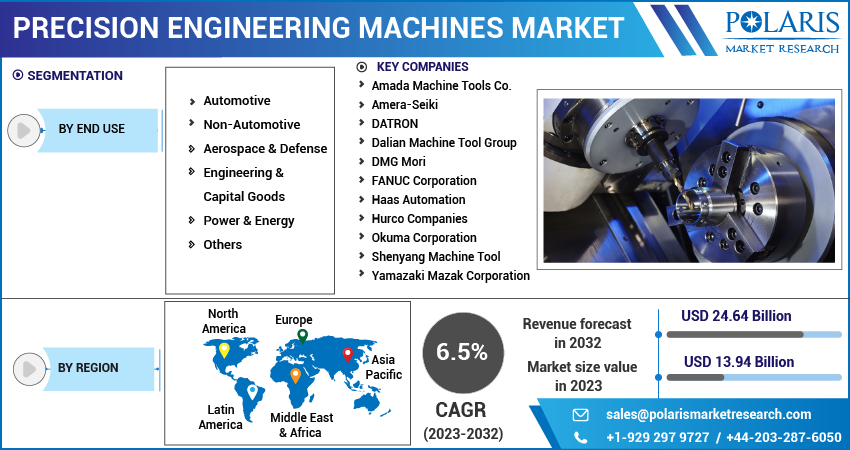

Precision Engineering Machines Market Share, Size, Trends, Industry Analysis Report, By End-use (Automotive, Non-Automotive), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3580

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

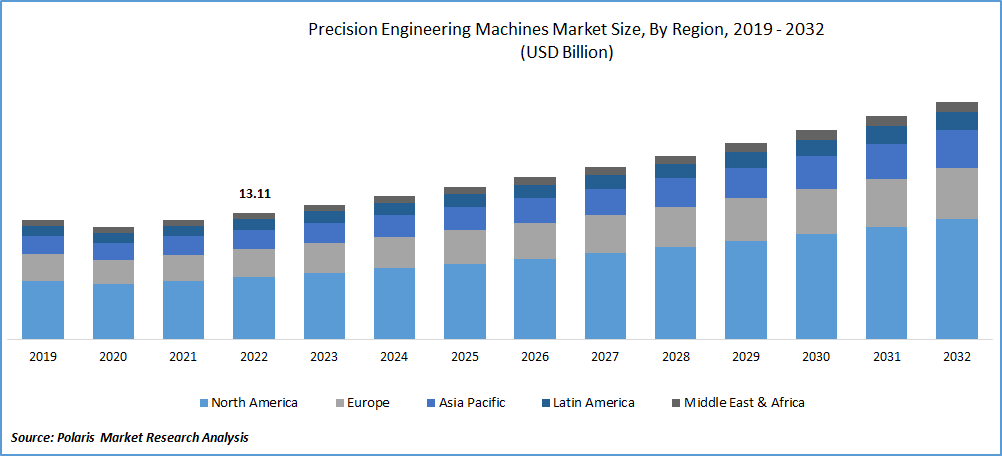

The global precision engineering machines market was valued at USD 13.11 billion in 2022 and is expected to grow at a CAGR of 6.5% during the forecast period. The market is expanding primarily due to the increasing demand for advanced precision machining solutions and the focus on minimizing downtime to enhance production efficiency, improve accuracy, and optimize machining processes. Advanced machining techniques are crucial in reducing machining time, resulting in cost savings in materials, setup, and customized machining. Consequently, precision engineering machinery has become a common fixture in manufacturing facilities as companies strive to enhance their operations.

Know more about this report: Request a Free Sample Report

The market has been severely impacted the outbreak of COVID-19, resulting in detrimental effects such as hindering innovation, reducing profitability, hampering cash flow, and causing economic imbalances. The pandemic led to the cancellation of numerous events in 2020, making it challenging for businesses to promote new products and technological advancements. Global lockdowns resulted in closing of offices and retail outlets and limitations on manufacturing, distribution, and travel, significantly influencing the market.

The disruptions in the supply chain and trade had direct repercussions on overall operations and revenue streams. To reduce costs and preserve capital, non-critical and capital expenditure investments, including plans for technology upgrades, were often delayed. Additionally, the lack of experienced workers in handling precision engineering equipment posed a risk, as it could lead to machine damage and jeopardize investments made by manufacturing units. The need for more skilled operators has become a significant obstacle to the industry's progress.

Precision engineering encompasses the creation of precise machine tools and encompasses various aspects such as machine design, construction, precision assessment, research and development, and the manufacturing and accurate measurement of goods and components. These tools can meet the requirements of both mass production and extremely intricate details. The latest advancements in precision engineering machines provide suppliers with increased quality control capabilities while minimizing labor input and enhancing profit margins. The rising demand for the most modern and sophisticated precision engineering machines can be attributed to their modular nature and smaller size compared to previous generations, making them more versatile and efficient.

Computerized machining systems offer a high level of accuracy, significantly reducing repetitive tasks and machining time, thereby enhancing the overall efficiency of industrial operations. Furthermore, technological advancements have resulted in the development of software and end-uses that enable managers to monitor machine activities in real time on the shop floor, facilitating informed decision-making. With the growing urban population and the expansion of commercial and residential sectors, manufacturers are striving to meet the increasing demand for precision engineering machines that can swiftly and efficiently cater to urban development needs.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The precision engineering machines market is experiencing growth driven by the increasing demand for machining solutions & strong focus on reducing downtime to improve production efficiency, & optimize machining processes. Moreover, the concept of Industry 4 promotes the integration of such manufacturing facilities to create holistic & flexible automation system designs that leverage precision engineering machinery for production and manufacturing purposes. As a result, the market holds significant potential with the advent of Industry 4 in the coming years.

Prominent market participants are actively introducing technologically advanced precision engineering machines. However, a key obstacle to market expansion arises from needing more experienced operators. Untrained operators may need help effectively operating precision engineering machines, posing a risk of mechanical damage and jeopardizing the investments made by production units. Additionally, the significant costs associated with training existing operators to proficiently operate modern precision machinery present another barrier in the market. Addressing the shortage of skilled operators and the costs of training them are crucial factors to overcome to facilitate the smooth adoption and operation of modern precision engineering machines.

Report Segmentation

The market is primarily segmented based on end use and region.

|

By End Use |

By Region |

|

|

Know more about this report: Speak to Analyst

Non-automotive Segment Accounted for the Largest Market Share in 2022

The non-automotive segment accounted for the largest market share in 2022. This segment comprises industries such as aerospace and defense, engineering and capital goods, power and energy, and others. In the aerospace industry, there has been a notable increase in demand for advanced materials like nickel and titanium alloys, leading to higher utilization of machine tools and cutting tools. In Germany, precision engineering machines are sought after in non-automotive industries due to their ability to produce components with enhanced accuracy and superior finish. The capital goods industry, particularly in APAC countries like Japan and China, is expected to witness substantial demand for precision engineering machinery, driven by the growing production of heavy equipment and shipbuilding activities.

The automotive segment recorded a steady growth rate. The automotive industry's increased focus on industrial and heavy machinery investments is anticipated to drive the demand for precision engineering machines in countries like Israel, Saudi Arabia, and other Middle Eastern nations. Additionally, the growing trend of incorporating advanced product technologies to enhance machinery productivity at drilling sites with deeper depths and higher-pressure requirements is expected to positively impact the European and Middle East & Africa (MEA) markets. This signifies the potential growth opportunities in the automotive sector and the increasing adoption of precision engineering machines in these regions.

Apac Region Dominated the Global Market in 2022

APAC region dominated the global market with a considerable market share. The significance of precision equipment is rapidly increasing in China's manufacturing sector. China is witnessing favorable growth opportunities in products & services to cater to the rising demand for advanced manufacturing & CNC machining services. Japan, with its nearly 200 machine tool manufacturers, is also a prominent player.

India and South Korea are also experiencing a surge in demand for precision engineering machinery, particularly in end-use industries such as automotive, power, and energy. This underscores the growing importance of Asia Pacific as a key market for precision engineering machines, driven by the region's expanding manufacturing capabilities and demands.

Europe registered a robust growth rate during the forecast period. Manufacturers in the region are leveraging technological advancements and integrating the latest automation technologies into their machinery, contributing to market growth. Robotics, design innovations, and advancements in manufacturing processes have led to increased automation in various aspects of vehicle design and performance enhancement. The significance of CNC machining is also growing across multiple sectors, as it plays a crucial role in modernizing manufacturing processes and achieving higher precision and efficiency. These trends highlight the importance of Europe in the global precision engineering machines market.

Competitive Insight

Some of the major players operating in the global market include Amada Machine Tools Co., Amera-Seiki, DATRON, Dalian Machine Tool Group, DMG Mori, FANUC Corporation, Haas Automation, Hurco Companies, Okuma Corporation, Shenyang Machine Tool, and Yamazaki Mazak Corporation.

Recent Developments

- In February 2021, DMG Mori's acquisition of GLOphotonics, a manufacturer specializing in femtosecond laser delivery technology, is poised to benefit the market significantly. This strategic move is expected to broaden the application of femtosecond lasers, creating enhanced surface quality and processing large components.

- In October 2021, Amada recently unveiled the Amada HRB-ATC, an advanced Automatic Tool Changer (ATC) technology. The introduction of this cutting-edge product by Amada aims to fulfill the market demand for such a solution, utilizing Amada's proprietary tools and expertise. By launching this innovative ATC technology, Amada aims to enhance product performance and distinctiveness, thereby creating opportunities for market expansion for businesses in the industry.

- In June 2021, DMG MORI introduced the DMP 35. This product launch aimed to offer customers a solution that combines several key features. It includes a tool magazine with 15 slots for tools up to 150 mm long, enabling efficient tool changes during machining operations.

Precision Engineering Machines Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 13.94 billion |

|

Revenue forecast in 2032 |

USD 24.64 billion |

|

CAGR |

6.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Amada Machine Tools Co., Amera-Seiki, DATRON, Dalian Machine Tool Group, DMG Mori, FANUC Corporation, Haas Automation, Hurco Companies, Okuma Corporation, Shenyang Machine Tool, and Yamazaki Mazak Corporation. |

FAQ's

key companies in Precision Engineering Machines Market are Amada Machine Tools Co., Amera-Seiki, DATRON, Dalian Machine Tool Group, DMG Mori, FANUC Corporation.

The global precision engineering machines market expected to grow at a CAGR of 6.5% during the forecast period.

The Precision Engineering Machines Market report covering key are end use, and region.

key driving factors in Precision Engineering Machines Market are Increasing demand for precision machining solutions.

The global precision engineering machines market size is expected to reach USD 24.64 billion by 2032.