Power Transformer Market Share, Size, Trends, Industry Analysis Report, Power Rating (Small Power Transformer, Medium Power Transformer, Large Power Transformer), By Phase, By Cooling Type, By End User, and By Region; Segment Forecast, 2025 - 2034

- Published Date:Nov-2024

- Pages: 118

- Format: PDF

- Report ID: PM5200

- Base Year: 2024

- Historical Data: 2020-2023

Market Outlook

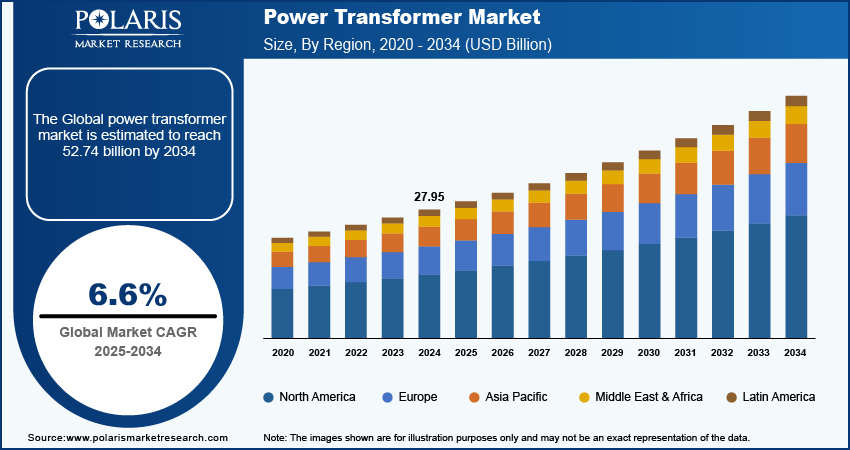

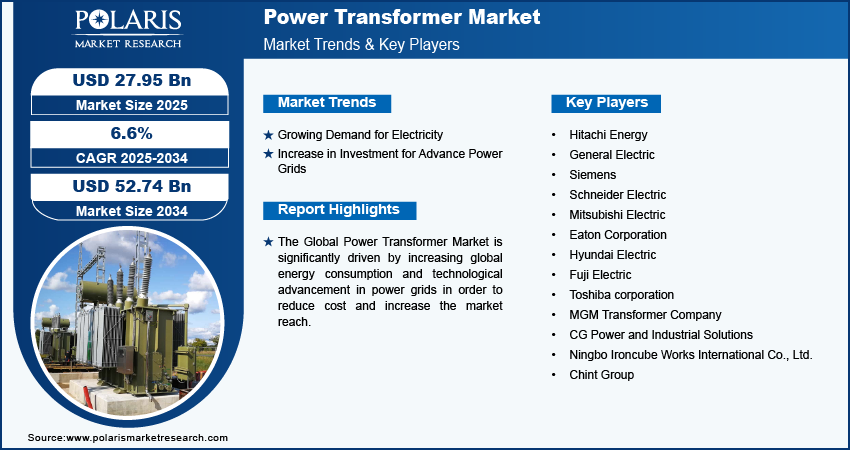

Power transformer market size was valued at USD 27.95 billion in 2024. The market is anticipated to grow from USD 29.75 billion in 2025 to USD 52.74 billion by 2034, exhibiting a CAGR of 6.6% during the forecast period.

Market Overview

Rapid urbanization and industrialization in developing economies are significantly fueling the growth of the power transformer market during the forecast period. Increased energy demands have resulted in the expansion of infrastructure projects, leading to increased demand for the installation of new power transformers. Additionally, the global shift towards renewable energy sources, such as wind and solar, necessitates advanced power transformers to manage and integrate these resources effectively. Government initiatives promoting energy efficiency and extending reliable power supply to remote areas also contribute to rising demand. Together, these factors are accelerating power transformer market expansion during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Increasing investments in transmission and distribution infrastructure, expanding power grid networks, and supportive government regulations are driving the growth of the power transformer market in study years. Additionally, increasing private sector investments in power equipment to match supply with the rising demand are contributing to the overall growth of the power transformer market. Together, these factors are accelerating the development and deployment of power transformers to meet evolving energy needs and infrastructure requirements

Growth Drivers

Growing Demand for Electricity

Rising population, urbanization, and industrialization in developing economies are significantly increasing the demand for electricity, leading to the growth of the power transformer market during the forecast period. The need for efficient and reliable power transmission systems, including advanced power transformers, is growing. For example, according to the U.S. Energy Information Administration, total U.S. electricity consumption reached approximately 4.07 trillion kWh in 2022—14 times higher than in the 1950s. This surprising increase highlights the urgent need for enhanced power infrastructure to meet escalating energy demands. Thus, increase in demand for electricity is driving the power transformer market

Increase in Investment for Advance Power Grids

To enhance grid reliability, reduce transmission losses, and support the integration of renewable energy sources, governments worldwide are investing in modernizing aging power grids into advanced, smart grids. This technological shift is expected to drive significant growth in the power transformer market. For example, in October 2023, the U.S. Department of Energy announced a substantial investment of USD 3.46 billion to upgrade the country’s aging electric grid. Such investments in grid modernization are likely to accelerate the demand for advanced power transformers, which are crucial for improving grid performance and accommodating new energy technologies.

Restraining Factors

High Initial Investment

High initial costs, especially for high-capacity transformers, pose substantial financial barriers and create obstacles for countries with limited budgets, restraining power transformer market growth during the forecast period. These cost constraints can hinder the widespread adoption and deployment of advanced power transformers, impacting market growth in regions where budget limitations are a critical concern.

Report Segmentation

The market is primarily segmented based on power rating, phase, cooling type, end user and region.

By Power Rating Analysis

Small Power Transformer (up to 60MVA) dominated power transformer market in 2024

Small Power Transformer (up to 60MVA) segment dominated the power transformer market in 2024. This is primarily due to the expansion of distributed generation system, growing renewable energy sources, with increasing demand for un-interrupted electricity supply are bolstering the segment growth. Low cost and ease of installation are creating new growth avenues for small power transformers in the utility sector.

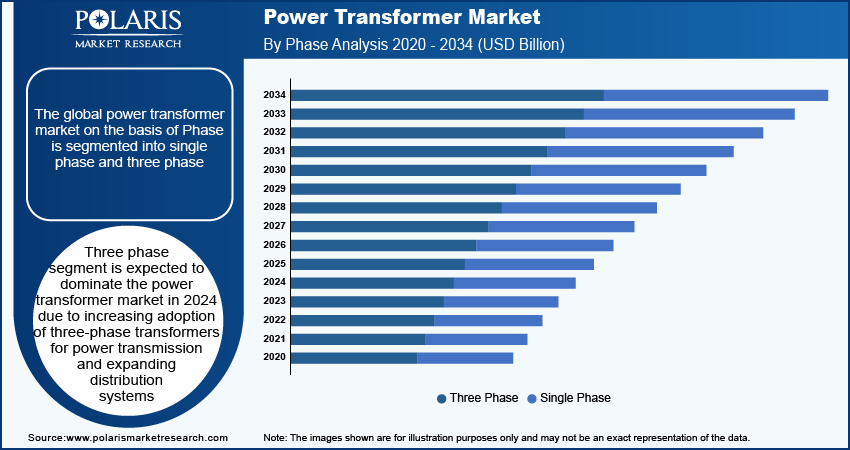

By Phase Analysis

Three Phase segment garnered with the fastest revenue share in 2024

Three phase segment accounted for the fastest revenue share in the power transformer market, due to increasing adoption of three-phase transformers for power transmission and expanding distribution systems. Their superior reliability in managing large power loads and efficient performance make them a preferred choice, further propelling the segment's growth.

By End Use Analysis

Utilities segment witnessed the significant revenue share in 2024

Utilities segment accounted for the largest revenue share in the power transformer market, owing to its crucial role in the generation, transmission, and distribution of power. Expanding industrial activities and the need for efficient power supplies in rural areas have created significant demand for the power transformers. This segment is particularly involved in the modernization of aging power grids for a reliable supply of electricity, which companies are participating in acquisition initiatives to fulfill this demand.

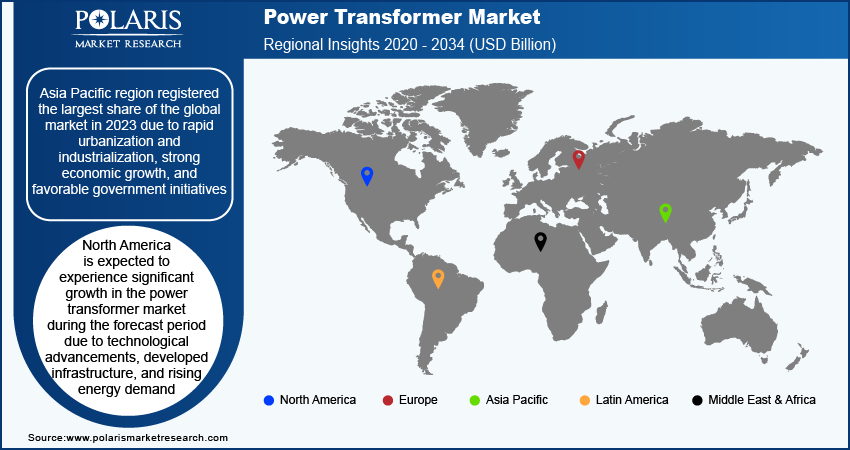

Regional Insights

Asia Pacific region registered the largest share of the global market in 2024

The Asia-Pacific region holds the largest share of the power transformer market, due to rapid urbanization and industrialization, strong economic growth, and favorable government initiatives. The region’s significant investments in infrastructure development and expansion of renewable energy sources further propel the power transformer market growth. These factors combine to enhance energy capacity and modernize power grids, placing Asia-Pacific as a leading player in the global power transformer market. The increasing demand for reliable and efficient power transmission solutions boosts the power transformer market growth in the forecast years.

North America is expected to experience significant growth in the power transformer market during the forecast period due to technological advancements, developed infrastructure, and rising energy demand. For example, according to the U.S. Energy Information Administration, U.S. energy production exceeded consumption in 2022, with production reaching 102.92 quads and consumption at 100.41 quads. This rising energy demand underscores the region’s commitment to enhancing its energy infrastructure and meeting growing demands, further supporting the expansion of the power transformer market in the region.

Power Transformer Market Competitive Analysis:

The market is highly competitive, with major players like Siemens, General Electric, and Schneider Electric leading innovation and offering advanced products. These companies focus on improving transformer efficiency, durability, and capacity to meet evolving energy demands. The market also sees a rise in smart transformers and environmentally friendly solutions, such as oil-free and recyclable transformers, driven by sustainability goals. Competition is intense, with companies striving for technological advancements, geographic expansion, and strategic mergers and acquisitions to maintain market leadership and meet diverse customer needs.

Some of the major players operating in the global power transformer market include:

- Hitachi Energy

- General Electric

- Siemens

- Schneider Electric

- Mitsubishi Electric

- Eaton Corporation

- Hyundai Electric

- Fuji Electric

- Toshiba corporation

- MGM Transformer Company

- CG Power and Industrial Solutions

- Ningbo Ironcube Works International Co., Ltd.

- Chint Group

Recent Developments in the Industry

- In May 2024, Hitachi Energy has announced a USD100 Billion investment to upgrade and modernize its power transformer factory in Varennes and other Montreal facilities, funded by the Government of Quebec. This investment aims to meet increasing North American demand for sustainable energy and supports global plans for electrification. The expansion includes a new 130,000 sq ft transformer testing facility, set to be completed by 2027, creating around 70 jobs. The initiative aligns with Quebec’s strategy to achieve carbon neutrality by 2050.

- In August 2023, CES Transformers' USD 4 million investment in expanding its Markham facility, supported by USD 610,000 from AMIC, and created 80 jobs and strengthen Ontario's manufacturing sector, reaching its highest employment since 2008.

Power Transformer Market Segmentation

By Power Rating Outlook (USD Billion, 2020 - 2034)

- Small Power Transformer (up to 60MVA)

- Medium Power Transformer (61-600MVA)

- Large Power Transformer (Above 600MVA)

By Phase Outlook (USD Billion, 2020 - 2034)

- Single

- Three

By Cooling Type Outlook (USD Billion, 2020 - 2034)

- Oil-cooled

- Air-Cooled

By End User Outlook (USD Billion, 2020 - 2034)

- Utilities

- Residential & Commercial

- Industrial

By Regional Outlook (USD Billion, 2019 – 2032)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Coverage

The power transformer market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, power rating, phase, cooling type, end user and their futuristic growth opportunities.

Power Transformer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 27.95 billion |

|

Revenue forecast in 2034 |

USD 52.74 billion |

|

CAGR |

6.6% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Power Transformer Market size was valued at USD 27.95 billion in 2024 and is projected to grow to USD 52.74 billion by 2034.

The global market is projected to grow at a CAGR of 6.6% during the forecast period, 2024-2032.

Asia Pacific had the largest share in the global market

The key players in the market are Hitachi Energy; General Electric; Siemens; Schneider Electric; Mitsubishi Electric; Eaton Corporation; Hyundai Electric; Fuji Electric; Toshiba Corporation; MGM Transformer Company; CG Power and Industrial Solutions; Ningbo Ironcube Works International Co., Ltd.; Chint Group.

The three-phase segment is anticipated to experience substantial growth with a significant CAGR in the global market. This growth is due to increasing adoption of three-phase transformers.

The Utilities segment accounted for the largest revenue share of the market in 2024 due to its major role in power transmission.