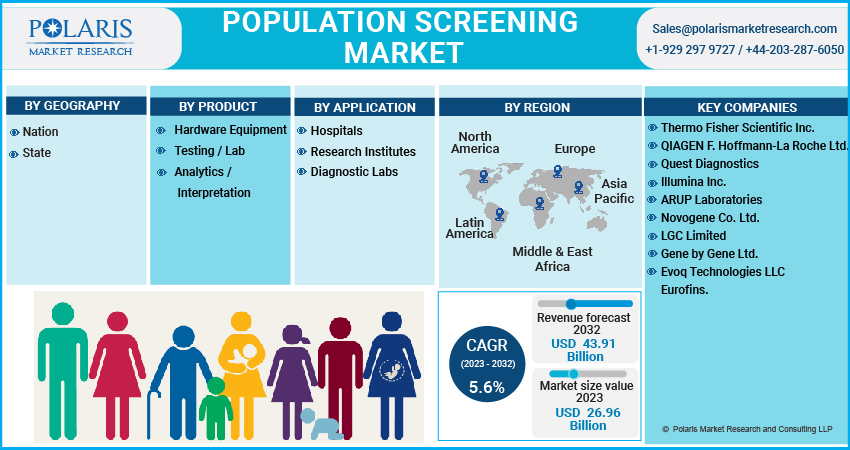

Population Screening Market Share, Size, Trends, Industry Analysis Report, By geography (Nation, State); By Product; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Apr-2023

- Pages: 117

- Format: PDF

- Report ID: PM3184

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

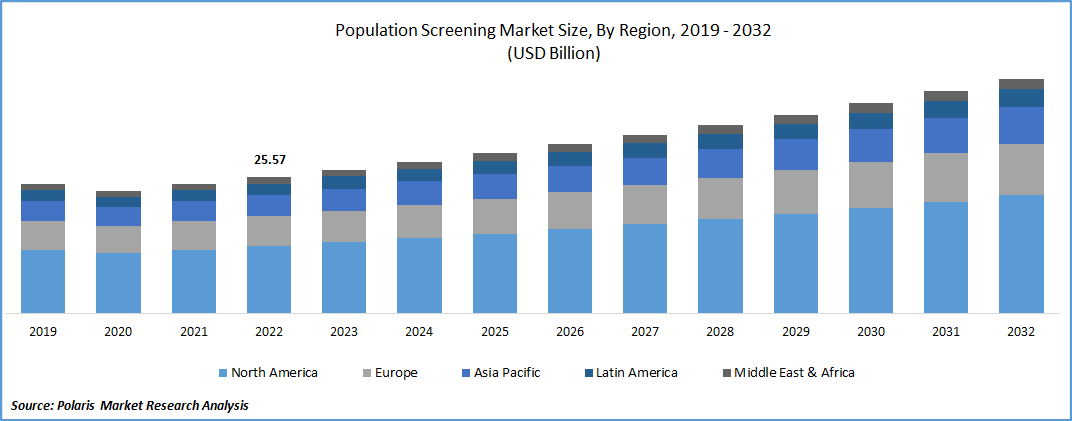

The global population screening market was valued at USD 25.57 billion in 2022 and is expected to grow at a CAGR of 5.6% during the forecast period. The goal of population screening for a disease or a risk marker is to minimize the disease's burden in the community, including disease incidence, morbidity, and mortality. This is accomplished by intervening to reduce individual disease risk or identifying illness earlier. Moreover, A population screening test identifies people who are more likely to have the condition and who need to be investigated further to determine whether they have the disease or condition. These are the few primary drivers responsible for market growth.

Know more about this report: Request for sample pages

Population-based screening uses an improvement framework to plan, coordinate, monitor, and evaluate. All of these activities must be adequately resourced to maximize the benefits. Such advances in scientific knowledge will offer many new opportunities for the population screening market. Thus, it is projected to grow significantly in the coming years. Population screening aims to find people in a healthy population at greater risk of developing health concerns to provide early intervention can be provided, thereby helping to reduce the incidence of the health problem. So, population screening increases effectiveness maximizes benefits and minimizes harm.

One of the key factors driving population screening market growth over the forecast period is the rising prevalence of cancer. Cancer is the world's second leading cause of death, according to the WHO. Cancer incidence reached 19.3 million in 2020, with 9.96 million cancer-related deaths projected. According to the International Agency for Research on Cancer, Cancer incidence is expected to reach 21.9 million by 2025 and 24.6 million by 2030. This increase in cancer cases is expected to force governments to launch a new program for population cancer screening.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising funding for population screening programs is anticipated to drive market growth. For example, the UK Ministry introduced the "Genome UK" implementation plan in May 2021 to improve population screening, diagnosis, & treatment of patients with genetic diseases. The genome project received USD 19.1 Mn from the UK government. Furthermore, Nostos Genomics raised USD 4.6 Mn in February 2022 for the research & development of novel tests to diagnose patients with genetic disorders.

Report Segmentation

The market is primarily segmented based on geography, product, application, and region.

|

By Geography |

By Product |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Nation segment is expected to dominate the market in 2022

The nation segment dominated the market in 2022 and is expected to be the fastest-growing segment over the forecast period. This is due to the widespread availability of population screening programs for various diseases at the national level. The U.S. Preventive Services Task Force (UPSTF) is the major governing body in the United States, working with the Centers for Disease Control and Prevention (CDC) to recommend a program for the country's population. Furthermore, governments worldwide are launching several initiatives to provide public free or subsidized health screening. For instance, the government has been implementing the National Family Planning Program, which provides beneficiaries with voluntary and informed choices through a target-free approach to limit the country's population growth.

States segment is expected to grow rapidly over the study period. Every state in the U.S. regulates and manages its screening program. As part of the NCD Control program, it is launching an initiative to conduct population screening for non-communicable diseases & their concerned risk factors throughout the state. The plan is to create a Statewide community registry of people over 30 who have NCDs with the help of local governments.

Moreover, as envisioned in the national NCD control program, the population-based screening program employs ASHA workers who visit houses under their jurisdiction to collect information on chronic diseases & risk factors among all people over 30. As a result, the survey will generate reports on the prevalence of diabetes/hypertension at the panchayat/district and state levels. The disease profiles generated for panchayats could be useful for policymakers and local self-governments.

Hardware equipment segment accounted for the largest market share in 2022

The equipment segment improves the accuracy of diagnostic results. It can be used in various departments of hospitals and medical centers, broadening medical practitioners' expertise. The treatment can be given in fields such as pediatrics, surgery, gynecology, dermatology, & diegetic. Furthermore, information containing medical data can be stored in computers for an extended period. Patients can also view their medical records, such as test results or treatment instructions.

The testing/lab segment is expected to grow the fastest during the forecast period. Cholesterol testing, fecal occult blood testing, pap tests, prostate-specific antigen tests, mammography, colonoscopies, and tests for diabetes are the most frequently performed for various diseases worldwide. Thus, the importance of disease screening in the general population has grown in recent years and is expected to grow further during the forecast period.

Hospital sector is expected to hold the significant revenue share in 2022

The rising prevalence of chronic and infectious diseases is driving the hospital sector. As a result, the number of patients requiring diagnosis and treatment has increased. Thus the demand for hospitals is anticipated to open profitable growth potential over the forecasting years. The increasing penetration of health insurance plans is expected to boost the growth of the Indian hospital market. Furthermore, increased coverage for various diseases and injuries in different health insurance plans is expected to drive market growth.

Moreover, rising awareness of the importance of health insurance plans and the emergence of new health insurance provider companies are expected to create lucrative opportunities for the growth of the hospital segment. The market segment for research institutes is anticipated to grow fastest during the forecasted period owing to increased research activities to identify candidates and established patient diagnoses for research participation.

The demand in North America is expected to account for largest revenue share in 2022

North America dominated the market and accounted for the largest revenue share. This increase is attributed to government preventive measures to halt disease progression. Due to the high awareness of the benefits of screening among patients and physicians, the United States and Canada are two major markets for population screening in North America. The United States is expected to see significant growth due to the country's high burden of chronic diseases, which require clinical laboratory services for efficient treatment and patient care.

Furthermore, one of the primary reasons for increasing screening rates in the United States is tuberculosis (TB) prevention. The Centers for Disease Control and Prevention (CDC) and the National Tuberculosis Controllers Association (NTCA) provide recommendations for screening, testing, & treatment of healthcare personnel. As a result, government initiatives to increase population screening for early disease diagnosis and treatment are expected to drive market growth.

Asia Pacific is expected to grow the fastest over the forecast period. This rapid expansion is due to increased unmet medical needs, advanced scientific research, and positive economic growth. In addition, China & India are viewed as potential business hubs for clinical testing & service providers. Furthermore, the market in this region is expected to grow as disposable income, urbanization, education, & awareness about preventing severe diseases increase.

Competitive Insight

Key players in the population screening market include Agilent Technologies, QIAGEN, Roche Ltd., Quest Diagnostics, Illumina, ARUP Laboratories, Thermo Fisher Scientific, Novogene, LGC Limited, Gene by Gene Ltd., Evoq Technologies, and Eurofins.

Recent Developments

- In November 2021, Evoq Technologies introduced its 1st phone-based retinal health testing platform, "SmartERG." It offers ophthalmic care with simple patient-provider connections and cloud services with strong support from AI and machine learning.

- In September 2021, Eurofins Scientific introduced "OmniGraf." It is the first renal transplant tool that combines cell-free DNA & gene data. Combined with TGI's technology & machine learning, it provides an accurate & real-time assessment of kidney transplant rejection in patients.

Population Screening Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 26.96 billion |

|

Revenue forecast in 2032 |

USD 43.91 billion |

|

CAGR |

5.6% from 2023 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Geography, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Some of the major players operating in the global market include Agilent Technologies Inc., Thermo Fisher Scientific Inc., QIAGEN F. Hoffmann-La Roche Ltd., Quest Diagnostics, Illumina Inc., ARUP Laboratories, Novogene Co. Ltd., LGC Limited, Gene by Gene Ltd., Evoq Technologies LLC, Eurofins. |

FAQ's

Key companies in population screening market are Agilent Technologies, QIAGEN, Roche Ltd., Quest Diagnostics, Illumina, ARUP Laboratories, Thermo Fisher Scientific, Novogene, LGC Limited, Gene by Gene Ltd.

The global population screening market expected to grow at a CAGR of 5.6% during the forecast period.

The population screening market report covering key segments are geography, product, application, and region.

Key driving factors in population screening market are increasing prevalence of diseases and growing investments in population screening.

The global population screening market size is expected to reach USD 43.91 billion by 2032.