Property and Casualty Insurance Market Share, Size, Trends, Industry Analysis Report, By Product Type (Condo Insurance, Homeowners Insurance, Renters Insurance, Landlord Insurance, Others); By Distribution Channel; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4345

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

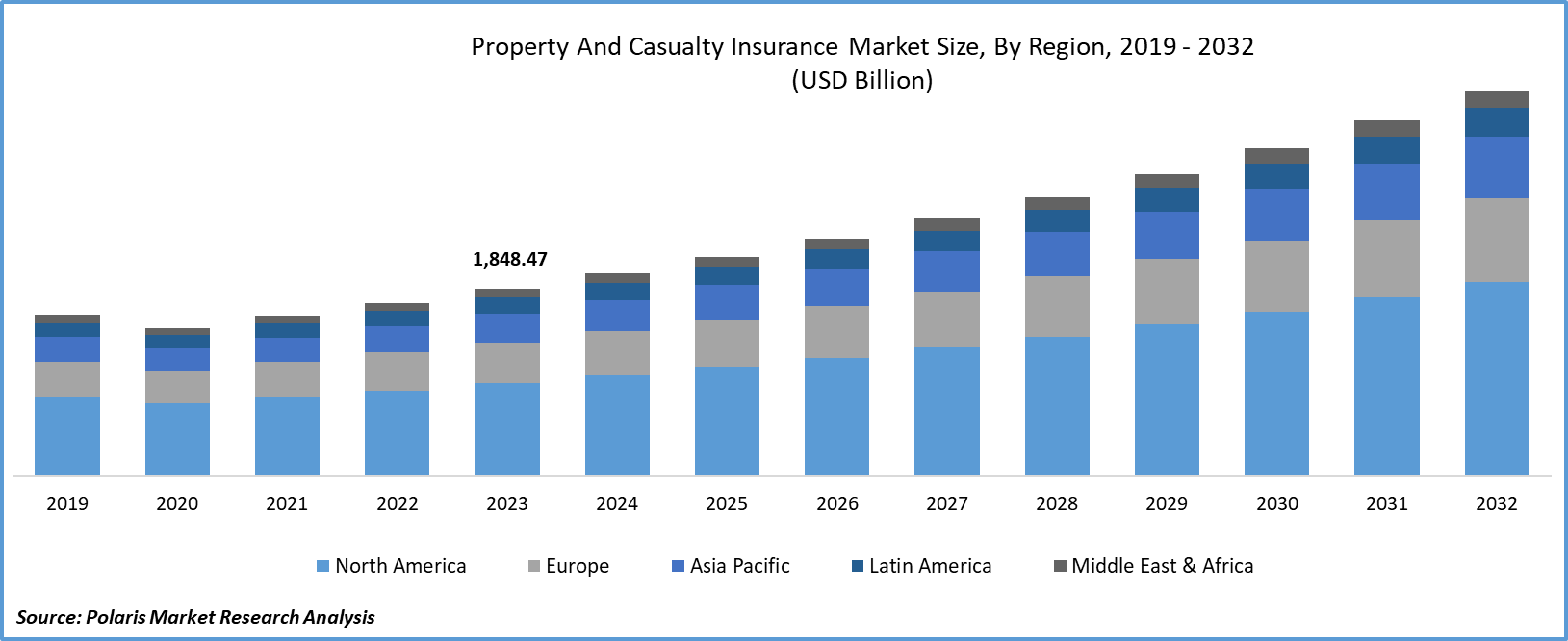

Property and Casualty Insurance Market size was valued at USD 1,848.47 billion in 2023.

The market is anticipated to grow from USD 2,000.05 billion in 2024 to USD 3,794.81 billion by 2032, exhibiting a CAGR of 8.3% during the forecast period.

Market Introduction

Technological advancements propel the property and casualty insurance market share, advancing core processes. Artificial intelligence and data analytics enhance precision, claims efficiency, and risk assessment accuracy. Telematics enables usage-based insurance models, tailoring premiums based on real-time data. Digital platforms streamline customer interactions, making policies more accessible. Embracing technology not only heightens market competitiveness but also transforms the property and casualty insurance landscape, ushering in a new era marked by enhanced customer experiences and effective risk management practices.

In addition, companies operating in the market are concentrating on developing new solutions to cater to the growing market demand.

For instance, in November 2023, Chubb introduced a novel insurance product catering to clients in the United Kingdom, specifically designed for the media sector. The media insurance offering encompasses tailored coverages, spanning media liability, terrorism, property, cyber, casualty, and legal expenses. Each coverage option is discretionary, allowing clients the flexibility to customize their insurance plans according to their individual needs and preferences.

Dynamic regulatory changes are instrumental in steering the trajectory of the market outlook for 2024. Evolving regulations and compliance requirements influence insurers' strategies, product offerings, and operational frameworks. Adapting to regulatory shifts ensures insurers maintain compliance while fostering innovation to meet emerging standards. Regulatory changes often drive market competitiveness, prompting insurers to refine their approaches and enhance customer-centric practices. The evolving regulatory landscape creates an environment where insurers must continually innovate and optimize their services, contributing to the overall dynamism and adaptability of the property and casualty insurance sector in response to legal and compliance mandates.

Property and casualty insurers are firms that offer coverage on benefits as well as accountability insurance for accidents, wounds, and damage to others or their possessions. They encompass a number of things involving auto insurance, marine insurance, home insurance, and professional accountability insurance. Property and casualty insurers provide insurance to consumers for probability up to a specific coverage amount negotiable for insurance premiums. Insurance premiums are cash discharges rendered by consumers negotiable for insurance coverage.

Homogenous to other insurers, when property and casualty insurers provide participation to a consumer, they must direct an insurance premium the consumer will disburse by observing the probability of the customer. The property and casualty insurance market demand is on the rise as an insurer will regularly observe the prospect of a consumer professing a claim and the possible amount of the claim when scheming the aggregate of insurance premiums they should charge.

To Understand More About this Research: Request a Free Sample Report

The Property and Casualty Insurance market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

The research study offers an in-depth analysis of the competitive landscape in the industry. It examines the top players in the center stack displays market on the basis of multiple factors, including market position, sales, new developments and products/services offered. Also, it details the key strategies like mergers, partnerships and collaborations that have been taken by center stack displays market key players to improve their position in the market.

Industry Growth Drivers

Economic Growth is Projected to Spur Product Demand

Economic growth is a pivotal force propelling the expansion of the market trends. As economies thrive, there is a concurrent surge in property values, business activities, and overall asset ownership. This heightened economic activity translates into an increased demand for insurance coverage to protect against potential risks and losses. Growing prosperity leads to more property investments, vehicle ownership, and valuable asset acquisition, driving the need for comprehensive insurance solutions. Economic growth, therefore, not only broadens the insurable landscape but also emphasizes the critical role of insurance in providing financial security amid a flourishing economic environment.

Increased Asset Ownership is Expected to Drive Market Growth

The surge in asset ownership is a pivotal driver propelling the growth of the market statistics. As individuals and businesses amass diverse assets like homes, vehicles, and valuables, the demand for comprehensive insurance coverage intensifies. Heightened asset ownership accentuates the necessity for robust protection against potential risks, including accidents, natural disasters, and liability concerns. This trend underscores the crucial role of the property and casualty insurance sector in providing financial security, aligning with the evolving landscape of increased prosperity and expanding portfolios. The market responds dynamically to the growing need for safeguarding diverse assets, ensuring comprehensive risk mitigation.

Industry Challenges

Cybersecurity Risks are Likely to Impede Market Growth

Cybersecurity risks pose a formidable constraint on the growth of the property and casualty insurance market insights. The increasing threat of cyberattacks introduces complexities in risk management and underwriting, limiting industry expansion. Insurers grapple with accurately assessing and pricing cybersecurity risks, leading to potential financial exposures. Constant adaptation in underwriting practices is essential due to high-profile data breaches impacting insurers' operational costs. This delicate balance between comprehensive coverage and managing digital risks underscores the challenging landscape faced by the insurance sector.

Report Segmentation

The property and casualty insurance market share analysis is primarily segmented based on product type, distribution channel, end-user, and region.

|

By Product Type |

By Distribution Channel |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

- Homeowners Insurance Segment Accounted for a Significant Market Share in 2023

The homeowner's insurance segment accounted for a significant market share in 2023. Homeowners insurance caters to homeowners' diverse needs. It intricately covers the home's structure against perils, from fire to natural disasters, ensuring robust protection. Personal property coverage extends to safeguard belongings and liability protection shields against legal claims for injuries or damages on the property. Additional living expenses support temporary relocation, while other structures coverage includes detached units. Medical payments to others address injuries, and a personal liability umbrella enhances overall protection. Specialized coverages and policy endorsements offer tailored solutions, and discounts incentivize safety measures. The policy covers loss of use and ensures full replacement costs for personal belongings.

By Distribution Channel Analysis

- Brokers Segment Accounted for a Significant Market Share in 2023

The broker's segment accounted for a significant market share in 2023. Securing property and casualty insurance through brokers involves a meticulous process. Clients judiciously select brokers based on expertise and reputation, entrusting them with a comprehensive assessment of assets and liabilities. Brokers analyze the dynamic insurance market, offering strategic policy recommendations tailored to specific needs. Collaborating closely, brokers customize coverage, select carriers matching clients' preferences, and negotiate optimal terms. They manage policies, providing ongoing support and efficient claims assistance, acting as intermediaries between clients and insurers. Brokers offer invaluable risk management advice, leveraging industry expertise to demystify complex terms. Proactively handling policy renewals, brokers ensure clients receive tailored, well-informed insurance solutions.

By End User Analysis

- Individuals Segment Held a Significant Market Revenue Share in 2023

The individual segment held a significant revenue share in 2023. This segment constitutes a tailored suite designed for individual risk management. Auto insurance comprehensively covers liability, collision, and comprehensive aspects, ensuring thorough protection for vehicles. Renters insurance seamlessly integrates property and liability coverage, specifically catering to those leasing residences. Homeowners insurance acts as a shield, offering protection against fire, theft, and natural disasters, even covering additional living expenses. Specialized coverage includes boat, motorcycle, jewelry, and valuables insurance. Travel insurance safeguards individuals during trips, and pet insurance addresses veterinary expenses. Flood and earthquake insurance provides targeted risk coverage, while identity theft and cyber insurance offer protection against contemporary threats. Critical illness insurance extends financial support upon diagnosis.

Regional Insights

- North America Region Dominated the Global Market in 2023

In 2023, the North American region dominated the global market. Shaped by robust economic activities, it features a competitive landscape where insurers, both large and regional, innovate to capture market share. Technological integration is prominent, with insurers leveraging digital tools for efficient operations in U.S. property & casualty outlook. Given the region's susceptibility to natural disasters, tailored coverage and risk strategies prevail. Compliance with varied regulatory frameworks is crucial, emphasizing insurers' adaptability. Ongoing innovation addresses emerging risks and distribution channels evolve to meet changing consumer preferences. Insurers actively engage in risk mitigation, utilizing data analytics for effective risk management. Customer education and engagement initiatives underscore the industry's commitment to informed decision-making.

The Asia-Pacific region is likely to experience significant growth in the forecasted years. Asia-Pacific's market exhibits a dynamic environment influenced by diverse economies, natural catastrophe risks, and regulatory nuances. Economic growth and an expanding middle class propel demand for home, auto, and personal liability coverage. The region's vulnerability to natural disasters shapes insurers' focus on catastrophic risk coverage. Emerging markets present growth potential, while microinsurance initiatives address the needs of a broader population. The competitive landscape features both global and local insurers adapting strategies to meet local demands and navigate evolving market trends.

Key Market Players & Competitive Insights

The market displays a fragmented landscape, anticipating increased competition as numerous participants enter the arena. Prominent service providers in the market continually upgrade their technologies to uphold a competitive edge, giving precedence to efficiency, integrity, and safety. These entities highlight strategic initiatives such as partnerships, product improvements, and collaborative endeavors to outshine their peers. Their objective is to secure a significant market share.

Some of the major players operating in the global property and casualty insurance market include:

- Allstate Corporation

- American International Group (AIG)

- Arch Capital Group

- Berkshire Hathaway

- Chubb Limited

- CNA Financial Corporation

- Farmers Insurance Group

- Hartford Financial Services Group

- Liberty Mutual

- Progressive Corporation

- State Farm

- The Hanover Insurance Group

- Travelers Companies

- USAA

- Zurich Insurance Group

Recent Developments

- In July 2023, Allianz Global Corporate & Specialty, in collaboration with the commercial insurance segment of regional Allianz Property & Casualty, commenced operations under the unified name "Allianz Commercial." This cohesive business entity serves as a single go-to-market platform, providing comprehensive insurance solutions tailored for mid-sized businesses, large enterprises, and specialized risks.

- In August 2022, Hartford introduced upgraded iterations of its exclusive Property Choice and General Liability Choice products, aiming to meet better the requirements of its corporate clientele spanning diverse industries and account scales. These enhanced product options offer unparalleled flexibility in establishing limits, terms, and conditions, facilitating a tailored solution with scalability. This results in a more expedited time-to-market and a reduction in paperwork, streamlining the insurance process for business customers.

- In February 2022, Everbridge, Inc. and Brown & Brown unveiled an innovative product, the first of its kind, designed to empower property and casualty insurance clients. This groundbreaking offering facilitates proactive advanced alerts regarding events that could affect insured properties. It goes beyond providing recommendations on actions that can be taken to mitigate disruption, minimize costs, and address potential threats to personal safety.

Report Coverage

The property and casualty insurance market report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, product types, distribution channels, end users, and their futuristic growth opportunities.

Property and Casualty Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,000.05 billion |

|

Revenue Forecast in 2032 |

USD 3,794.81 billion |

|

CAGR |

8.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Uncover the dynamics of the Property and Casualty Insurance sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Radiation Dose Management Market

Hadron Therapy Market

Medical Radiation Shielding Market

Pessary Market

gRNA Market

FAQ's

The Property and Casualty Insurance Market report covering key segments are product type, distribution channel, end user, and region.

Property and Casualty Insurance Market Size Worth $3,794.81 Billion By 2032

Property and Casualty Insurance Market exhibiting the CAGR of 8.3% during the forecast period.

North American is leading the global market

key driving factors in Property and Casualty Insurance Market are economic growth is projected to spur the product demand