Programmed Nano Drones Market Size, Share, Trends, Industry Analysis Report: By Type, Payload (Camera, Control Systems, Tracking Systems, and Others), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 118

- Format: PDF

- Report ID: PM5516

- Base Year: 2024

- Historical Data: 2020-2023

Programmed Nano Drones Market Overview

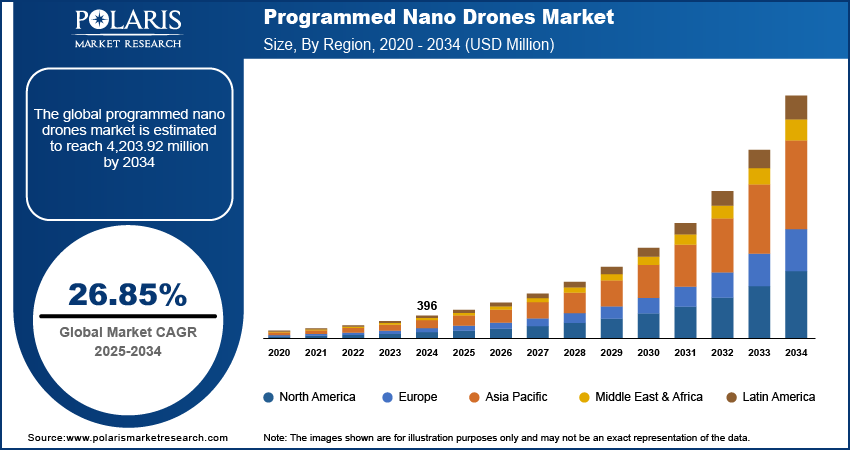

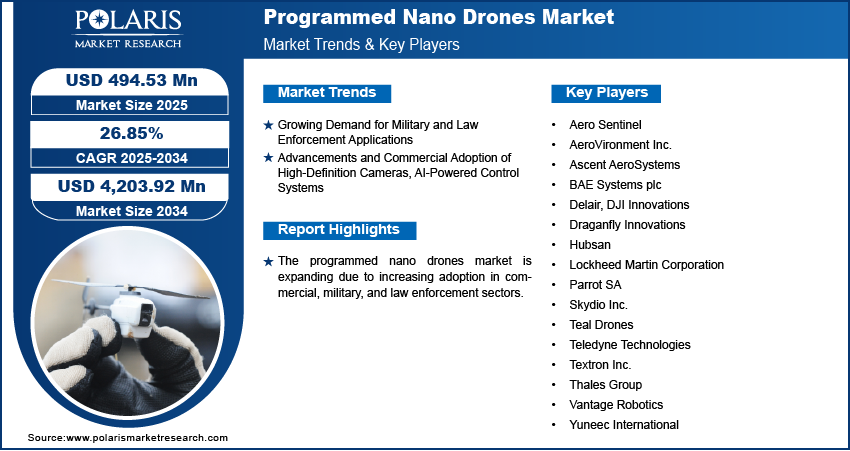

The global programmed nano drones market size was valued at USD 396 million in 2024. The market is projected to grow from USD 494.53 million in 2025 to USD 4,203.92 million by 2034, exhibiting a CAGR of 26.85% during 2025–2034.

The Programmed Nano Drones Market refers to the industry focused on ultra-small, autonomous drones programmed for specific tasks, including surveillance, medical delivery, environmental monitoring, and military applications, driven by advancements in AI and nanotechnology.

The programmed nano drones market is growing due to the rising adoption of such drones across commercial, military, and consumer sectors. In the military and law enforcement domain, these drones are extensively used for surveillance, reconnaissance, and tactical operations due to their compact size, agility, and advanced intelligence capabilities. Moreover, concerns related to national and state security, governments are increasingly investing in drone technologies to security and enhance border surveillance. Additionally, the market demand for rotary-wing programmed nano drones is rising, particularly in the military and law enforcement sectors, due to their enhanced capabilities for surveillance and reconnaissance operations.

Between 2021 and 2024, defense agencies worldwide actively deployed these drones for border patrol and real-time data collection, enhancing situational awareness. For instance, in 2023, Teledyne FLIR Defense secured a USD 94 million IDIQ contract from the US Army to supply Black Hornet 3 nano drones, enhancing reconnaissance and surveillance capabilities of the forces. Thus, the ability to operate in confined spaces with superior manoeuvrability makes these drones essential in tactical operations, further contributing to the market growth.

To Understand More About this Research: Request a Free Sample Report

Another driving factor for programmed nano drones market growth is the advancements in camera and tracking systems integrated within programmed nano drones. These drones offer real-time data transmission and detailed aerial imaging, which are widely used in industrial inspections, agricultural monitoring, and environmental research. Government initiatives to promote smart city development and disaster management are further boosting the market. Moreover, programmed nano drones also provide benefits such as enhanced operational flexibility, reduced human risk, and remote accessibility. Their applications extend to media coverage, infrastructure inspection, and search and rescue missions. A key industry trend boosting market opportunity is the incorporation of artificial intelligence (AI) and machine learning (ML) in drone navigation systems, enabling autonomous operations and predictive analytics.

Programmed Nano Drones Market Dynamics

Growing Demand for Military and Law Enforcement Applications

The demand for programmed nano drones for military and law enforcement applications has grown significantly due to global security concerns, increasing defense budgets, and technological advancements.

Governments worldwide are prioritizing the modernization of defense infrastructure for internal and external security, which is boosting the need for programmed nano drones. Countries such as the US, China, and India are among the leading investors in military modernization and are, therefore, rapidly adopting programmed nano drones. Thus, the growing trend for military equipment modernization is highlighting the importance of nano drones, boosting the programmed nano drones market demand.

Advancements and Commercial Adoption of High-Definition Cameras, AI-Powered Control Systems

Technological innovations in programmed nano drones, particularly in payload systems such as high-definition cameras, AI-powered control systems, and real-time tracking, are significantly driving programmed nano drones market expansion. These drones are increasingly adopted across commercial sectors for infrastructure inspection, agricultural monitoring, and delivery services. For instance, Flapone, a logistics company, has implemented drones to offer commercial services. Thus, the implementation of such drones has reduced operational costs and enhanced delivery efficiency. Additionally, the integration of Artificial Intelligence has enabled autonomous flight and predictive maintenance, which reduces human intervention and ensures seamless operations. Programmed nano drones are becoming essential tools in commercial applications, creating substantial market opportunities with continuous advancements in AI algorithms and sensor technology.

Programmed Nano Drones Market Segment Analysis

Programmed Nano Drones Market Assessment by Type

The programmed nano drones market segmentation, based on type, includes fixed-wing programmed nano drones, rotary-wing programmed nano drones, flapping-wing programmed nano drones, and others. The fixed-wing programmed nano drones segment dominated the programmed nano drones market share in 2024, driven by their superior endurance and ability to cover large distances with minimal energy consumption. These drones are widely adopted in agricultural monitoring, mapping, and surveying applications, where long flight times and stable aerial views are essential. Additionally, military and defense organizations prefer fixed-wing drones for intelligence, surveillance, and reconnaissance (ISR) missions in remote and hostile environments. Their capability to carry heavier payloads, including advanced sensors and imaging systems, further boosts market demand. Factors such as technological advancements in aerodynamic design and battery efficiency are also contributing to the segmental growth.

Programmed Nano Drones Market Evaluation by Payload

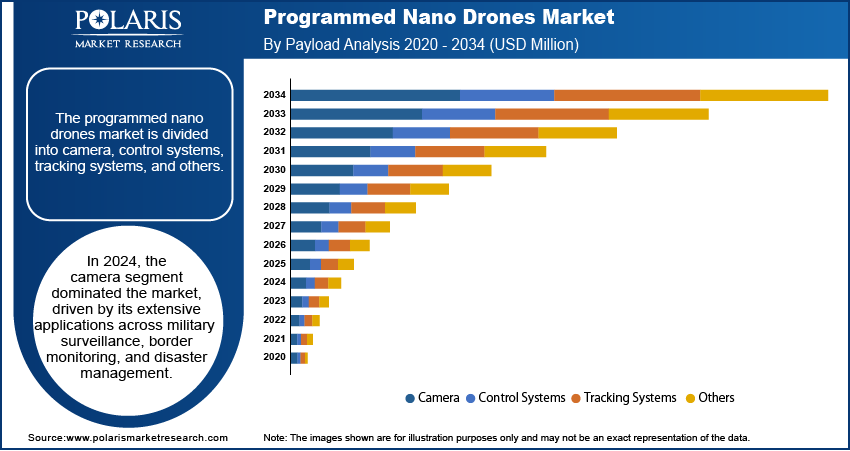

In terms of payload, the programmed nano drones market is divided into camera, control systems, tracking systems, and others. In 2024, the camera segment dominated the market, driven by its extensive applications across military surveillance, border monitoring, and disaster management. Enhancements in imaging capabilities, such as real-time data transmission and high-resolution imagery, have accelerated the adoption of camera-equipped nano drones. Additionally, advancements in AI-powered image recognition and object detection have further enhanced operational efficiency in security operations.

In the commercial sector, industries such as agriculture, construction, and mining are increasingly utilizing camera-equipped nano drones for aerial inspections, site monitoring, and crop health analysis. As companies prioritize remote monitoring and automated inspections, the camera segment continues to witness significant market opportunity.

Programmed Nano Drones Market Outlook by End User

The programmed nano drones market is segmented by end user into consumer, military or law enforcement, commercial, and others. The military or law enforcement segment is expected to experience the fastest market growth rate during the forecast period. This growth is primarily driven by the increasing adoption of nano drones for surveillance, reconnaissance, and intelligence-gathering missions. Military forces worldwide are leveraging these lightweight and agile drones for real-time situational awareness, border security, and battlefield monitoring. Additionally, law enforcement agencies are utilizing nano drones for crowd monitoring, search and rescue operations, and crime scene investigations.

Government investments in defense modernization and the integration of advanced drone technologies, including AI-powered autonomous operations and enhanced communication systems, are further accelerating market demand. Moreover, defense organizations, including the US Department of Defense and European defense agencies, have initiated research and procurement programs for nano drone fleets. Thus, with the growing emphasis on enhancing national security, this segment presents substantial growth opportunities.

Programmed Nano Drones Market Regional Analysis

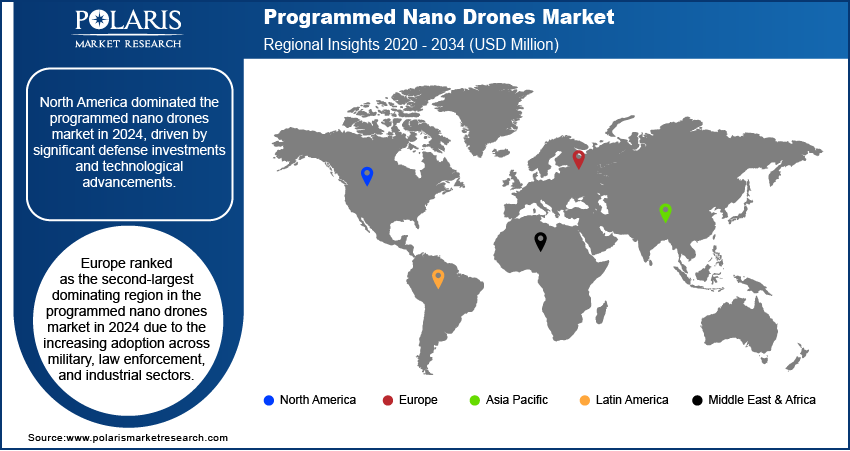

By region, the study provides the programmed nano drones market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to extensive defense investments and technological advancements. The US Department of Defense has significantly increased the deployment of nano drones for intelligence, surveillance, and reconnaissance (ISR) missions. In January 2025, the US Army expanded its fleet of autonomous nano drones to enhance situational awareness and tactical operations. Additionally, commercial sectors such as agriculture, logistics, and infrastructure management are adopting nano drones for remote inspections and monitoring. As a result, market revenue in North America is projected to sustain its dominance during the forecast period. Key trends such as drone swarm technology and autonomous flight capabilities are also contributing to the region’s expanding market share.

The US leads the market due to high budget allocation toward defense investments, military modernization programs, and widespread adoption in commercial sectors such as agriculture, logistics, and infrastructure monitoring.

Canada is witnessing growing market demand for nano drones, driven by increasing applications in border security, environmental monitoring, and public safety, supported by government investments and technological advancements.

Europe ranked as the second-largest dominating region in the programmed nano drones market in 2024 due to the increasing adoption across military, law enforcement, and industrial sectors. Countries such as France, Germany, and the UK have enhanced their defense capabilities by integrating nano drones for border surveillance and tactical operations. Additionally, the rising emphasis on public safety and anti-terrorism measures is accelerating drone deployment by law enforcement agencies. On the commercial front, sectors such as infrastructure inspection, agriculture, and environmental monitoring are experiencing significant growth opportunities. The European Union’s investments in drone research and regulations supporting safe UAV operations further stimulate market growth. Trends in energy-efficient drone design and the adoption of AI-powered control systems are expected to drive market demand across Europe during the forecast period.

The programmed nano drones market in Asia Pacific is poised to register the fastest growth rate during the forecast period. This growth is driven by increasing defense budgets and advancements in domestic drone manufacturing. Countries such as China, India, and Japan are investing in drone technologies for military reconnaissance, border surveillance, and disaster response. In March 2025, India’s Defense Research and Development Organization (DRDO) launched swarm drones for enhanced border patrolling. Government programs supporting drone innovation, such as China’s AI-focused military modernization plan, are fostering market expansion. Furthermore, the adoption of drone swarm technologies and advancements in tracking systems are expected to remain key trends contributing to the region’s accelerated growth.

Programmed Nano Drones Market – Key Players & Competitive Analysis Report

Leading companies in the programmed nano drones market are making substantial investments in research and development to enhance their product portfolios, driving market growth throughout the forecast period. Additionally, these industry players are actively pursuing strategic initiatives to strengthen their global presence. Notable market developments include advancements in advanced drone technologies, cross-border collaborations, increased funding, and mergers and acquisitions involving both private enterprises and government organizations.

The market is consolidated, with the presence of limited numbers of key global and regional market players. A few major players in the market include DJI Innovations, AeroVironment Inc., Parrot SA, Lockheed Martin Corporation, BAE Systems plc, Hubsan, Thales Group, Draganfly Innovations, Skydio Inc., Northrop Grumman Corporation, Textron Inc., Delair, Teal Drones, Yuneec International, and Aero Sentinel.

Lockheed Martin Corporation is an aerospace, defense, and security company that specializes in advanced technology systems. It offers drone solutions in the programmed nano drone market. The company focuses on autonomous systems, surveillance, and defense applications and contributes to military modernization programs, including drones.

Ascent AeroSystems is a US-based company specializing in the design and manufacturing of compact, all-weather coaxial unmanned aerial vehicles (UAVs). Operating in the commercial, industrial, public safety, and defense sectors, its modular UAV platforms offer advanced durability and versatility. Ascent AeroSystems focuses on developing rugged, compact, and versatile coaxial UAV platforms tailored for demanding environments.

List of Key Companies in Programmed Nano Drones Market

- Aero Sentinel

- AeroVironment Inc.

- Ascent AeroSystems

- BAE Systems plc

- Delair

- DJI Innovations

- Draganfly Innovations

- Hubsan

- Lockheed Martin Corporation

- Parrot SA

- Skydio Inc.

- Teal Drones

- Teledyne Technologies

- Textron Inc.

- Thales Group

- Vantage Robotics

- Yuneec International

Programmed Nano Drones Market Market Developments

November 2024: AeroVironment announced an all-stock acquisition of defense technology startup BlueHalo, valued at approximately USD 4.1 billion. This strategic move aims to expand AeroVironment's portfolio in the drone warfare segment.

September 2024: Vantage Robotics launched Trace; a pocket-sized nano drone designed for covert aerial reconnaissance. Trace offers capabilities akin to larger drones, including 30+ minute flight times, gimbal-stabilized high-resolution visible light and thermal cameras with 24x zoom, and both indoor and outdoor flight capabilities. This innovation addresses the needs of national security, law enforcement, and critical infrastructure management sectors.

Programmed Nano Drones Market Segmentation

By Type Outlook (Revenue, USD Million, 2020–2034)

- Fixed-Wing Programmed Nano Drones

- Rotary-Wing Programmed Nano Drones

- Flapping-Wing Programmed Nano Drones

- Others

By Payload Outlook (Revenue, USD Million, 2020–2034)

- Camera

- Control Systems

- Tracking Systems

- Others

By End User Outlook (Revenue, USD Million, 2020–2034)

- Consumer

- Military or Law Enforcement

- Commercial

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Programmed Nano Drones Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 396 million |

|

Market Size Value in 2025 |

USD 494.53 million |

|

Revenue Forecast by 2034 |

USD 4,203.92 million |

|

CAGR |

26.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 396 million in 2024 and is projected to grow to USD 4,203.92 million by 2034.

The global market is projected to register a CAGR of 26.85% during the forecast period.

North America held the largest market share in 2024.

A few of the key players in the market DJI Innovations, Teledyne Technologies, Ascent AeroSystems, Vantage Robotics, AeroVironment Inc., Parrot SA, Lockheed Martin Corporation, BAE Systems plc, Hubsan, Thales Group, Draganfly Innovations, Skydio Inc., Textron Inc., Delair, Teal Drones, Yuneec International, and Aero Sentinel.

The fixed-wing programmed nano drones segment dominated the market share in 2024.

The military or law enforcement segment is expected to experience the fastest growth rate in the programmed nano drones market during the forecast period.