Potato Protein Market Size, Share, Trends, Industry Analysis Report: By Type (Potato Protein Concentrate and Potato Protein Isolate), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 125

- Format: PDF

- Report ID: PM3083

- Base Year: 2024

- Historical Data: 2020-2023

Potato Protein Market Overview

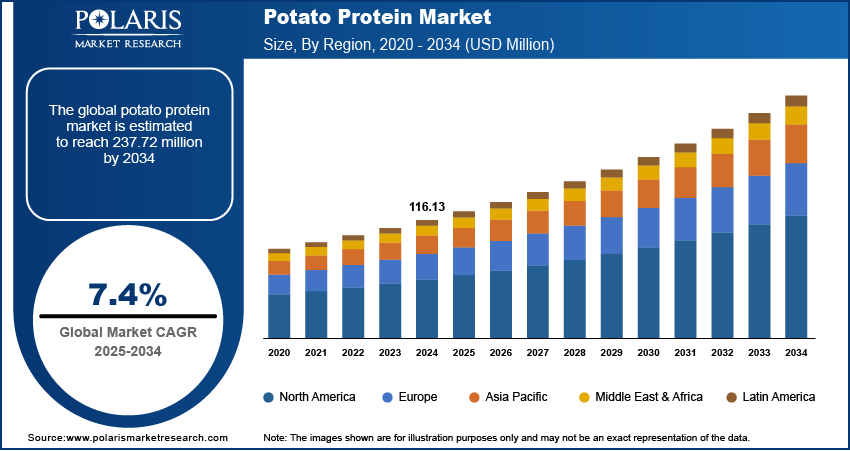

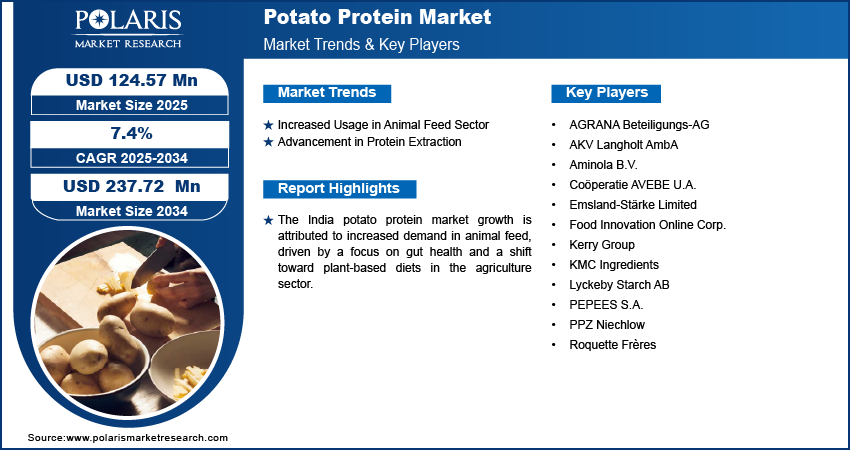

The global potato protein market size was valued at USD 116.13 million in 2024. The market is projected to grow from USD 124.57 million in 2025 to USD 237.72 million by 2034, exhibiting a CAGR of 7.4% during the forecast period.

Potato protein is a high-quality, plant-based protein derived from potatoes. It is used in vegan and vegetarian diets. Potato protein contains all nine essential amino acids, making it a complete protein source for muscle repair and overall health.

The growing preference for plant-based diets among consumers is driving the potato protein market development. People are seeking healthier and more sustainable protein sources, due to which the preference for potato protein is growing as it contains hypoallergenic properties. Potato proteins are a popular choice for vegetarians, vegans, and those having dairy or soy allergies. The shift toward clean-label ingredients and plant-based products in the food & beverage industries is driving the growth of the market.

To Understand More About this Research: Request a Free Sample Report

The growth of the functional food & beverage industry is driving the potato protein market growth. According to the US Department of Energy, in 2022, the US alone contained over 50,000 establishments in the functional food & beverage industry, which showcases the growth of the industry. This growth is fueled by the rising number of health-conscious consumers seeking nutrition-packed products. Potato protein’s versatility and high protein content make it a valuable ingredient in fortified beverages, protein bars, and dietary supplements. Additionally, potato proteins' ability to improve texture and protein enrichment while being allergen-free improves its appeal, driving its adoption in diverse product formulations across the industry, thereby fueling the market growth.

Potato Protein Market Dynamics

Increased Usage in Animal Feed Sector

Potato protein is gaining traction in the animal feed sector due to its high digestibility and nutritional value. Livestock producers are increasingly using potato protein as an alternative to traditional feed ingredients such as soybean and fishmeal. Additionally, the growing number of product launches specifically catering to animal nutrition is driving potato protein adoption in the animal feed sector. For instance, Agrana launched potato protein for feedstuffs, which are suitable for all forms of livestock. Therefore, the growing usage of potato protein in the animal feed sector fuels the potato protein market demand.

Advancement in Protein Extraction

Advances in protein extraction and processing technologies have improved the quality, yield, and cost-effectiveness of potato protein. Innovations such as enzymatic hydrolysis and membrane filtration ensure that potato protein retains its nutritional properties while meeting food safety standards. These advancements improve potato protein usability in various applications and make it more accessible to manufacturers. Hence, the rising advancements in protein extraction boosts the potato protein market growth.

Potato Protein Market Segment Analysis

Potato Protein Market Assessment by Type Outlook

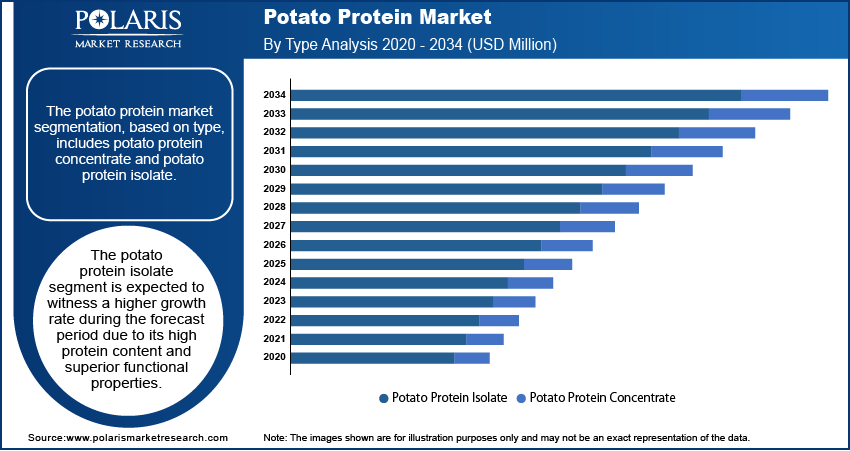

The potato protein market segmentation, based on type, includes potato protein concentrate and potato protein isolate. The potato protein isolate segment is expected to witness a higher growth rate during the forecast period due to its high protein content and superior functional properties. Isolates are widely preferred in the food & beverage industry for their solubility, emulsification, and foaming capabilities. They are also hypoallergenic and suitable for a variety of dietary needs, including vegan and gluten-free diets. Increasing demand for clean-label and plant-based products has led increase in the consumption of potato protein isolates in protein supplements, sports nutrition, and meat alternatives, thereby driving segmental growth.

Potato Protein Market Evaluation by Application Outlook

The potato protein market segmentation, based on application, includes animal feed, meat products, food and beverages, supplement, and others. The food and beverage segment dominated the potato protein market share in 2024 driven by its extensive use in various applications such as bakery, snacks, dairy alternatives, and protein-enriched foods. Potato protein’s neutral taste, excellent amino acid profile, and functional benefits, such as enhancing texture and stability, make it a preferred ingredient in various recipes in the food & beverage industry. The rising demand for plant-based and allergen-free foods, coupled with innovations in functional product formulations, is further driving the demand for potato protein in the food & beverage industry.

Potato Protein Market Regional Analysis

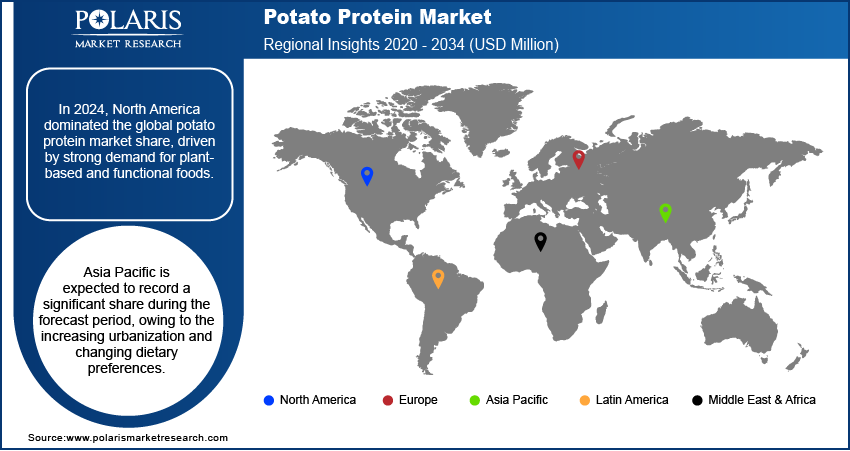

By region, the study provides the potato protein market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the potato protein market revenue share, driven by strong demand for plant-based and functional foods. According to the Good Food Institute, in 2023, the US recorded plant-based food sales worth USD 8.1 billion, which showcases the growing demand for plant-based foods in the region. Additionally, the region features a well-established food processing industry and hosts a high number of health-conscious consumers. The rise in veganism and manufacturers' initiatives to develop innovative products drive the North America potato protein market expansion.

Asia Pacific is expected to record a significant share of the potato protein market revenue during the forecast period, driven by increasing urbanization and changing dietary preferences. The rising popularity of plant-based diets in countries such as China, Japan, and Australia is driving the demand for potato protein products. Additionally, the growing awareness about sustainable agriculture and clean-label food is driving the potato protein market growth in Asia Pacific.

The Indian potato protein market is experiencing significant growth due to rising demand in the animal feed sector and the expansion of agriculture. With a large portion of the population engaged in agriculture and poultry farming, there is a growing focus on improving livestock gut health. Farmers are increasingly adopting plant-based diets for livestock, driving higher demand for potato protein as a sustainable and nutritious feed ingredient.

Potato Protein Market – Key Players & Competitive Analysis Report

The potato protein market is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are positively impacting the potato protein industry by introducing innovative products to meet the demand of specific sectors. This competitive environment is amplified by continuous progress in product offerings. A few major players in the potato protein market include Lyckeby Starch AB, AKV Langholt AmbA, Roquette Frères, Coöperatie AVEBE U.A., AGRANA Beteiligungs-AG, PPZ Niechlow, Emsland-Stärke Limited, KMC Ingredients, Kerry Group, Aminola B.V., and PEPEES S.A.

Kerry Group plc is a global provider of taste and nutrition solutions, primarily serving the food, beverage, and pharmaceutical industries. Headquartered in Tralee, County Kerry, Ireland, the company operates through two main segments—taste & nutrition and Kerry Dairy Ireland. The taste & nutrition segment includes a wide range of products, such as flavors, proteins, and bioactives, that cater to various applications. Kerry Group has a diverse product portfolio comprising over 18,000 items. Notable brands include DaVinci Gourmet and Big Train. The company operates globally with manufacturing facilities in 151 locations across 36 countries and has sales operations that reach more than 150 nations. The regional operations of Kerry Group are divided into three main regions, including the Americas, Europe, and the Asia Pacific Middle East Africa (APMEA). The Americas account for about 52% of the company’s revenue, followed by Europe at 25% and APMEA at 23%.

Roquette Frères is a family-owned French company founded in 1933, with its headquarters located in Lestrem, France. It is recognized as a significant player in the starch production industry, ranking as the fourth largest producer globally. The company processes starch from various sources, including corn, wheat, potatoes, and peas, resulting in over 650 different by-products. Roquette has customers across over 100 countries, with an annual turnover of around USD 5.4 billion. The product portfolio of Roquette encompasses several categories. These include native and modified starches of over 300 types derived from maize, wheat, potatoes, and peas—plant proteins obtained from peas and wheat, and polyols such as sorbitol and maltitol. Additionally, the company produces dietary fibers that offer various nutritional benefits and cereal sugars such as maltodextrins and glucose. These products are utilized in multiple sectors, including food and nutrition (baking, beverages, and dairy), pharmaceuticals (as excipients), cosmetics, animal nutrition, and industrial applications. Roquette operates on a global scale with a notable presence in Europe, North America, and Asia. The company has established 30 production sites worldwide, with major facilities located in France (the largest in Lestrem), the US (Keokuk and Gurnee), China (Nanning and Lianyungang), and South Korea (Ulsan).

Key Companies in Potato Protein Market

- AGRANA Beteiligungs-AG

- AKV Langholt AmbA

- Aminola B.V.

- Coöperatie AVEBE U.A.

- Emsland-Stärke Limited

- Kerry Group

- KMC Ingredients

- Lyckeby Starch AB

- PEPEES S.A.

- PPZ Niechlow

- Roquette Frères

Potato Protein Industry Developments

In May 2024, Avebe launched PerfectaSOL, the next-generation potato protein, at Food Ingredients Europe 2023. It was celebrated for its exceptional texture and potential in creating innovative plant-based products.

In October 2022, AKV Langholt acquired Cargill's stake in their joint venture potato starch business. The acquisition will make AKV Langholt the sole owner of the potato starch facility in Denmark. This deal follows AKV Langholt's recent purchase of Cargill's potato starch plant in France.

Potato Protein Market Segmentation

By Type Outlook (Revenue USD Million, 2020–2034)

- Potato Protein Concentrate

- Potato Protein Isolate

By Application Outlook (Revenue USD Million, 2020–2034)

- Animal Feed

- Meat Products

- Food and Beverages

- Supplement

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Potato Protein Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 116.13 million |

|

Market Size Value in 2025 |

USD 124.57 million |

|

Revenue Forecast by 2034 |

USD 237.72 million |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The potato protein market size was valued at USD 116.13 million in 2024 and is projected to grow to USD 237.72 million by 2034.

The global market is projected to register a CAGR of 7.4% during 2025–2034.

North America held the largest share of the global market in 2024.

A few key players in the market are Lyckeby Starch AB, AKV Langholt AmbA, Roquette Frères, Coöperatie AVEBE U.A., AGRANA Beteiligungs-AG, PPZ Niechlow, Emsland-Stärke Limited, KMC Ingredients, Kerry Group, Aminola B.V., and PEPEES S.A.

The food & beverage segment dominated the market in 2024 due to its extensive use in various applications such as bakery, snacks, dairy alternatives, and protein-enriched foods

The potato protein isolate segment is expected to register a higher growth rate during the forecast period due to its high protein content and superior functional properties.