Precision Farming Software Market Share, Size, Trends, Industry Analysis Report, By Technology (Guidance System Technologies, Variable Rate Technology); By Delivery Model; By Service; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 118

- Format: PDF

- Report ID: PM4805

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

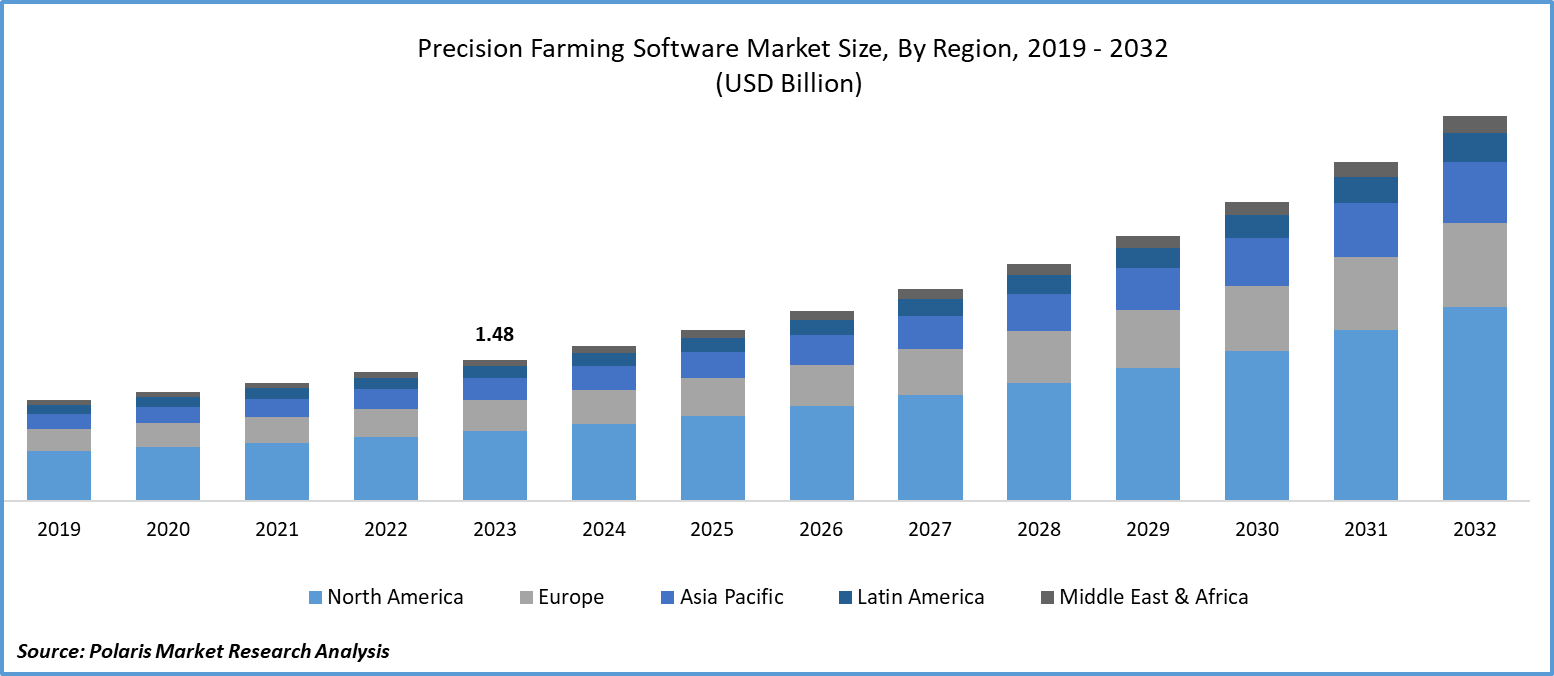

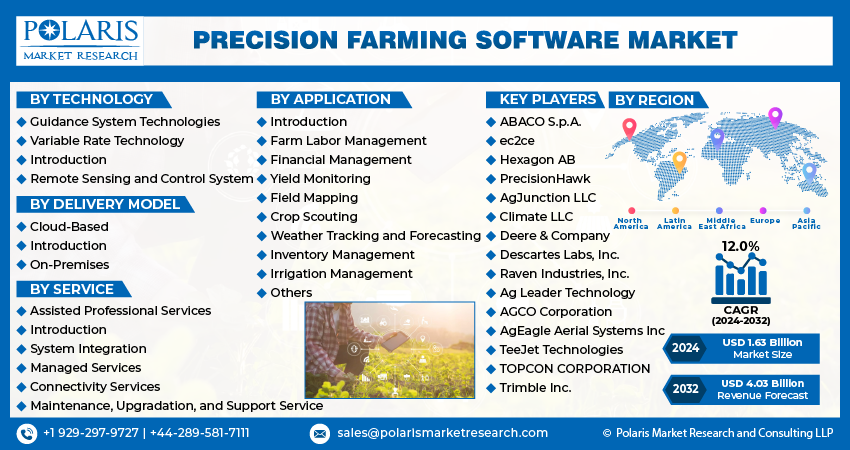

Global precision farming software market size was valued at USD 1.48 billion in 2023. The market is anticipated to grow from USD 1.63 billion in 2024 to USD 4.03 billion by 2032, exhibiting the CAGR of 12.0% during the forecast period

Precision Farming Software Market Overview

With the increasing necessity for digitization across all sectors to reduce costs and improve productivity, the precision farming software market expansion, which includes farming software, drones, agriculture sensors, and more, is also undergoing digitization to support agricultural businesses. To shield farmers from the effects of adverse price fluctuations in their produce, numerous agritech companies are developing innovative models to simplify farming practices. These models focus on wireless platforms to facilitate real-time decision-making regarding yield monitoring, field mapping, irrigation scheduling, harvesting management, crop health monitoring, and other aspects.

For instance, in January 2024, AGCO Corporation unveiled FarmerCore, an innovative global initiative designed to transform the farmer and dealer experience. This introduction of a pioneering end-to-end distribution approach signifies a significant milestone in AGCO's continuous Farmer-First strategy, underscoring its commitment to empowering farmers globally for enhanced productivity, profitability, and sustainability.

To Understand More About this Research:Request a Free Sample Report

Moreover, the rising recognition of precision agriculture's advantages in enhancing agricultural production has led to significant growth in the precision agriculture market. Given the increasing food demand due to the continuously growing population, the adoption of precision agriculture tools has become essential for farmers. Technological advancements and innovations are the key drivers of the precision farming software market growth, as they assist farmers in optimizing their yield and reducing losses through efficient resource utilization.

However, precision agriculture generates large amounts of sensitive data, including information on soil health, crop yields, and farming practices. It is crucial to protect this data from unauthorized access, use, or disclosure to maintain farmers' privacy and prevent potential misuse. Implementing strong data privacy measures, such as encryption, access controls, and data anonymization, is essential to safeguard this information. Ethical issues arise regarding the collection, use, and sharing of agricultural data. Farmers may be concerned about how their data is utilized and whether it primarily benefits them or serves commercial interests.

Precision Farming Software Market Dynamics

Market Drivers

Growing Worldwide Population-Related Need for Food

As the world population continues to grow, there is an increasing demand for food, which puts a strain on vital resources like fresh water. To meet this demand in a sustainable manner, it is crucial to reduce water usage in agriculture. One way to achieve this is by cultivating crops that can thrive with less water or are more resistant to water scarcity. Additionally, improving irrigation systems to minimize water wastage and maximize efficiency will be essential. This necessity for more efficient water uses and sustainable agriculture practices is expected to drive the adoption of precision farming techniques. Precision farming involves using technology to monitor and manage agricultural practices more precisely. By employing precision farming methods, farmers can optimize the use of resources such as water, fertilizers, and pesticides. This not only enhances production capacity but also minimizes the environmental impact of agriculture by reducing the amount of resources wasted.

Increasing Emphasis on Raising Agricultural Production and Food Security

Precision farming software market opportunity has increasingly focused on improving food security and agricultural productivity. By utilizing technologies such as IoT sensors, drones, GPS, and machine learning algorithms, these tools enable farmers to optimize the use of resources such as fertilizers, water, and pesticides, resulting in more efficient and long-term farming practices. These technologies allow farmers to monitor crop health in real-time, identify areas for better enhancement, and make informed decisions based on data to maximize yields while minimizing inputs.

Furthermore, precision farming software provides valuable insights into weather patterns, crop performance, soil conditions, helping farmers mitigate risks and adapt to environmental changes. This software significantly contributes to food security by increasing productivity and reducing waste, It is essential as the world's population is still growing. Furthermore, these technologies are essential for protecting the environment and guaranteeing the long-term viability of agriculture since they support sustainable farming methods.

Market Restraints

Needs Specific Knowledge to Navigate Successfully

The necessity to efficiently manage several technologies and data streams gives rise to the complexity and integration issues associated with precision farming software. Farmers and other agricultural professionals may find this complexity intimidating, and it takes specific knowledge to manage it successfully. Precision farming entails gathering and analyzing data on soil, plants, and environmental conditions using cutting-edge technologies such as GPS, drones, IoT sensors, and machine learning algorithms. Afterward, decisions about crop management, irrigation, and fertilizer application are made with this data in hand. Since various technologies and data streams need to be seamlessly handled in order to produce insights that can be put to use, their integration might be difficult. A thorough understanding of data analytics, agricultural techniques, and technologies is necessary for this.

Report Segmentation

The market is primarily segmented based on technology, delivery model, service, application, and region.

|

By Technology |

By Delivery Model |

By Service |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Precision Farming Software Market Segmental Analysis

By Technology Analysis

The guidance system technologies segment led the industry of precision farming software market demand with substantial revenue share in 2023. Precision and accuracy in guidance system technology play a crucial role in modern agriculture, offering farmers significant benefits. These technologies ensure that agricultural machinery is precisely positioned and aligned, leading to improved crop establishment and more effective weed control. This precision contributes to higher yields by enabling farmers to achieve uniform planting, targeted application of inputs such as fertilizers and pesticides, and efficient weed management. By using guidance technology, farmers can plant their crops with greater precision, ensuring that each seed is placed at the optimal distance and depth for optimal growth. This accuracy also extends to the application of inputs, allowing farmers to apply fertilizers and pesticides only where they are needed, minimizing waste and reducing environmental impact.

By Delivery Model Analysis

The on-premises segment accounted for the largest market share in 2023 and is likely to retain its position throughout the precision farming software market forecast period. Many farmers favor the on-premises delivery model due to its ability to provide heightened data security and control. Farmers can maintain complete control over their information and guarantee compliance with data privacy requirements by storing all software and data on their infrastructure. Farmers who value data security and are hesitant to give sensitive agricultural data to outside parties may find this feature very appealing. Furthermore, on-premises solutions provide constant access to applications and data in remote or rural locations where internet connectivity may be spotty or nonexistent. This address worries about downtime and guarantees that farmers can carry on running their businesses successfully despite obstacles related to connectivity or geography.

By Application Analysis

Based on application analysis, the market has been segmented on the basis of Introduction, Farm Labor Management, Financial Management, Yield Monitoring, Field Mapping, Crop Scouting, Weather Tracking and Forecasting, Inventory Management, and Irrigation Management. The yield monitoring segment held a significant market share in revenue share in 2023. These apps are vital resources because they offer insightful data on crop performance and opportunities for improvement. By giving farmers access to this vital information, they empower them to make well-informed decisions about crop selection, input management, and harvesting techniques, eventually optimizing returns on investment.

Moreover, yield-tracking apps support farmers in evaluating the efficacy of different tactics and making the required modifications by helping with performance evaluation and providing useful benchmarks. Their broad acceptance by farmers seeking to optimize their operations and achieve long-term success in agriculture can be attributed in large part to their versatility and reactivity.

Precision Farming Software Market Regional Insights

The North America Region Dominated the Global Market with the Largest Market Share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. North America stands out as a key region in the precision farming software market development. Farmers in this region are highly educated and are increasingly adopting advanced farming systems, mobile apps, cloud services, farm management software, imagery services, and data analytics. Moreover, North America has captured a significant share of the precision farming software market opportunity due to the rising use of advanced agricultural equipment and solutions such as sensors, steering, and guidance systems.

The region leads in this market, thanks to the presence of several critical manufacturers of high technologies. The Wide Area Augmentation System (WAAS), a GNSS-based solution, is particularly popular in North America, with a market penetration of 66%. The North American market holds great potential for satellite-based devices and equipment. The growing demand for real-time kinetic technology, sprayer controllers, and fertilizer, robotics, networks, variable rate irrigation, and remote sensing technologies is a key driver of market growth. Some of the prominent precision farming software companies in the US market include Deere & Company, AgJunction, Inc., Trimble, Inc., and Raven Industries.

The Asia Pacific region is expected to be the fastest-growing region, with a healthy CAGR during the projected period. There's a noticeable rise in technology adoption across various sectors, including agriculture. The improved accessibility and affordability of advanced solutions mainly drives this increase. Consequently, farmers are increasingly opting for precision farming techniques and investing in state-of-the-art software to improve the efficiency and effectiveness of their operations.

Additionally, governments across the Asia Pacific are actively promoting precision farming adoption. They do this through supportive policies, subsidies, and various initiatives aimed at encouraging farmers to integrate precision farming practices. These governmental initiatives are instrumental in promoting the adoption of precision farming software, motivating farmers to utilize technology to optimize resource management, enhance productivity, and promote long-term agricultural practices. For instance, in January 2024, from the Indian government, it is anticipated that the Union Budget for 2024–2025 will prioritize research and development, blockchain transparency, smart agriculture, IoT devices for precision farming, and ERP solutions for sustainable farming practices.

Competitive Landscape

The Precision Farming Software market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ABACO S.p.A.

- Ag Leader Technology

- AGCO Corporation

- AgEagle Aerial Systems Inc

- AgJunction LLC

- Climate LLC

- Deere & Company

- Descartes Labs, Inc.

- ec2ce

- Hexagon AB

- PrecisionHawk

- Raven Industries, Inc.

- TeeJet Technologies

- TOPCON CORPORATION

- Trimble Inc.

Recent Developments

- In January 2024, AgEagle Aerial Systems Inc. took part in the UMEX 2024 Unmanned System Exhibition and Conference alongside FEDS Drone-powered Solutions. AgEagle's high-performing unmanned aerial systems are distributed by FEDS. One person can operate the lightweight fixed-wing eBee VISION and eBee TAC drones, which can be launched in only three minutes. The efficacy of professional intelligence, surveillance, and reconnaissance (ISR) missions is ensured by the eBee VISION, which offers HD live video insights in dynamic contexts, including GNSS-denied situations.

- In March 2023, CNH Industrial N.V., the parent company of Raven Industries, Inc., announced its strategic integration plans. These plans aim to enhance the company's range of automated technologies by integrating Augmenta's Sense & Act capabilities into various variable-rate crop spraying applications. This move represents a significant advancement for Raven Industries, Inc. in improving its comprehensive suite of automated solutions.

- In April 2023, Hexagon's Agriculture division introduced an application for real-time production monitoring via mobile phones.

Report Coverage

The Precision Farming Software market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, technology, delivery model, service, application and their futuristic growth opportunities.

Precision Farming Software Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.63 billion |

|

Revenue forecast in 2032 |

USD 4.03 billion |

|

CAGR |

12.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Technology, By Delivery Model, By Service, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Precision Farming Software Market report covering key segments are technology, delivery model, service, application and region.

Precision Farming Software Market Size Worth $4.03 Billion By 2032

Precision Farming Software Market exhibiting the CAGR of 12.0% during the forecast period

North America is leading the global market

key driving factors in Precision Farming Software Market are Growing worldwide population-related need for food