Programmatic Advertising Platform Market Size, Share, Trends, Industry Analysis Report: By Deployment Model (Cloud-Based and On-Premises), Pricing Model, Platform Type, Ad Format, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 – 2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5216

- Base Year: 2024

- Historical Data: 2020-2023

Programmatic Advertising Platform Market Overview

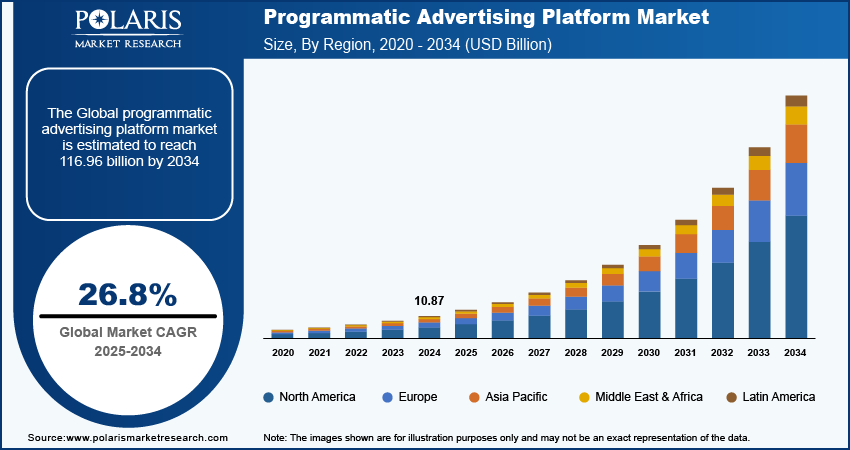

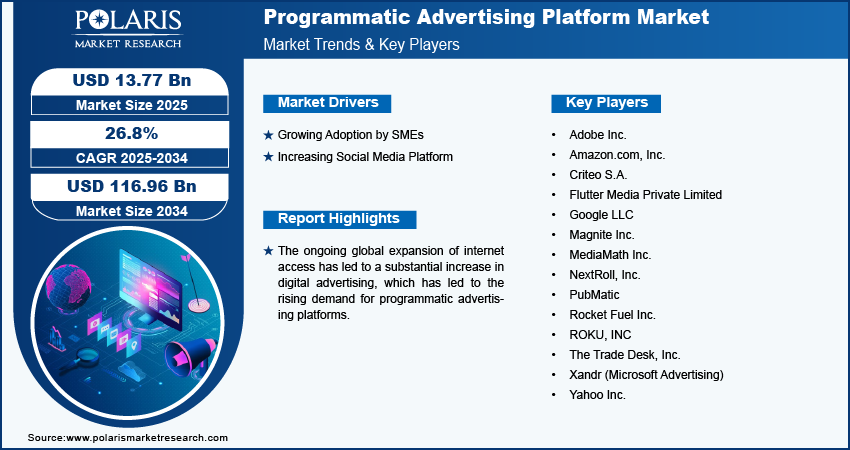

Global programmatic advertising platform market size was valued at USD 10.87 billion in 2024. The market is projected to grow from USD 13.77 billion in 2025 to USD 116.96 billion by 2034, exhibiting a CAGR of 26.8% during the forecast period.

Programmatic advertising platforms are advanced technological solutions that automate the buying, selling, and management of digital advertising. This method leverages artificial intelligence (AI) and machine learning algorithms to facilitate real-time transactions between advertisers and publishers, significantly streamlining the ad placement process compared to traditional methods.

The ongoing global expansion of internet access has led to a substantial increase in digital advertising, which has led to the rising demand for programmatic advertising platforms. This platform targets specific audiences and drives engagement efficiently, which encourages enterprises to adopt programmatic advertising platforms. Furthermore, the proliferation of mobile internet use and the prevalence of smartphones fueled the demand for programmatic advertising platforms.

To Understand More About this Research: Request a Free Sample Report

The rising significance of data analytics in marketing strategies has led to an increase in the utilization of programmatic advertising. Advertisers are using extensive data to enhance their campaigns, thereby improving return on investment (ROI). This surge in demand is projected to propel the expansion of programmatic advertising platforms and increase their market presence.

Programmatic Advertising Platform Market Driver Analysis

Growing Adoption by SMEs

Small and medium-sized enterprises (SMEs) are increasingly embracing programmatic advertising due to its scalability, affordability, and targeted approach. Programmatic platforms enable SMEs to execute precise ad campaigns without the need for substantial budgets or extensive marketing teams, democratizing advanced advertising techniques for smaller businesses. This shift is broadening the market's scope by incorporating a more diverse set of advertisers and enhancing the variety of ads and audiences within the programmatic ecosystem. The more SMEs leverage programmatic advertising, the overall market evolves robust and dynamic, catering to a broader spectrum of business needs and customer preferences. For instance, according to the SBA Office of Advocacy, in 2023, the United States experienced a significant surge in small business establishments, with 33.3 million new ventures and a workforce of 61.6 million.

Increasing Social Media Platform

Social media platforms have emerged as an essential channel for digital advertising due to their extensive user bases and advanced targeting capabilities. Programmatic advertising, which leverages real-time bidding, enhances this by enabling advertisers to place highly targeted ads on these platforms. This method maximizes visibility and engagement by dynamically adjusting ad placements to reach the most relevant audiences based on user data and behavior. For instance, according to the University of Maine, the global social media user base has reached 4.8 billion, which accounts for 59.9% of the world's population and 92.7% of all internet users. In the period between April 2022 and April 2023, there was a 3.2% increase in social media users, with 150 million new users joining the platforms. This surge in social media users has driven greater demand for programmatic advertising platforms in the market.

Programmatic Advertising Platform Market Segment Analysis

Programmatic Advertising Platform Market Analysis by Ad Format Insights

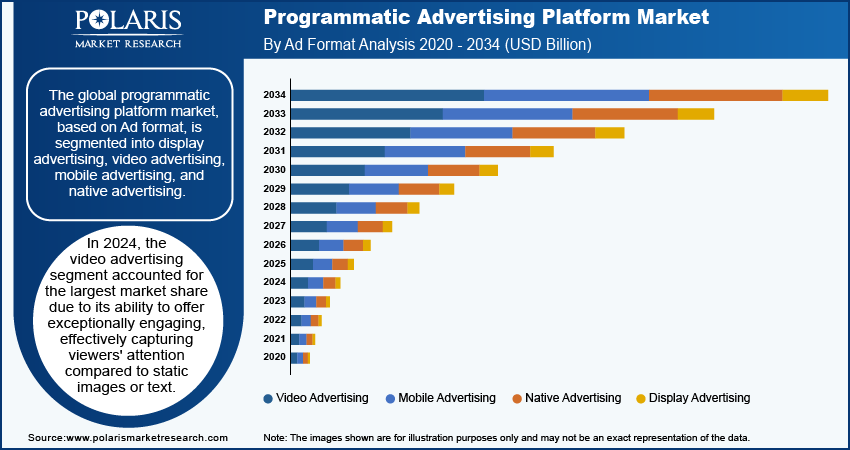

The global programmatic advertising platform market, based on Ad format, is segmented into display advertising, video advertising, mobile advertising, and native advertising. In 2024, the video advertising segment accounted for the largest market share. Video content has proven to be exceptionally engaging, effectively capturing viewers' attention compared to static images or text. This heightened engagement results in increased retention rates and enhanced recall for promoted products and services, establishing video as the preferred advertising format. The rapid proliferation of streaming platforms, including YouTube, Netflix, Hulu, and others, has significantly expanded the audience for video content. These platforms present a range of ad formats, such as pre-roll, mid-roll, and post-roll ads, creating extensive opportunities for advertisers to connect with a broad and diverse audience.

The widespread adoption of smartphones and tablets has substantially elevated the consumption of video content on mobile devices. Social media giants such as Facebook, Instagram, TikTok, and Snapchat have seamlessly integrated video ads into their feeds, stories, and reels, augmenting the reach and efficacy of video advertising.

For instance, according to NCBI, in 2022, the annual advertising revenue from children aged 0-12 in the US is over USD 2 billion USD, and from all youth aged 0-17, it's nearly USD 11 billion, spread across the six major social media platforms. Notably, approximately 30-40% of this revenue is generated from three platforms: Snapchat, TikTok, and YouTube. This indicates a notable surge in the demand for video advertising, which in turn is contributing to the increased popularity of programmatic advertising platforms.

Programmatic Advertising Platform Market Analysis by End Use Insights

The global programmatic advertising platform market segmentation, based on end use, includes advertisers & publishers, media buyers, data management platforms (DMP), and others. In 2024, the data management platform (DMP) category emerged as the fastest-growing market segment. DMPs play a pivotal role in aggregating and processing large volumes of data sourced from multiple channels, providing valuable insights into consumer behavior. This data is instrumental in creating unique, personalized advertising campaigns, a fundamental part of programmatic advertising.

Programmatic advertising heavily depends on real-time data for optimizing ad placement and bidding strategies. DMPs are crucial in furnishing this data, empowering advertisers to target the right audience effectively. Such real-time targeting capability significantly elevates the efficiency and efficacy of advertising initiatives.

Programmatic Advertising Platform Market Analysis by Regional Insights

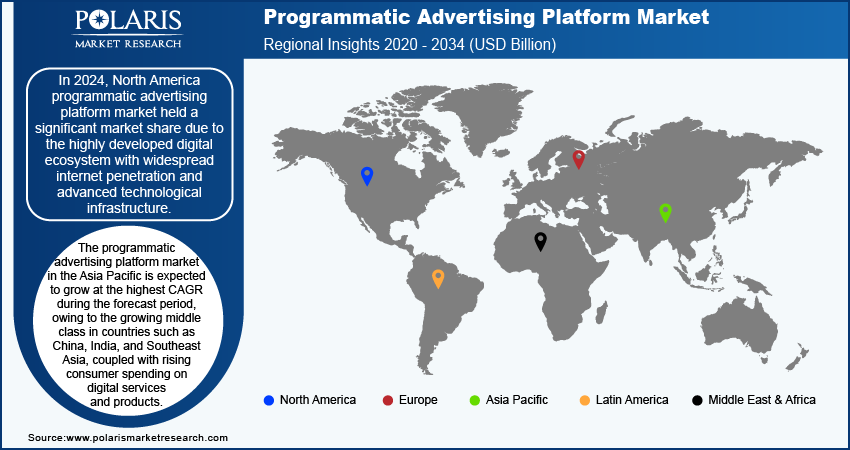

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America programmatic advertising platform market held a significant market share. North America, particularly the US, has a highly developed digital ecosystem with widespread internet penetration and advanced technological infrastructure. For instance, according to the US Census Bureau, as of 2021, 95% of US households owned a computer, and 90% had a broadband internet subscription, marking an increase from 2018 figures of 92% and 85%, respectively. This substantial surge in internet adoption and digitalization has led to increased demand for programmatic advertising platforms market in North America.

The rise and expansion of programmatic advertising platforms are attributed to businesses' utilization of advanced tools and technologies to enhance their digital marketing efforts. North America is one of the top regions globally in terms of advertising expenditures. Companies in this region allocate substantial budgets to digital advertising, including programmatic advertising, to effectively target their audiences. This high level of financial investment catalyzes the growth and advancement of programmatic platforms.

The US programmatic advertising platform market is expected to grow at a significant CAGR during the forecast period. The U.S. consumer market demonstrates significant digital media engagement, encompassing social media, streaming services, and mobile applications. This high level of engagement presents extensive opportunities for advertisers to connect with audiences through programmatic advertising.

The programmatic advertising platform market in the Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growing middle class in countries such as China, India, and Southeast Asia is driving a surge in consumer spending on digital services and products. This rise in consumer expenditure is fueling a heightened demand for digital advertising, particularly through programmatic platforms. Furthermore, the e-commerce sector in the region is expanding at an unprecedented pace. As more consumers shift towards online shopping, advertisers are allocating substantial resources to digital marketing in order to capture this audience, significantly leading to a surge in demand for programmatic advertising solutions.

For example, according to the USDA, the e-commerce market in Japan is valued at approximately $4 trillion, making Japan the world's fourth-largest e-commerce market. This substantial e-commerce market is expected to contribute to the rapid growth of the programmatic advertising platform market in Asia Pacific.

Programmatic Advertising Platform Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the programmatic advertising platform market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the programmatic advertising platform industry must offer cost-effective items.

Major players in the programmatic advertising platform market include Adobe Inc.; Amazon.com, Inc.; Criteo; Flutter Media Private Limited; Google LLC; Magnite Inc.; MediaMath Inc.; NextRoll, Inc.; PubMatic; Rocket Fuel Inc.; ROKU, INC; Netflix; The Trade Desk, Inc.; Xandr (Microsoft Advertising); and Yahoo Inc.

Criteo is a technology company that provides marketing and monetization services across multiple regions, including North America, Europe, South America, the Middle East, Africa, and Asia Pacific. Additionally, Criteo delivers advanced solutions such as the Criteo AI Engine, which includes lookalike finder, recommendation, and predictive bidding algorithms, as well as dynamic creative optimization, sponsored product placement algorithms, and other product placement algorithms. In September 2022, Criteo S.A., the commerce media company, launched Commerce Max, a self-service, all-in-one demand-side platform (DSP) designed for enterprise marketers. It is built for scalability and leverages Criteo’s advanced retail media and programmatic capabilities.

Netflix, Inc. is a provider of entertainment services that offers a wide range of content including documentaries, feature films, TV series, and games in multiple languages. The company enables members to stream content on various internet-connected devices and digital video players such as TVs, set-top boxes, and mobile devices. In May 2024, Netflix launched its advertising technology platform and established fresh collaborations with additional programmatic platforms and measurement vendors.

Key Companies in Programmatic Advertising Platform Industry Outlook

- Adobe Inc.

- Amazon.com, Inc.

- Criteo

- Flutter Media Private Limited

- Google LLC

- Magnite Inc.

- MediaMath Inc.

- NextRoll, Inc.

- PubMatic

- Rocket Fuel Inc.

- ROKU, INC

- Netflix

- The Trade Desk, Inc.

- Xandr (Microsoft Advertising)

- Yahoo Inc.

Programmatic Advertising Platform Industry Developments

May 2024: Launch Cart launched a programmatic Adtech Platform named LaunchAds.ai. This advanced platform utilizes artificial intelligence to optimize and simplify advertising campaigns across various digital platforms such as Instagram, Facebook, YouTube, Google, LinkedIn, Spotify, Snapchat, and TikTok.

June 2023: Triton Digital, a leading technology and services provider for the digital audio, podcast, and broadcast radio industries, acquired Manadge, an advanced advertising intelligence platform focusing on programmatic advertising. This acquisition is positioned to empower Triton Digital publishers and demand partners with real-time access to advertising-related data and the capability to conduct comprehensive performance analyses through an intuitive analytics platform.

May 2023: Quantcast launched a self-serve platform that leverages artificial intelligence (AI) for programmatic advertising on the open internet. This platform aims to streamline advertising for independent agencies and advertisers, granting businesses of all sizes access to audience insights and tools that were previously exclusive to major ad spenders.

Programmatic Advertising Platform Market Segmentation

By Deployment Model Outlook (Revenue, USD Billion; 2020–2034)

- Cloud-based

- On-premises

By Pricing Model Outlook (Revenue, USD Billion; 2020–2034)

- CPM (Cost Per Mile)

- CPC (Cost Per Click)

- CPV (Cost Per View)

- Others

By Platform Type Outlook (Revenue, USD Billion; 2020–2034)

- Demand-Side Platform (DSP)

- Supply-Side Platform (SSP)

- Ad Exchange

By Ad Format Outlook (Revenue, USD Billion; 2020–2034)

- Display Advertising

- Video Advertising

- Mobile Advertising

- Native Advertising

By End Use Outlook (Revenue, USD Billion; 2020–2034)

- Advertisers & Publishers

- Media Buyers

- Data Management Platform (DMP)

- Others

By Regional Outlook (Revenue, USD Billion; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Programmatic Advertising Platform Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.87 Billion |

|

Market Size Value in 2025 |

USD 13.77 Billion |

|

Revenue Forecast in 2034 |

USD 116.96 Billion |

|

CAGR |

26.8% from 2025 to 2034 |

|

Base Year |

2023 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global programmatic advertising platform market size was valued at USD 10.87 billion in 2024.

The global market is projected to register a CAGR of 26.8% during the forecast period 2025-2034

North America had a significant share of the global market.

The key players in the market are Adobe Inc.; Amazon.com, Inc.; Criteo S.A.; Flutter Media Private Limited; Google LLC; Magnite Inc.; MediaMath Inc.; NextRoll, Inc.; PubMatic; Rocket Fuel Inc.; ROKU, INC; The Trade Desk, Inc.; Xandr (Microsoft Advertising); and Yahoo Inc.

The video advertising category dominated the market in 2024.

The data management platform had the largest share in the global market.