Precision Farming Market Size, Share, Trends, Industry Analysis Report: By Offering, Technology (Guidance Technology, Remote Sensing Technology, and Variable Rate Application), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 125

- Format: PDF

- Report ID: PM1018

- Base Year: 2024

- Historical Data: 2020-2023

Precision Farming Market Overview

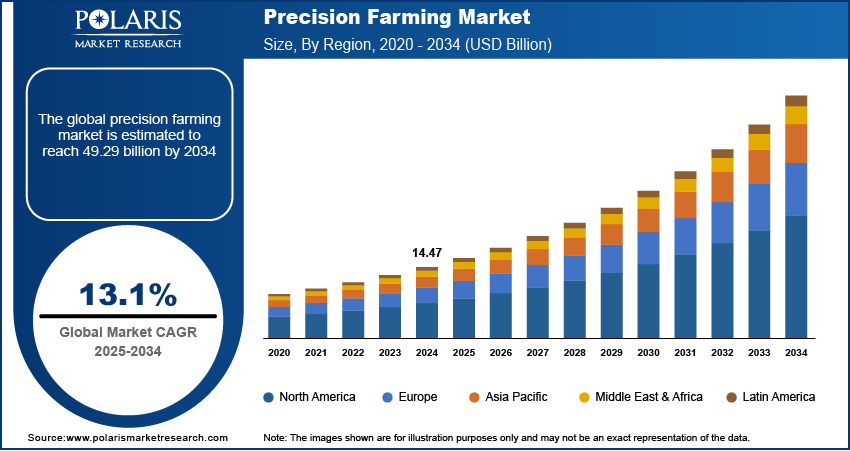

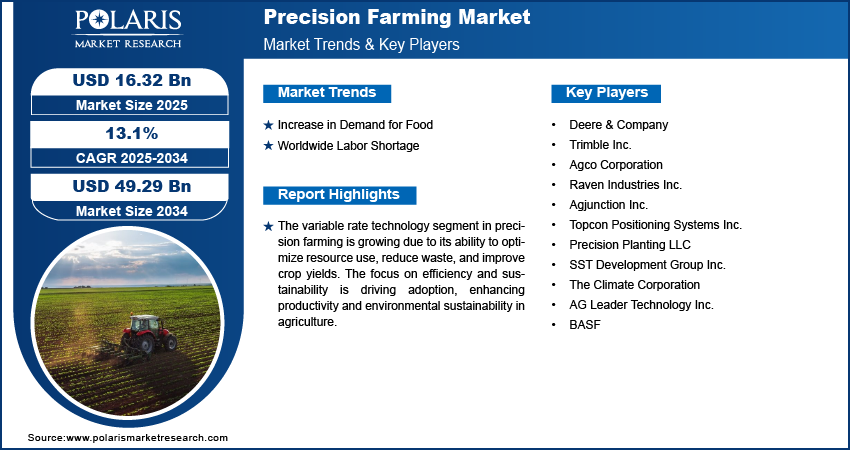

Precision farming market size was valued at USD 14.47 billion in 2024. The market is projected to grow from USD 16.32 billion in 2025 to USD 49.29 billion by 2034, exhibiting a CAGR of 13.1% during the forecast period.

Precision farming is an agricultural practice that uses advanced technologies, such as GPS, sensors, and data analytics, to optimize the management of crops and livestock monitoring. It aims to improve efficiency, increase yields, and reduce environmental impact by making precise adjustments to farming practices based on real-time data.

The adoption of precision agriculture is on the rise worldwide due to the increasing demand to improve crop yield while ensuring environmental protection. The precision farming market growth is primarily driven by the growing demand for food crops due to population growth and the increasing need to monitor crop health for high-quality crop production. The market is further propelled by the development of the global agricultural industry, land use limitations, and declining arable land. The integration of advanced technologies such as big-data analytics and telematics, along with government support and subsidies, supplement the market growth.

To Understand More About this Research: Request a Free Sample Report

Precision Farming Market Dynamics

Increase in Demand for Food

The global population is growing rapidly, leading to an increasing demand for food. Farmers face the challenge of producing more food with limited resources. Precision farming helps address this by improving farming efficiency and boosting crop yields. Technologies that optimize the use of water, complex fertilizers, and pesticides allow farmers to grow more food without using excessive resources or harming the environment. This enhanced efficiency is crucial for ensuring a stable food supply, making precision farming a vital solution to meet the challenges of feeding a growing population, thereby driving the precision farming market demand.

Worldwide Labor Shortage

The agriculture industry worldwide is facing a shortage of skilled labor, making it difficult for farmers to keep up with modern agriculture’s demand. Precision farming helps address this issue by automating many farming tasks, reducing the need for manual labor. Technologies such as drones, sensors, and autonomous tractors handle tasks such as soil monitoring and crop health monitoring and applying fertilizers, making it easier for farmers to manage their land with fewer workers. This reduction in labor dependency is significantly driving the market.

Precision Farming Market Segment Analysis

Precision Farming Market Assessment by Offerings Outlook

The precision farming market segmentation, based on offerings, includes hardware, automation & control system, sensing devices, access points, software, web-based/local, cloud based, services, system integration, managed services, maintenance & support, and consulting. The hardware segment accounted for the largest share in 2024. This is due to the growing demand for advanced farming equipment such as GPS devices, sensors, drones, and automated machinery. These tools help farmers collect data, monitor crop health, and optimize farming practices. Hardware plays a critical role in the implementation of precision farming, enabling farmers to increase productivity while reducing resource wastage. Therefore, these factors are driving the growth of the hardware segment in the global market.

Precision Farming Market Evaluation by Technology Outlook

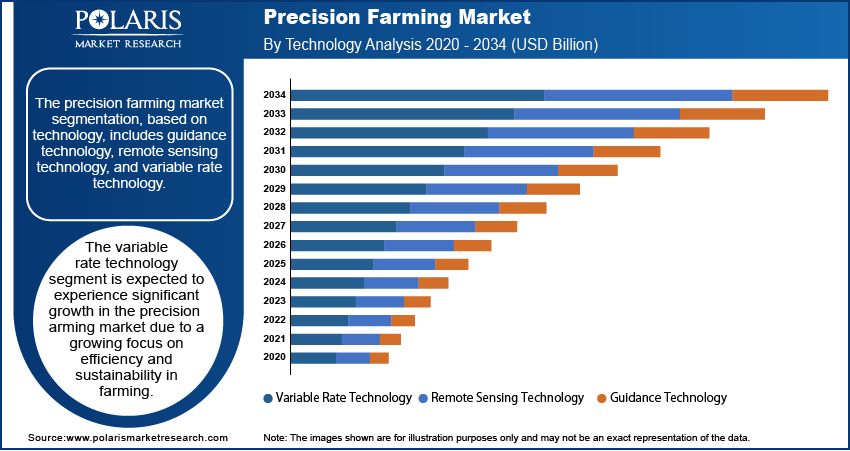

The precision farming market segmentation, based on technology, includes guidance technology, remote sensing technology, and variable rate technology. The variable rate technology segment is expected to experience significant growth. Variable rate technology enables farmers to adjust the application of resources such as water, fertilizers, and pesticides based on real-time data about specific areas of a field. This technology helps optimize input use, reducing waste and costs while improving crop yields. Additionally, the growing focus on efficiency and sustainability in farming is driving the adoption of variable rate technology, as it allows farmers to target specific needs in their fields, ultimately enhancing both productivity and environmental sustainability. Therefore, these factors combined are propelling the variable rate technology segment growth in the precision farming market report.

Precision Farming Market Regional Insights

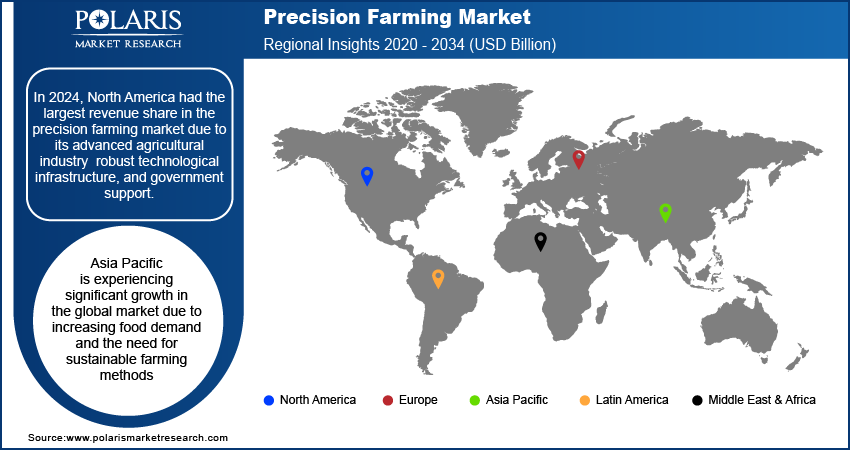

By region, the study provides the precision farming market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America had the largest precision farming market revenue share due to its advanced agricultural industry, robust technological infrastructure, and government support. The adoption of technologies such as variable rate technology, GPS mapping, and yield monitoring is rapidly increasing in the region. This shift is driven by the need to enhance crop yields, cut input costs, and reduce environmental impact. Additionally, government programs offering subsidies and tax incentives encourage farmers to adopt these advanced techniques, improving efficiency in large-scale farming operations and thereby driving the precision farming market growth in North America.

Asia Pacific is experiencing significant growth in the global market due to increasing food demand and the need for sustainable farming methods. Countries such as China, India, and Japan are adopting advanced technologies such as GPS, sensors, and drones to optimize crop production and minimize resource use. Additionally, due to vast agricultural lands and large populations, these nations are focusing on improving farming efficiency. Government support and rising awareness about the benefits of precision farming are fueling the growth of the precision farming market in Asia Pacific.

Precision Farming Market Key Players & Competitive Analysis Report

The precision farming market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meeting the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the precision farming industry include Deere & Company, Trimble Inc., Agco Corporation, Raven Industries Inc., Agjunction Inc., Topcon Positioning Systems Inc., Precision Planting LLC, SST Development Group Inc., The Climate Corporation, AG Leader Technology Inc., and BASF SE.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for end-uses, such as polyamides and isocyanates, are available through the materials section, inorganic basic products, and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various density compositions and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, surface technologies provide chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services.

Trimble Inc. is a global technology company that specializes in providing advanced solutions for various sectors, including agriculture, construction, geospatial, and transportation. Founded in 1978, Trimble is headquartered in Sunnyvale, California, USA. The company operates across multiple regions worldwide, including North America, Europe, Asia Pacific, and Latin America, serving a diverse clientele with its range of technological innovations. Trimble is a publicly traded company and does not have a parent company. Trimble offers comprehensive smart farming solutions designed to enhance productivity and operational efficiency. Recently, Trimble has launched a suite of products incorporating 5G technology to support precision agriculture. These products include advanced GPS systems and data analytics tools that leverage 5G services to provide real-time insights and improved automation capabilities for farmers.

Key Companies in Precision Farming Market

- Deere & Company

- Trimble Inc.

- Agco Corporation

- Raven Industries Inc.

- Agjunction Inc.

- Topcon Positioning Systems Inc.

- Precision Planting LLC

- SST Development Group Inc.

- The Climate Corporation

- AG Leader Technology Inc.

- BASF

Precision Farming Market Developments

August 2024: AGCO Corporation launched new products at the 2024 Farm Progress Show, including tractors from Fendt and Massey Ferguson, alongside innovations from PTx Trimble, Precision Planting, and FarmerCore.

July 2023: John Deere announced the acquisition of Smart Apply, a precision spraying equipment company based in Indiana. Smart Apply offers the Smart Apply Intelligent Spray Control System that can improve the performance and precision of virtually any air-blast sprayer used in tree nursery, vineyard, and orchard spraying applications.

April 2023: AGCO and Hexagon agreed to expand the distribution of Hexagon's Ag guidance systems. With the new agreement, customers will have an option between third-party aftermarket systems and AGCO’s premium integrated guidance systems, MF Guide and Valtra Guide.

Precision Farming Market Segmentation

By Offering Outlook (Revenue USD Billion, 2020–2034)

- Hardware

- Automation & Control System

- Sensing Devices

- Access Points

- Software

- Web-based/Local

- Cloud Based

- Services

- System Integration

- Managed Services

- Maintenance & Support

- Consulting

By Technology Outlook (Revenue USD Billion, 2020–2034)

- Guidance Technology

- Remote Sensing Technology

- Variable Rate Technology

By Application Outlook (Revenue USD Billion, 2020–2034)

- Yield Monitoring

- Crop Scouting

- Field Mapping

- Variable Rate Application

- Weather Tracking and Forecasting

- Inventory Management

- Farm Labor Management

- Financial Management

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Precision Farming Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.47 billion |

|

Market Size Value in 2025 |

USD 16.32 billion |

|

Revenue Forecast in 2034 |

USD 49.29 billion |

|

CAGR |

13.1% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The precision farming market size was valued at USD 14.47 billion in 2024 and is projected to grow to USD 49.29 billion by 2034.

The global market is projected to register a CAGR of 13.1% during the forecast period, 2025-2034.

North America had the largest share of the global market in 2024.

The key players in the market are Deere & Company, Trimble Inc., Agco Corporation, Raven Industries Inc., Agjunction Inc., Topcon Positioning Systems Inc., Precision Planting LLC, SST Development Group Inc., The Climate Corporation, AG Leader Technology Inc., and BASF SE.

The hardware segment accounted for the largest share in 2024 due to the growing demand for advanced farming equipment such as GPS devices, sensors, drones, and automated machinery.

The variable rate technology segment is expected to experience significant growth in the precision farming market due to a growing focus on efficiency and sustainability in farming.