Predictive Maintenance Market Share, Size, Trends, Industry Analysis Report, By Component (Solutions, Services); By Deployment Model (Cloud, On-Premise); By Organization Size; By Industry Vertical; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 111

- Format: PDF

- Report ID: PM2443

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

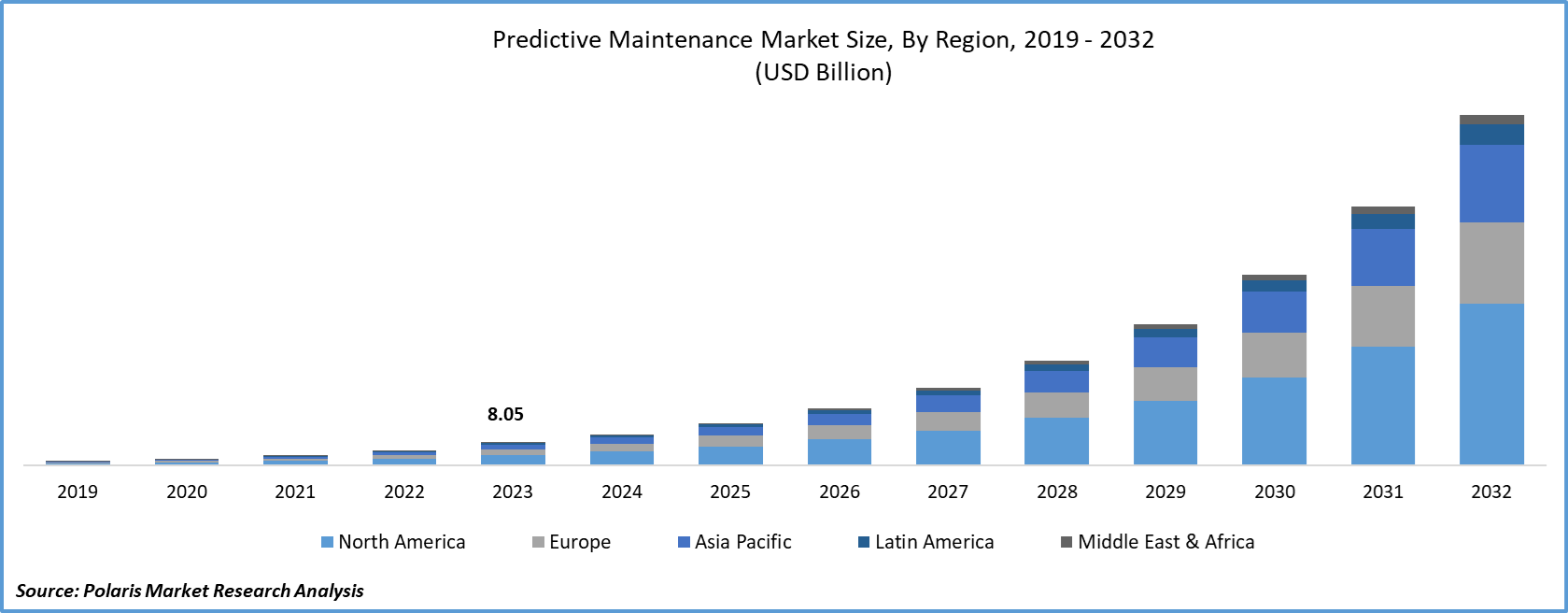

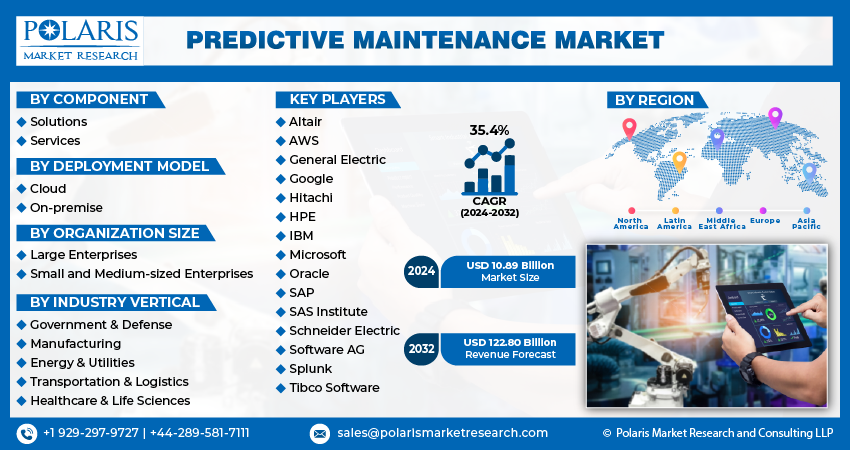

The global predictive maintenance market size was valued at USD 8.05 billion in 2023. The market is anticipated to grow from USD 10.89 billion in 2024 to USD 122.80 billion by 2032, exhibiting the CAGR of 35.4% during the forecast period.

The growth of this market is primarily driven by the need for reduced cost and downtime associated with predictive maintenance.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

For instance, the data from the U.S. Department of Energy indicates that predictive maintenance is very cost-effective and that it helps an enterprise to gain remarkable results such as a tenfold increase in ROI, 70-75% decrease in breakdowns, 25-30% reduction in costs, and 35-45% reduction in downtime.

In addition, the industry enables the technicians to plan and prepare for a repair by taking steps, including shifting the capacity to other equipment or scheduling activity for times with the minimum impact on production. This results in the elimination of unplanned downtime during the production process.

The Covid-19 pandemic disrupted industrial networks and manufacturing, including demand-side shocks along with the supply disruptions that had a negative impact on the industry. The enterprises were forced to take harsh actions for their staff and employees, as SMEs were shut down, and production & manufacturing facilities were put on hold for a longer period of time.

However, this situation has led to significant growth in focus on digital transformation among enterprises. For instance, the pandemic has boosted the need for enhanced manufacturing processes with the integration of technologies such as Machine Learning (ML) and Artificial Intelligence (AI) for the industry. This has made manufacturing systems more agile and helped manufacturing companies increase their production capacity.

Industry Dynamics

Growth Drivers

Upsurge in investment in predictive maintenance solutions to reduce cost and downtime fuels the growth of the global market. Investment in predictive maintenance initiatives generates a tangible return on investment (ROI). For instance, predictive maintenance users reported metrics such as 2-6% increased availability, 5-10% inventory cost reduction, and 10-40% reduction in reactive maintenance.

In addition, as per the recent study by Deutsche Messe AG and Roland Berger, VDMA 81% of companies are currently devoting time and resources to predictive maintenance subject, while 40% already have confidence that is practicing predictive maintenance PdM will be most significant for future business. This increase in awareness and trust in predictive maintenance solutions is projected to fuel the growth of the industry in upcoming years.

On the other hand, the integration of artificial intelligence and machine learning has created lucrative growth opportunities for the predictive maintenance industry. An increasing number of customers are using such solutions powered by AI to help shift from a reactive to a proactive approach. In addition, the market players are actively introducing new AI-enabled solutions. For instance, in September 2020, TeamViewer, a provider of remote connectivity solutions, launched TeamViewer IoT software, an AI-supported solution.

Report Segmentation

The market is primarily segmented on the basis of component, deployment model, organization size, industry vertical, and region.

|

By Component |

By Deployment Model |

By Organization Size |

By Industry Vertical |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Component

The solution segment dominated the global market. The solution leverages the data accumulated by different IoT sensors and performs an in-depth data analysis for the prediction of an anomaly in the operation of the critical equipment. The growth of this segment is mainly driven by the increasing demand for predictive maintenance market solutions, which minimize unplanned downtime and allows the prolonged life of machinery.

In addition, the market players are introducing innovative solutions to meet the demand for the predictive maintenance market. For instance, in May 2021, aiSensing launched a new AI-based predictive maintenance solution which is based on SensiML Analytics Toolkit and QuickLogic EOS S3 Platform. On the other hand, the services segment is anticipated to witness the highest growth rate during the forecast period. These services are expected to gain traction in the market due to the need for implementation and consulting of solutions.

In certain cases, companies directly prefer adopting managed services for their businesses as per their requirements. Moreover, the rising need to train the staff, effective utilization of these solutions, and assistance in integration & deployment are expected to boost the growth of the services segment.

Insight by Deployment Model

The cloud segment is anticipated to witness the highest CAGR in the global market during the forecast period due to the fact that the cloud-based services offer businesses the competitive advantages such as remote accessibility, internal data delivery & handling, direct IT control, robust deployment, faster data processing, efficient resource utilization, and cost-effectiveness.

In addition, the integration of the Industrial Internet of Things, artificial intelligence, and machine learning with cloud-based services have become an essential part of Industry 4.0. Hence, the proliferation of Industry 4.0 has further boosted the growth of the segment. Moreover, the on-premise segment is expected to contribute the largest revenue in 2021. On-premise predictive maintenance software is installed and operated from a customer's in-house server and computing infrastructure.

Organizations are deploying this technology through on-premises software, as this type of deployment has complete control over data and processes. In addition, it is considered a more secure and reliable solution by large enterprises. The aforementioned factors boost the growth of this segment.

Insight by Industry Vertical

The healthcare segment is expected to witness the highest CAGR during the forecast period. The predictive maintenance of biomedical devices such as X-ray, MR, tomography, ventilators, and mammography is one of the major concerns to increase decision-making capabilities and optimize operational efficiencies in hospitals.

For instance, Accruent, a Texas-based services provider, offers predictive maintenance market solutions for critical hospitals and healthcare machinery such as ventilators and MRI machines with their asset management (EAM) solution. Also, Accruent is responsible for providing healthcare asset management solutions to more than 55% of hospitals in the U.S.

Geographic Overview

North America is the largest revenue contributor in the global market due to the presence of a large number of solution and service vendors in this region. In addition to this, increasing awareness regarding predictive measures, their importance, and early adoption of technology has further boosted the growth of the market.

Moreover, the huge manufacturing sector in this region is projected to create demand for the predictive maintenance market. For instance, the manufacturing sector in the U.S. accounts for over 11.3% of the total output in the economy, and it employs nearly 8.5% of the workforce. Moreover, APAC is anticipated to witness the highest growth in the global market. Increasing focus towards an innovative solution for achieving optimized output drives the region’s growth.

Competitive Insights

Some of the major players operating the market include Altair, AWS, General Electric, Google, Hitachi, HPE, IBM, Microsoft, Oracle, SAP, SAS Institute, Schneider Electric, Software AG, Splunk, and Tibco Software.

Predictive Maintenance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.89 billion |

|

Revenue forecast in 2032 |

USD 122.80 billion |

|

CAGR |

35.4% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Component, By Deployment Model, By Organization Size, By Industry Verticals, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Altair, AWS, General Electric, Google, Hitachi, HPE, IBM, Microsoft, Oracle, SAP, SAS Institute, Schneider Electric, Software AG, Splunk, and Tibco Software |