Port Equipment Market Share, Size, Trends, Industry Analysis Report, By Equipment Type (Mooring Systems, Tug Boats, Cranes, Ship Loaders, Container Lift Trucks, and Others); By Application; By Type; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3213

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

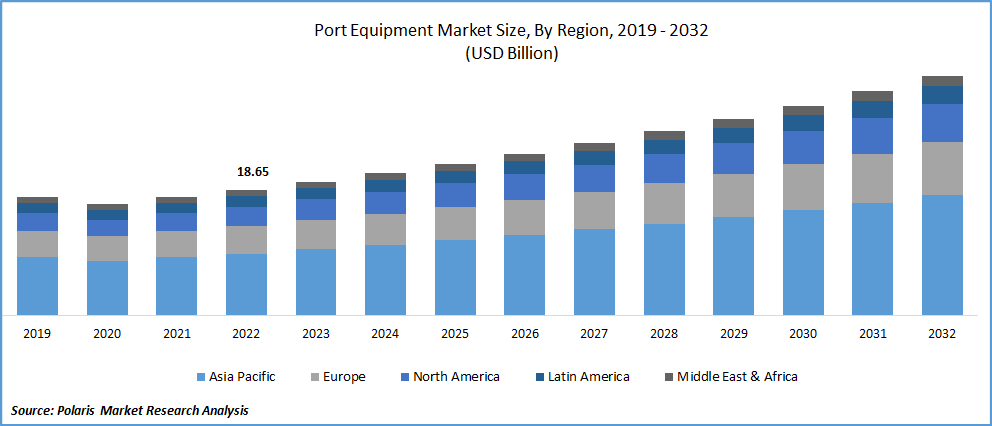

The global port equipment market was valued at USD 19.85 billion in 2023 and is expected to grow at a CAGR of 6.7% during the forecast period. Increasing usage of port equipment for variety of applications including loading and unloading of heavy cargo containers from one place to another across various warehouses and ports and continuous growth in the port infrastructure projects across several regions to boost the import-export trade activities along with the growing implementation on after-sales services and establishment of warehousing facilities are expected to be the major driving factors for the market growth.

Ports are critical to the trade and economic vitality of any nation. They serve as a link between land and sea and act as bustling hubs where a variety of cargo is loaded, unloaded, and shipped. The efficiency and effectiveness of these hubs depend largely on the equipment used to handle the challenging problems in port environments. Port equipment is defined as the vehicles and machines used in maritime operations. These machines can be either electric or diesel-powered. Also, in recent times, hybrid port equipment has made its way into the port equipment market.

There exists a wide range of port equipment types, including mooring systems, forklifts, tug boats, cranes, log stackers, ship loaders, and container lift trucks. Forklifts find applications in moving materials over short distances, with log stackers being used to transport logs or other similarly shaped materials using powered claws. Mobile cranes run on wheels or tracks and have hooks to lift lower heavy objects. Port equipment finds several applications in maritime operations, including stacking, scrap handling, bulk handling, and general cargo. With rising electrification and automation worldwide and a growing focus on new technologies, the market is projected to witness steady growth over the forecast period.

The research report offers a quantitative and qualitative analysis of the port equipment market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Know more about this report: Request for sample pages

Major market companies operating worldwide are highly focusing on innovative technologies like sensors, EV technology, and automation to increase their revenue and streamline business operations are likely to offer lucrative market growth opportunities. For instance, in June 2022, CM Labs, announced the launch of its latest training simulator, named Vortex MasterCab, which allows port terminals to train new operators more safely and effectively and prepare port personnel for various kinds of new equipment and processes.

Furthermore, the rising import and export of a variety of goods and commodities through seaports owing to the wide range of free-trade agreements including Trans Pacific Strategic Economic Partnership, AFTA, and NAFTA, among many other initiatives, especially in emerging economies coupled with the growing consumption of material handling and logistics equipment, are likely to create huge demand and growth in the near future.

The rapid spread of COVID-19 has forced many countries to impose various stringent regulations and lockdowns, that resulted of closure of manufacturing facilities due to disruptions in the global supply chain, which in turn, had a negative impact on overall demand and sales of port equipment during the pandemic.

Industry Dynamics

Growth Drivers

Penetration for electrification and automation across the globe in recent years with a large number of ports are already being implanted on this kid of program along with the growing focus on the introduction of new technologies to realize the actual net-zero targets and achieving carbon neutrality are among the prominent factors influencing the market growth at rapid pace. The exponential growth in the number of new port development projects worldwide, as port infrastructure plays a very crucial and important role in any country’s trade and economy and helps to strengthen the trade infrastructure, is further anticipated to create huge demand and growth opportunities for the port equipment market over the next coming years.

For instance, Indian government will invest around USD 82 Bn in the port development projects by 2025, to improve the clean energy sources in the maritime sector and ancillary waterways projects. Over, 574 projects at a defined cost are being identified under the Sagarmala project and will also attract private investment in the port sector.

Report Segmentation

The market is primarily segmented based on equipment type, application, type, and region.

|

By Equipment Type |

By Application |

By Type |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Cranes segment accounted for the largest market share in 2022

The growth of the segment is highly attributable to the increasing adoption of various types of cranes in port, as it enables the port operators to efficiently manage or handle a variety of vessels while reducing noise and carbon emissions. Additionally, the growing penetration among the port operators to replace the old model cranes with newer and innovative ones, which helps to decrease the cost per move, are also likely to contribute significantly to the segment growth.

The ship loaders segment is expected to exhibit the fastest growth over the coming years, on account of the rapid surge in the number of loading and unloading operations and its ability to provide flexibility in the handling of very large cargo at a faster transfer rate, that leads to the increasing use of ship loaders in various port equipment types. Moreover, high prevalence for innovated mobile loaders across the globe to enhance the operational efficiency which in turn propelling the segment market growth.

Container handling segment held a significant market revenue share

The container handling segment led the global market and held majority market revenue share in 2022, which is mainly driven by increasing need and demand for diverse range of port operations including heavy lifting, stacking, loading, unloading, bulk handling, and many others along with the continuous rise in the global trade activities and trade volume, that requires large containers and their handling equipment.

Moreover, various large manufacturers of port equipment around the world such as Konecranes, Kalmar, and Hyster-Yale Materials Handling are incorporating several auction procedures to boost the system’s performance and efficiency, that is also anticipated to fuel the demand and growth of the market over the coming years.

Hybrid segment is expected to witness highest growth

The hybrid segment is projected to gain fastest growth rate throughout the forecast period, owing to the growing transformation of ports towards the clean and green ports and large number of favorable government initiatives and funding projects from both private and government institutions. For instance, in December 2021, Indonesia, announced that they are going to launch to make the country’s port more environment friendly and reduce the carbon emissions and also protect the marine ecosystem. The green port initiative will mainly focus on increasing use of clean energy and strengthen the country’s port infrastructure.

Diesel segment dominated the port equipment market in terms of revenue in 2022, on account of its high fuel efficiency, better performance, power, and reliability along with the several stringent government norms imposed by governments to mandate the port manufactures to focus on clean diesel technologies.

Asia Pacific region dominated the global market in 2022

The regional market growth can be highly attributed to continuous rise in the maritime commerce transport activities along with the presence of some of the world’s largest and most usable ports in countries like China and India and significant growth in the investment in port industry. Furthermore, the establishment of various automated terminals and continuous rise in the infrastructure to support the seaborne trade, are likely to boost the growth of the regional market.

North America region is expected to be the fastest growing region during the study period, which is accelerated by rapid automation of operations and business processes across wide range of industries, that in turn boosting the demand for managing these automated services through port and material handling equipment vehicles coupled with the robust presence of prominent market manufacturers in the region.

Competitive Insight

Some of the major players operating in the global market include Liebherr Group, Konecranes, Sany Heavy Industries, Shanghai Zhenhua Heavy Industries, Anhui Heli, American Crane & Equipment, Til Limited, Lonking Holdings, Mcnally Bharat Engineering, Timars Svets & Smide, CVS Ferrari, Cavotec, Hyster, and Prosertek.

Recent Developments

- In June 2022, Konecranes, introduced battery-based container handling for introducing the sustainable services for the port operations. This solution will include the “Battery RTG” & the Gottwald Generation. The machines can be easily operated in both ways manually or automatically and enable zero local carbon dioxide emissions.

- In March 2022, Port Gdansk Eksploatacja has signed a strategic contract with the Liebherr Group for a new machine LHM 550 mobile harbor crane, that will be mainly used for bulk handling. This harbor crane is suitable for a wide range of applications even heavy-duty lifts of up to 150 tons are possible with these cranes.

Port Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 21.13 billion |

|

Revenue Forecast in 2032 |

USD 35.57 billion |

|

CAGR |

6.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By equipment type, By Application, By Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Liebherr Group, Konecranes Abp, Sany Heavy Industries Co. Ltd., Shanghai Zhenhua Heavy Industries, Anhui Heli, American Crane & Equipment, Til Limited, Lonking Holdings Ltd., Mcnally Bharat Engineering, Timars Svets & Smide Ab, CVS Ferrari, Cavotec, Hyster, and Prosertek. |

We provide our clients the option to personalize the port equipment market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

FAQ's

The port equipment market report covering key segments are equipment type, application, type, and region.

Port Equipment Market Size Worth $35.57 Billion By 2032.

The global port equipment market expected to grow at a CAGR of 6.7% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in port equipment market are increase in usage of electric port equipment to minimize the carbon consumption.