Power Plant Boiler Market Size, Share, Trends, Industry Analysis Report

: By Process (Fluidized Bed Combustion, Pulverized Fuel Combustion, and Others), Technology, Fuel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM3165

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

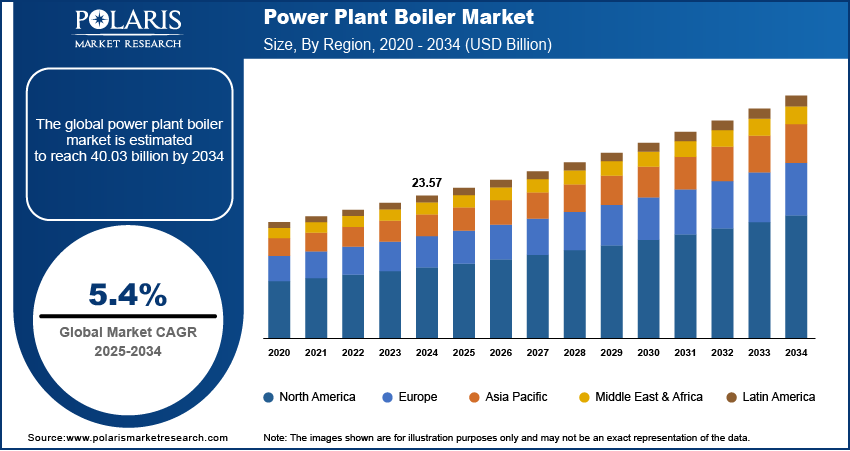

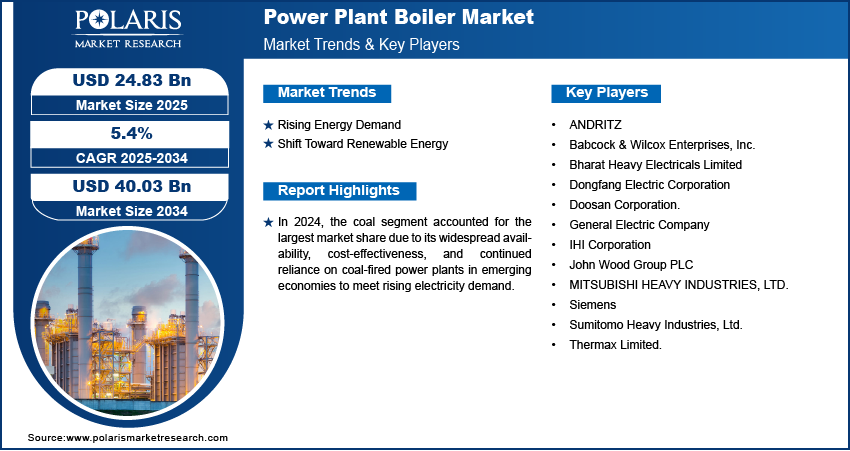

Power plant boiler market size was valued at USD 23.57 billion in 2024, growing at a CAGR of 5.4% during the forecast period. Rising global energy demand, stricter environmental regulations, and the shift to cleaner technologies are collectively driving growth in the market.

Key Insights

- The pulverized fuel combustion segment leads due to high thermal efficiency, emission reduction capabilities, and compatibility with large-scale power plants.

- Coal remains the dominant fuel segment, supported by low cost, availability, and cleaner coal technologies such as ultra-supercritical systems.

- Asia Pacific holds the largest market share, driven by rapid industrialization, coal reliance, and large-scale investment in energy infrastructure and renewables.

- North America is growing steadily due to clean energy investments, infrastructure modernization, and regulatory support for low-emission boiler technologies.

Industry Dynamics

- Rising global electricity demand and industrial growth are increasing the need for modern, efficient power plant boilers across developing regions.

- Stricter environmental regulations drive adoption of high-efficiency, low-emission boiler technologies to reduce carbon footprints and meet compliance standards.

- Investments in hybrid, biomass, and waste-to-energy plants are creating demand for advanced boilers suited to diverse renewable power systems.

- High installation and maintenance costs of advanced boiler systems can deter adoption, especially in cost-sensitive and smaller-scale power projects.

Market Statistics

2024 Market Size: USD 23.57 billion

2034 Projected Market Size: USD 40.03 billion

CAGR (2025–2034): 5.4%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The power plant boiler market is an industry focused on the manufacturing, deployment, and maintenance of boilers used in power generation facilities. These boilers convert water into steam, driving turbines to generate electricity. The market is driven by rising energy demand, advancements in boiler efficiency, and the transition toward cleaner and more sustainable power generation technologies.

Governments worldwide are enforcing stricter environmental standards, accelerating the adoption of advanced and cleaner boiler technologies which is further contributing to the market growth. Additionally, rapid industrial development and urban expansion increase electricity demand, which supports the market growth.

The demand for high-efficiency and low-emission boilers is increasing as outdated power plants undergo upgrades and replacements. Many power plants are shifting to modern boiler systems to improve performance, reduce emissions, and meet strict environmental regulations. Advanced boiler technologies, such as ultra-supercritical and supercritical boilers, are gaining popularity due to their ability to generate more power with less fuel while reducing carbon emissions. Additionally, automation in boiler operations enhances efficiency, safety, and cost-effectiveness, making modern boilers a preferred choice for power plants. These innovations not only improve energy production but also support sustainability goals, driving significant growth in the power plant boiler market as industries and governments invest in cleaner and more efficient energy solutions.

Market Dynamics

Growing Energy Demand

The world needs more electricity as cities grow, industries expand, and new technologies develop. This increasing demand is pushing the need for more power plants and better ways to generate electricity. As economies grow and industries use more energy, the market for power plant boilers is also expanding. The use of electric vehicles, smart grids, and digital technology is making electricity even more essential, leading to new opportunities in the power plant boiler market. To ensure a steady electricity supply, both governments and private companies are upgrading old power plants and building new ones with modern, high-capacity boilers.

Shift to Renewable Energy

More money is being invested in biomass, waste-to-energy, and hybrid power plants, driving demand for power plant boilers. In the U.S., 469 hybrid power plants operated at the end of 2023, a 21% increase from 2022. These plants produced nearly 49 GW of electricity, with energy storage growing by over 59%. As the world moves towards cleaner energy, both governments and private investors are putting money into alternative energy sources. Biomass and waste-to-energy plants need advanced boilers to turn organic and industrial waste into electricity. Hybrid plants, which combine solar, wind, and traditional fuels, also rely on efficient boilers to work smoothly. This shift to clean energy is creating new opportunities for the power plant boiler market.

Segment Insights

Assessment by Process Outlook

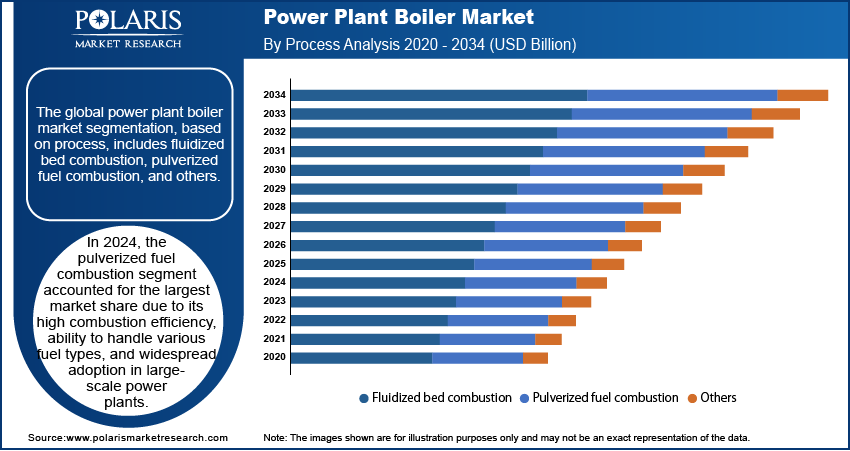

The global power plant boiler market segmentation, based on process, includes fluidized bed combustion, pulverized fuel combustion, and others. In 2024, the pulverized fuel combustion segment accounted for the largest market share due to its high combustion efficiency, ability to handle various fuel types, and widespread adoption in large-scale power plants. The technology's capability to generate higher thermal efficiency, reduce emissions, and support flexible load operations further strengthens its dominance. Additionally, the increasing demand for advanced and efficient power generation systems accelerates the adoption of pulverized fuel combustion technology, supporting its position in the market.

Evaluation by Fuel Outlook

The power plant boiler market is segmented by fuel into petroleum, nuclear, natural gas, coal, and renewables. In 2024, the coal segment accounted for the largest market share. This growth is due to its widespread availability, cost-effectiveness, and continued reliance on coal-fired power plants in emerging economies to meet rising electricity demand. Additionally, advancements in clean coal technologies, such as ultra-supercritical and carbon capture systems, have improved efficiency and reduced emissions, further supporting power plant boiler market expansion.

Regional Analysis

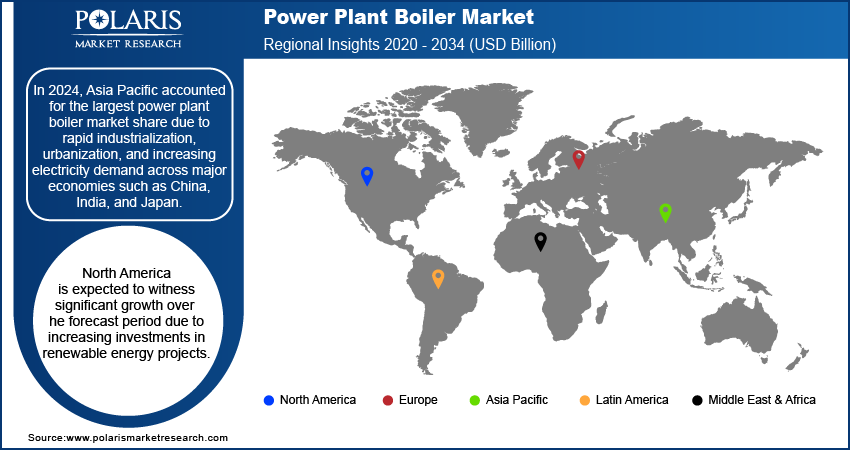

By region, the study provides power plant boiler market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for the largest market share due to rapid industrialization, urbanization, and increasing electricity demand across major economies such as China, India, and Japan. The region's significant reliance on coal-fired power plants, along with substantial investments in energy infrastructure, has driven the adoption of advanced boiler technologies to enhance efficiency and reduce emissions. For instance, in December 2024, the Australian Government has assigned USD 50 million to the Green Investments Partnership under Singapore’s Financing Asia’s Transition Partnership initiative, aimed at promoting clean energy transitions and sustainable infrastructure in Southeast Asia. Government initiatives promoting clean energy, coupled with the expansion of renewable and hybrid power plants, further contribute to market growth. Additionally, the presence of key manufacturers and ongoing technological advancements support the region’s market expansion.

The power plant boiler market in North America is expected to witness significant growth over the forecast period. This is due to increasing investments in renewable energy projects, the modernization of aging power infrastructure, and stringent environmental regulations promoting the adoption of advanced, high-efficiency boiler technologies. For instance, in October 2024, the US Department of Energy announced a USD 149.87 million investment in 67 projects focused on energy efficiency and clean energy at Federal facilities. This funding is across 28 US states and territories, as well as six international locations, supporting efforts to reduce carbon footprints and promote sustainability. The shift toward cleaner fuels, including natural gas and biomass, along with government initiatives supporting carbon reduction, is driving the market expansion. Additionally, the region's rising electricity demand and the replacement of outdated coal-fired plants with advanced boiler systems contribute to market growth. The presence of major industry players and continuous technological advancements further support market development in North America.

Power Plant Boiler Key Market Players & Competitive Analysis Report

The competitive landscape of the power plant boiler market is characterized by the presence of key global and regional players focusing on technological advancements, strategic partnerships, and capacity expansions to strengthen their market position. Leading companies are investing in high-efficiency and low-emission boiler technologies to align with stringent environmental regulations and evolving industry standards. Mergers and acquisitions are prominent strategies enabling firms to expand their product portfolios and market reach. Additionally, research and development efforts are accelerating innovations in supercritical and ultra-supercritical boiler systems, enhancing operational efficiency and sustainability. Competition remains intense, driven by growing power demand and the transition toward cleaner energy sources.

Siemens AG is engaged in the engineering and manufacturing of technology solutions, specializing in electrification, automation, and digitalization across various industries. The company was founded in 1847 and is headquartered in Munich, Germany. Siemens' product portfolio includes systems for power generation and transmission, industrial automation equipment, medical devices, and smart infrastructure solutions. The services provided by Siemens encompass engineering solutions, consulting, and customized systems integration tailored to specific customer needs. The company's diverse operations allow it to serve a broad range of sectors, including energy, healthcare, transportation, and manufacturing. Moreover, in the power plant boiler sector, Siemens provides advanced boiler technologies that enhance efficiency and reduce emissions. Their solutions are designed to meet the evolving demands of modern power generation while ensuring compliance with stringent environmental regulations.

Bharat Heavy Electricals Limited (BHEL) is engaged in the manufacturing of electrical equipment and services for power generation and transmission, specializing in heavy electrical machinery. The company was founded in 1964 and is headquartered in New Delhi, India. BHEL's product portfolio includes boilers, turbines, generators, and transformers tailored for thermal and hydroelectric power plants. The services provided by BHEL encompass project engineering, procurement, construction management, and after-sales support for various power projects. The company operates numerous manufacturing facilities across India and has a significant footprint in over 80 countries. Furthermore, BHEL designs and manufactures high-efficiency boilers that provide diverse energy needs.

Key Companies

- ANDRITZ

- Babcock & Wilcox Enterprises, Inc.

- Bharat Heavy Electricals Limited

- Dongfang Electric Corporation

- Doosan Corporation.

- General Electric Company

- IHI Corporation

- John Wood Group PLC

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Siemens

- Sumitomo Heavy Industries, Ltd.

- Thermax Limited.

Power Plant Boiler Industry Developments

November 2024: Mitsubishi Heavy Industries and Hokuetsu Corporation started a CO2 capture demonstration project at the Niigata Mill. Utilizing MHI's "CO2MPACT™ Mobile" technology, the project captures CO2 emissions from a chemical recovery boiler essential for the mill's steam and electricity in paper manufacturing. The project aims to assess the system's effectiveness in operation.

August 2024: Babcock & Wilcox announced that its subsidiary, Babcock & Wilcox Construction Co., LLC, secured a USD 25 million agreement for boiler upgrades and pressure component replacements at a U.S. thermal power plant.

June 2024: ANDRITZ supplied a fluidized bed boiler system for a sewage sludge mono-incineration facility in Bielefeld, Germany, enhancing waste treatment efficiency and energy recovery.

Power Plant Boiler Market Segmentation

By Process Outlook (Revenue USD Billion 2020 - 2034)

- Fluidized bed combustion

- Pulverized fuel combustion

- Others

By Technology Outlook (Revenue USD Billion 2020 - 2034)

- Subcritical

- Supercritical

- Ultra-critical

By Fuel Outlook (Revenue USD Billion 2020 - 2034)

- Petroleum

- Nuclear

- Natural gas

- Coal

- Renewables

By Regional Outlook (Revenue USD Billion 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 23.57 billion |

|

Market Size Value in 2025 |

USD 24.83 billion |

|

Revenue Forecast in 2034 |

USD 40.03 billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global power plant boiler market size was valued at USD 23.57 billion in 2024 and is projected to grow to USD 40.03 billion by 2034.

The global market is projected to register a CAGR of 5.4% during the forecast period.

In 2024, Asia Pacific accounted for the largest market share due to rapid industrialization, urbanization, and increasing electricity demand across major economies such as China, India, and Japan.

Some of the key players in the market are ANDRITZ; Babcock & Wilcox Enterprises, Inc.; Bharat Heavy Electricals Limited; Dongfang Electric Corporation; Doosan Corporation; General Electric Company; IHI Corporation; John Wood Group PLC; MITSUBISHI HEAVY INDUSTRIES, LTD.; Siemens; Sumitomo Heavy Industries, Ltd.; and Thermax Limited.

In 2024, the pulverized fuel combustion segment accounted for the largest market share due to its high combustion efficiency, ability to handle various fuel types, and widespread adoption in large-scale power plants

In 2024, the coal segment accounted for the largest market share due to its widespread availability, cost-effectiveness, and continued reliance on coal-fired power plants in emerging economies to meet rising electricity demand.