Polyvinyl Butyral Market Share, Size, Trends, Industry Analysis Report

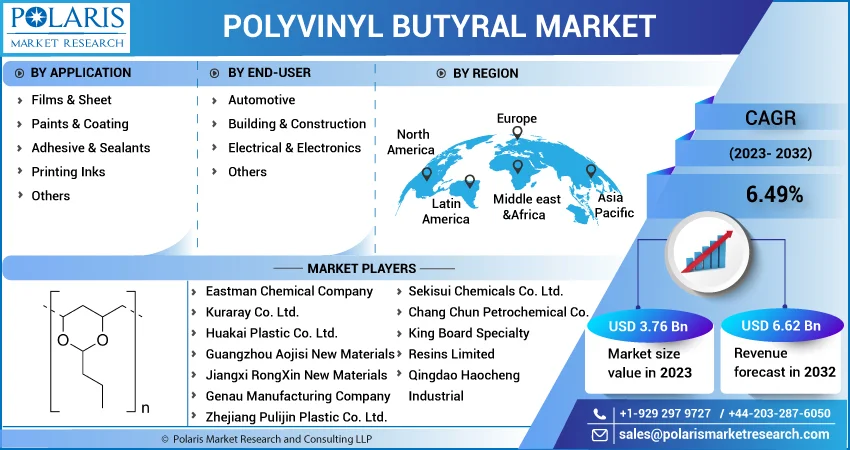

By Application (Films & Sheet, Paints & Coating, Adhesive & Sealants, Printing Inks, and Others); By End-Use; By Region; Segment Forecast, 2023-2032

- Published Date:Mar-2023

- Pages: 117

- Format: PDF

- Report ID: PM3080

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

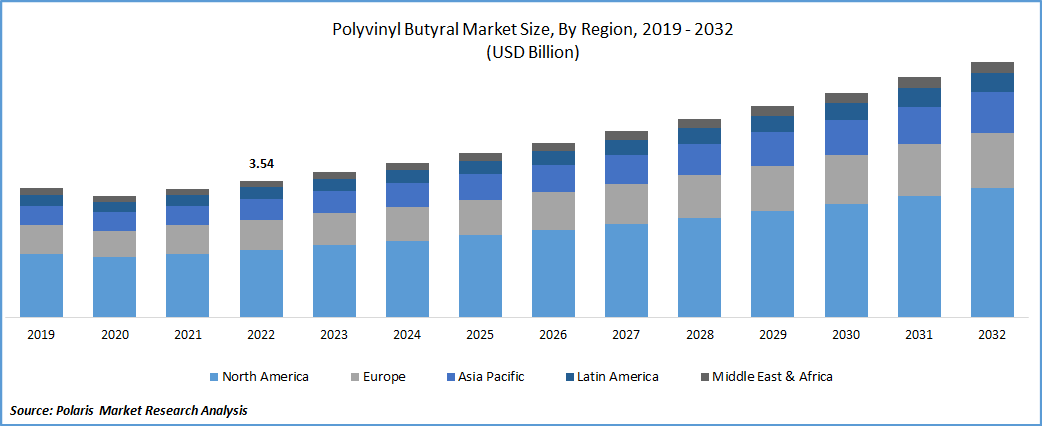

The global polyvinyl butyral market was valued at USD 3.54 billion in 2022 and is expected to grow at a CAGR of 6.49% during the forecast period. The growing utilization of PVB-based paints & coating and adhesives across a wide range of industries, including assembly, manufacturing, woodwork, paper, packaging, and consumer products, and a positive outlook towards the automobile industry in China, Japan, India, and Indonesia are among the major factors influencing the global market growth. In addition, the rapid boost in the worldwide population coupled with the favorable government initiatives to support product development and innovations through public-private partnerships and foreign direct investments across the globe are also anticipated to create lucrative growth opportunities for the market in the coming years.

Know more about this report: Request for sample pages

For instance, in January 2023, Saint-Gobain, North America, announced the launch of its new glass circular economy program at two different locations in California. In collaboration with Shark Solutions, a Danish-based recycler of polyvinyl butyral, the waste automotive windshield glass will be diverted from the landfill and recycled. The resulting product will be sent to CertainTeed Insulation’s facility as a recycled ingredient.

In recent years, the prevalence of the product is heavily increasing in laminated safety glass, and as an interlayer in sandwich laminated glass due to the high safety and security it provides in automobile windshields. Thus the growing production capacity and volumes of automobiles worldwide fuel the need and adoption of PVBs. For instance, the total production of motor vehicles stood at 79.1 million units, with an increase of 1.3% from the previous year.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the Polyvinyl Butyral market. During the pandemic, the automotive manufacturing facilities were highly halted during the imposed lockdown and many other stringent regulations on trade activities by many countries, which has directly affected the demand for polyvinyl butyral. For instance, according to our findings, global passenger car production declined by over 16% in 2020 compared to the previous year.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising investment in research & development activities and higher technological advancements in the electricals & electronics industry have fueled the product demand across a wide range of photovoltaics applications of PVB, which are key factors influencing the market growth. In addition, the major market manufacturers are extremely focused on enhancing the efficiency of thin films, & manufacturing techniques to expedite production capacity, which is also fueling the demand and growth of the polyvinyl butyral market. Furthermore, the increasing awareness regarding the various beneficial properties of PVBs, including better absorption of UV light against break-in and acoustic protection along with their easy availability in the market at very reasonable prices, has boosted its adoption across numerous industries and driving the market growth.

Report Segmentation

The market is primarily segmented based on application, end-user, and region.

|

By Application |

By End-User |

By Region |

|

|

|

Know more about this report: Request for sample pages

Films & sheets segment accounted for the largest market share in 2022

The films & sheets segment accounted for a considerable global market share in 2022 and is expected to retain its position with a significant growth rate over the coming years. The growth of the segment market can be attributed to its increased usage as an interlayer in the production of multiple types of laminated glasses, which are used in a wide range of sectors, including architectural and automotive. Additionally, it has gained significant traction as a safety glass that helps keep the components intact even when broken. Along with this, PVB films find vast applications in the real estate and construction industry that are further likely to boost the growth of the segment market.

Moreover, the paints & coating segment is also expected to grow at a substantial rate of growth throughout the anticipated period, which is mainly accelerated by the exponential growth in the industrial sector, especially in emerging economies like India, Brazil, South Korea, and China coupled with the increased awareness regarding the beneficial characteristics of the product such as superior strength, binding properties, and ability to reduce the emissions of volatile organic compounds.

Electrical & electronics segment is expected to witness significant growth during the forecast period

The electronics & electricals segment is projected to grow at the fastest growth rate during the study period, which is highly attributable to a rapid increase in the utilization of a variety of renewable sources of energy in the electrical & electronics industry, as PVB films are highly economical and convenient for the solar photovoltaic modules and encapsulation material that helps in improving the UV protection and overall performance of the glass. In addition, a surge in the number of regulations on clean energy and growth in the demand and adoption of solar cells across the globe are also anticipated to fuel the demand for the product in the near future.

The automotive segment led the industry with a majority market share in 2022 on account of its numerous advantageous features, such as offering better protection of the graphics, better finish, & prevention bubbles formulation on the product surface. Moreover, the increasing adoption of safety glass to produce road & side glass on luxury vehicles for reducing noise, light transfer, and improved safety, along with the less smoke generation & low flammability of PVB films & sheets, has fueled its demand and growth around the world.

Asia Pacific region dominated the global market in 2022

Asia Pacific dominated the global market with a significant revenue share in 2022 and is projected to maintain its dominance throughout the forecast period. The regional market growth can be mainly driven by ascending demand for various fast-moving consumer goods and continuous rise in the penetration for a product across industrial machinery, equipment, and containers. Additionally, the development is anticipated to gain significant utilization in packaging applications because of the high demand for laminated glass and adhesives by hospitals and other healthcare institutions, especially in developing nations like India, China, and South Korea.

The APAC region's photovoltaic industry is also among the fastest emerging industries. It is gaining significant traction owing to the increase in solar energy generation projects and the high focus on expanding its manufacturing facilities for PVB resins, fueling the product's consumption in the industry.

Europe region accounted for a substantial market share in 2022, owing to the increasing E.U. funding with various supportive measures such as subsidies, tax breaks, and government incentives. The enlargement of the construction industry across different European countries, including Germany, the U.K., the Netherlands, and the U.K., is fueling the demand for polyvinyl butyral over the coming years.

Competitive Insight

Some of the major players operating in the global market include Eastman Chemical Company, Kuraray, Huakai Plastic, Tiantai Kanglai Industrial, Guangzhou Aojisi New Materials, Jiangxi RongXin, Genau Manufacturing, Zhejiang Pulijin Plastic, Sekisui Chemicals, Chang Chun Petrochemical, & Qingdao Haocheng.

Recent Developments

- In October 2022, Fiberlogy, a leading 3D printing filament manufacturer, announced the launch of its new 3D printing material named FibersSmooth, a filament made up of polyvinyl butyral. It allows 3D prints to be easily post-processed to a very smooth and glossy finish, mainly designed for use with the FDM and FFF.

- In March 2021, Chargeurs Fashion Technologies, a leading apparel interlinings manufacturer, announced the launch of its new brand identity for its permanent line of interlinings that has launched a few years ago. The company focuses on creating product coatings using recycled polyvinyl butyral, which is largely used as a safer layer inside the building glass.

Polyvinyl Butyral Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3.76 billion |

|

Revenue forecast in 2032 |

USD 6.62 billion |

|

CAGR |

6.49% from 2023–2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Application, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Eastman Chemical Company, Kuraray Co. Ltd., Huakai Plastic Co. Ltd., Tiantai Kanglai Industrial Co. Ltd., Guangzhou Aojisi New Materials, Jiangxi RongXin New Materials, Genau Manufacturing Company, Zhejiang Pulijin Plastic Co. Ltd., Sekisui Chemicals Co. Ltd., Chang Chun Petrochemical Co., King Board Specialty Resins Limited, and Qingdao Haocheng Industrial. |

FAQ's

The global polyvinyl butyral market size is expected to reach USD 6.62 billion by 2032.

Key players in the polyvinyl butyral market are Eastman Chemical Company, Kuraray, Huakai Plastic, Tiantai Kanglai Industrial, Guangzhou Aojisi New Materials, Jiangxi RongXin, Genau Manufacturing.

Asia Pacific contribute notably towards the global polyvinyl butyral market.

The global polyvinyl butyral market expected to grow at a CAGR of 6.49% during the forecast period.

The polyvinyl butyral market report covering key segments are application, end-user, and region.