Power Factor Correction Market Size, Share, Trends, Industry Analysis Report: By Reactive Power (0–200 KAVR, 200–500 KAVR, 500–1500 KAVR, and Above 1500 KAVR), Type, Sales Channel, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2024–2032

- Published Date:Oct-2024

- Pages: 118

- Format: PDF

- Report ID: PM5135

- Base Year: 2023

- Historical Data: 2019-2022

Power Factor Correction Market Overview

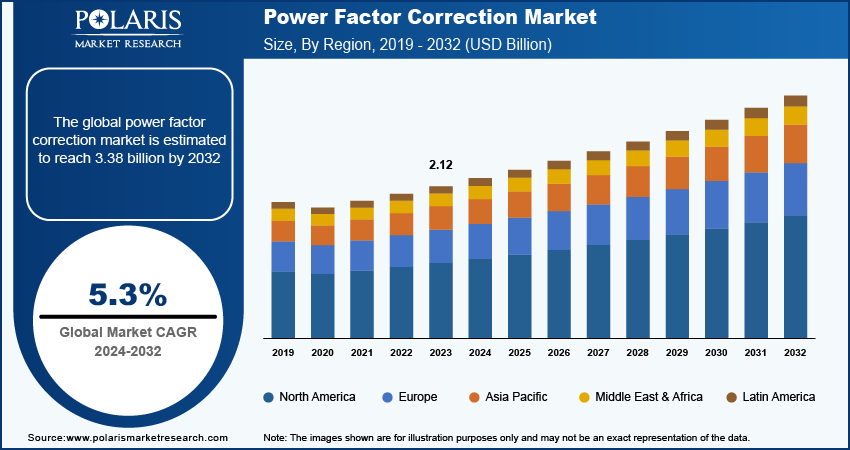

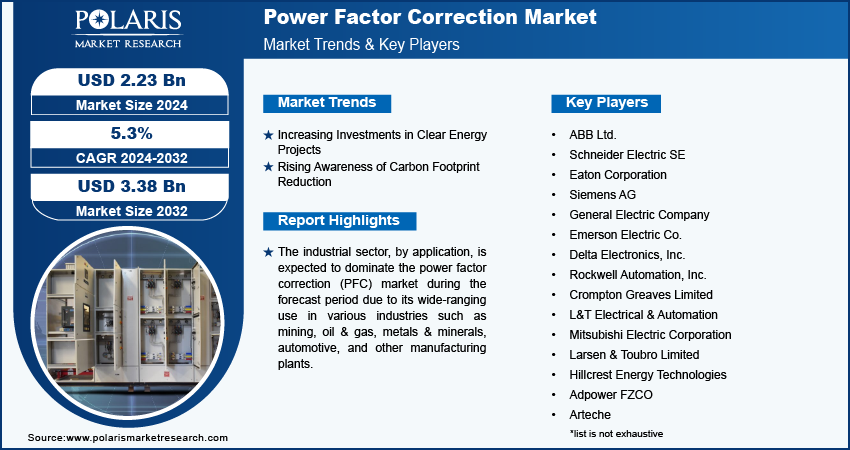

The power factor correction market size was valued at USD 2.12 billion in 2023. The market is projected to grow from USD 2.23 billion in 2024 to USD 3.38 billion by 2032, exhibiting a CAGR of 5.3% during 2024–2032.

Power factor correction (PFC) is a process in electrical engineering that improves power usage efficiency in various settings. It involves adjusting the power factor closer to 1 by adding capacitors or inductors to counteract inefficiencies caused by inductive loads. PFC reduces energy losses, lowers costs, and promotes sustainable power consumption, especially in energy-intensive industries such as manufacturing and utilities.

The demand for power factor correction (PFC) is increasing globally due to rising energy consumption driven by rapid industrialization and urbanization. As pressure on power grids rises, PFC becomes crucial for industries looking to optimize energy usage, minimize power losses, and lower electricity costs. Additionally, as energy efficiency regulations become stringent and global emphasis on sustainability intensifies, companies are compelled to invest in PFC technologies to improve energy management practices and meet environmental standards. In September 2023, The California Public Utilities Commission (CPUC) incentivized utilities to invest in power factor correction solutions as part of their clean energy strategies. Utilities such as Pacific Gas and Electric (PG&E) have incorporated PFC systems to optimize their infrastructure, reduce energy losses, and comply with state regulations regarding energy efficiency and carbon emissions reduction.

To Understand More About this Research: Request a Free Sample Report

Continuous advancements in PFC technologies drive significant improvements in energy efficiency and system reliability across various sectors. Modern PFC solutions have evolved beyond traditional capacitor banks to include advanced power electronics, such as active and passive filters, which dynamically adjust the power factor in real time. These innovations are particularly important in today’s increasingly complex electrical grids, where the integration of renewable energy sources and variable loads can cause fluctuations that impact power quality.

Power Factor Correction Market Trends

Increasing Investments in Clean Energy Projects

The increasing investments in clean energy projects are promoting advanced technologies that enhance energy efficiency and grid stability. As the global push for renewable energy gains momentum, integrating these energy sources into existing electrical grids often causes fluctuations in power quality and stability, necessitating effective power management solutions such as PFC technologies. Clean energy projects frequently incorporate smart grid technologies and advanced power electronics, complementing PFC systems by enabling real-time monitoring and dynamic adjustments to power factors. This would stimulate the demand for PFC solutions to enhance grid performance and create opportunities for innovative PFC technologies that can adapt to the unique challenges presented by a diverse energy landscape in the coming years.

Rising Awareness of Carbon Footprint Reduction

The increasing focus on reducing carbon footprint is significantly influencing business operations, making power factor correction (PFC) solutions essential for achieving sustainability goals. By implementing PFC systems, industrial facilities can significantly lower energy consumption, thereby minimizing their carbon footprint and supporting a more reliable electrical grid. These solutions help organizations meet regulatory compliance and sustainability targets while reducing reliance on fossil fuels, aligning with global initiatives such as the Paris Agreement. Investing in PFC technologies improves operational efficiency and cost-effectiveness, as well as demonstrates a commitment to environmental responsibility, enhancing reputation and competitiveness in an eco-conscious market. Thus, the growing emphasis on carbon footprint reduction is expected to drive the adoption and innovation of power factor correction solutions during the forecast period.

Power Factor Correction Market Segment Insights

Power Factor Correction Market Breakdown, by Reactive Power Outlook

The 0–200 KVAR segment is anticipated to dominate the power factor correction (PFC) market during the forecast period owing to its versatility across various low to medium-level industrial, commercial, and residential applications. Facilities with moderate power requirements are particularly well-suited for implementing these systems, allowing businesses to enhance energy efficiency without the need for significant alterations to their existing infrastructure. Furthermore, the demand for PFC solutions within this range is expected to grow due to several factors, including the drive for reduced energy costs and compliance with increasing regulations aimed at promoting energy-efficient practices within these sectors.

Power Factor Correction Market Breakdown, by Type Outlook

The power factor correction market segmentation, based on type, includes automatic and fixed. In 2023, the automatic segment dominated the market due to its real-time, efficient, and precise management of power quality. This system adjusts to varying load conditions without the need for operator intervention, making it ideal for industries and commercial facilities with fluctuating power demands. By optimizing energy consumption, this technology lowers operational expenses and mitigates the risk of penalties due to inadequate power factors. Thus, demand for automatic PFC systems is rising, driven by the growing focus of business operators on enhancing the reliability and efficiency of energy utilization.

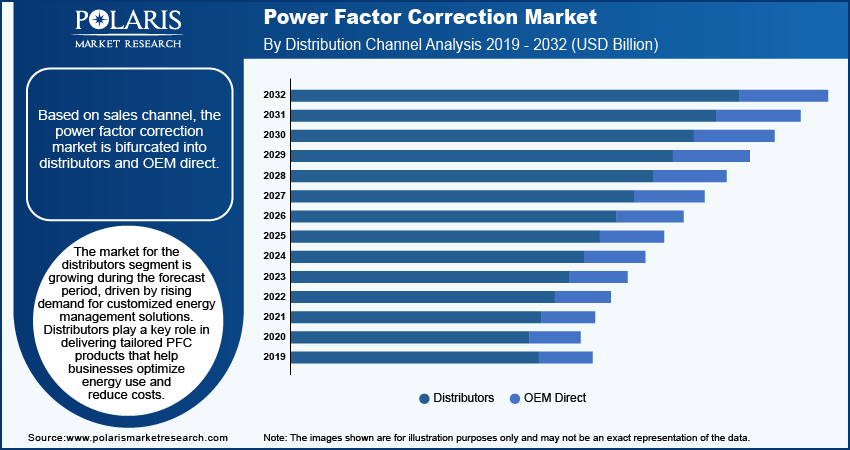

Power Factor Correction Market Breakdown, by Sales Channel

The distributors segment held the largest market share in 2023 due to the increasing demand for customized solutions across various industries. Businesses are seeking effective energy management and cost-saving strategies, and distributors play a crucial role in providing PFC products tailored to meet customer requirements. Their ability to offer localized support, technical expertise, and other products is driving their success. Additionally, the rise in industrial and commercial activities is boosting the demand for efficient distribution channels, further contributing to the growth of the PFC market for the distributors segment.

Power Factor Correction Market Breakdown, by Application Outlook

The industrial sector, by application, is expected to dominate the power factor correction (PFC) market during the forecast period due to its wide-ranging use in various industries such as mining, oil & gas, metals & minerals, automotive, and other manufacturing plants. These industries often face significant power fluctuations and high energy consumption, making power factor correction crucial for improving energy efficiency and reducing operational costs. Additionally, strict regulations and increasing energy expenses motivate these industries to embrace PFC solutions to improve power quality and avoid penalties associated with poor power factors. As industrial operations increasingly prioritize energy efficiency and sustainability, the demand for PFC systems in this sector is anticipated to remain robust, making its leading position in the market.

PFC Market Regional Insights

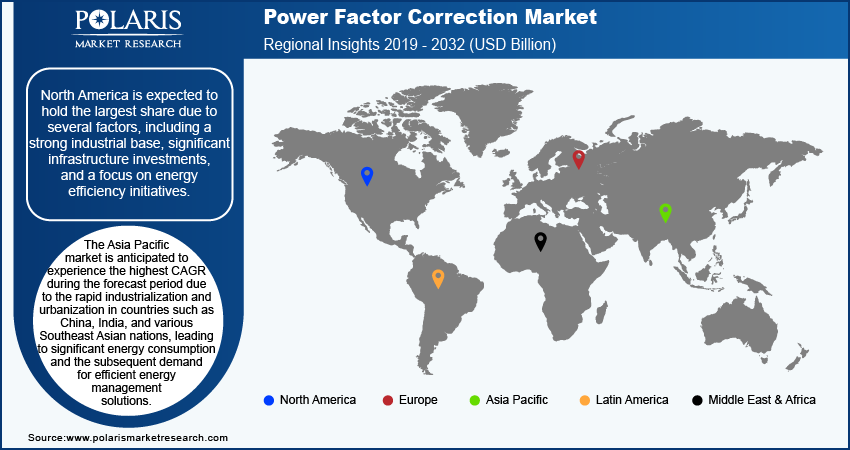

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share due to several factors such as a strong industrial base, significant investments in infrastructure, and the growing focus on energy efficiency initiatives. Industries in the region such as manufacturing, oil & gas, and mining are subject to strict regulatory standards, which require effective power factor correction solutions.

North America has witnessed an increase in renewable energy projects, further driving the demand for advanced PFC systems. With ongoing technological advancements and a growing emphasis on sustainable energy practices, North America is well-positioned to maintain its dominance in the PFC market. The California Energy Commission implemented strict energy efficiency regulations for the commercial and industrial sectors. These regulations encourage the use of PFC (power factor correction) technologies to enhance power quality and meet the standards. This regulatory framework, combined with substantial investments in traditional and renewable energy sectors, highlights the increasing need for power factor correction solutions in North America. This further solidifies the region's position as a leader in the market.

The Asia Pacific power factor correction (PFC) market is anticipated to experience the highest CAGR during the forecast period. This growth is driven by rapid industrialization and urbanization in countries such as China, India, and various Southeast Asian nations. As these countries undergo significant industrial development, they are experiencing substantial energy consumption, leading to an increased demand for efficient energy management solutions. Moreover, government initiatives and regulations aimed at improving energy efficiency and reducing carbon emissions are promoting the adoption of PFC systems across the region. Additionally, the expansion of infrastructure and increased investments in grid modernization are expected to create opportunities for the development of PFC technologies in the coming years. As a result, Asia Pacific is poised to take the lead in market expansion during the forecast period.

Power Factor Correction Market – Key Players and Competitive Insights

The competitive landscape of the power factor correction market is characterized by a diverse array of global and regional players striving to capture market share through innovation, strategic partnerships, and geographic expansion. Major players in the industry, such as Hitachi Energy Ltd, ABB, and GE Vernova, leverage their extensive R&D capabilities and broad distribution networks to offer a wide range of advanced power factor correction products. These companies focus on product innovation, including improvements in safety, functionality, and cost-efficiency, to meet the evolving needs of technology providers. Additionally, smaller and regional companies are increasingly entering the market, offering specialized and niche products that cater to specific technology needs or local market demands. Competitive strategies often include mergers and acquisitions, partnerships with institutions, and investments in emerging markets to expand reach and enhance market presence. A few major market players are ABB Ltd.; Schneider Electric SE; Eaton Corporation; Siemens AG; General Electric Company; Emerson Electric Co.; Delta Electronics, Inc.; Rockwell Automation, Inc.; Crompton Greaves Limited; L&T Electrical & Automation; Mitsubishi Electric Corporation; Larsen & Toubro Limited; RTR Energia SRL; Adpower FZCO; Arteche; Avantha Group; Bharat Heavy Electricals Limited; Dynamic Control Systems; EPCOS AG; and Ergon Energy Corporation Limited.

Eggtronic specializes in highly integrated mixed-signal controllers designed for high-performance wired and wireless power converters based in Italy. The company introduced a new high-performance AC/DC converter technology that offers industry-leading efficiency, reduced component count, and improved EMI performance for high-power applications that require power factor correction (PFC). This technology, called ClassEgg, was showcased for the first time at CES 2023. ClassEgg enhances the traditional boost PFC by utilizing a proprietary magnetic component to ensure ZVS, lower EMI, and reduced component count. It provides better performance than interleaved solutions at the cost of a standard boost PF.

Hillcrest Energy Technologies, a clean technology company based in Vancouver, BC, Canada, is at the forefront of developing innovative power conversion technologies and digital control systems for diverse applications. The company has recently launched a testing and demonstration program for its latest Zero Voltage Switching (ZVS) technology, specifically highlighting its effectiveness in power factor correction (PFC).

Key Companies in Power Factor Correction Market

- ABB Ltd.

- Schneider Electric SE

- Eaton Corporation

- Siemens AG

- General Electric Company

- Emerson Electric Co.

- Delta Electronics, Inc.

- Rockwell Automation, Inc.

- Crompton Greaves Limited

- L&T Electrical & Automation

- Mitsubishi Electric Corporation

- Larsen & Toubro Limited

- Hillcrest Energy Technologies

- Adpower FZCO

- Arteche

- Avantha Group

- Bharat Heavy Electricals Limited Dynamic Control Systems

- EPCOS AG

- Eggtronic

Power Factor Correction Industry Developments

In March 2023, Toshiba Electronic Europe GmbH introduced a new 650V-rated discrete IGBT designed for use in Power Factor Correction (PFC) circuits for AC/home appliances, power supplies for industrial equipment, and various other applications.

In August 2023, Eaton announced significant investments in its North American manufacturing and operations to support the rapidly growing demand for its electrical solutions. The company is expanding manufacturing and boosting resilience to increase the supply of its solutions for customers in utility, commercial, healthcare, industrial, and residential markets across North America. This initiative also influences the power factor correction market.

In July 2024, GE Vernova’s Grid Solutions, in partnership with TECO Electric and Machinery Co., started the ZhangGong Step-up Substation and YongXing Switchyard projects in Taiwan, featuring GE’s ±200 Mvar STATCOM systems. These STATCOMs, set to enhance grid stability and facilitate renewable energy integration, are connected via a 161 kV transmission line. This development reflects the growing demand for advanced grid solutions in the power factor correction market that improve power quality and support the transition to renewable energy sources.

Power Factor Correction Market Segmentation

By Reactive Power Outlook

- 0–200 KAVR

- 200–500 KAVR

- 500–1500 KAVR

- Above 1500 KAVR

By Type Outlook

- Automatic

- Fixed

By Sales Channel Outlook

- Distributors

- OEM Direct

By Application Outlook

- Industrial

- Mining

- Oil & Gas

- Metals & Minerals

- Automotive

- Other Manufacturing Plants

- Renewables

- Solar

- Wind

- BESS

- Others

- Commercial

- Datacenters

- EV Charging

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Power Factor Correction Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 2.12 billion |

|

Market Size Value in 2024 |

USD 2.23 billion |

|

Revenue Forecast by 2032 |

USD 3.38 billion |

|

CAGR |

5.3% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019–2022 |

|

Forecast Period |

2024–2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global power factor correction market size was valued at USD 2.12 billion in 2023 and is projected to grow to USD 3.38 billion by 2032.

The global market is projected to register a CAGR of 5.3% during the forecast period.

North America is expected to hold the largest share due to several factors, including a strong industrial base, significant infrastructure investments, and a focus on energy efficiency initiatives.

A few key players in the PFC market are ABB Ltd.; Schneider Electric SE; Eaton Corporation; Siemens AG; General Electric Company; Emerson Electric Co.; Delta Electronics, Inc.; Rockwell Automation, Inc.; Crompton Greaves Limited; L&T Electrical & Automation; Mitsubishi Electric Corporation; Larsen & Toubro Limited; RTR Energia SRL; Adpower FZCO; Arteche; Avantha Group; Bharat Heavy Electricals Limited; Dynamic Control Systems; EPCOS AG; and Ergon Energy Corporation Limited.

The industrial sector segment led the market in 2023 due to its wide range of use in various industries such as mining, oil & gas, metals & minerals, automotive, and other manufacturing plants.