Process Spectroscopy Market Size, Share, Trends, Industry Analysis Report: By Component, Technology (Atomic Spectroscopy, Mass Spectroscopy, and Molecular Spectroscopy), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 119

- Format: PDF

- Report ID: PM5090

- Base Year: 2023

- Historical Data: 2019-2022

Process Spectroscopy Market Overview

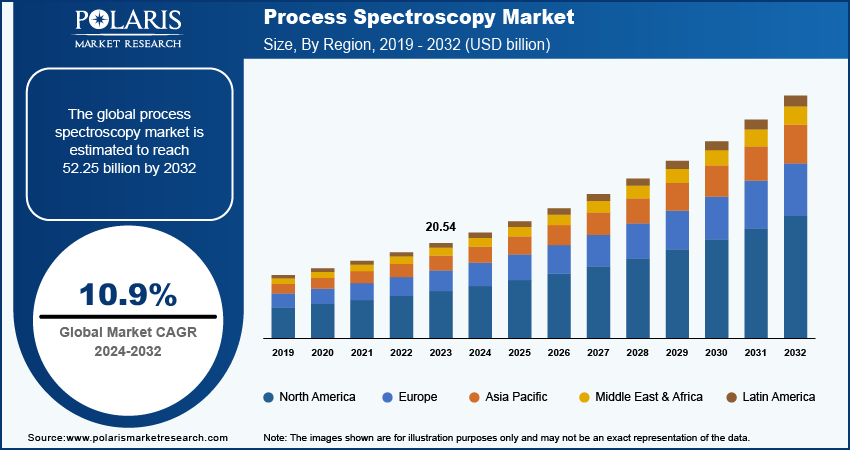

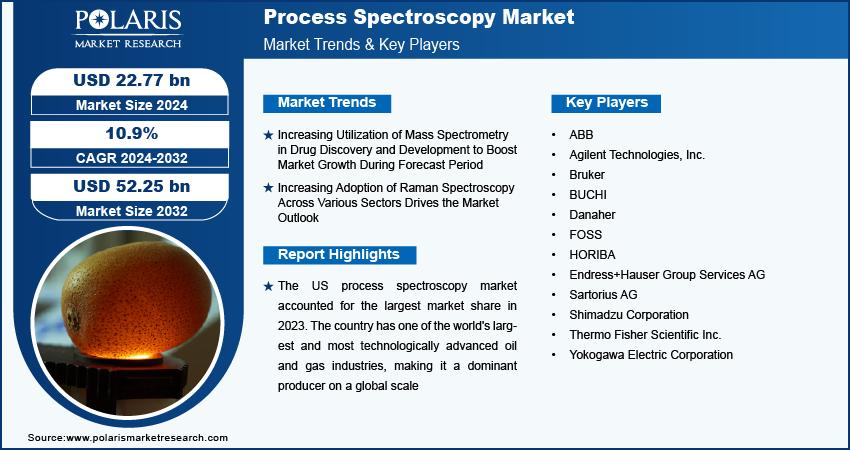

The process spectroscopy market size was valued at USD 20.54 billion in 2023. The market is projected to grow from USD 22.77 billion in 2024 to USD 52.25 billion by 2032, exhibiting a CAGR of 10.9% during 2024–2032.

The process spectroscopy market encompasses a range of spectroscopic techniques used for real-time monitoring and control of industrial processes. The analytical approach involves studying the interaction between substances and electromagnetic radiation. The growing utilization of spectroscopic techniques in the pharmaceuticals, food, and agriculture sectors fuels the market expansion. Furthermore, the rising awareness of high-quality food and pharmaceuticals, complying with the regulations and standards set by the governments and relevant organizations, drives the market trend.

To Understand More About this Research: Request a Free Sample Report

The growing biopharmaceutical industry significantly propels the demand for process spectroscopy. Process spectroscopy helps optimize fermentation processes, monitor cell cultures, and ensure the consistency and safety of biotech products, thereby driving innovation and growth in the biotechnology sector, consequently contributing to the growth of the process spectroscopy market. Further, environmental monitoring is significantly contributing to the process spectroscopy market growth. Industries continuously track pollutants, assess environmental impact, and ensure compliance with regulatory standards. Process spectroscopy methods offer analysis of air, water, and soil quality, facilitating timely responses to environmental issues. The increasing need for effective environmental management and regulatory compliance drives demand for process spectroscopy solutions, thereby propelling market growth.

Process Spectroscopy Market Trends

Increasing Utilization of Mass Spectrometry in Drug Discovery and Development to Boost Market Growth During Forecast Period

Mass spectrometry is a powerful analytical technique used to determine the mass-to-charge ratio of ions. It finds wide applications across various scientific disciplines, including fundamental research and industrial processes requiring precise measurements of elemental and molecular components.

Mass spectrometry is extensively used in the pharmaceutical industry for drug discovery and development processes. The technique plays a crucial role in drug screening and lead optimization. It is utilized to identify compounds that interact with specific protein targets and assess drug concentrations and metabolic pathways in pharmacokinetic and pharmacodynamic studies. In October 2023, Sai Life Sciences, an Indian contract research, development, and manufacturing organization, collaborated with Dassault Systemes, a global player in 3D design, engineering, and software solutions, to accelerate drug discovery efforts. The partnership aims to incorporate solutions from Dassault Systemes to enhance productivity, data quality, and collaboration within Sai Life Sciences Research and Development Process laboratories, ultimately expediting drug discovery initiatives. Thus, the inherent advantages of mass spectrometry in drug discovery and development are expected to drive market growth during 2024–2032.

Increasing Adoption of Raman Spectroscopy Across Various Sectors Drives the Market Outlook

There is an increasing adoption of Raman spectroscopy across various sectors such as airports, pharmaceuticals, and chemicals. In 2022, US airlines carried 194 million more passengers than in 2021, marking a 30% year-over-year increase. Throughout the year, US airlines carried 853 million passengers, up from 658 million in 2021 and 388 million in 2020. This surge in air travel highlights the rising need for enhanced security measures, thereby boosting the adoption of Raman spectroscopy at airports. Raman spectroscopy is pivotal for the detection of explosive and hazardous substances in luggage and cargo due to its rapid and nondestructive analytical capabilities. This critical application enhances airport security. Owing to all these benefits, the demand for Raman spectroscopy is expected to rise, which would fuel the growth of the process spectroscopy market in the coming years.

Process Spectroscopy Market Segment Insights

Process Spectroscopy Market – Technology-Based Insights

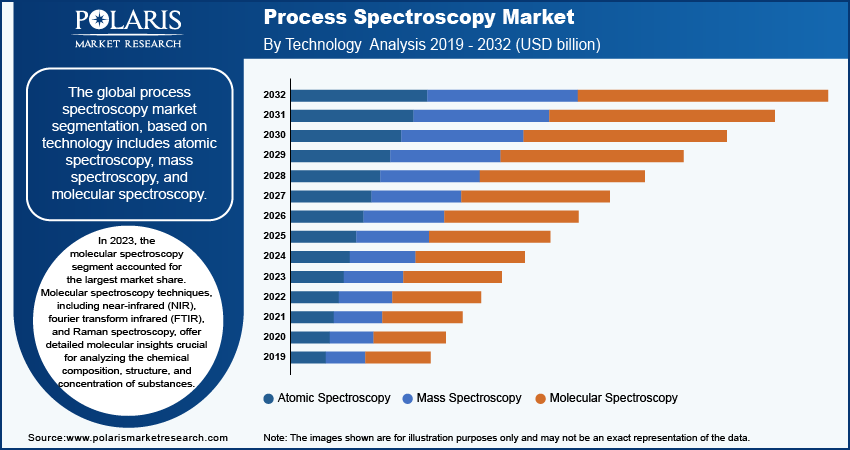

The global process spectroscopy market segmentation, based on technology includes atomic spectroscopy, mass spectroscopy, and molecular spectroscopy. In 2023, the molecular spectroscopy segment accounted for the largest market share. Molecular spectroscopy techniques, including near-infrared (NIR), fourier transform infrared (FTIR), and Raman spectroscopy, offer detailed molecular insights crucial for analyzing the chemical composition, structure, and concentration of substances. These techniques play a pivotal role in various sectors such as pharmaceuticals, chemicals, and food & beverages. They are versatile and have widespread applicability across various industries.

FTIR, in particular, is extensively utilized for process monitoring and ensuring product quality. In December 2020, Shimadzu launched a new FTIR-based plastic analyzer specifically designed to simplify the evaluation of plastic degradation. This advancement is well-suited for the analysis of microplastics or contaminants and significantly contributes to the market growth for the molecular spectroscopy segment.

Process Spectroscopy Market – Application-Based Insights

Process spectroscopy techniques are increasingly utilized for real-time monitoring and quality assurance of food products. These techniques offer rapid analysis of critical parameters such as moisture content and fat, protein, and carbohydrate levels, which are essential for maintaining product consistency and compliance with safety standards. They also play a crucial role in contaminant detection and adulterant identification, ensuring the safety of food products. Moreover, a collaboration between spectroscopy equipment manufacturers and key industry players has led to the development of tailored solutions to meet process requirements. For instance, in January 2024, NeoSpectra and Eurofins QTA partnered to enhance on-site analysis solutions for the food industry, consequently driving the adoption of process spectroscopy.

In agriculture, process spectroscopy is used for soil composition analysis and crop health monitoring, particularly using NIR spectroscopy to gain insights into soil nutrient levels and crop growth stages, enabling farmers to optimize fertilization and irrigation practices. This widespread adoption of process spectroscopy significantly impacts the food and agricultural segment's ability to determine product quality.

Process Spectroscopy Market – Regional Insights

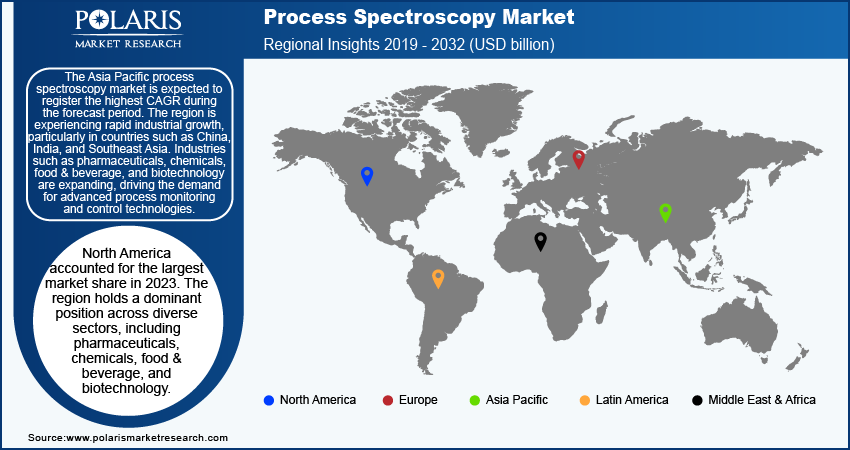

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest market share in 2023. The region holds a dominant position across diverse sectors, including pharmaceuticals, chemicals, food & beverage, and biotechnology. These industries rely heavily on process spectroscopy for tasks such as quality control, regulatory adherence, and process enhancement. Furthermore, regulatory authorities such as the FDA and EPA uphold stringent quality and safety benchmarks across these sectors. Process spectroscopy methods facilitate businesses in complying with these standards by offering accurate and dependable data. Government regulations and financial backing boost the advancement of technologies such as spectroscopy, further propelling the regional market expansion.

The US process spectroscopy market accounted for the largest market share in 2023. The country has one of the world's largest and most technologically advanced oil and gas industries, making it a dominant producer on a global scale. In 2022, oil production in the US was 12.1 million barrels per day, whereas natural gas production reached 121.1 billion cubic feet per day in December 2022. This substantial rise in oil and gas production in the US has significantly increased the utilization of process spectroscopy, thereby driving market growth in the country.

The Asia Pacific process spectroscopy market is expected to register the highest CAGR during the forecast period. The region is experiencing rapid industrial growth, particularly in countries such as China, India, and Southeast Asia. Industries such as pharmaceuticals, chemicals, food & beverage, and biotechnology are expanding, driving the demand for advanced process monitoring and control technologies. The rise in manufacturing activities across various sectors increases the need for process spectroscopy to ensure product quality and optimize production processes. The pharmaceutical industry in Asia Pacific is rapidly growing due to increasing healthcare needs and investments in healthcare infrastructure. Process spectroscopy is used extensively for quality control and compliance with stringent regulations. NIR spectroscopy is employed in pharmaceutical manufacturing to ensure the consistency and purity of drugs, reducing production costs and enhancing product quality.

The India process spectroscopy market is expected to grow significantly during the forecast period due to the rising geriatric population. The increasing geriatric population is expected to drive the demand for pharmaceutical and biotechnological products. The Elderly in India 2021 report indicates that the number of people aged 60 and above in India was around 137.9 billion in 2021 and is projected to reach 193.8 billion by 2031. Elderly people are at higher risk of chronic disease. The biotechnology industry focuses on developing new drugs and therapies to address the specific health needs of the aging population. This includes biologics, gene therapies, and personalized medicine, all of which require precise manufacturing and quality control processes, thereby boosting the process spectroscopy market in India.

Process Spectroscopy Market – Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will drive the process spectroscopy market growth. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the process spectroscopy industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global process spectroscopy industry to benefit clients and expand the business. In recent years, the industry has offered some technological advancements. Major players in the process spectroscopy market are ABB; Agilent Technologies, Inc.; Bruker; BUCHI; Danaher; FOSS; HORIBA; Endress+Hauser Group Services AG; Sartorius AG; Shimadzu Corporation; Thermo Fisher Scientific Inc.; and Yokogawa Electric Corporation.

Thermo Fisher Scientific Inc. is the in providing services to the scientific community. They are improving patient health via diagnostics, promoting the study of life sciences, resolving complex analytical problems, increasing lab productivity, or creating and producing therapies that will change people's lives. Through there industry-leading brands, which include Thermo Scientific, Invitrogen, Applied Biosystems, Unity Lab Services, Fisher Scientific, Patheon, and PPD, our worldwide team offers an unmatched mix of cutting-edge technology, buying ease, and pharmaceutical services. In April 2022, Thermo Fisher Scientific Inc. launched the Thermo Scientific Ramina Process Analyzer, a nondestructive and continuous Raman spectroscopic analyzer tailored for process monitoring, including biopharmaceutical manufacturing. The system enables quick setup and deployment, taking 15 minutes to produce spectral data on specific analytes within seconds, eliminating the requirement for sample preparation.

Shimadzu delivers science and technology solutions. It works on medical equipment, measuring instruments, industrial equipment, and aircraft equipment business segments. The company offers measuring instruments and advanced analytical instruments which includes liquid and gas chromatography, liquid and gas chromatography-mass spectrometry, columns, reagents, consumables, software and informatics, molecular spectroscopy, elemental analysis, and others. In December 2023, Shimadzu Scientific Instruments launched IRSpirit-X series FTIR spectrophotometers, including the high-sensitivity IRSpirit-TX, entry-level IRSpirit-LX, and moisture-resistant IRSpirit-ZX.

Key Companies in Process Spectroscopy Market

- ABB

- Agilent Technologies, Inc.

- Bruker

- BUCHI

- Danaher

- FOSS

- HORIBA

- Endress+Hauser Group Services AG

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corporation

Process Spectroscopy Industry Developments

In February 2024, Bruker Corporation launched the new BEAM – the first dedicated single-point spectrometer utilizing the full power of FT-NIR spectroscopy, enhancing in-process control for solid samples.

In April 2024, Metrohm Process Analytics launched XRF spectrometer 2060 XRF Process Analyzer. This Energy-Dispersive X-ray Fluorescence (EDXRF) instrument offers dependable online X-ray fluorescence analysis for liquid process control.

In January 2023, Avantes launched a new Compact Spectrometer. The versatile and powerful device is set to revolutionize spectroscopy with wide usability in various applications and industries.

Process Spectroscopy Market Segmentation

By Component Outlook

- Hardware

- Software

By Technology Outlook

- Atomic Spectroscopy

- Mass Spectroscopy

- Molecular Spectroscopy

- NIR

- FT-IR

- Raman

- NMR

- Others

By Application Outlook

- Chemical

- Food & Agriculture

- Metal & Mining

- Oil & Gas

- Pharmaceutical

- Polymer

- Pulp & Paper

- Water & Wastewater

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Process Spectroscopy Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 20.54 billion |

|

Market Size Value in 2024 |

USD 22.77 billion |

|

Revenue Forecast in 2032 |

USD 52.25 billion |

|

CAGR |

10.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global process spectroscopy market size was valued at USD 20.54 billion in 2023.

The global market is projected to register a CAGR of 10.9% during 2024–2032.

North America accounted for the largest market share in 2023 due to its dominant position across diverse sectors, including pharmaceuticals, chemicals, food & beverage, and biotechnology

ABB; Agilent Technologies, Inc.; Bruker; BUCHI; Danaher; FOSS; HORIBA; Endress+Hauser Group Services AG; Sartorius AG; Shimadzu Corporation; Thermo Fisher Scientific Inc.; and Yokogawa Electric Corporation are among the key players in the market.

The molecular spectroscopy segment dominated the market in 2023 due to its extensive use in process monitoring and ensuring product quality.

The food & agriculture segment held the largest market share in 2023 due to being essential for maintaining product consistency and compliance with safety standards.