Prebiotic Ingredient Market Size, Share, Trends, Industry Analysis Report

: By Type (Inulin, Oligosaccharides, and Others), Application, Source, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025 –2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM1087

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

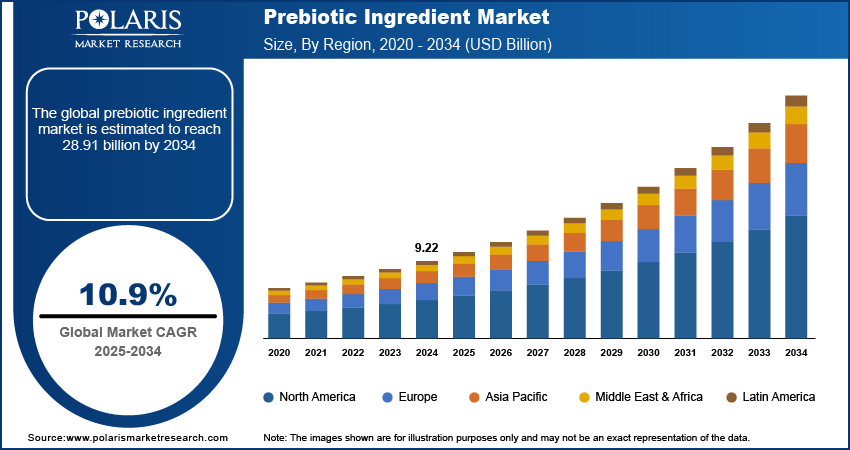

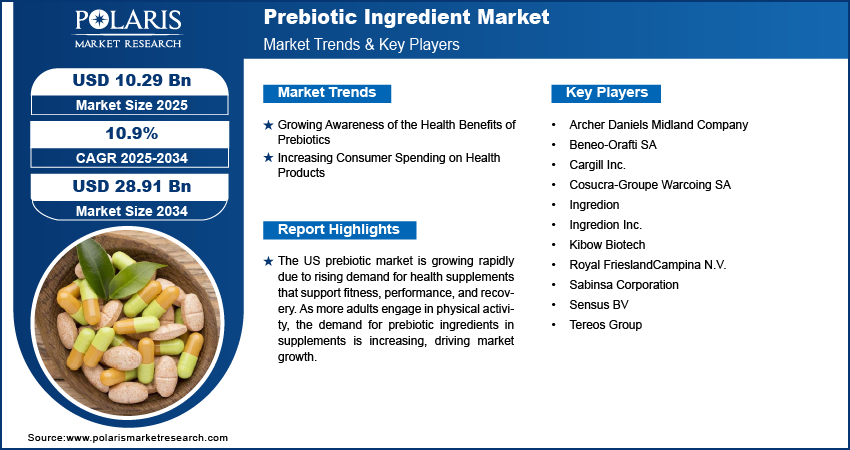

The prebiotic ingredient market size was valued at USD 9.22 billion in 2024. It is projected to grow from USD 10.29 billion in 2025 to USD 28.91 billion by 2034, exhibiting a CAGR of 10.9% during the forecast period. The market growth is driven by increasing demand for gut health products, advancements in ingredient formulations, consumer preference for natural ingredients, rising awareness of health benefits, and growing consumer spending on wellness products.

Key Insights

- The food & beverages segment accounted for the largest market share in 2024.

- The inulin segment is experiencing significant growth in the market due to its health advantages, including enhanced gut health and digestion.

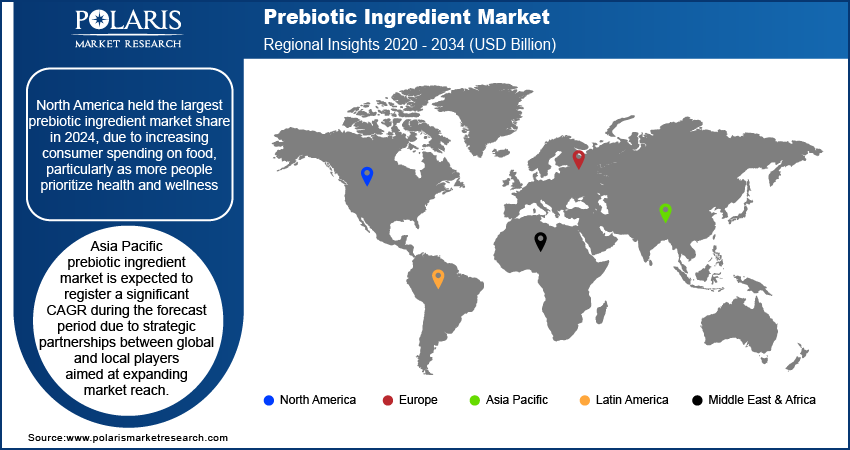

- North America prebiotic ingredient market held the largest market share in 2024 due to growing consumer demand for food, especially as more people concentrate on health and wellness.

- Asia Pacific is encountering a notable CAGR during the forecast period due to strategic alliances between local and global players aimed at expanding market penetration.

Industry Dynamics

- Prebiotics reinforce digestion and holistic gut health and are becoming increasingly approved for their capacity to improve immunity, manage weight, and prevent obesity, which is driving the market ahead.

- People are becoming more conscious about their health and funding commodities that support digestive health, immunity, and overall well-being.

- People are discovering the benefits of gut health linked to skin health, highlighting the positive effects on skin appearance and overall well-being.

- Elevated production prices and a lack of awareness regarding commodities and the increased intake of mineral ingredients restrain the market.

Market Statistics

2024 Market Size: USD 9.22 billion

2034 Projected Market Size: USD 28.91 billion

CAGR (2025-2034): 10.9%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The prebiotic ingredient market growth is driven by increasing demand within the food and beverage industry, particularly as consumers look for products that support gut health. Formulation advancements in galacto-oligosaccharides and inulin have significantly enhanced the quality and availability of prebiotic ingredients, making them more effective and accessible for manufacturers.

There is a strong consumer preference for natural and clean-label ingredients, leading to a higher demand for prebiotics derived from natural, minimally processed sources. In response, manufacturers are focusing on developing formulations that use clean, recognizable ingredients, aligning with consumer desires for healthier, more transparent food options. This combination of health trends, technological innovation, and demand for natural personal care ingredients is driving the prebiotic ingredient market value.

The growing adoption of prebiotics in skin health is driving the market. Consumers are increasingly aware of the connection between gut health and skin health, with research highlighting the positive effects of prebiotics on the skin’s appearance and overall well-being. Prebiotics, such as inulin and oligosaccharides, are known to support the gut microbiome, which in turn can lead to healthier, clearer skin. Consequently, there is a rising demand for skincare products, including creams, serums, and supplements, that contain prebiotic ingredients. Manufacturers are responding to this trend by incorporating prebiotics into their formulations to cater to the growing consumer interest in natural, skin-friendly products. For instance, in May 2023, Tereos Group launched a novel prebiotic ingredient named FOSbeauty, designed to improve skin microbiota by fostering beneficial bacteria. This shift towards using prebiotics for skin health, combined with the broader wellness trend, is fueling the prebiotic ingredient market demand.

Prebiotic Ingredient Market Dynamics

Growing Awareness of Health Benefits of Prebiotics

Prebiotics support digestion and overall gut health and are becoming increasingly popular for their ability to boost immunity, manage weight, and help prevent obesity. Rising health consciousness has led more consumers to adopt plant-based diets, with veganism gaining significant popularity. This shift is fueling the demand for plant-based prebiotics. In response, many companies are introducing plant-based prebiotics to meet this growing demand, positively impacting the prebiotic ingredient market growth.

Increasing Consumer Spending on Health Products

People are prioritizing their health and wellness, due to which they are investing in products that support digestive health, immunity, and overall well-being. For instance, according to the Indian National Health Systems Resource Center, consumer out-of-pocket spending on health products was USD 396 million in 2021, showcasing an increase in spending on health products. This growing focus on health, combined with rising disposable incomes, is encouraging manufacturers to introduce prebiotic-infused foods, beverages, and supplements, fueling the demand for prebiotic ingredients, which is propelling the prebiotic ingredient market expansion.

Prebiotic Ingredient Market Segment Analysis

Prebiotic Ingredient Market Assessment by Application Outlook

The prebiotic ingredient market segmentation, based on application, includes animal feed, cosmetics, dietary supplements, food & beverages, and others. In 2024, the food & beverages segment held the largest share due to rising sales of food and beverages. This rise in sales is influenced by shifts in lifestyle, evolving consumer food preferences, and growing consumer demand for gut-friendly beverages has led major companies in the food and beverage industry to target gut health with their offerings. This is driving the segmental growth in the global market.

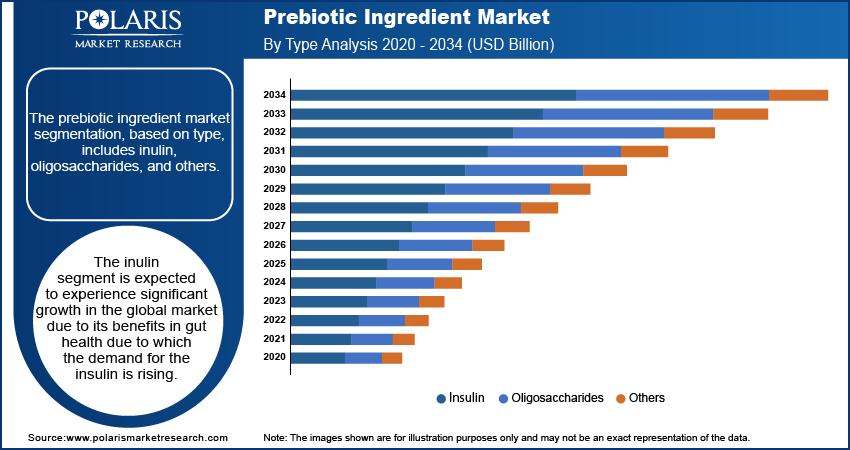

Prebiotic Ingredient Market Evaluation by Type Outlook

The prebiotic ingredient market segmentation, based on type, includes inulin, oligosaccharides, and others. The inulin segment is expected to experience significant growth in the global market. Inulin, a naturally occurring fiber found in plants such as chicory, is gaining popularity due to its health benefits, particularly in improving gut health and digestion. Insulin helps support the growth of beneficial gut bacteria, promoting overall wellness due to which the demand for inulin is increasing. This growing awareness and preference for natural prebiotics is driving the growth of the inulin segment in the market.

Prebiotic Ingredient Regional Insights

By region, the study provides the prebiotic ingredient market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024, due to increasing consumer spending on food, particularly as more people prioritize health and wellness. Rising focus on digestive health, immunity, and overall well-being, consumers are seeking products that support these needs. For instance, according to the US Bureau of Labor Statistics, consumer spending on packaged food increase by 6.9% in 2023 from 2022. This shift is encouraging manufacturers to incorporate prebiotics into various food products such as snacks, beverages, and supplements. The combination of higher spending and a focus on health is fuelling the demand for prebiotic ingredients in North America.

The prebiotic ingredient market in the US is poised for rapid growth due to the increasing demand for health supplements that support health, performance, and recovery. A large number of adults are participating in physical activity, due to which the demand for health supplements, which include prebiotic ingredients, is growing. For instance, according to the Centers for Disease Control and Prevention, nearly 47% of adults meet aerobic exercise guidelines, and over 24% engage in both aerobic and muscle-strengthening activities. This growing focus on fitness has led to a higher demand for prebiotic ingredients among health supplement manufacturers. Therefore, increasing demand for health supplements is driving the market in the US.

Asia Pacific prebiotic ingredient market is expected to register a significant CAGR during the forecast period. This growth is due to strategic partnerships between global and local players aimed at expanding market reach. Companies are collaborating with local businesses, distributors, and suppliers to improve their product offerings and improve distribution networks. These partnerships help in gaining better access to diverse consumer bases and regional markets. For instance, in February 2024, AB-LIFE entered China through a partnership with Wonderlab, a China-based company known for its innovative probiotics. The collaboration introduces Shape100, a probiotic blend targeting cholesterol and weight management, enhancing market presence. Combining these expertise and resources, businesses are able to develop innovative prebiotic solutions and increase their market presence.

Prebiotic Ingredient Market Key Players & Competitive Analysis Report

The prebiotic ingredient industry is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. This competitive environment is amplified by continuous progress in product offerings. Major players in the market include Archer Daniels Midland Company, Beneo-Orafti SA, Cargill Inc., Cosucra-Groupe Warcoing SA, Ingredion, Ingredion Inc., Kibow Biotech, Royal FrieslandCampina N.V., Sabinsa Corporation, Sensus BV, Tereos Group

Archer Daniels Midland Company (ADM) is engaged in the manufacture and distribution of food & beverage, animal feed, industrial chemicals, etc. The company has diversified its operations to include oilseeds processing, corn processing, specialty food ingredients, animal nutrition, and bioactives. The company’s operations are classified into three business segments Ag Services & Oilseeds, Carbohydrate Solutions, Nutrition. The company sells various types of floors and starches through its human nutrition segment. Apart from human nutrition, it also operates animal nutrition and industrial biosolutions. ADM's products are used in a variety of applications, including food and beverages, animal feed, industrial uses, and renewable fuels. The company's customer base includes food and beverage manufacturers, animal nutrition companies, industrial manufacturers, and energy producers, among others. The company operates over in 190 countries and has consolidated subsidiaries in more than 70 countries. It owns more than 160 warehouses and terminals, which are used as bulk storage, and has 62 innovation centers. The company was founded in 1902 and headquartered in Chicago, Illinois, United States.

BENEO is a global company that specializes in functional ingredients, including prebiotics from chicory root, plant-based proteins, and digestive health solutions. Operating under the Südzucker Group, BENEO focuses on advancing nutrition and sustainability in human and animal diets. In August 2023, Beneo showcased its innovative prebiotic ingredients at IFT 2024. The company is focused on gut health and digestive wellness, aiming to highlight the benefits of its chicory root fibers and plant-based ingredients for food manufacturers.

Key Companies in Prebiotic Ingredient Market

- Archer Daniels Midland Company

- Beneo-Orafti SA

- Cargill Inc.

- Cosucra-Groupe Warcoing SA

- Ingredion

- Ingredion Inc.

- Kibow Biotech

- Royal FrieslandCampina N.V.

- Sabinsa Corporation

- Sensus BV

- Tereos Group

Prebiotic Ingredient Market Developments

June 2024: Kerr by Ingredion announced that several of its fruit and vegetable products have received Upcycled Certification, aligning with the increasing consumer demand for sustainable and health-focused ingredients.

November 2021: ADM acquired Deerland Probiotics & Enzymes to improve its global health and wellness portfolio. This acquisition strengthens ADM’s capabilities in providing advanced probiotics, prebiotics, and enzyme ingredients for diverse health applications.

Prebiotic Ingredient Market Segmentation

By Type Outlook (Revenue - USD Billion, 2020 - 2034)

- Inulin

- Oligosaccharides

- Mannan Oligosaccharides

- Galacto Oligosaccharides

- Fructo Oligosaccharides

- Others

By Application Outlook (Revenue - USD Billion, 2020 - 2034)

- Food & Beverage

- Dietary Supplements

- Cosmetics

- Animal Feed

- Others

By Source Outlook (Revenue - USD Billion, 2020 - 2034)

- Roots

- Grains

- Vegetables

By Regional Outlook (Revenue - USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Prebiotic Ingredient Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.22 billion |

|

Market Size Value in 2025 |

USD 10.29 billion |

|

Revenue Forecast in 2034 |

USD 28.91 billion |

|

CAGR |

10.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global prebiotic ingredient market size was valued at USD 9.22 billion in 2024 and is projected to grow to USD 28.91 billion by 2034.

The global market is projected to register a CAGR of 10.9% during the forecast period, 2024-2032

North America had the largest share of the global market.

The key players in the market are Archer Daniels Midland Company, Beneo-Orafti SA, Cargill Inc., Cosucra-Groupe Warcoing SA, Ingredion, Ingredion Inc., Kibow Biotech, Royal FrieslandCampina N.V., Sabinsa Corporation, Sensus BV, Tereos Group

The food & beverages segment held the largest market share the market in 2023.

The insulin segment is expected to experience significant growth in the global market.