Process Automation and Instrumentation Market Size, Share, Trends, Industry Analysis Report: By Instrument (Field Instruments and Process Analyzers), Solution, Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5194

- Base Year: 2024

- Historical Data: 2020-2023

Process Automation and Instrumentation Market Overview

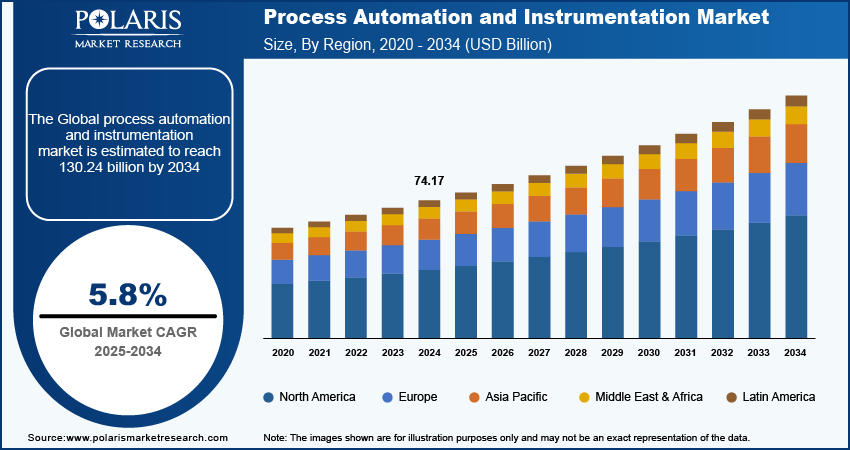

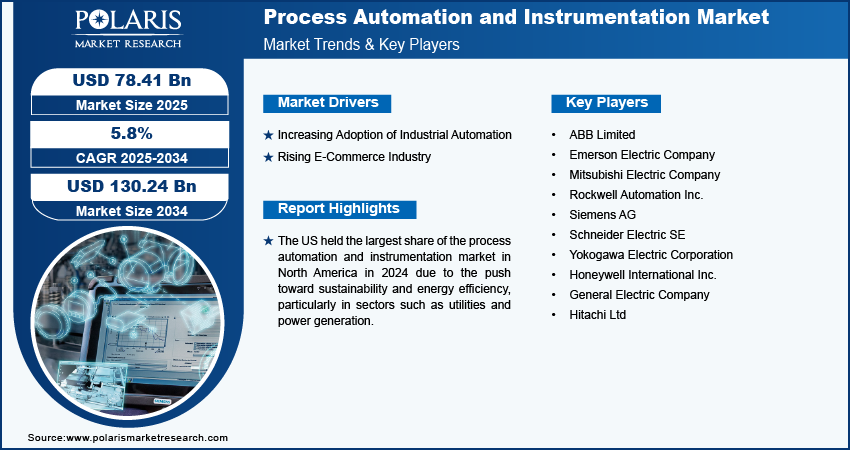

The process automation and instrumentation market size was valued at USD 74.17 billion in 2024. The market is projected to grow from USD 78.41 billion in 2025 to USD 130.34 billion by 2034, exhibiting a CAGR of 5.8% during 2025–2034.

Process automation and instrumentation refer to the technologies and systems used to automate industrial processes and control various aspects of production. Integration of these technologies enhances process efficiency, safety, and consistency. The increasing demand for industrial automation and control systems is driving the need for process automation and instrumentation. Increasing competition and the need for efficiency are driving industries to adopt automation to reduce costs, minimize human errors, and optimize production. This trend is driving the need for advanced control systems and instrumentation solutions, contributing to the process automation and instrumentation market growth. Furthermore, Industry 4.0 is encouraging the use of smart factories, where process automation and instrumentation play a pivotal role, thereby driving market growth.

To Understand More About this Research: Request a Free Sample Report

Rapid advancements in technology, particularly in sensors, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), have significantly improved the precision of industrial process monitoring and control. Technological innovations have increased the demand for automation and instrumentation systems, thereby contributing to the growing process automation and instrumentation market size. Moreover, the rise in capital expenditure for infrastructure development, especially in emerging markets, is driving the need for automation and instrumentation in sectors such as construction, water management, and energy. This is largely due to the increasing government investments in infrastructure projects, which propel the market expansion.

Process Automation and Instrumentation Market Driver Analysis

Increasing Adoption of Industrial Automation

The rising demand for industrial automation is largely driven by the need to reduce costs, minimize human errors, and optimize production efficiency in increasingly competitive markets. Automation technologies allow industries to replace manual processes with systems that operate continuously, reducing labor costs and increasing output. In sectors such as manufacturing, oil & gas, and chemicals, where large-scale production is essential, automation enhances productivity and eliminates the variability caused by human errors. Furthermore, the increasing oil and gas consumption from energy and industrial manufacturing sectors has led to the rising adoption of process automation and instrumentation as it enables higher efficiency. According to the Energy Information Administration, the global oil consumption data highlights the US as the largest consumer, with 20.01 million barrels per day, representing 20% of the world's total. China follows with a consumption of 15.15 million barrels per day, accounting for 15% of the global share. India, with 5.05 million barrels per day, contributes to 5% share across the world.

Rising E-Commerce Industry

The growing e-commerce industry is expected to propel the demand for process automation and instrumentation systems during the forecast period. According to IBEF, the India e-commerce market is projected to reach a valuation of USD 350 billion by 2030. It demonstrated robust growth in 2022, achieving a notable 21.5% increase to reach USD 74.8 billion. Process automation and instrumentation play a crucial role in the e-commerce industry by enhancing efficiency in order processing, warehouse management, and overall supply chain operations. Automation systems streamline tasks such as order entry, inventory updates, and shipment tracking, allowing companies to handle high volumes of transactions with accuracy and speed. Technological advancements allow e-commerce businesses to improve operational efficiency, minimize errors, and meet customer expectations in a highly competitive marketplace, thereby driving the process automation and instrumentation market growth.

Process Automation and Instrumentation Market Segment Analysis

Process Automation and Instrumentation Market Breakdown, by Industry Insights

The global process automation and instrumentation market segmentation, based on industry, includes chemicals, energy & power, food & beverages, metals & mining, oil & gas, pharmaceuticals, pulp & paper, water & wastewater treatment, and others. In 2024, the oil & gas segment accounted for the largest market share due to its high demand for operational efficiency, safety, and cost control in complex and hazardous environments. The sector’s reliance on continuous production processes and the need to monitor and control various parameters, such as pressure, temperature, and flow rate, make automation and instrumentation critical for maintaining optimal performance. Furthermore, strategic partnerships in the oil & gas industry are significantly contributing to the market's growth. Collaborations between technology providers and oil & gas companies are focused on integrating advanced process automation and instrumentation solutions to address the sector's complex operational needs. For instance, in August 2024, SICK and Endress+Hauser formed a strategic partnership for global sales and service of SICK’s process analyzers and gas flowmeters, with plans for a joint venture for production and development. Thus, by partnering with technology experts, oil and gas companies leverage innovations such as advanced sensors, data analytics, and automation systems to enhance efficiency, safety, and sustainability in their operations. Therefore, the oil & gas segment accounted for the largest process automation and instrumentation market share in 2024.

Process Automation and Instrumentation Market Breakdown, by Instrument Insights

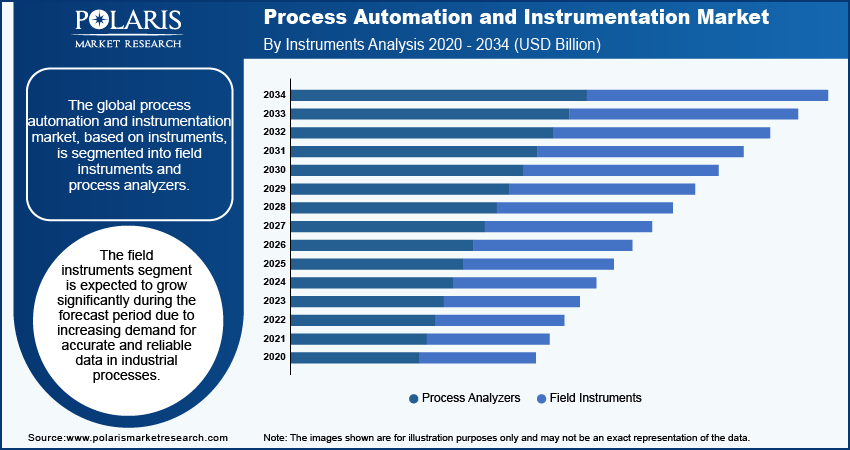

The global process automation and instrumentation market, based on instrument, is segmented into field instruments and process analyzers. The field instruments segment is expected to grow significantly during the forecast period due to increasing demand for accurate and reliable data in industrial processes. Companies adopt advanced field instruments that provide precise measurements of variables such as temperature, pressure, and flow. The integration of sophisticated field instruments becomes essential as the industries strive for greater efficiency, safety, and regulatory compliance. Moreover, field instruments facilitate real-time monitoring and control, enabling more effective management of operational parameters and proactive maintenance.

Process Automation and Instrumentation Market Regional Insights

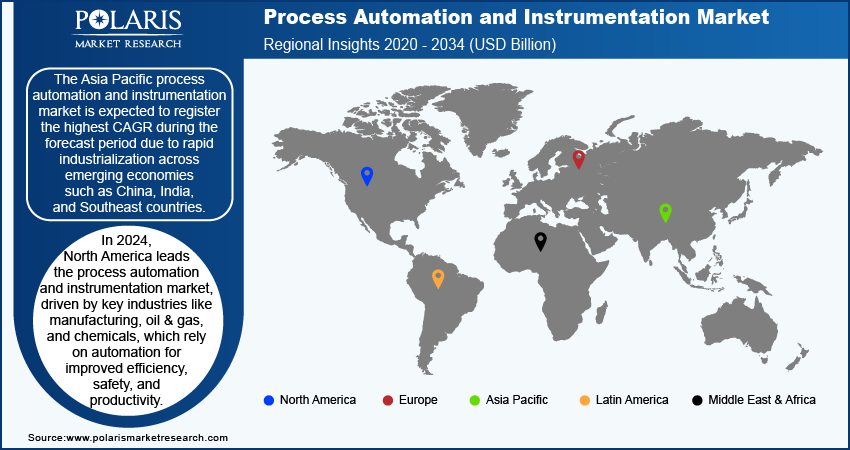

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest process automation and instrumentation market share in 2024 due to the presence of major industries in the region, such as manufacturing, oil & gas, and chemicals. These industries are heavily reliant on process automation to enhance efficiency, safety, and productivity. Additionally, the strong presence of leading technology providers and the rapid integration of Industry 4.0 solutions, including industrial Internet of Things (IIoT) and advanced analytics, have fueled the regional market growth. At SEMICON Taiwan, Delta and its US-based subsidiary Universal Instruments presented solutions aimed at advancing digital twins and AI-driven automation in semiconductor manufacturing. These solutions feature the DIATwin Virtual Machine Development Platform, which has been shown to accelerate new product development by up to 20%. Thus, the increasing progress in the industrial sector toward process automation and instrumentation systems is driving the North America process automation and instrumentation market.

The US held the largest process automation and instrumentation market share in North America in 2024. The country witnesses a push toward sustainability and energy efficiency, particularly in sectors such as utilities and power generation, which has driven the adoption of automation and instrumentation to optimize resource management and reduce emissions.

The Asia Pacific process automation and instrumentation market is expected to register the highest CAGR during the forecast period due to rapid industrialization across emerging economies such as China, India, and Southeast Asia. Furthermore, the region’s expanding manufacturing sector, especially in industries such as electronics, automotive, and chemicals, is fueling the adoption of process automation technologies to streamline operations and reduce costs. In August 2024, China accounted for ∼30% of global manufacturing output in 2022. Therefore, the growing manufacturing industry in the Asia Pacific is driving the demand for process automation and instrumentation solutions in the region.

The China process automation and instrumentation market is expected to record the highest CAGR during the forecast period due to the rising focus on upgrading its manufacturing infrastructure, particularly through initiatives such as "Made in China 2025." Such initiatives promote the integration of smart technologies, including automation and IoT, across industries. Furthermore, the growing investments in sectors such as automotive, electronics, and chemicals, alongside stringent environmental and safety regulations, are accelerating the adoption of process automation and instrumentation across the country.

Process Automation and Instrumentation Market – Key Players and Competitive Insights

The competitive landscape of the process automation and instrumentation market is characterized by the presence of several global and regional players, all competing for market share through innovation, strategic partnerships, and geographic expansion. Key players such as Siemens, ABB, Honeywell, Emerson, and Rockwell Automation dominate the market with their extensive product portfolios, advanced technologies, and strong customer bases. The major players are focusing on integrating digital solutions such as industrial Internet of Things (IIoT), cloud computing, and advanced analytics, to provide more comprehensive automation and instrumentation offerings. Meanwhile, regional players are expanding their capabilities through collaboration and localized solutions tailored to industry needs. The rising demand for smart manufacturing and the digitalization of industrial processes is creating competition among key players. Moreover, to maintain a competitive edge, companies are investing in research and development, offering customized solutions, and pursuing mergers and acquisitions to enhance their technological capabilities and market reach.

ABB Limited, Emerson Electric Company, Mitsubishi Electric Company, Rockwell Automation Inc., Siemens AG, Schneider Electric SE, Yokogawa Electric Corporation, Honeywell International Inc., General Electric Company, and Hitachi Ltd are among the major process automation and instrumentation market players.

ABB, a technology company, operates through four segments—electrification, motion, process automation, and robotics & discrete automation. The electrification segment offers a product portfolio of switchgears. The motion segment offers drive products, system drives, services, traction, IEC LV Motors, generators, and NEMA motors. Moreover, process automation and robotics & discrete automation cater to various energy and process industries and also offer measurement analytics, machine automation, and robotics solutions. Prominent end-markets catered by the company are renewables, automotive, food & beverage, distribution, oil & gas, chemicals, mining & metals, buildings, etc. The company’s prominent channel partners include distributors followed by direct sales, engineering, procurement, and construction (EPCs), Original equipment manufacturers (OEMs), system integrators, and panel builders. In September 2023, ABB launched a new value provider program for process automation solutions during their channel partner conference.

Honeywell International Inc. is a multinational conglomerate corporation headquartered in Charlotte, North Carolina. The company offers products in four areas—building technologies, aerospace, safety & productivity solutions (SPS), and performance materials and technologies (PMT). Honeywell Aerospace provides aircraft engines; avionics; flight management systems; and services to airlines, airports, manufacturers, space programs, and militaries. Moreover, in 2020, the company acquired Ballard Unmanned Systems to expand the product portfolio of aerospace segments. It operates for various industries such as aerospace and travel, commercial real estate, energy, healthcare, life sciences, logistics & warehouse, retail, and utilities. In February 2024, Honeywell enhanced the automation capabilities of the Experion Process Knowledge System with the upcoming Release R530. This will introduce advanced features to boost control room setups through firmware and software improvements, aligning with major trends in automation, aviation, and energy transition.

Key Companies in Process Automation and Instrumentation Industry Outlook

- ABB Limited

- Emerson Electric Company

- Mitsubishi Electric Company

- Rockwell Automation Inc.

- Siemens AG

- Schneider Electric SE

- Yokogawa Electric Corporation

- Honeywell International Inc.

- General Electric Company

- Hitachi Ltd

Process Automation and Instrumentation Industry Developments

In March 2024, ABB launched the ABB Ability Symphony Plus SDe Series, a set of hardware products for upgrading process control systems with minimal disruption. This allows plant operators to boost efficiency and productivity with the latest technologies.

In April 2024, Siemens launched Simatic S7-1200 G2 controllers. The controllers will be integrated into the Simatic Controller family. This latest version is poised to broaden Siemens' product line while showcasing advancements aimed at simplifying automation and programming processes for their valued customers.

In February 2024, GE's Grid Solutions business launched GridBeats, a full suite of software-defined automation solutions designed to facilitate grid digitalization and improve grid resilience.

Process Automation and Instrumentation Market Segmentation

By Instrument Outlook (Revenue – USD Billion, 2020–2034)

- Field Instruments

- Level Transmitters

- Pressure Transmitters

- Temperature Transmitters

- Others

- Process Analyzers

By Solution Outlook (Revenue – USD Billion, 2020–2034)

- DCS

- Functional Safety

- HMI

- MES

- PLC

- SCADA

By Industry Outlook (Revenue – USD Billion, 2020–2034)

- Chemicals

- Energy & Power

- Food & Beverages

- Metals & Mining

- Oil & Gas

- Pharmaceuticals

- Pulp & Paper

- Water & Wastewater Treatment

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Process Automation and Instrumentation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 74.17 Billion |

|

Market Size Value in 2025 |

USD 78.41 Billion |

|

Revenue Forecast By 2034 |

USD 130.24 Billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global process automation and instrumentation market size was valued at USD 74.17 billion in 2024 and is projected to grow to USD 130.34 billion by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

North America accounted for the largest share of the global market in 2024 due to the presence of major industries in the region, such as manufacturing and oil & gas.

ABB Limited, Emerson Electric Company, Mitsubishi Electric Company, Rockwell Automation Inc., Siemens AG, Schneider Electric SE, Yokogawa Electric Corporation, Honeywell International Inc., General Electric Company, and Hitachi Ltd are a few key process automation and instrumentation market players.

The oil & gas segment dominated the market in 2024 due to its high demand for operational efficiency, safety, and cost control.

• The field instruments segment accounted for the largest market share due to the increasing demand for accurate and reliable data in industrial processes.