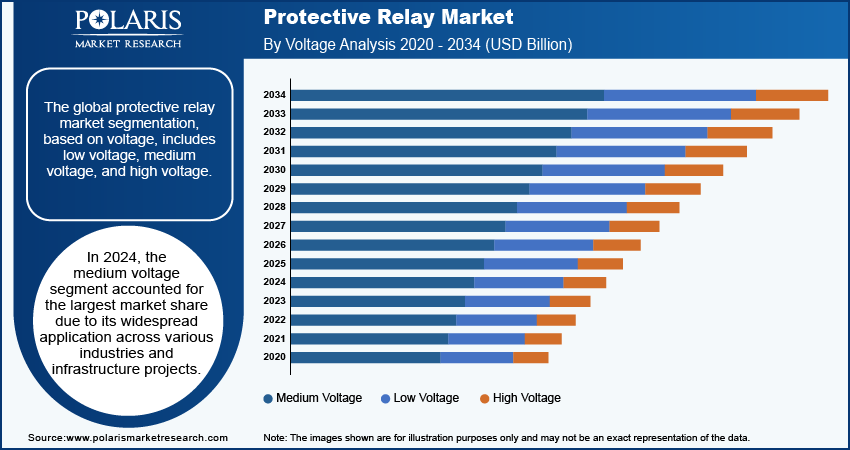

The global protective relay market segmentation, based on voltage, includes low voltage, medium voltage, and high voltage. In 2024, the medium voltage segment accounted for the largest market share due to its widespread application across various industries and infrastructure projects. Medium voltage systems, typically ranging between 1 kV and 35 kV, are crucial in distributing electricity efficiently from substations to commercial, industrial, and residential areas. The growing demand for reliable power supply in rapidly urbanizing regions, coupled with industrial expansion, particularly in sectors such as manufacturing, mining, and construction, has boosted the need for medium-voltage systems. Moreover, the integration of renewable energy sources, such as wind and solar power, into national grids has further driven the adoption of medium voltage equipment, as these energy systems require efficient power transmission and distribution.

Protective Relay Market Breakdown by End Use Insights

The global protective relay market segmentation, based on end use, includes utilities, industrial, railways, and others. The industrial category is expected to be the highest growing CAGR during the forecast period. This is attributed to the increasing industrial sectors, such as manufacturing, oil and gas, mining, and chemical processing, which are witnessing increased electrification and automation to improve operational efficiency and productivity. For instance, according to NIST, in 2022, the manufacturing sector made a significant contribution of USD 2.3 trillion to the US GDP, accounting for 11.4% of the total GDP. Thus, the rising demand for reliable power distribution systems, with the rapid expansion of industrial activities, is driving the need for advanced electrical infrastructure, contributing to market growth.

Regional Insights

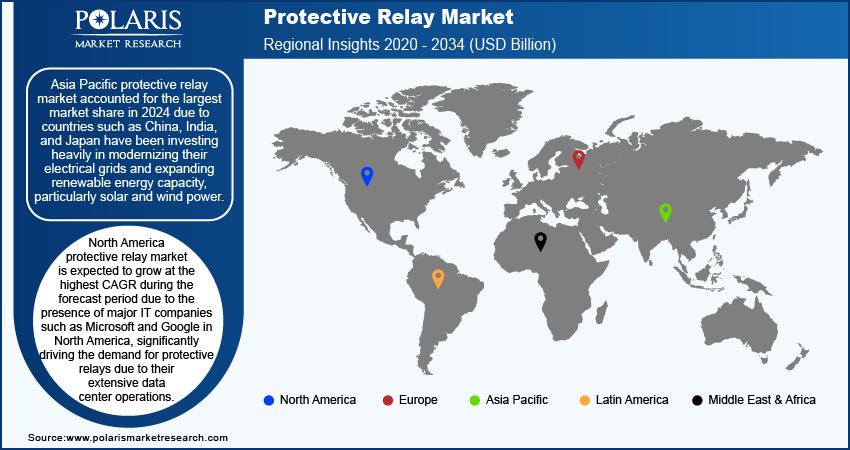

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific protective relay market accounted for the largest market share in 2024. This is attributed to countries such as China, India, and Japan have been investing heavily in modernizing their electrical grids and expanding renewable energy capacity, particularly solar and wind power. This shift toward renewable energy sources increased the demand for protective relays, which play a crucial role in ensuring grid stability and protecting electrical equipment. Additionally, the growing need for reliable power supply in large-scale industries, with ongoing projects in smart grid technologies and grid modernization, has driven the adoption of advanced protective relays. China's protective relay market had the largest market share in 2024 due to the rapid expansion of EV infrastructure, including charging stations and grid integration.

North America protective relay market is expected to grow at the highest CAGR during the forecast period due to the presence of major IT companies such as Microsoft and Google. These companies are significantly driving the demand for protective relays due to their extensive data center operations. These data centers require a constant and reliable power supply to ensure uninterrupted services and protect critical infrastructure. Thus, the expansion of companies’ operations to support cloud computing and various digital services is driving demand for protective relays, thereby fueling market growth.

Protective Relay Key Market Players & Competitive Insights

The competitive landscape of the protective relay market is characterized by a diverse array of key players, each striving to leverage technological advancements and expand their market presence.

Major companies, including Siemens, Schneider Electric, GE, and ABB, are at the forefront, offering a wide range of innovative protective relay solutions that cater to various industries, such as utilities, manufacturing, and renewable energy. These companies are heavily investing in research and development to enhance the functionality and reliability of their products, focusing on integrating smart technologies and digital capabilities that align with the growing trend of smart grid implementations.

Strategic partnerships, mergers, and acquisitions are also common as companies seek to enhance their product portfolios and expand their geographical reach. The increasing demand for automation and real-time monitoring solutions in electrical systems further intensifies competition, driving firms to differentiate themselves through advanced features, superior performance, and enhanced customer support. Major players include ABB; Doble Engineering Company; Eaton; Fanox; Mitsubishi Electric Corporation; General Electric; NR Electric Co., Ltd.; Siemens; Schneider Electric; Schweitzer Engineering Laboratories, Inc.; TIEPCO; ZIV; and TOSHIBA CORPORATION.

ABB operates as a technology company worldwide. The company operates through four segments: electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers a product portfolio of switchgear under the distribution solution subsegment. The motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics & discrete automation offer measurement analytics, machine automation, and robotics to various energy and process industries. Some of the prominent end-markets catered by the company are renewables, automotive, food & beverage, distribution, oil & gas, chemicals, mining & metals, buildings, etc. The company’s prominent channel partners include distributors followed by direct sales, engineering, procurement, and construction (EPCs), Original equipment manufacturers (OEMs), system integrators and panel builders. In February 2023, ABB launched the REX640 protection relay for advanced power generation and distribution by introducing high-speed transfer device functionality.

Siemens AG specializes in electrification, automation, and digitalization and operates in a diverse range of industries, such as energy, healthcare, financing, building technology, transportation, and manufacturing. The company provides a comprehensive range of products and services, including power generation systems, turbines, medical imaging equipment, trains, and automation software, as well as building technologies and smart grid solutions. In December 2022, Siemens introduced the innovative Dual Powered Protection Relay-7SR46. The Siemens Reyrolle 7SR46 provides reliable overcurrent and earth fault protection for medium voltage transformer stations, ensuring secure operation and enhancing grid stability.

List of Key Companies in the Protective Relay Industry Outlook

- ABB

- Doble Engineering Company

- Eaton

- Fanox

- Mitsubishi Electric Corporation

- General Electric

- NR Electric Co., Ltd.

- Siemens

- Schneider Electric

- Schweitzer Engineering Laboratories, Inc.

- TIEPCO

- ZIV

- TOSHIBA CORPORATION

Protective Relay Industry Developments

May 2024: General Electric and TECO collaborated to provide STATCOM systems and transformer solutions for substations connected via a 161 kV transmission line. TECO will handle civil work and site operations. This partnership emphasizes a dedication to sustainable energy solutions for global impact.

May 2024: Schweitzer Engineering Laboratories (SEL) launched the SEL-787L Line Current Differential Relay. This relay offers cost-effective, rapid, secure, and reliable line current differential protection for distribution and industrial applications.

February 2023: Schneider Electric launched new product lines in Bengaluru to meet the growing demand for protection relays and IoT gateways for power-grade digitization and management.

Protective Relay Market Segmentation

By Voltage Outlook (Revenue, USD Billion, 2020–2034)

- Low Voltage

- Medium Voltage

- High Voltage

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Electromechanical & Static Relay

- Digital & Numerical Relay

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Transmission line

- Busbar

- Transformer

- Feeder

- Generator

- Motor

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Utilities

- Industrial

- Railways

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Protective Relay Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2.69 Billion |

|

Market Size Value in 2025 |

USD 2.84 Billion |

|

Revenue Forecast in 2034 |

USD 4.59 Billion |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global protective relay market size was valued at USD 2.69 billion in 2024 and is projected to grow to USD 4.59 billion by 2034.

The global market is projected to grow at a CAGR of 5.5% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

The key players in the market are ABB; Doble Engineering Company; Eaton; Fanox, Mitsubishi Electric Corporation; General Electric; NR Electric Co., Ltd.; Siemens; Schneider Electric; Schweitzer Engineering Laboratories, Inc.; TIEPCO; ZIV; and TOSHIBA CORPORATION.

The medium voltage segment category dominated the market in 2024.

The industrial category had the highest growing CAGR in the forecast period.