Procurement Analytics Market Share, Size, Trends, Industry Analysis Report

By Component (Solution, Service); By Deployment; By Application; By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2876

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

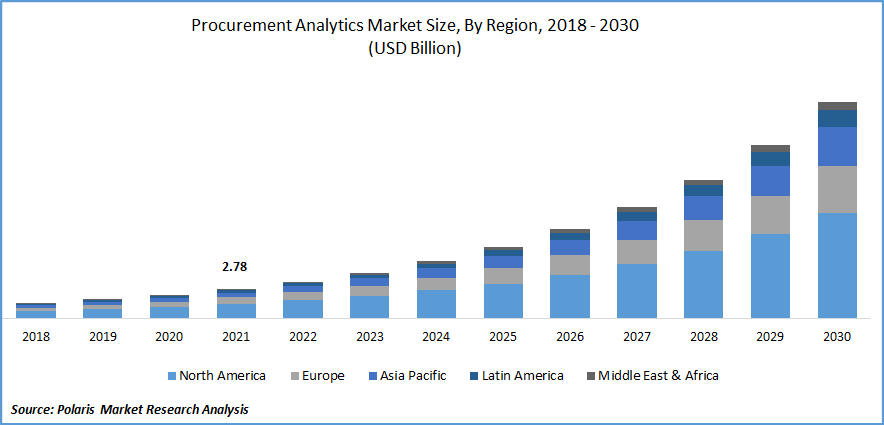

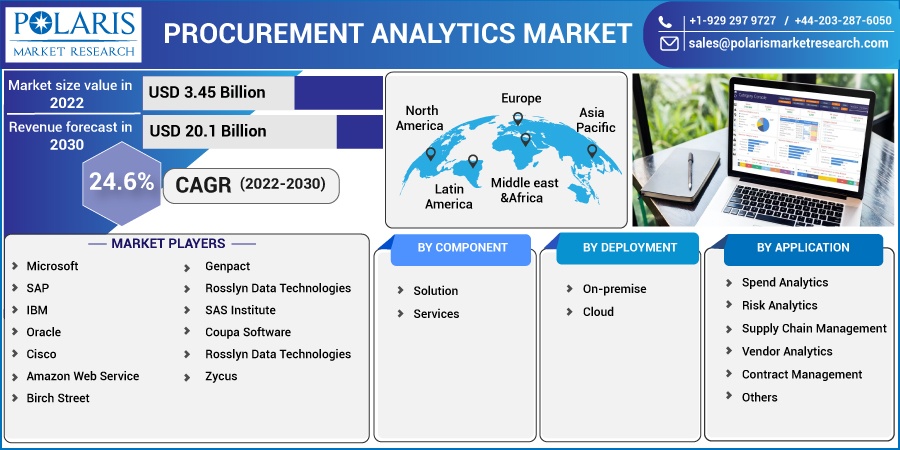

The global procurement analytics market was valued at USD 2.78 billion in 2021 and is expected to grow at a CAGR of 24.6% during the forecast period.

The market is expanding as more attention is being placed on improving the operational performance of procurement procedures. As more individuals become aware of the benefits of this data, such as precise supply chain projections, improved decision models, and cost savings, the market for procurement analytics is growing. For instance, in April 2021, Oracle's developed procurement analytics features within Fusion ERP Analytics provide executives and category managers with the entire visibility into spend, supplier performance, and operational effectiveness required to remain competitive. This service combines information on finances and purchasing.

Know more about this report: Request for sample pages

Procurement analytics is a method of gaining access to the enormous database of procurement data to provide a set of insightful data that can be utilized to improve operations and generate value.

Additionally, on the other side, the market's expansion is being hampered by data security issues, integration worries, and a lack of adequate analytics tools. Despite the obstacles, companies that provide predictive analytics work tirelessly to guarantee the security of user information.

The COVID-19 pandemic's emergence prompted the implementation of crisis management. Suppliers and organizations that provide procurement analytics are working together to develop cooperative innovation programmers to look into the new potential for revenue and profits. Additionally, procurement analytics are becoming more popular since they can help businesses reduce the pandemic's effects on their economies and assist other organizations with their operations, which encourages businesses to use them.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The need to understand risks and losses, lower operating costs, boost productivity, and implement ongoing business growth is driving an increase in the use of procurement analytics. Expenditure analytics improves the adoption of cost-saving practices, makes massive files easily accessible, and provides greater in-depth knowledge through Data Visualization. Data is also updated and located in real time. It increases the system's scalability and reduces the organization's investment through improved use and consumption.

Additionally, businesses are being encouraged to employ spend analytics solutions in impoverished countries by the advancement of IoT technologies and the growth potential in developing economies. All consumer gadgets now have Bluetooth and Wi-Fi built in, which has significantly boosted data generation quality while also speeding up data gathering. This is projected to increase demand for spending analytics, especially in the retail sector.

Report Segmentation

The market is primarily segmented based on component, deployment, application, and region.

|

By Component |

By Deployment |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The solution category is expected to have largest revenue share

In 2021, the solution category led the market with a significant revenue share. Predictive analytics are commonly used in procurement analytics systems to develop future estimates from past data sets of businesses, supporting management staff in making important choices about overall procurement. Furthermore, due to the potential benefits of deciding on vendor relationships and purchasing decisions, the need for well-implemented procurement analytics solutions is still growing.

For instance, Zycus, a leading provider of an all-inclusive and complete Source-to-Pay suite for procurement the Sydney, Australia-based business has switched from its current multi-software setup to a fully-fledged S2P solution. Improvements in global business unit synergy will result from this.

The on-premise segment will account for a higher share of the market.

In 2021, the on-premises industry will have the highest revenue share during the forecast period. The market is anticipated to develop at a faster rate during the forecast period as a result of the rising adoption of enterprise application software. Variables influence the segment's market share in the procurement analytics market, including local security control and data protection due to the segment's on-premises data storage. Additionally, the growth strategies were advantageous to market participants in that they were able to build their businesses, establish a stronger regional presence, and increase the size of the emergency medical software sector.

For instance, Central Square Technologies, a market leader in public safety software, stated in January 2022 that Paragould, Arkansas had selected Central Square's 911 Pro to replace Motorola Vesta for its emergency dispatch requirements. By selecting this option, the dispatchers in Paragould would have access to user-friendly software developers and essential features, such as enhanced location resources, which would streamline their work and lead to better services for the locals.

Supply Chain Management is expected to hold the significant revenue share

Supply chain management will have substantial growth during the forecast period. The use of the procurement process makes it easier to obtain, classify, and analyze expenditure data using specialist software, which is one of the reasons for the expansion of the segment. Many businesses use digital platforms to handle vendor management, contracts, and purchases. Spend analytics is a helpful tool because these systems are typically fragmented and don't give a comprehensive picture of expenditure across departments and locations.

The risk analytics industry is expected to register the highest growth rate over the study period. Furthermore, decision-making has become increasingly challenging as company complexity tied to data has increased. For instance, Microsoft Corp, in April 2022 announced that in collaboration with Kraft Heinz, for its supply chain networks. It will enable the company in procuring things on time.

The demand in North America is expected to witness significant growth

North America is expected to be dominant and anticipated to last for the forecast period and generate more global revenue, in 2021. The region will flourish since it is seeing a lot of new entrepreneur setups that are looking forward to acquiring new clients and establishing customer trust by adopting new digital paradigms to gain a competitive advantage over incumbent competitors. For instance, in May 2021, IBM unveiled Watson AIOps, an AI-based platform that automates how enterprises self-identify, diagnose, and react to IT abnormalities in real time. Automation in IT Operations is provided by IBM Cloud Pak for Watson AIOps Version 3.1 and its new features.

Additionally, companies are constantly trying to find ways to enhance the quality of their goods and distinguish their supply chain analytics offerings. For instance, PartsSource Pro, the company's flagship product and the industry's first and only clinical resource management platform was unveiled, in June 2022.

Competitive Insight

Key players include Microsoft, SAP, IBM, Oracle, Cisco, Amazon Web Service, Birch Street, Genpact, Rosslyn Data Technologies, SAS Institute, Coupa Software, Rosslyn Data Technologies, and Zycus

Recent Developments

- In September 2021, Japan Cloud and Coupa Software announced a strategic partnership to create Coupa K.K which is a joint venture to grow business in Japan through Business Spend Management.

- In June 2020, Microsoft and adaptive biotechnologies partnered together to introduce a new database ImmuneCODE for transferring the immune response to the COVID-19 virus.

Procurement Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 3.45 billion |

|

Revenue forecast in 2030 |

USD 20.1 billion |

|

CAGR |

24.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Deployment, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Microsoft, SAP, IBM, Oracle, Cisco, Amazon Web Service, Birch Street, Genpact, Rosslyn Data Technologies, SAS Institute, Coupa Software, Rosslyn Data Technologies, and Zycus |