Probiotic and Prebiotic Soda Market Size, Share, Trends, Industry Analysis Report

: By Product (Probiotic Soda and Prebiotic Soda), Flavor, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Mar-2025

- Pages: 129

- Format: PDF

- Report ID: PM5434

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

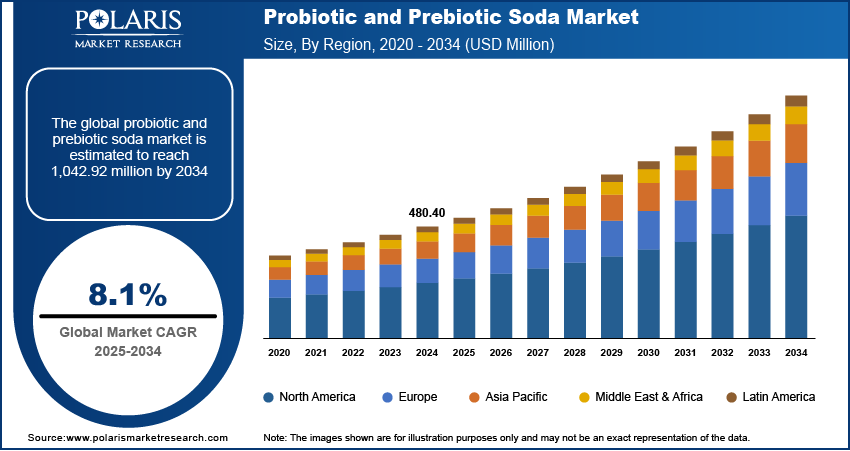

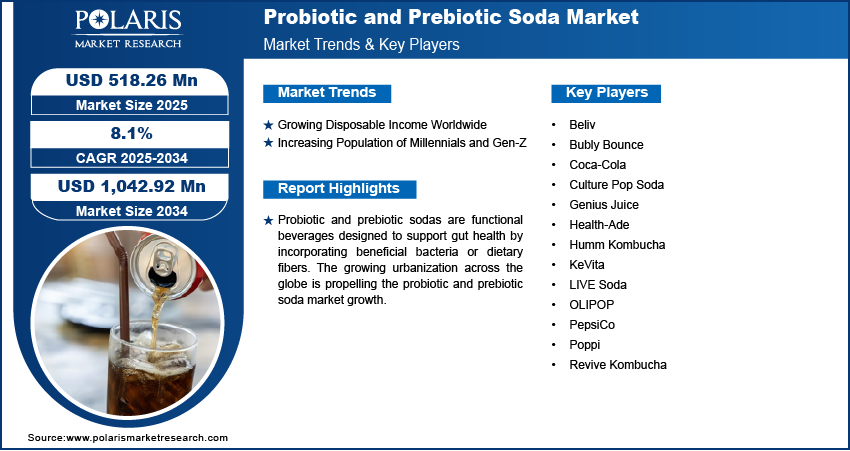

The probiotic and prebiotic soda market size was valued at USD 480.40 million in 2024, growing at a CAGR of 8.1% during 2025-2034. The growing urbanization globally and increased popularity of e-commerce platforms are a few of the key factors fueling market expansion.

Key Insights

- The probiotic soda segment accounted for the largest market share in 2024. The segment’s dominance is attributed to the increased consumer awareness about gut health.

- The fruit flavor segment led the market in 2024, owing to increased consumer preference for naturally flavored beverages.

- North America dominated the market in 2024, primarily driven by the region’s well-established functional beverage sector and increased awareness about gut health.

- Asia Pacific is projected to witness robust growth. Increasing disposable income and rising consumer awareness are driving market growth in the region.

Industry Dynamics

- Growing disposable income has enabled people to invest in premium products, such as probiotic and prebiotic sodas, that support their health and well-being.

- Increasing popularity of probiotic and prebiotic sodas among gen Z and millennials is boosting the market expansion.

- Rising emphasis on the development of innovative formulations is expected to create several market opportunities in the coming years.

- Lack of awareness and availability in low-income countries may hinder market growth.

Market Statistics

2024 Market Size: USD 480.40 million

2034 Projected Market Size: USD 1,042.92 million

CAGR (2025-2034): 8.1%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Probiotic and prebiotic sodas are functional beverages designed to support gut health by incorporating beneficial bacteria or dietary fibers. Probiotic sodas contain live microorganisms, such as “good” bacteria, which help maintain a balanced gut microbiome. These microorganisms improve digestion, strengthen the immune system, reduce bloating, and alleviate symptoms of certain digestive disorders. Prebiotic sodas, on the other hand, include fibers such as inulin or chicory root that nourish the beneficial bacteria already present in the gut. These fibers enhance gut health, support mineral absorption, lower cholesterol levels, and reduce the risk of constipation.

The growing urbanization across the globe is propelling the probiotic and prebiotic soda market growth. According to the World Bank collection of development indicators, the urban population in the World was reported at 57.25% in 2023. Urbanization leads to busier lifestyles, which encourages people to seek convenient, health-conscious food and beverage options, driving the demand for functional beverages that offer health benefits beyond traditional nutrition. Probiotic and prebiotic sodas cater to this demand by promoting gut health, boosting immunity, and enhancing overall well-being. Food service establishments in urban centers further drive demand for probiotic and prebiotic sodas as restaurants, juice bars, and fitness cafes increasingly incorporate these drinks into their menus to cater to health-conscious customers. Moreover, urban areas have expanded retail infrastructure, which makes it easier for consumers to purchase probiotic and prebiotic sodas, thereby increasing demand.

The probiotic and prebiotic soda market demand is driven by the increasing popularity of e-commerce platforms. E-commerce platforms provide a wide range of options, making it easier for consumers to discover and compare different brands and flavors of probiotic and prebiotic sodas. This variety caters to diverse preferences and dietary needs, further driving demand. Additionally, e-commerce sites often offer detailed product information, customer reviews, and ratings, which build trust and encourage purchases. The rise of e-commerce has also expanded the reach of probiotic and prebiotic soda brands, enabling them to connect with consumers in remote or underserved areas. This broader market access contributes to increased sales and brand awareness.

Market Dynamics

Growing Disposable Income Worldwide

Increased disposable income encourages people to invest in premium products that support their health and well-being. Probiotic and prebiotic sodas, with their gut health benefits, align perfectly with this trend. These beverages offer functional benefits beyond traditional sodas, appealing to health-conscious consumers who prioritize wellness. Additionally, the growth of disposable income expands the availability of premium retail channels, such as health food stores, specialty beverage shops, and online platforms. These channels often stock probiotic and prebiotic sodas, making them more accessible to consumers who are willing to pay a premium for high-quality, health-focused products, thereby driving demand. Hence, the adoption of probiotic and prebiotic soda is rising with growing disposable income worldwide. For instance, the US Bureau of Economic Analysis (BEA) published data stating that in January 2025, US disposable personal income (DPI) increased by $194.3 billion, or 0.9%, compared to the previous month.

Increasing Population of Millennials and Gen-Z

Millennials and Gen Z consumers actively seek products that support gut health, boost immunity, and enhance overall well-being. This high awareness and interest in wellness make probiotic and prebiotic sodas an attractive choice for these demographics. Social media and digital trends further amplify interest in probiotic and prebiotic soda among Millennials and Gen Z. Influencers, nutritionists, and wellness bloggers frequently highlight the benefits of probiotics and prebiotics, making these sodas more appealing and driving demand. Millennials and Gen Z also embrace innovation and variety, which create opportunities for brands to introduce new flavors and formulations. Therefore, the probiotic and prebiotic soda market is expanding with the growing population of millennials and Gen-Z. For instance, according to data published by the World Economic Forum, there are 1.8 billion millennials around the world, equal to 23% of the global population, and Asia is home to a quarter of the global population of millennials.

Segment Analysis

Market Evaluation by Product

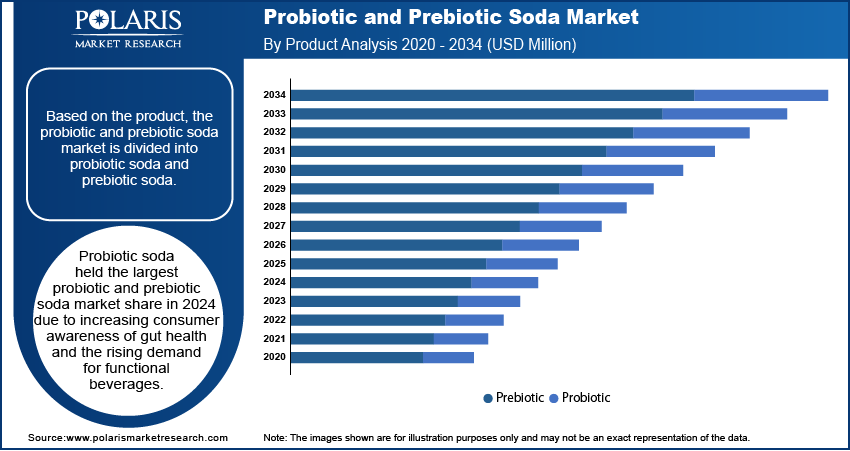

Based on the product, the probiotic and prebiotic soda market is divided into probiotic soda and prebiotic soda. Probiotic soda held the largest probiotic and prebiotic soda market share in 2024 due to increasing consumer awareness of gut health and the rising demand for functional beverages. Many consumers prioritized drinks with live probiotics that support digestion, immunity, and overall well-being. The growing popularity of fermented foods and beverages, such as kombucha and kefir, contributed to this shift, making probiotic sodas a preferred choice for those seeking similar health benefits in a more refreshing and convenient form. Additionally, advancements in formulation techniques allowed brands to develop probiotic sodas with enhanced shelf stability, ensuring live cultures remained active for extended periods. This improvement further encouraged consumers to adopt these beverages as part of their daily routines, contributing to the segment dominance.

Market Assessment by Flavor

In terms of flavor, the probiotic and prebiotic soda market is segregated into fruit, cola, and others. The fruit flavor segment accounted for a major market share in 2024 owing to rising consumer preference for refreshing and naturally flavored beverages. Many people favored fruit-based options due to their familiar taste profiles and perceived health benefits. Flavors such as citrus, berry, and tropical blends attracted health-conscious consumers looking for a balance between functionality and taste. The widespread association of fruits with vitamins, antioxidants, and natural sweetness made these beverages a popular choice over artificially flavored alternative. Additionally, brands leveraged the appeal of exotic and superfruit varieties such as acai, pomegranate, and dragon fruit to differentiate their products and capture a larger audience. The growing trend of clean-label and organic ingredients further contributed to the dominance of fruit flavors.

Regional Analysis

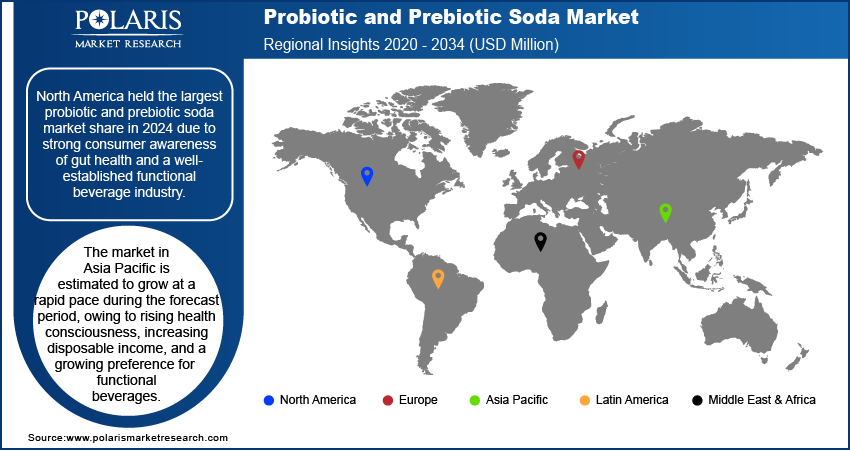

By region, the study provides probiotic and prebiotic soda market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024 due to strong consumer awareness of gut health and a well-established functional beverage industry. The region's high demand for health-focused drinks such as probiotics and prebiotic soda resulted from growing concerns about digestive issues, immunity support, and overall wellness. The presence of key market players and innovative startups further fueled growth in the region by introducing diverse flavors, clean-label formulations, and convenient packaging. Additionally, the expansion of e-commerce platforms and direct-to-consumer sales models enabled brands to reach a broader audience, increasing accessibility and market penetration. The US dominated the market within North America, supported by a robust health and wellness culture, strong purchasing power, and a rapidly growing demand for alternative beverages. The country’s widespread retail distribution networks, including supermarkets, health stores, and online platforms, contributed to regional dominance.

The probiotic and prebiotic soda market in Asia Pacific is estimated to grow at a rapid pace during the forecast period, owing to rising health consciousness, increasing disposable income, and a growing preference for functional beverages. Countries such as China, Japan, and India have witnessed a surge in demand for gut-friendly drinks fueled by a combination of traditional dietary practices and modern wellness trends. China is expected to dominate the regional market due to its massive consumer base, expanding urbanization, and rapid adoption of health-centric lifestyles. The strong influence of traditional fermented foods, such as kimchi, miso, and yogurt-based drinks, has created a favorable environment for probiotic and prebiotic sodas. Additionally, the expansion of premium beverage brands and the increasing availability of these drinks in mainstream retail channels have contributed to market growth in the region.

Key Market Players & Competitive Analysis Report

The probiotic and prebiotic soda market is highly competitive, driven by increasing consumer demand for functional beverages that support gut health. The market is characterized by product innovation, with brands focusing on unique formulations that combine probiotics, prebiotics, and natural ingredients to appeal to health-conscious consumers. Competition is fueled by the growing trend toward digestive wellness, clean-label products, and plant-based ingredients. Companies are differentiating through flavor variety, organic certifications, and reduced sugar content to attract a broader audience. E-commerce and retail expansion are key strategies for market penetration, while sustainability efforts, such as eco-friendly packaging and ethical sourcing, are gaining importance. The market continues to evolve as consumer preferences shift towards healthier, functional beverage alternatives.

The probiotic and prebiotic soda market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Beliv, Bubly Bounce, Coca-Cola, Culture Pop Soda, Genius Juice, Health-Ade, Humm Kombucha, KeVita, LIVE Soda, OLIPOP, PepsiCo, Poppi, and Revive Kombucha.

Coca-Cola founded in 1886 and headquartered in Atlanta, Georgia, is a global company in the beverage industry. It offers a diverse portfolio of over 200 brands, including sparkling beverages such as Coca-Cola, Sprite, and Fanta, as well as juices, enhanced waters, teas, coffees, energy drinks, and ready-to-drink cocktails. Coca-Cola entered the growing prebiotic soda industry with the launch of Simply Pop, a product aimed at tapping into the rising demand for gut-health-focused beverages. Simply Pop, introduced under Coca-Cola’s Simply Beverages brand, is available in five fruity flavors: strawberry, pineapple mango, fruit punch, lime, and citrus punch.

OLIPOP is a major brand in the fast-growing prebiotic soda industry, offering a healthier alternative to traditional sugary beverages. Co-founded by Ben Goodwin, OLIPOP focuses on combining prebiotics, botanical extracts, and plant-based fibers to support gut health while delivering the nostalgic taste of classic sodas. The brand uses natural sweeteners such as stevia and monk fruit instead of artificial additives, ensuring a clean and health-conscious product. OLIPOP ingredients include functional fibers such as chicory root, cassava root, and Jerusalem artichoke, which act as prebiotics to nourish beneficial gut bacteria.

List Of Key Companies

- Beliv

- Bubly Bounce

- Coca-Cola

- Culture Pop Soda

- Genius Juice

- Health-Ade

- Humm Kombucha

- KeVita

- LIVE Soda

- OLIPOP

- PepsiCo

- Poppi

- Revive Kombucha

Probiotic and Prebiotic Soda Industry Developments

March 2025: PepsiCo announced that it is going to buy prebiotic soda brand Poppi for USD 1.95 billion to compete with Coca-Cola.

February 2025: Coca-Cola announced the launch of its prebiotic soda brand, Simply Pop, to compete with Olipop and Poppi.

November 2023: Beliv, a global beverage technology company, unveiled its latest brand, Mighty Pop. It is the first soda brand with Pre-, Pro, and Postbiotics all within one formulation.

Probiotic and Prebiotic Soda Market Segmentation

By Product Outlook (Revenue, USD Million, 2020-2034)

- Prebiotic Soda

- Probiotic Soda

By Flavor Outlook (Revenue, USD Million, 2020-2034)

- Fruit

- Cola

- Others

By Distribution Channel Outlook (Revenue, USD Million, 2020-2034)

- Online

- Offline

By Regional Outlook (Revenue, USD Million, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Probiotic and Prebiotic Soda Market Report Scope

|

Report Attributes |

Details |

|

Probiotic and Prebiotic Soda Market Value in 2024 |

USD 480.40 Million |

|

Probiotic and Prebiotic Soda Forecast in 2025 |

USD 518.26 Million |

|

Revenue Forecast in 2034 |

USD 1,042.92 Million |

|

CAGR |

8.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global probiotic and prebiotic soda market size was valued at USD 480.40 million in 2024 and is projected to grow to USD 1,042.92 million by 2034.

The global market is projected to register a CAGR of 8.1% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Beliv, Bubly Bounce, Coca-Cola, Culture Pop Soda, Genius Juice, Health-Ade, Humm Kombucha, KeVita, LIVE Soda, OLIPOP, PepsiCo, Poppi, and Revive Kombucha.

The probiotic soda segment dominated the probiotic and prebiotic soda market revenue in 2024.

The fruit segment held the largest prebiotic soda market revenue in 2024.