Prostaglandin Analogs Market Size, Share, Trends, Industry Analysis Report: By Route of Administration (Topical, Oral, and Injectable), By Drug Type, By Application, By Distribution Channel, and By Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Sep-2024

- Pages: 115

- Format: PDF

- Report ID: PM5052

- Base Year: 2023

- Historical Data: 2019-2022

Prostaglandin Analogs Market Overview

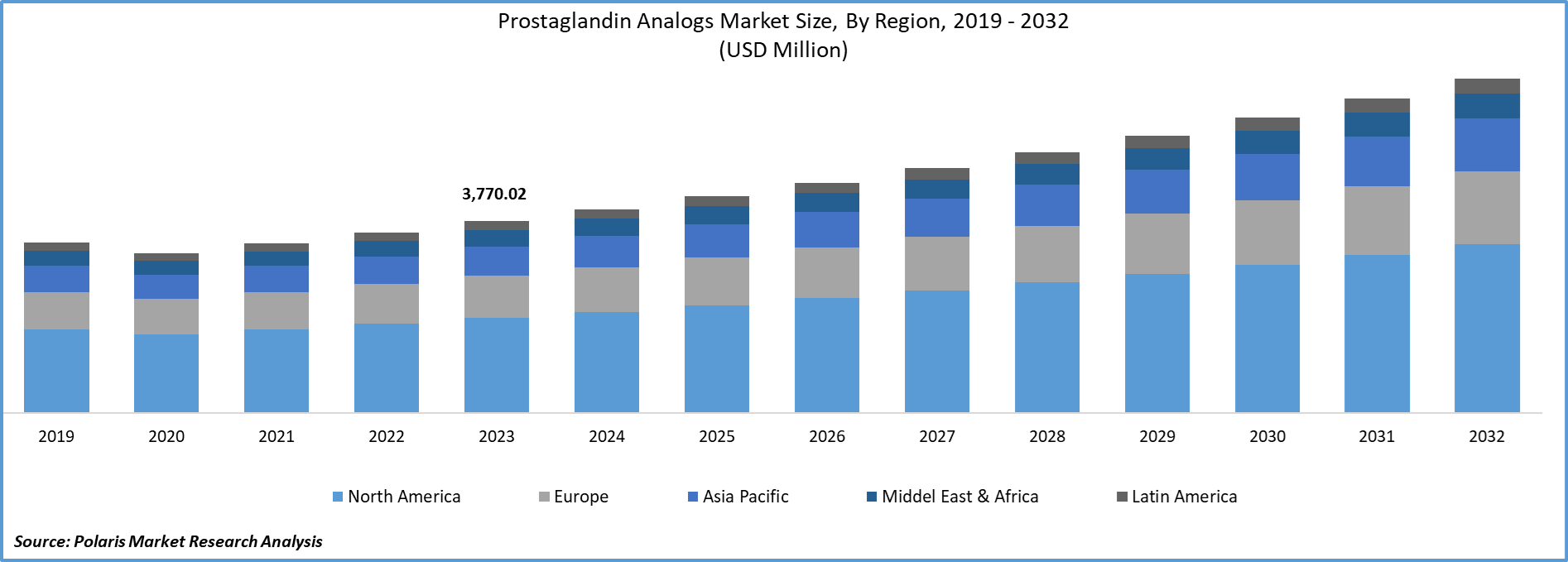

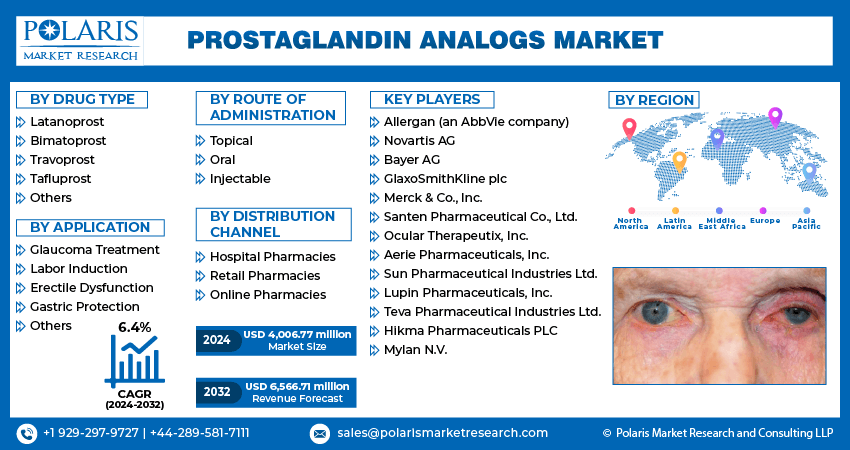

Global prostaglandin analogs market size was valued at USD 3,770.02 million in 2023. The market is projected to grow from USD 4,006.77 million in 2024 to USD 6,566.71 million by 2032, exhibiting a CAGR of 6.4% during the forecast period.

The global prostaglandin analogs market is experiencing significant growth, driven by the rising prevalence of glaucoma and other ophthalmic conditions, which are leading to increased demand for effective treatment options. Prostaglandin analogs, known for their efficacy in reducing intraocular pressure, are becoming the treatment of choice in ophthalmology.

Advancements in drug formulations, such as the development of combination therapies, are enhancing therapeutic outcomes and boosting market expansion. Emerging trends include a growing focus on patient compliance, leading to the innovation of sustained-release formulations and user-friendly drug delivery systems. Aso, market is witnessing increased investment in research and development aimed at expanding the therapeutic applications of prostaglandin analogs beyond ophthalmology into areas such as cardiovascular and reproductive health.

To Understand More About this Research: Request a Free Sample Report

Prostaglandin Analogs Market Drivers and Trends

Rising Prevalence of Ophthalmic Conditions

The increasing incidence of ophthalmic conditions, particularly glaucoma, is a major driver of the prostaglandin analogs market. Glaucoma is one of the leading causes of irreversible blindness globally, and prostaglandin analogs are among the most effective treatments available for reducing intraocular pressure, a key factor in glaucoma management. As the aging population grows, the prevalence of glaucoma and other related conditions is expected to rise, further fueling the demand for prostaglandin analogs. This trend is prompting pharmaceutical companies to invest in developing more advanced and patient-friendly formulations, ensuring sustained market growth.

Advancements in Drug Formulations and Delivery Systems

Another significant trend in the prostaglandin analogs market is the ongoing innovation in drug formulations and delivery systems. Traditional prostaglandin analogs are administered as eye drops, which can be challenging for patients to use consistently, leading to issues with compliance. In response, there is a growing focus on developing sustained-release formulations and novel drug delivery systems that enhance ease of use and improve patient adherence. For instance, new formulations that provide longer-lasting effects with less frequent dosing are gaining popularity as they reduce the burden on patients and potentially lead to better therapeutic outcomes.

Expansion of Therapeutic Applications

The expansion of therapeutic applications beyond ophthalmology represents a crucial trend in the Prostaglandin Analogs market. Research and development efforts are increasingly exploring the potential of prostaglandin analogs in treating other conditions, such as cardiovascular diseases and reproductive health issues. These analogs are being investigated for their vasodilatory and uterine contraction properties, which could lead to new indications and broaden their market potential. As more studies validate these applications, the market is likely to see diversification, with prostaglandin analogs playing a role in a wider range of therapeutic areas.

Prostaglandin Analogs Market Segment Insights

Market Breakdown by Drug Type Insights

In terms of drug type, the global market is categorized into latanoprost, bimatoprost, travoprost, tafluprost, and others. In the prostaglandin analogs market, latanoprost is the dominating segment due to its widespread adoption as a first-line treatment for glaucoma and ocular hypertension. Its proven efficacy in reducing intraocular pressure, coupled with its established safety profile, has made it the preferred choice among both healthcare professionals and patients. Latanoprost's dominance is further reinforced by its availability in both branded and generic forms, ensuring its accessibility across various markets. Moreover, its once-a-day dosing regimen enhances patient compliance, contributing to its sustained market leadership.

Bimatoprost is emerging as the highest-growing segment in the market, driven by its dual benefits in ophthalmology and cosmetic applications. Similar to latanoprost, bimatoprost is highly effective in lowering intraocular pressure. It is also gaining popularity for its off-label use in promoting eyelash growth, leading to its inclusion in cosmetic products. This dual functionality is expanding its consumer base and driving growth in both medical and aesthetic markets. Other drugs like Travoprost and Tafluprost also hold significant market shares, offering alternative options for patients who may not respond optimally to Latanoprost or Bimatoprost.

Prostaglandin Analogs Market Route of Administration Insights

In terms of route of administration, the global market is categorized into topical, oral, and injectable. The topical route of administration dominates the prostaglandin analogs market, primarily because it is the most common method for treating ophthalmic conditions like glaucoma. Topical administration, typically in the form of eye drops, is highly preferred due to its direct application to the affected area, leading to effective and targeted reduction of intraocular pressure with minimal systemic absorption. This method is widely accepted by both healthcare providers and patients due to its ease of use and the availability of multiple prostaglandin analogs in this form, including Latanoprost, Bimatoprost, and Travoprost.

The injectable route is also emerging as the largest-growing segment in the market, driven by advancements in drug delivery technologies and the development of sustained-release formulations. Injectable prostaglandin analogs are being explored for their potential to offer longer-lasting effects, reducing the need for frequent administration and improving patient adherence. This route is gaining traction, particularly in cases where topical administration is insufficient or where a more controlled and extended release of the drug is beneficial.

Prostaglandin Analogs Market Application Insights

In terms of application, the global market is categorized into glaucoma treatment, labor induction, erectile dysfunction, gastric protection, and others. The glaucoma treatment segment dominates the prostaglandin analogs market, primarily due to the high prevalence of glaucoma and the proven effectiveness of these drugs in managing intraocular pressure. Glaucoma, a major cause of blindness, necessitates effective long-term treatment. Prostaglandin analogs have emerged as the first-line therapy because they significantly lower intraocular pressure and have a favorable safety profile. The widespread use of drugs such as Latanoprost, Bimatoprost, and Travoprost highlights the segment's dominance. This dominance is further supported by ongoing clinical research and the development of new formulations aimed at improving patient compliance and outcomes.

Labor induction is the highest-growing segment within the prostaglandin analogs market, driven by the increasing use of these drugs in obstetrics to induce labor in pregnant women. Prostaglandin analogs like Dinoprostone are widely used for cervical ripening and labor induction, especially in cases where timely delivery is critical for the health of the mother or fetus. This application is gaining traction as more healthcare providers adopt these analogs due to their effectiveness and relatively low risk of complications. Additionally, the rising number of births and the growing awareness of the benefits of medical labor induction are contributing to the rapid expansion of this segment, positioning it as a key area of growth within the market.

Prostaglandin Analogs Market Distribution Channel Insights

In terms of distribution channel, the global market is categorized into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominates the prostaglandin analogs market, primarily due to the critical role hospitals play in managing serious conditions such as glaucoma and labor induction. Hospital pharmacies are the preferred distribution channel for these medications because they are often prescribed for acute treatments or specialized therapies that require close monitoring by healthcare professionals. Patients typically receive their initial prescriptions or treatments directly through hospital pharmacies, ensuring the availability of the necessary medications in a controlled and professional environment. This channel’s dominance is reinforced by the trust and reliability associated with hospital-based care, particularly for conditions requiring precise dosage and administration.

Another fastest-growing distribution channel in the prostaglandin analogs market is the online pharmacies segment, driven by the increasing convenience and accessibility they offer to patients. As more consumers turn to digital platforms for their healthcare needs, online pharmacies are gaining popularity, particularly for the ongoing management of chronic conditions like glaucoma. The ability to easily order refills, access a broader range of products, and benefit from competitive pricing are key factors contributing to the growth of this segment. Additionally, the rise in telemedicine and e-prescriptions has further boosted the expansion of online pharmacies, making them an increasingly important channel for the distribution of prostaglandin analogs.

Prostaglandin Analogs Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Prostaglandin Analogs Market Regional Insights

By region, the study provides industry insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates the prostaglandin analogs market, driven by the high prevalence of glaucoma and other ophthalmic conditions, coupled with advanced healthcare infrastructure and strong awareness among patients and healthcare providers. The region's dominance is further supported by significant investment in research and development, leading to the introduction of innovative products and therapies. The availability of a wide range of prostaglandin analogs, along with favorable reimbursement policies, also contributes to the market's growth in North America.

Europe has a substantial market for prostaglandin analogs due to the aging population and the increasing incidence of glaucoma and other ophthalmic disorders. Countries such as Germany, France, and the UK are key contributors due to their well-established healthcare systems and high awareness of glaucoma treatment options. The region also benefits from strong regulatory frameworks that ensure the availability of effective and safe medications. Moreover, ongoing research and collaborations between pharmaceutical companies and research institutions in Europe are fostering innovation, leading to the introduction of advanced drug formulations.

The Asia Pacific region is also experiencing rapid growth in the prostaglandin analogs market, fueled by the rising prevalence of glaucoma and increasing healthcare expenditures. Countries such as China, Japan, and India are at the forefront, driven by large patient populations, improving healthcare infrastructure, and growing awareness of eye health. The expanding middle class in these countries are also contributing to the demand for advanced ophthalmic treatments. Additionally, the region is witnessing increased investments in healthcare and pharmaceutical R&D, leading to the development and commercialization of new and more accessible prostaglandin analogs.

Prostaglandin Analogs Market Share, Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Prostaglandin Analogs Market Key Market Players & Competitive Insights

Key players in the prostaglandin analogs market include Pfizer Inc., Allergan (an AbbVie company), Novartis AG, Bayer AG, and GlaxoSmithKline plc. Other notable companies are Merck & Co., Inc., Santen Pharmaceutical Co., Ltd., Ocular Therapeutix, Inc., and Aerie Pharmaceuticals, Inc. Additionally, companies such as Sun Pharmaceutical Industries Ltd., Lupin Pharmaceuticals, Inc., Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, and Mylan N.V. play significant roles in the market. These companies are recognized for their extensive portfolios of prostaglandin analogs and their contributions to advancing ophthalmic care.

The competitive landscape of the prostaglandin analogs market is marked by a high level of innovation and market presence from both established pharmaceutical giants and emerging players. Major companies leverage their extensive research and development capabilities to introduce new and improved formulations, enhancing the efficacy and patient adherence of their products. This competitive edge is often supported by strong marketing strategies, extensive distribution networks, and strategic partnerships with healthcare providers and institutions. The market is characterized by continuous product launches and clinical trials aimed at expanding indications and improving drug delivery methods.

Emerging players and generic drug manufacturers are also making significant inroads, contributing to competitive dynamics by offering cost-effective alternatives to branded prostaglandin analogs. This has led to increased price competition and pressure on profit margins for leading companies. The market is also influenced by regulatory challenges, patent expirations, and the need for compliance with stringent quality standards. Companies that can effectively navigate these challenges while meeting evolving patient needs and preferences are well-positioned to capture growth opportunities in the expanding global market.

Pfizer Inc. is a major player in the prostaglandin analogs market, known for its extensive portfolio of pharmaceutical products, including those for ophthalmic conditions. Pfizer's dominance is attributed to its strong research and development capabilities and its broad distribution network. The company has a significant presence in the glaucoma treatment segment, leveraging its expertise in drug formulation and innovation to offer effective prostaglandin analogs.

Allergan (an AbbVie company) is another key player in the market, recognized for its flagship prostaglandin analogs used in the treatment of glaucoma. Allergan's strength lies in its robust pipeline of ophthalmic medications and its focus on developing new formulations to improve patient outcomes.

List of Key Companies in Prostaglandin Analogs Market

- Pfizer Inc.

- Allergan (an AbbVie company)

- Novartis AG

- Bayer AG

- GlaxoSmithKline plc

- Merck & Co., Inc.

- Santen Pharmaceutical Co., Ltd.

- Ocular Therapeutix, Inc.

- Aerie Pharmaceuticals, Inc.

- Sun Pharmaceutical Industries Ltd.

- Lupin Pharmaceuticals, Inc.

- Teva Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals PLC

- Mylan N.V.

Prostaglandin Analogs Industry Developments

- January 2024: Allergan received FDA approval for its new combination therapy, Combigan (brimonidine tartrate/timolol maleate), which includes an innovative approach to treating intraocular pressure in glaucoma patients.

- March 2023: Pfizer announced the acquisition of Seagen Inc., which will enhance its oncology portfolio and potentially impact its broader therapeutic strategies, including ophthalmic care.

Prostaglandin Analogs Market Segmentation

Prostaglandin Analogs Market – Drug Type Outlook

- Latanoprost

- Bimatoprost

- Travoprost

- Tafluprost

- Others

Prostaglandin Analogs Market – Route of Administration Outlook

- Topical

- Oral

- Injectable

Prostaglandin Analogs Market – Application Outlook

- Glaucoma Treatment

- Labor Induction

- Erectile Dysfunction

- Gastric Protection

- Others

Prostaglandin Analogs Market – Distribution Channel Outlook

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Prostaglandin Analogs Market – Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Prostaglandin Analogs Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 3,770.02 million |

|

Market Size Value in 2024 |

USD 4,006.77 million |

|

Revenue Forecast in 2032 |

USD 6,566.71 million |

|

CAGR |

6.4% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The prostaglandin analogs market has been divided into specific segments based on the medication type, application, route of administration, and distribution routes. Additionally, the study gives the reader a thorough grasp of the various divisions on a worldwide and regional scale.

Growth/Marketing Strategy: To drive growth in the prostaglandin analogs market, companies are focusing on enhancing product differentiation through advanced formulations and improved drug delivery systems. Strategic investments in research and development are crucial for introducing novel therapies and expanding indications beyond ophthalmology. Additionally, leveraging digital marketing and e-commerce platforms helps in reaching a broader patient base and increasing brand visibility. Strategic partnerships and collaborations with healthcare providers and institutions are also key to expanding market reach and improving patient access to innovative treatments. Emphasizing patient adherence and support programs further strengthens market position and drives sustained growth.

FAQ's

The global prostaglandin analogs market size was valued at USD 3,770.02 million in 2023 and is projected to grow to USD 6,566.71 million by 2032.

The global market is projected to register a CAGR of 6.4% during the forecast period, 2023-2032.

North America had the largest share of the global market.

Key players in the prostaglandin analogs market include Pfizer Inc., Allergan (an AbbVie company), Novartis AG, Bayer AG, and GlaxoSmithKline plc. Other notable companies are Merck & Co., Inc., Santen Pharmaceutical Co., Ltd., Ocular Therapeutix, Inc., and Aerie Pharmaceuticals, Inc.

The hospital pharmacies dominated the market in 2023.

The Glaucoma segment had the largest share in the global market.

Prostaglandin analogs are synthetic compounds that mimic the effects of naturally occurring prostaglandins in the body. Prostaglandins are lipid compounds that play key roles in various physiological processes, including inflammation, pain, and regulation of blood flow. Prostaglandin analogs are primarily used in medicine to treat conditions such as glaucoma and other ocular disorders by reducing intraocular pressure.

Here are some key trends observed in this market: Advancements in Drug Formulations: Development of sustained-release formulations and novel delivery systems to improve patient adherence and therapeutic outcomes. Expansion of Therapeutic Applications: Increasing exploration of prostaglandin analogs for conditions beyond ophthalmology, including labor induction, erectile dysfunction, and gastric protection. Rising Demand for Combination Therapies: Growing interest in combination therapies that enhance efficacy and convenience for managing chronic conditions like glaucoma. Digital and E-Commerce Integration: Increasing use of digital platforms and e-commerce for distributing prostaglandin analogs, improving accessibility and patient reach.

A new company entering the prostaglandin analogs market should focus on innovation and differentiation to stay ahead of the competition. Emphasizing the development of advanced, user-friendly contraceptive solutions, such as novel delivery systems or extended-release formulations, can set the company apart. Leveraging digital health technologies for personalized patient engagement and support can enhance market appeal. Additionally, targeting emerging markets with tailored products and strategic partnerships with local healthcare providers can capture new opportunities. Investing in comprehensive R&D and staying responsive to evolving consumer preferences and regulatory trends will further strengthen the company’s competitive edge.

Companies producing prostaglandin analogs and related products, healthcare providers, and other consulting firms.