Popcorn Container Market Size, Share, Trends, Industry Analysis Report: By Product Type, Material, Application (Residential and Cinemas), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 125

- Format: PDF

- Report ID: PM5285

- Base Year: 2024

- Historical Data: 2020-2023

Popcorn Container Market Overview

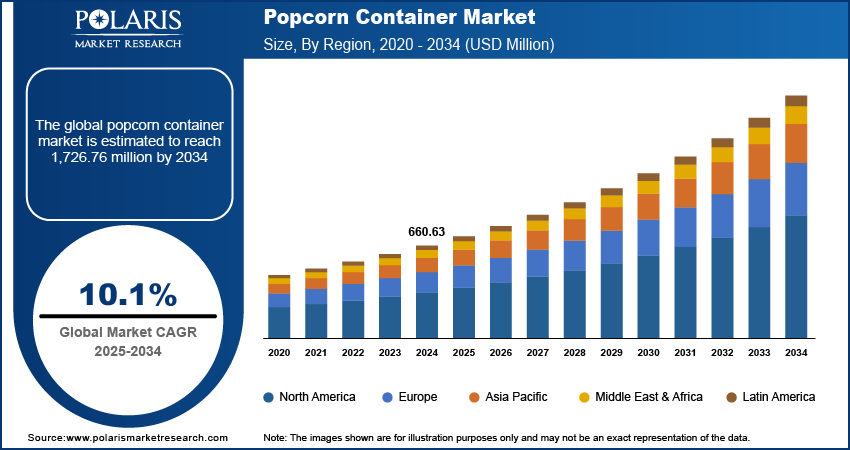

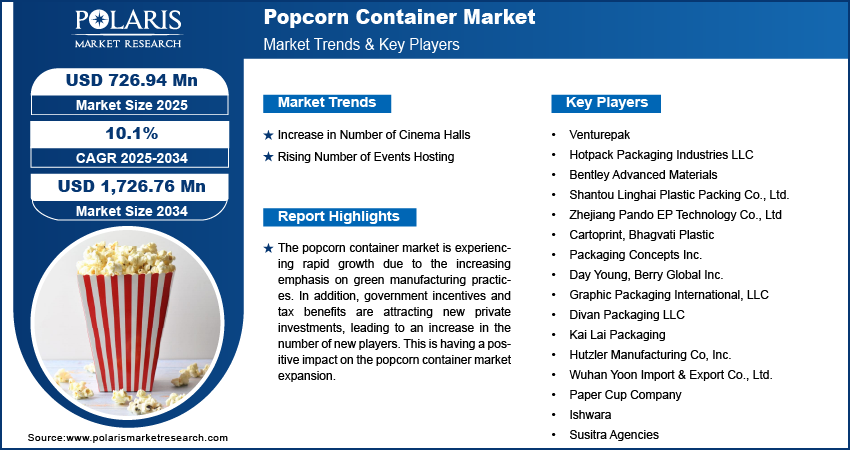

The popcorn container market size was valued at USD 660.63 million in 2024. The market is projected to grow from USD 726.94 million in 2025 to USD 1,726.76 million by 2034, exhibiting a CAGR of 10.1% during 2025–2034.

A popcorn container is a box used to hold popcorn, typically made of paper or plastic. Increasing interest in sustainable packaging solutions drives the popcorn container market growth. Government initiatives aimed at reducing the environmental impact of product production have introduced various incentives. These measures have encouraged numerous manufacturers to adopt sustainable packaging solutions. This shift toward sustainable practices helps companies align their products with consumer values and regulatory requirements. The continued adoption of eco-friendly and sustainable packaging is expected to fuel the popcorn container market expansion.

To Understand More About this Research: Request a Free Sample Report

The increasing trend of home entertainment is expected to boost the popcorn container market development during the forecast period. The rise in consumers opting for streaming services and home movie nights has led to greater demand for snacks, particularly popcorn, which has become a staple for at-home viewing experiences. Families and friends gathering to watch movies seek convenient and appealing packaging for their snacks, resulting in higher sales of popcorn containers designed specifically for home use. Manufacturers are responding to this trend by offering a variety of innovative and customizable popcorn containers that enhance the overall experience.

Popcorn Container Market Drivers and Trends

Increase in Number of Cinema Halls

The increasing number of cinema halls is primarily driving the popcorn container market demand. According to the Indian Open Government Data Platform, as of 2024, India has 10,167 theater screens, a significant rise from 9,742 screens in 2023, emphasizing a growing entertainment industry. Additionally, this expansion is coupled with a significant increase in cinema footfall, with the average number of daily shows growing from 450 in 2010 to 623 in 2022. Popcorn is an essential part of the movie-watching experience. Therefore, the demand for popcorn rises as more theaters open and showtimes expand. Cinema operators are willing to enhance customer satisfaction, leading to a higher demand for visually appealing and functional popcorn containers. Moreover, themed movie events and promotional screenings further drive the need for unique and branded packaging solutions. The focus on quality and innovative popcorn containers is essential as cinemas operate to provide a memorable experience for their patrons. This coordination between the growth of cinema infrastructure and the increasing popularity of popcorn as a snack is increasing the demand for popcorn containers, leading to the popcorn container market growth during the forecast period.

Rising Number of Events Hosting

The growing popularity of social gatherings, corporate events, and celebrations has led to an increased demand for snacks, particularly popcorn. Popcorn is a favored choice for its versatility and appeal, making it an ideal addition to events such as parties, weddings, and festivals. Event organizers often seek stylish and functional popcorn containers to enhance the overall experience for attendees, driving an increase in demand for innovative packaging solutions. Additionally, themed events encourage the use of customized containers that align with specific motifs or branding. Consequently, the increase in the number of social gatherings and event hosting is increasing the demand for containers, driving the popcorn container market revenue.

Popcorn Container Market Segment Insights

Popcorn Container Market Outlook – by Material Insights

The popcorn container market segmentation, based on material, includes plastic and paper. The paper segment is expected to register a higher CAGR during the forecast period. The rising preference toward sustainability has increased the number of manufacturers in paper container production, leading to the expansion of the paper segment. Additionally, government incentives and tax benefits for green manufacturing have increased the number of players operating in the market, positively impacting the segment growth during the forecast period.

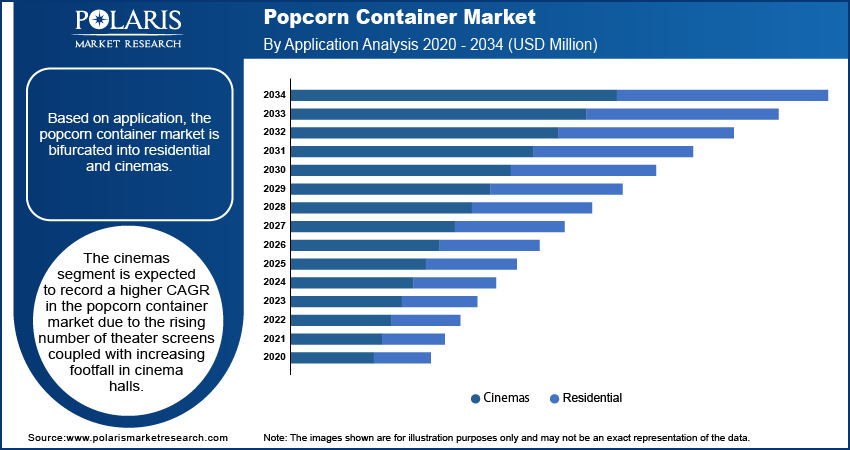

Popcorn Container Market Assessment – by Application Insights

The popcorn container market segmentation, based on application, includes residential and cinemas. The cinema segment dominated the popcorn container market share in 2024. Popcorn serving during movie screenings has been an integral part of cinemas historically. An increasing number of theater screens coupled with an increase in footfall in theaters is driving the growth of the cinema segment.

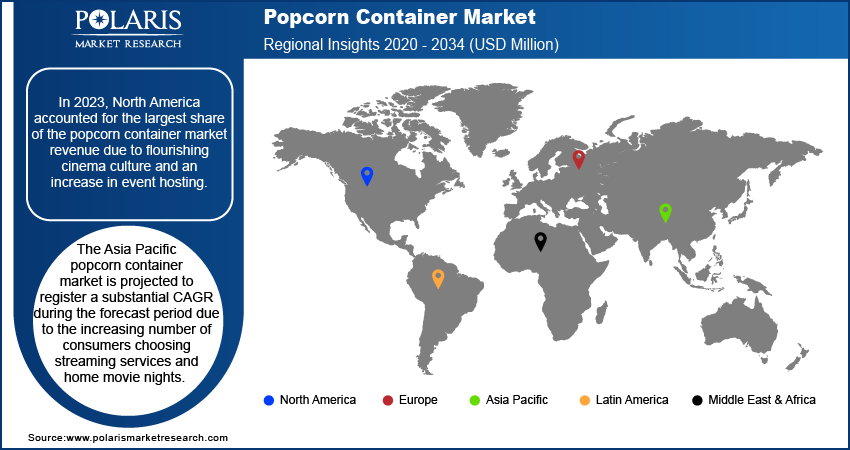

Popcorn Container Market Regional Insights

By region, the study provides the popcorn container market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest popcorn container market share in 2024, driven by a rise in cinema culture and an increase in event hosting. The revival of movie theatres post-pandemic has led to a marked increase in attendance, firmly establishing popcorn as a staple snack choice. This trend is complemented by the rising popularity of hosting various events, from film screenings to community festivals, where popcorn serves as a favored treat. Additionally, the region is witnessing a significant shift toward sustainable practices in packaging. Government incentives aimed at promoting green manufacturing are encouraging more companies to adopt eco-friendly materials and processes. The expansion of the popcorn container market has increased the number of players, driving greater competition and innovation. Thus, the increasing number of theater screens and event hosting coupled with government incentives toward green manufacturing is driving the North America popcorn container market expansion.

The Asia Pacific popcorn container market is projected to experience substantial growth during the forecast period. The increasing preference for streaming services and home movie nights has led to a surge in demand for snacks, particularly popcorn. This shift has driven a rise in sales of popcorn containers designed for home use as families and friends seek to recreate the cinema experience at home. The popularity of social media platforms amplifies this trend, as users share their home movie setups, often featuring appealing popcorn presentations. Additionally, the availability of various popcorn flavors and gourmet options is sparking interest in creative and stylish packaging that enhances the snacking experience. Manufacturers are innovating their product lines to meet this demand, offering containers that are functional and visually appealing, which is contributing to the Asia Pacific popcorn container market growth.

The popcorn container market in India is expected to grow rapidly during the forecast period due to the rising trend of home entertainment. Consumers are embracing the convenience of streaming movies and series at home with an increase in subscriptions to over-the-top (OTT) platforms. For instance, in 2024, the regional OTT platform Aha announced its plans to invest USD 12 million over three years, expanding into new languages and content genres. The demand for popcorn has surged during movie nights with family and friends, driving the need for diverse and appealing popcorn containers designed for home use. Manufacturers are responding to this trend by offering innovative designs and sustainable options, positioning the Indian popcorn container market for substantial growth during the forecast years.

Popcorn Container Market – Key Players and Competitive Insights

The popcorn container market is continuously evolving, with many companies striving to innovate and stand out. Leading global corporations dominate the market by utilizing extensive research and development, advanced manufacturing technologies, and significant capital to maintain a competitive edge. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the popcorn container market to benefit clients. Major players in the market are Venturepak; Hotpack Packaging Industries LLC; Bentley Advanced Materials; Shantou Linghai Plastic Packing Co., Ltd.; Zhejiang Pando EP Technology Co., Ltd; Cartoprint; BHAGVATI PLASTIC; Packaging Concepts Inc.; Day Young; Berry Global Inc.; Graphic Packaging International, LLC; Divan Packaging LLC; Kai Lai Packaging; Hutzler Manufacturing Co, Inc.; Wuhan Yoon Import & Export Co., Ltd.; Paper Cup Company; ISHWARA; and Susitra Agencies.

Venturepak Ltd. is a privately held company based in St. Helens, Merseyside, UK, specializing in plastic packaging solutions. The company supplies injection molded tubs, pots, and buckets. Products are tamper-evident, produced from high-quality food-grade polypropylene, and comply with the highest food safety and hygiene standards. Additionally, the majority of products can be enhanced with in-mold labeling (IML) techniques for customized branding. Recently, Venturepak launched an eco-friendly range of popcorn containers to meet the increasing demand for sustainable packaging options. With a focus on quality and innovation, Venturepak aims to expand its presence in the competitive packaging market.

Hotpack Packaging Industries LLC, established in 1995, operates as a subsidiary of Hotpack Group and is headquartered in Ajman, UAE. The company serves a diverse clientele across the Middle East, Africa, and parts of Asia, specializing in a wide range of packaging solutions. Hotpack's extensive product portfolio includes disposable food containers, plates, cups, cutlery, and custom packaging designed for the food service and retail sectors. Recently, In 2023, Hotpack launched a new line of biodegradable packaging products in response to the increasing demand for sustainable alternatives in the market. This initiative reflects the company’s ability to adapt to evolving consumer preferences while maintaining a robust product lineup.

Key Companies in Popcorn Container Market

- Venturepak

- Hotpack Packaging Industries LLC

- Bentley Advanced Materials

- Shantou Linghai Plastic Packing Co., Ltd.

- Zhejiang Pando EP Technology Co., Ltd

- Cartoprint

- Bhagvati Plastic

- Packaging Concepts Inc.

- Day Young

- Berry Global Inc.

- Graphic Packaging International, LLC

- Divan Packaging LLC

- Kai Lai Packaging

- Hutzler Manufacturing Co, Inc.

- Wuhan Yoon Import & Export Co., Ltd.

- Paper Cup Company

- Ishwara

- Susitra Agencies

Popcorn Container Industry Developments

June 2024: Saica and Mondelez partnered to develop recyclable paper-based packaging for multipacks in the confectionery sector, aligning with sustainability goals, which could influence innovations in the popcorn container.

May 2024: Mondi unveiled a new secondary paper packaging solution, ‘TrayWrap,’ to replace plastic shrink film for bundling food and beverage products. This sustainable packaging, made from Mondi’s Advantage StretchWrap range, was initially utilized by a coffee brand in Sweden to secure 12 coffee packages. The paper-based wrap was designed with prepunched folding points for stability and stackability. While being crafted from 100% recyclable kraft paper sourced from renewable resources, it emphasizes its eco-friendly benefits for popcorn containers.

Popcorn Container Market Segmentation

By Product Type Outlook (USD Million, 2020–2034)

- Buckets

- Tubs

- Cups

By Material Outlook (USD Million, 2020–2034)

- Paper

- Plastics

By Application Outlook (USD Million, 2020–2034)

- Residential

- Cinemas

By Regional Outlook (USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Popcorn Container Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 660.63 million |

|

Market Size Value in 2025 |

USD 726.94 million |

|

Revenue Forecast by 2034 |

USD 1,726.76 million |

|

CAGR |

10.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 660.63 million in 2024 and is projected to grow to USD 1,726.76 million by 2034.

The global market is projected to grow at a CAGR of 10.1% during 2025–2034.

North America accounted for the largest market share in 2024.

A few key players in the market are Venturepak; Hotpack Packaging Industries LLC; Bentley Advanced Materials; Shantou Linghai Plastic Packing Co., Ltd.; Zhejiang Pando EP Technology Co., Ltd; Cartoprint; BHAGVATI PLASTIC; Packaging Concepts Inc.; Day Young; Berry Global Inc.; Graphic Packaging International, LLC; Divan Packaging LLC; Kai Lai Packaging; Hutzler Manufacturing Co, Inc.; Wuhan Yoon Import & Export Co., Ltd.; Paper Cup Company; ISHWARA; and Susitra Agencies.

The plastic segment is expected to record a higher CAGR in the global market during the forecast period.

The cinemas segment held a larger share of the market in 2024.