Prefilled Syringes Market Size, Share, Trends, Industry Analysis Report

: By Material (Glass and Plastic), Closing System, Product, Design, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM1692

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

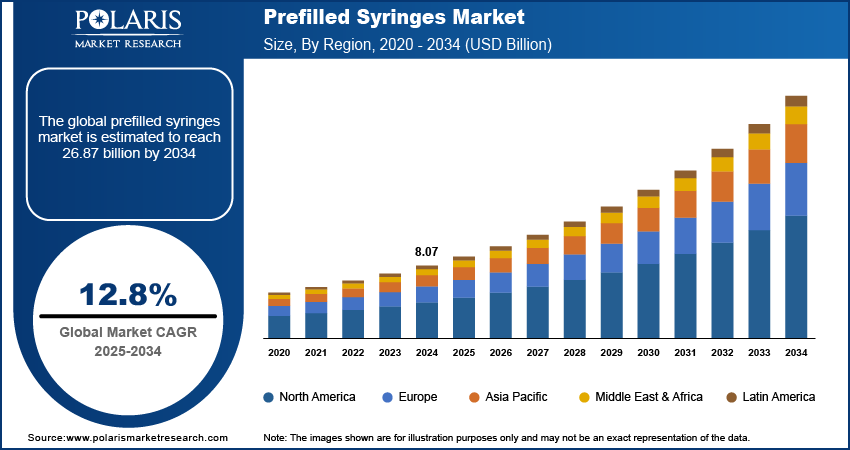

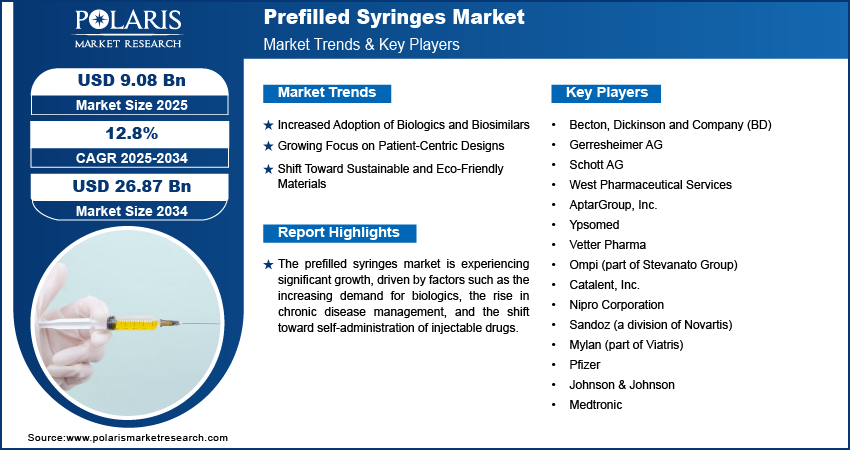

The global prefilled syringes market size was valued at USD 8.07 billion in 2024, growing at a CAGR of 12.8% during 2025–2034. The market is driven by the increasing prevalence of chronic diseases, rising demand for biologics, advancements in injectable drug delivery systems, patient-centric design innovations, and the shift toward eco-friendly materials and self-administration.

Key Insights

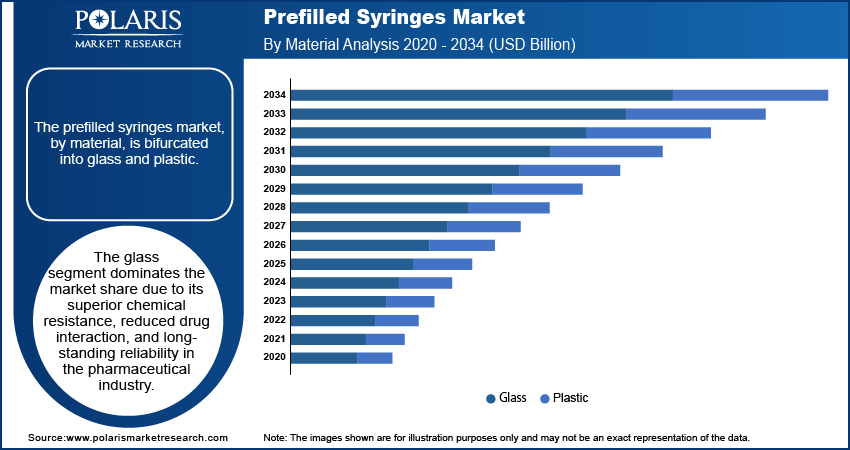

- The glass segment dominates the market due to its superior chemical resistance, reducing drug interaction and contamination risks.

- The staked needle systems segment holds the largest market share due to its integrated design, reducing preparation time and contamination risk.

- The complete syringe sets segment has a larger market share as they offer ready-to-use solutions, minimizing preparation time and contamination risks.

- The single-chamber segment holds the largest market share due to its simplicity, cost-effectiveness, and broad application across various drug formulations.

- The pharmaceutical & biotechnology companies segment holds the largest market share due to their role in developing biologics, vaccines, and injectable therapies.

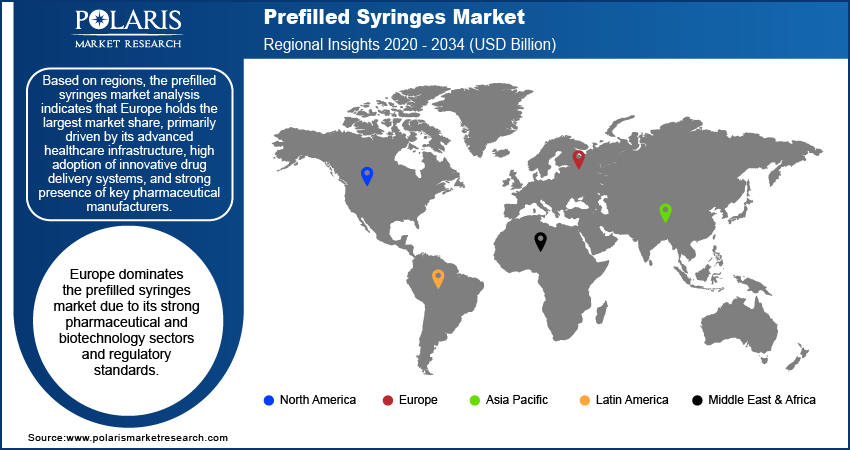

- Europe holds the largest market share, driven by advanced healthcare infrastructure, regulatory standards, and strong pharmaceutical sectors.

- Asia Pacific is growing rapidly, driven by increasing government spending, rising chronic diseases, and advancements in drug delivery systems.

Industry Dynamics

- The market is driven by the rising prevalence of chronic diseases and increasing demand for biologics.

- Technological advancements in patient-centric designs, such as auto-disable syringes and needle-free options, are enhancing safety and usability.

- The shift towards sustainable and eco-friendly materials is reducing plastic waste and meeting regulatory demands.

- Expanding healthcare infrastructure and increasing access in emerging markets are contributing to market growth.

- High production costs for biologics and sustainable materials may limit adoption and slow market growth.

Market Statistics

- 2024 Market Size: USD 8.07 billion

- 2034 Projected Market Size: USD 26.87 billion

- CAGR (2025–2034): 12.8%

- Europe: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The market encompasses the production, distribution, and use of syringes preloaded with medications or vaccines, offering convenience and reducing contamination risks. The market is driven by the increasing prevalence of chronic diseases, rising demand for biologics, and advancements in injectable drug delivery systems. The use of environmentally friendly materials, the introduction of dual-chamber syringes, and technological developments targeted at improving patient safety and usability are driving the market growth. Further, the market is growing as a result of an aging population, an expanding healthcare system, and a trend toward injectable therapy self-administration.

Market Dynamics

Increased Adoption of Biologics and Biosimilars

The rising prevalence of chronic conditions, such as diabetes and autoimmune diseases, has driven the demand for biologics, which require specialized delivery mechanisms. Prefilled syringes are increasingly favored for administering biologics due to their precision and reduced contamination risk. According to the International Diabetes Federation, ∼537 million adults were suffering from diabetes in 2021, a number expected to grow, highlighting the increasing reliance on insulin-based therapies. The growing availability of biosimilars—lower-cost alternatives to biologics—has further propelled the need for prefilled syringes, as these products must meet stringent safety and efficacy requirements. Thus, the growing use of biologics and biosimilars raises demand for pre-filled syringes, which propels market growth.

Growing Focus on Patient-Centric Designs

Technological advancements have enabled the development of prefilled syringes with features aimed at improving patient comfort and usability. For example, auto-disable syringes and needle-free options are becoming more prevalent to enhance the user experience and safety. According to a World Health Organization report from 2021, safety-engineered devices are crucial for lowering needle-stick injuries, which impact millions of healthcare workers every year. This trend aligns with the broader healthcare shift toward self-administration, especially for treatments such as hormone therapies and rheumatoid arthritis medications. Hence, this growing focus on patient-centric designs leads to the development of more pre-filled syringes.

Shift Toward Sustainable and Eco-Friendly Materials

Environmental concerns are prompting manufacturers to innovate with sustainable materials for prefilled syringes, reducing plastic waste and carbon footprints. Many companies are exploring the use of biodegradable polymers and recyclable materials in their products to meet regulatory standards and consumer expectations. A 2023 survey by the Healthcare Plastics Recycling Council found that over 70% of respondents in the industry consider sustainability a critical factor in product development. Such trends are expected to drive more innovation, particularly in markets with stringent environmental regulations such as European Union.

Segment Insights

Market Outlook – Material-Based Insights

The prefilled syringes market, by material, is segmented into glass and plastic, each offering distinct benefits. The glass segment dominates the market share due to its superior chemical resistance, reduced drug interaction, and long-standing reliability in the pharmaceutical industry. Glass syringes are mostly preferred for high-viscosity drugs and biologics, which require materials that maintain drug integrity and stability. The high inertness of glass minimizes the risk of leachables or contamination, making it the standard choice for sensitive medications.

The plastic segment is experiencing a higher growth rate, driven by advancements in polymer technologies and the rising demand for lightweight, durable, and shatter-resistant alternatives. These syringes are particularly suited for high-volume products and emergency care settings due to their portability and reduced breakage risk. The introduction of cyclic olefin polymers (COPs), which combine transparency with high chemical resistance, has propelled the adoption of plastic syringes in the market. Additionally, plastic syringes align with the growing preference for disposable, eco-friendly designs, supported by the shift toward sustainable healthcare solutions.

Market Assessment – Closing System-Based Insights

The prefilled syringes market, by closing system, is segmented into staked needle systems, luer cone systems, and luer lock form systems, each catering to specific application needs. The staked needle systems segment holds the largest market share due to their integrated design, which reduces preparation time and minimizes the contamination risk. These systems are particularly preferred in emergency care and mass immunization programs, where efficiency and safety are critical. Their widespread use in administering vaccines and biologics further consolidates their dominance, supported by their compatibility with a broad range of medications.

The luer lock form systems segment is registering the highest growth rate, driven by their secure connection mechanism that reduces the likelihood of leakage and accidental disconnection. These systems are increasingly utilized in applications requiring precise dosing and flexibility to accommodate a variety of needle types. The growth is further supported by their adoption in high-pressure injection systems for viscous drugs, such as monoclonal antibodies and oncology treatments. The demand for luer lock systems is also fueled by the rising emphasis on patient safety and regulatory compliance in the healthcare industry.

Market Evaluation – Product-Based Insights

By product, the prefilled syringes market is segmented into complete syringe sets and components & accessories, each serving distinct needs within the healthcare sector. The complete syringe sets segment holds a larger market share as the sets offer a ready-to-use solution, eliminating the need for assembly and reducing preparation time. Their widespread use in critical care, vaccination programs, and chronic disease management highlights their importance in ensuring operational efficiency and patient safety. These pre-assembled products are particularly advantageous for healthcare facilities seeking to streamline workflows and minimize contamination risks.

The components & accessories segment is registering a higher growth rate due to their increasing adoption in customizable applications and specialized drug delivery systems. This segment serves manufacturers and healthcare providers who need specific syringe parts, such as barrels, plungers, and needles, for tailored configurations. The demand for these components is being fueled by advancements in drug formulations that require innovative delivery methods. Furthermore, the increasing focus on sustainability has led to the development of reusable and modular instruments, which aligns with the broader industry trend toward eco-friendly healthcare solutions.

Market Assessment – Design-Based Insights

The prefilled syringes market, by design, is segmented into single-chamber, double-chamber, and multiple-chamber systems, each serving unique therapeutic and operational needs. The single-chamber segment holds the largest market share due to its simplicity, cost-effectiveness, and broad application across various drug formulations, including vaccines, anticoagulants, and biologics. Its widespread use in chronic disease management and routine immunization programs can be attributed to its user-friendly nature and compatibility with standard injection protocols.

The double-chamber segment is registering a higher growth rate, driven by their ability to store lyophilized drugs and their diluents separately, enabling reconstitution at the point of care. This design is particularly valuable in the administration of unstable formulations, such as certain biologics and antibiotics, where maintaining efficacy is critical. The demand for double-chamber syringes is further fueled by the increasing focus on advanced drug delivery systems that support precise dosing and enhance patient compliance in complex treatment regimens.

Market Outlook – End User Insights

Based on end user, the prefilled syringes market is segmented into pharmaceutical & biotechnology companies, contract research & manufacturing organizations (CROs and CMOs), and others, each contributing to market dynamics in distinct ways. The pharmaceutical & biotechnology companies segment holds the largest market share due to their significant role in the development and distribution of biologics, vaccines, and injectable therapies. These companies heavily invest in prefilled syringes to ensure precise dosing, improve patient safety, and enhance drug stability, aligning with regulatory standards and patient-centric healthcare models.

The contract research & manufacturing organizations segment is experiencing the highest growth, driven by the increasing trend of outsourcing drug development and production processes. These organizations offer specialized expertise and scalable manufacturing capabilities, which are particularly advantageous for small to mid-sized companies seeking to streamline operations and reduce costs. The rising demand for prefilled syringes among healthcare CROs and CMOs is also fueled by their ability to support rapid product launches, customized designs, and flexible production volumes, addressing the evolving needs of the pharmaceutical and biotechnology sectors.

Regional Insights

By region, the study covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The regional analysis of the market indicates that Europe holds the largest market share, primarily driven by its advanced healthcare infrastructure, high adoption of innovative drug delivery systems, and strong presence of key pharmaceutical manufacturers. The region's stringent regulatory standards for drug safety and quality have encouraged the use of prefilled syringes, particularly for biologics and vaccines. Additionally, increasing investments in research and development and rising awareness of patient safety contribute to the market's dominance in Europe. Other regions, including North America and Asia Pacific, are witnessing significant growth due to expanding healthcare facilities and the growing prevalence of chronic diseases.

Europe dominates the global market revenue share due to its strong pharmaceutical and biotechnology sectors, advanced healthcare infrastructure, and regulatory standards. The region's adoption of prefilled syringes is driven by the growing demand for biologics and the increasing focus on patient safety and self-administration of injectable medications. Countries such as Germany, the UK, and France lead the market, supported by robust healthcare systems and a high number of product approvals for prefilled syringes. The European Union's stringent regulations on drug packaging and delivery further accelerate the adoption of these devices, particularly in vaccine administration and chronic disease management.

The Asia Pacific prefilled syringes market is experiencing significant growth, driven by a large and rapidly growing healthcare sector, increased government spending, and rising awareness of advanced drug delivery systems. Countries such as China, Japan, and India are major contributors to this growth, with an expanding population of elderly individuals and a rising burden of chronic diseases. The region is also witnessing rapid advancements with integration of AI in pharmaceutical manufacturing and the increased availability of biologics, which are driving the demand for prefilled syringes. The increasing trend of self-injection therapies and improvements in healthcare access further support market expansion in the Asia Pacific region.

Key Players and Competitive Insights

Becton; Dickinson and Company (BD); Gerresheimer AG; Schott AG; West Pharmaceutical Services; and AptarGroup, Inc. are a few key players in the market. Other active participants include Ypsomed; Vetter Pharma; Ompi (a part of Stevanato Group); Catalent, Inc.; Nipro Corporation; Sandoz (a division of Novartis); Mylan (now part of Viatris); Pfizer; Johnson & Johnson; Medtronic; Biogen; and Teva Pharmaceuticals. These companies are involved in the design, manufacturing, and distribution of prefilled syringes, serving pharmaceutical and biotechnology industries globally. Many of these companies focus on innovations such as safety features, eco-friendly materials, and specialized designs to meet the growing demand for injectable therapies.

In terms of competitive dynamics, companies are differentiating themselves through technological advancements, such as developing multi-chamber syringes, enhancing ease of use, and ensuring compatibility with biologics and high-viscosity drugs. Furthermore, many players are pursuing strategic collaborations and partnerships with pharmaceutical companies to co-develop prefilled syringe solutions. This allows for the customization of syringes to meet specific drug delivery requirements, boosting their market position. Additionally, companies are investing in research and development to improve the overall performance, safety, and sustainability of prefilled syringes, including efforts to incorporate recyclable materials and reduce waste.

The market is characterized by significant competition, with companies focusing on product innovation, quality control, and regulatory compliance to maintain their market position. As the demand for biologics and self-administration devices grows, key players are focusing on expanding their product offerings to cover a wide range of therapeutic areas. Price sensitivity and regulatory approval processes are key challenges in this market, with companies needing to ensure that their products meet strict global standards. Furthermore, rising demand from emerging markets, especially in Asia Pacific, offers opportunities for growth, as local manufacturers also increase their presence to cater to regional needs.

Becton, Dickinson and Company (BD) is a prominent player in the market. The company designs and manufactures a wide range of medical devices, including syringes, needles, and drug delivery systems. BD is known for its focus on innovation, particularly in developing solutions that enhance the safety and effectiveness of drug delivery.

Gerresheimer AG is another key player, providing a variety of packaging and drug delivery solutions, including prefilled syringes. The company specializes in producing glass and plastic syringes, with a focus on offering products that ensure safe and reliable medication delivery.

List of Key Companies

- Becton, Dickinson and Company (BD)

- Gerresheimer AG

- Schott AG

- West Pharmaceutical Services

- AptarGroup, Inc.

- Ypsomed

- Vetter Pharma

- Ompi (part of Stevanato Group)

- Catalent, Inc.

- Nipro Corporation

- Sandoz (a division of Novartis)

- Mylan (part of Viatris)

- Pfizer

- Johnson & Johnson

- Medtronic

Prefilled Syringes Industry Developments

- January 2025: SCHOTT Pharma announced the launch of SCHOTT Topac infuse polymer syringes. The company revealed that the new system comes with a tamper-evident cap and carton packaging that takes away the need for traditional blister packs.

- December 2024: Baxter introduced five new injectable products. The new injectables include the Regadenoson Injection. According to Baxter, the injection is a ready-to-use formulation and is available in 0.4mg/5 ml strength.

-

In October 2024, BD entered into a strategic partnership with ten23, a biotechnology company, to develop advanced prefilled syringes for gene therapies, highlighting its efforts to address the growing demand for specialized drug delivery solutions.

-

In August 2024, Gerresheimer announced the expansion of its manufacturing facilities in Europe to meet the rising demand for prefilled syringes, particularly for biologic drugs. This expansion reflects the company's commitment to strengthening its presence in the growing market for injectable drug delivery systems.

Market Segmentation

By Material Outlook

- Glass

- Plastic

By Closing System Outlook

- Staked Needle System

- Luer Cone System

- Luer Lock Form System

By Product Outlook

- Complete Syringe Set

- Components & Accessories

By Design Outlook

- Single-Chamber

- Double-Chamber

- Multiple-Chamber

By End User Outlook

- Pharmaceutical & Biotechnology Companies

- Contract Research & Manufacturing Organizations

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.07 billion |

|

Market Size Value in 2025 |

USD 9.08 billion |

|

Revenue Forecast by 2034 |

USD 26.87 billion |

|

CAGR |

12.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Closing System By Product By Design By End User |

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The prefilled syringes market has been broadly segmented on the basis of material, closing system, product system, design, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategies in the prefilled syringes market focus on expanding product offerings, improving safety features, and catering to the growing demand for biologics and self-injection therapies. Companies are increasingly investing in research and development to enhance syringe designs, such as multi-chamber and needle-free options, to meet the specific needs of patients and healthcare providers. Strategic partnerships with pharmaceutical companies and collaborations for customized drug delivery systems are also common. Additionally, expanding production capabilities in emerging markets and focusing on sustainability are becoming key components of the growth strategy, as companies aim to address regional demand and regulatory requirements.

FAQ's

The global prefilled syringes market size was valued at USD 8.07 billion in 2024 and is projected to grow to USD 26.87 billion by 2034.

The global market is projected to register a CAGR of 12.8% during the forecast period.

Europe had the largest share of the global market in 2024.

A few key players in the prefilled syringes market are Becton; Dickinson and Company (BD); Gerresheimer AG; Schott AG; West Pharmaceutical Services; and AptarGroup, Inc. Other active participants include Ypsomed; Vetter Pharma; Ompi (a part of Stevanato Group); Catalent, Inc.; Nipro Corporation; Sandoz (a division of Novartis); Mylan (now part of Viatris); Pfizer; Johnson & Johnson; Medtronic; Biogen; and Teva Pharmaceuticals.

The glass segment accounted for a larger share of the global market in 2024.

The staked needle system segment accounted for the largest share of the global market in 2024.

Prefilled syringes are single-use, pre-sterilized syringes that come preloaded with a specific dose of medication and are ready for immediate injection. They are designed to eliminate the need for manual filling, reducing the risk of contamination, dosing errors, and infection. Prefilled syringes are commonly used for injectable drugs, biologics, vaccines, and other treatments that require precise, reliable administration. They are made from materials such as glass or plastic and are often designed with safety features such as auto-disable mechanisms to enhance patient safety and ease of use.

A few key prefilled syringes market trends are described below: Increased Demand for Biologics: The rise in biologic drug therapies, which require precise and stable delivery, is driving the adoption of prefilled syringes. Growth in Self-Administration: With more patients managing chronic conditions at home, there is a growing preference for prefilled syringes designed for easy self-injection. Innovation in Materials: The use of eco-friendly and sustainable materials, including biodegradable plastics, is becoming a key trend in response to environmental concerns. Safety Features: Safety-engineered syringes with features such as needle shields and auto-disable mechanisms are gaining popularity to reduce the risks of needle-stick injuries and contamination.

A new company entering the prefilled syringes market must focus on innovation in syringe design and safety features to differentiate itself. Developing advanced solutions, such as multi-chamber syringes for complex biologics or needle-free systems, could address the growing demand for precise and user-friendly drug delivery. Additionally, investing in sustainable and eco-friendly materials would align with the increasing emphasis on environmental responsibility. Targeting emerging markets, where healthcare infrastructure is rapidly expanding, could provide market growth opportunities. Collaborating with pharmaceutical companies to offer customized syringe solutions for specific drug formulations could further enhance competitiveness.

Companies manufacturing, distributing, or purchasing prefilled syringes and related products and other consulting firms must buy the report.