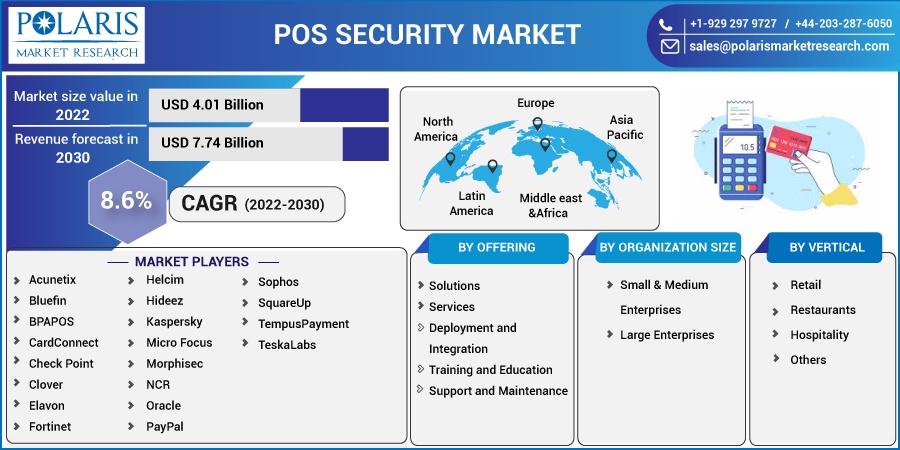

POS Security Market Share, Size, Trends, Industry Analysis Report, By Offering (Solutions, Services); By Organization Size (Small & Medium Sized, Large); By Vertical (Retail, Restaurants, Hospitality); By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 115

- Format: PDF

- Report ID: PM2675

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

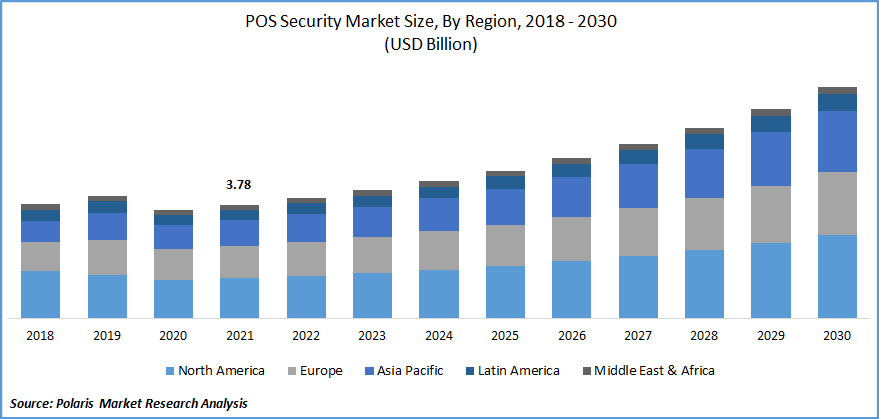

The POS security market was valued at USD 3.78 billion in 2021 and is expected to grow at a CAGR of 8.6% during the forecast period. The rapid utilization of POS systems for transaction processes has increased cyber threats, increasing the demand for POS security.

Know more about this report: Request for sample pages

Point of sale (POS) security offers safe environments for consumers to purchase and complete transactions. Its security measures are essential for preventing unauthorized users from accessing electronic payment systems and reducing the chances of credit card information theft or fraud.

Retailers may experience severe fines, penalties, data loss, financial losses, and reputational harm due to the consequences of cyberattacks. Additionally, people that use IoT devices in retail face security risks. IoT devices are used by more than 84% of companies. However, less than 50% have implemented reliable security measures against cyberattacks.

For instance, the fact that most businesses consistently use the same passwords makes brute-force attacks more common, which makes it easier for hackers to steal and alter data. The growing number of POS hackers is responsible for the market’s growth.

Modern businesses employ a variety of security solutions. Companies frequently use endpoint security products, firewalls, and other security tools. The value proposition for POS security is predicated on companies replacing these current solutions with a collection of proprietary, integrated products. Not all companies are eager to throw away their existing solutions and replace them. This can make it more challenging for companies to use POS security solutions.

The Covid-19 pandemic negatively impacted the market. Due to stringent lockdowns, the number of attacks dropped sharply from around 8000 in 2019 to 5000 in 2020. There was a decline in the utilization of the POS system, leading to decreasing demand for POS security. Although during the pandemic, people mostly used to shop online, the utilization of UPIs and bank transfer increased, influencing the market’s growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The occurrence of the vast number of POS attacks is one of the major factors driving the market's growth. Due to POS attacks, many organizations have concurred with data privacy and regulations. The growing security breaches on POS devices and stringent regulatory framework for security are anticipated for the market's growth.

Data encryption, reduced insider threats, strong passwords, actively monitoring the POS network, and others are some ways to prevent a POS breach. The increasing penetration of cloud-based applications also plays a vital role in this market. Cloud POS is more secure than traditional POS systems as data is handled at a remote and secured location. Cloud POS systems remove a load of data management from the daily task. Thus, many SMEs and large enterprises moved towards cloud-based POS systems.

The surge in cashless transactions that complement the adoption of POS terminals has driven the POS security market. Retailers worldwide have adopted cashless payment methods due to growing concerns that COVID-19 can be spread via contact with infected surfaces. A recent MasterCard poll indicated that between February and March 2020, contactless transactions at grocery and medicine stores increased twice as quickly as regular checkout systems, owing to its vast safety and cleanliness as key drivers.

Report Segmentation

The market is primarily segmented based on offering, organization size, vertical and region.

|

By Offering |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Services accounted for the largest market share in 2021

Services segment accounted for the most significant market share in 2021. It includes several services required to distribute, accomplish, and maintain POS security solutions in organizations. The services provided by vendors in the POS security market support the customers in using and preserving POS security solutions.

The segment includes deployment and integration, training and education, and support and maintenance. Many vendors provide security as an additional feature with POS devices. Integrating a complete and robust POS security framework is one of the primary and vital steps for protecting sensitive information. The security architecture is designed according to government norms. System integration includes integrating the POS system into the consumer’s security system plan with minimum deviation.

Large Enterprises are expected to grow at the highest rate during the forecast period

The large enterprise segment is expected to account for the largest market share in 2021. It is also estimated to be the fastest-growing segment over the forecast period. It owns a large volume of data that addresses cybersecurity attacks.

These enterprises own the required finance and workforce to implement the POS security solutions and services in their systems. One of the most common forms of cyber security threats is credit and debit card data theft, which is being done by targeting POS systems. Due to weak security systems, large enterprises' systems are often exposed to these threats increasing the adoption of POS terminals.

Retail segment is expected to grow at the highest rate during the forecast period

Based on verticals, the market is segmented into retail, restaurants, and hospitality. The retail segment is expected to account for the most considerable market share. It is expected to grow fastest during the forecast period as retailers are rapidly deploying POS systems to increase the efficiency of their operations.

Good connectivity between retailers and customers across multiple checkpoints gives greater convenience, which has led to increased attacks on the POS systems by hackers to steal PII and payment card information. Thus, retailers adopt POS systems on a large scale for their business.

North America is projected to grow at the fastest during the forecast period

The market in North America is expected to increase at the fastest rate during the forecast period due to the presence of the largest number of POS security market vendors among all the regions. Increased use of electronic payment mechanisms, including automated clearing houses (ACH), ATMs, and POS networks, is driving the market's growth in this region.

Growing online POS terminals and the widespread acceptance of credit and debit cards at retail establishments have presented consumers with significant payment alternatives. The growing concern for protecting sensitive payment data has increased government intervention. Several security-related regulatory compliances control the protection of the POS systems in the North America region, attributing to this region's growth.

The PCI DSS and other regulatory compliances assist organizations in protecting sensitive data. With the novel requirements for terminal certification, TA 7.2 and DC POS 3.0, the operation of POS terminals is secured and standardized. All these factors are supposed to propel the POS security market.

Competitive Insight

Some of the major players operating in the global market include Acunetix, Bluefin, BPAPOS, CardConnect, Check Point, Clover, Elavon, Fortinet, Helcim, Hideez, Kaspersky, Micro Focus, Morphisec, NCR, Oracle, PayPal, Sophos, SquareUp, TempusPayment, TeskaLabs, Thales, TokenEx, Tripwire, Upserve, Vend, Verifone.

Recent Developments

In May 2022, Verifone and Lavu collaborated to provide unified payments and point of sale solutions to restaurants integrating Lavu’s all-in-one restaurant software suite with Verifone’s FLEX payment solution, including its Advanced Payments Methods platform.

In November 2021, CyberRes released Voltage SecureData Services which allows data security solutions to be deployed within business applications in the cloud leading to pseudonymization and anonymization of sensitive personal data.

POS Security Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.01 billion |

|

Revenue forecast in 2030 |

USD 7.74 billion |

|

CAGR |

8.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Offering, By Organization Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Acunetix, Bluefin, BPAPOS, CardConnect, Check Point, Clover, Elavon, Fortinet, Helcim, Hideez, Kaspersky, Micro Focus, Morphisec, NCR, Oracle, PayPal, Sophos, SquareUp, TempusPayment, TeskaLabs, Thales, TokenEx, Tripwire, Upserve, Vend, and Verifone. |