Pre-owned Luxury Watches Market Share, Size, Trends, Industry Analysis Report, By Type (Automatic, Manual), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024- 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4385

- Base Year: 2022

- Historical Data: 2019-2022

Report Outlook

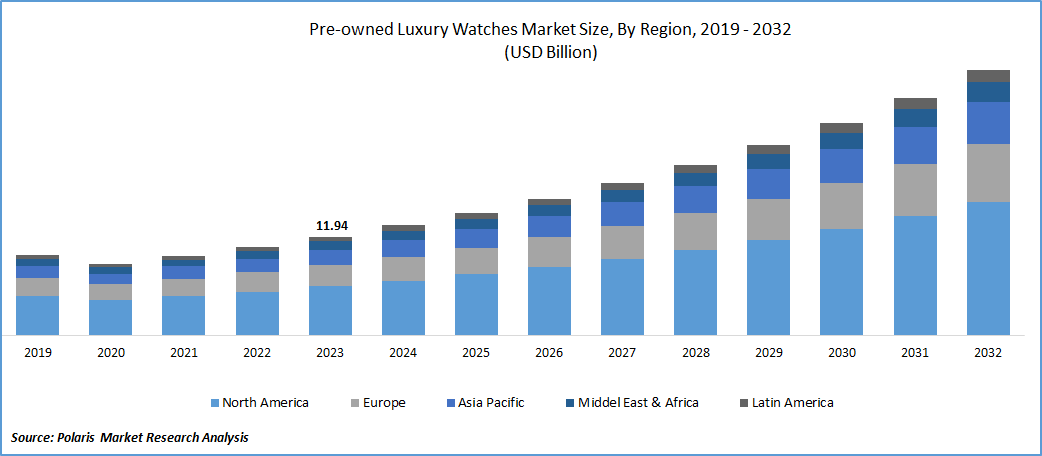

The global pre-owned luxury watches market was valued at USD 11.94 billion in 2023 and is expected to grow at a CAGR of 11.6% during the forecast period.

Luxury watches are seen as a symbol of prestige and success. Owning a timepiece from a renowned brand is often associated with a certain level of accomplishment and sophistication. The craftsmanship, design, and history behind these brands contribute to their prestige, making them desirable symbols of luxury. The investment aspect adds another layer of appeal. Unlike many other consumer goods that depreciate over time, luxury watches often retain or increase in value. This makes them attractive not only as accessories but also as financial assets. Some collectors view these watches as investments that can appreciate over the years, creating a unique intersection between fashion and finance.

Moreover, the timeless appeal of these brands transcends generations. The heritage and reputation associated with names like Rolex & Patek Philippe make them coveted by collectors across different age groups. This generational continuity further fuels demand in the market.

To Understand More About this Research:Request a Free Sample Report

Luxury second-hand market continues to attract the customers driven by a dual motivation, affordability & immediate availability, while others are drawn to the exclusivity of certain models. The desire for the status-defining items and the convenience of immediate access contribute to the ongoing appeal of the market. Interestingly, certain luxury watches, like those from Rolex, can paradoxically be more expensive in the secondhand market compared to their original retail prices. This phenomenon is attributed to the combination of high demand and limited supply, making exclusive and discontinued models particularly sought after. Customers are often willing to pay a premium for immediate access to these exclusive pieces.

Furthermore, the strong financial performance exhibited by pre-owned luxury timepieces has captured the interest of new buyers, contributing to the market's expansion. Wealthy investors are increasingly exploring unconventional investment opportunities to diversify their portfolios and hedge against inflation. Luxury watches have emerged as an attractive segment within alternative assets for these affluent investors and others. This is owing to the sustained high demand for these timepieces and their track record of yielding substantial price appreciation in the market over the years.

Industry Dynamics

Growth Drivers

Growing Online Platforms

The market landscape has undergone a profound shift with the rapid rise of e-commerce and online marketplaces. Digital platforms have not only facilitated seamless connections between buyers and sellers but have also expanded the market's global reach. The convenience of browsing, comparing, and purchasing pre-owned luxury watches has been greatly enhanced by established authentication and verification processes.

In this digital era, the impact of social media & celebrity endorsements can’t be overstated. Celebrities, watch enthusiasts, & influencers leverage these platforms to show their pre-owned luxury time pieces, generating heightened interest & desirability among followers. The power of these endorsements plays a significant role in shaping consumer preferences and driving pre-owned luxury watches market trends.

Report Segmentation

The market is primarily segmented based on type, distribution channel, and region.

|

By Type |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

Automatic segment accounted for the largest market share in 2023

Automatic segment accounted for the largest share. The driving force behind this dominance lies in the exceptional craftsmanship and meticulous attention to detail inherent in the creation of automatic luxury watches. These timepieces are frequently handcrafted by highly skilled artisans, dedicating extensive hours to perfecting every intricate element. The combination of their meticulous craftsmanship and the use of premium materials, including precious metals and gemstones, imparts a distinctive allure to automatic luxury watches. This unique blend of artistry and fine engineering appeals specifically to connoisseurs who appreciate the intricate craftsmanship and precision behind each individual piece.

Manual segment will grow rapidly. It places a significant emphasis on tradition and heritage, with many renowned brands boasting a rich history spanning centuries. The allure for buyers lies in the concept of possessing a timepiece that embodies a sense of legacy and tradition. These watches showcase iconic designs & features that have endured relatively un-changed for many years. This enduring consistency creates a sense of the continuity & timelessness, further enhancing the appeal for those seeking a connection to the historical and traditional aspects of luxury timepieces.

By Application Analysis

Offline segment held the significant market share in 2023

Offline segment held the significant market share. The ability for the customers to physically examine the time pieces, engage with experienced sales staff, & authenticate the watches in person contributes significantly to reducing the perceived risk associated with acquiring high-value, pre-owned luxury watches. The offline distribution channel's emphasis on personal interaction and tangible experiences aligns with the discerning nature of luxury watch buyers, fostering a greater sense of trust and confidence in their purchase.

Online segment is expected to gain substantial growth rate. The transformation of consumer purchasing behavior in the market is evident through the accessibility and convenience provided by online platforms. Through a few simple clicks, buyers can peruse an extensive selection of pre-owned time pieces without the necessity of visiting physical brick-and-mortar stores. This convenience appeals for a customer base that is tech-savvy and values time efficiency, establishing online channels to tap more market share.

Regional Insights

North America dominated the global market in 2023

North America dominated the global market. The surge in e-commerce and online marketplaces has significantly facilitated consumer access to and acquisition of pre-owned luxury watches. Online platforms now offer a convenient and secure avenue for both buying and selling these high-value items, thereby enhancing market accessibility. Additionally, the proliferation of online communities & forums dedicated to the luxury watches has played a pivotal role in building trust among customers. The ability to connect with the experienced collectors and sellers within these online spaces contributes to a sense of assurance and reliability in the market.

The Asia Pacific will grow with substantial pace. This growth is primarily driven by the rising affluence of the region's upper-class consumers, which has fueled an escalating demand for the luxury items, including high-end time pieces. As the disposable incomes in the region continue to rise, there is a noticeable trend of individuals seeking to invest in the luxury watches.

The market responds to this demand by providing an appealing option for consumers to access prestigious brands at a more affordable price point. This is particularly attractive to those who aspire to own luxury watches but may find the original retail prices prohibitive. The availability of pre-owned luxury watches allows individuals to fulfill their desire for high-end timepieces while still being mindful of their budget, contributing to the growth of the region.

The European market for pre-owned luxury watches capitalizes on the region's extensive history and culture of watchmaking, particularly with Switzerland being a prominent global hub for high-end watch manufacturing. This historical legacy has a collector's community and a thriving market specifically to the vintage & rare timepieces. Enthusiasts are attracted to pre-owned watches for their distinctive designs, exceptional craftsmanship, & historical significance embedded in each timepiece.

Key Market Players & Competitive Insights

Market is anticipated to experience moderate competition among companies, given the abundance of players within the industry. In response to shifting consumer trends, many companies are diversifying their product portfolios as a strategy to attain a competitive advantage in the market.

Some of the major players operating in the global market include:

- Bob's Watches

- Chrono24

- Crown & Caliber

- eBay Inc.

- Govberg

- The Watch Club

- TrueFacet, LLC

- WatchBox

- Watches of Switzerland

- Watchfinder & Co

Recent Developments

- In October 2023, CHRONEXT has declared the acquisition of the brand rights and domain of the European retailer Watchmaster. This acquisition marks another significant milestone in CHRONEXT's growth strategy, consolidating the company's position in the European market.

- In August 2023, Watches of Switzerland has introduced an online selection of pre-owned luxury timepieces. These watches have undergone thorough inspection and authentication, ensuring their genuineness, and are accompanied by a twelve-month warranty.

Pre-owned Luxury Watches Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13.30 billion |

|

Revenue forecast in 2032 |

USD 32.05 billion |

|

CAGR |

11.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Pre-owned Luxury Watches Market include Bob's Watches, Chrono24, Crown & Caliber, eBay.

The global pre-owned luxury watches market is expected to grow at a CAGR of 11.6% during the forecast period.

Pre-owned Luxury Watches Market report covering key segments are type, distribution channel, and region.

Affordability and value retention are among the factors that drive the pre-owned luxury watches market growth.

The pre-owned luxury watches market size is expected to reach $ 32.05 billion by 2032.