Polyvinyl Alcohol Market Size, Share, Trends, Industry Analysis Report: By Grade (Fully Hydrolyzed, Partially Hydrolyzed, and Sub-Partially Hydrolyzed), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 119

- Format: PDF

- Report ID: PM1498

- Base Year: 2024

- Historical Data: 2020-2023

Polyvinyl Alcohol Market Overview

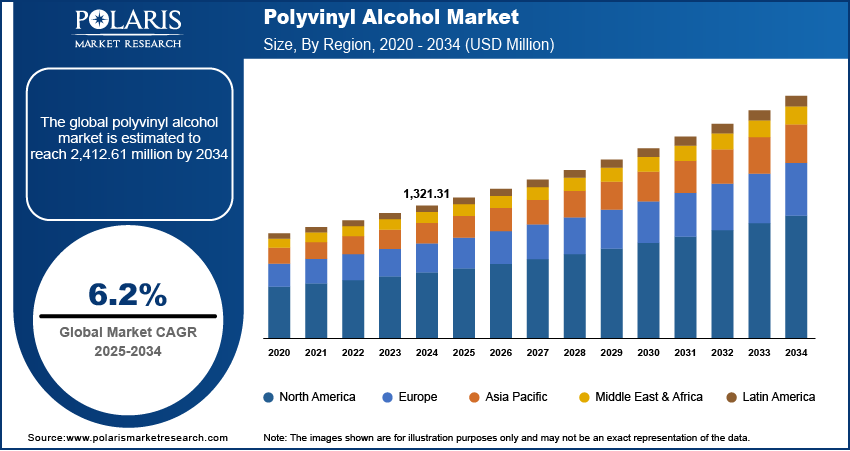

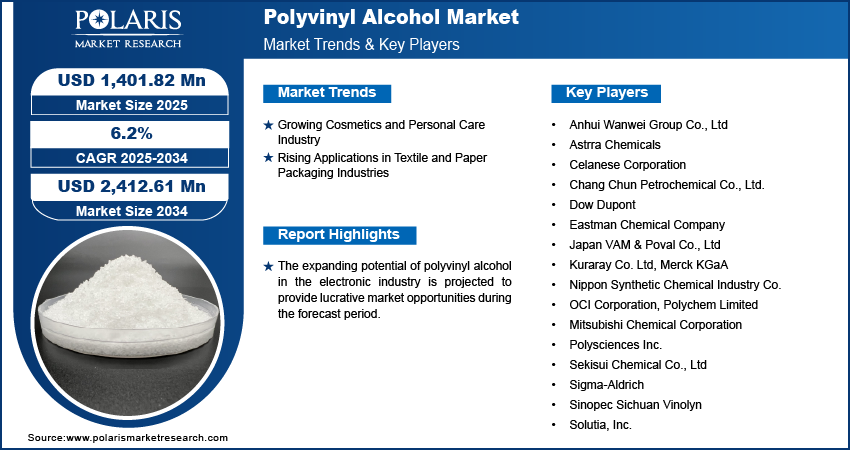

The global polyvinyl alcohol (PVA) market size was valued at USD 1,321.31 million in 2024. The market is projected to grow from USD 1,401.82 million in 2025 to USD 2,412.61 million by 2034. It is projected to exhibit a CAGR of 6.2% from 2025 to 2034.

Polyvinyl alcohol (PVA) is a colorless, odorless synthetic polymer that is soluble in water. The polymer is a crucial component in the composition of various end-use products, including coatings, adhesives, films, and textile fibers. It finds applications in diverse industries such as packaged foods, building, coatings, printing, textiles, electronics, paper, and cosmetics.

The growing demand for polyvinyl alcohol from the packaging sector, owing to its excellent oxygen resistance, absorption in water, and biodegradability, is the key factor driving the polyvinyl alcohol market growth. Further, the rising emphasis on eco-friendly packaging supports the market growth.

To Understand More About this Research: Request a Free Sample Report

Emerging demographic conditions like urbanization and a growing middle class shaping consumer behavior, rising consumer purchasing powers in emerging economies, and out-of-home consumption trends are expected to drive the food packaging market in the coming years, thereby positively impacting the polyvinyl alcohol market demand. The expanding potential of polyvinyl alcohol in the electronic industry for producing devices such as transistors that require high dielectric properties is expected to create lucrative polyvinyl alcohol market opportunities during the forecast period.

Polyvinyl Alcohol Market Dynamics

Growing Cosmetics and Personal Care Industry

The unique properties and versatility of PVA drive its demand in the cosmetics and personal care industry. Polyvinyl alcohol finds applications as a thickener and film-forming agent in various cosmetics and personal care products, including eye makeup, face masks, hair styling agents, and skin care items. With consumers increasingly looking for new products to add to their grooming and beauty routines, the cosmetics and personal care industry is projected to grow, impacting the polyvinyl alcohol market development favorably.

Rising Applications in Textile and Paper Packaging Industries

Polyvinyl alcohol provides several benefits to the textile industry, including adhesion, flexibility, and film-forming properties. It is widely used for wrap sizing, fabric finishing, and screen printing by textile manufacturers. Also, polyvinyl alcohol is used in the packaging industry owing to its exceptional barrier and film-forming properties. PVA films can be produced with different characteristics and thicknesses, making them suitable for a wide range of packaging applications. Thus, the growing use of polyvinyl alcohol in textile and paper packaging industries drives the PVA market expansion.

Polyvinyl Alcohol Market Segment Insights

Polyvinyl Alcohol Market Outlook by Grade Insights

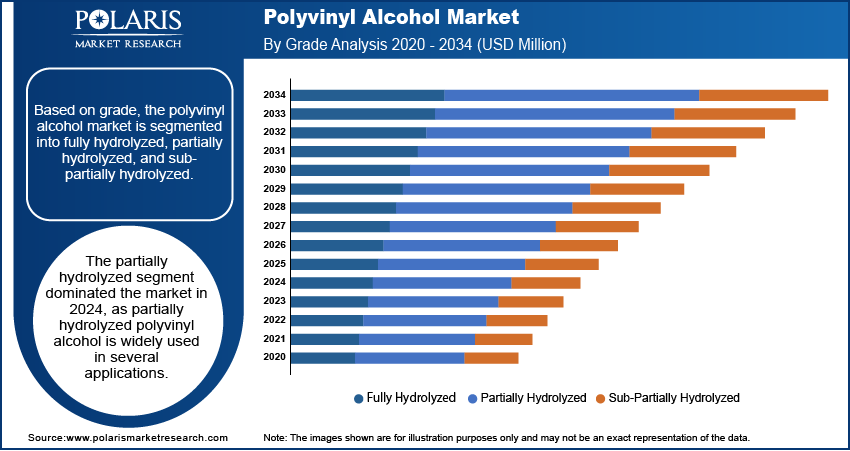

The polyvinyl alcohol market, based on grade, is segmented into fully hydrolyzed, partially hydrolyzed, and sub-partially hydrolyzed. The partially hydrolyzed segment dominated the market with the largest revenue share in 2024. Partially hydrolyzed polyvinyl alcohol is widely used in several applications, including warp-sizing for spun and filament yarn, pressure-sensitive adhesives, remoistening adhesives, soil stabilization, and films. Also, it finds applications as an emulsifier in ethylene-vinyl acetate (EVA) emulsions. Consequently, the demand for partially hydrolyzed PVA is high in industries such as food packaging and construction, driving the dominance of the segment in the market for polyvinyl alcohol.

The fully hydrolyzed segment is anticipated to witness the fastest growth from 2025 to 2034, owing to the rising demand in the textile processing and paper industries. The increasing use of paper as a plastic alternative in various sectors is anticipated to boost paper production in Asian countries. This trend is expected to drive growth in the fully hydrolyzed segment during the forecast period.

Polyvinyl Alcohol Market Assessment by Application Insights

The PVA market, based on application, is segmented into food packaging, textiles, paper, construction, polymerization aids, and others. The food packaging segment dominated the market with over 35.1% market revenue share in 2024. The growing demand for nontoxic and biodegradable packaging solutions in the food & beverage sector, along with advantages such as moisture resistance and increasing trends such as out-of-home consumption, drives the segment’s dominance in the market.

The construction segment is projected to register a significant growth rate during the forecast period due to the favorable properties of polyvinyl alcohol for construction activities. These include static percolation of cement slurries, adsorption capacity, superior solubility in water, and particle density.

Polyvinyl Alcohol Market Regional Analysis

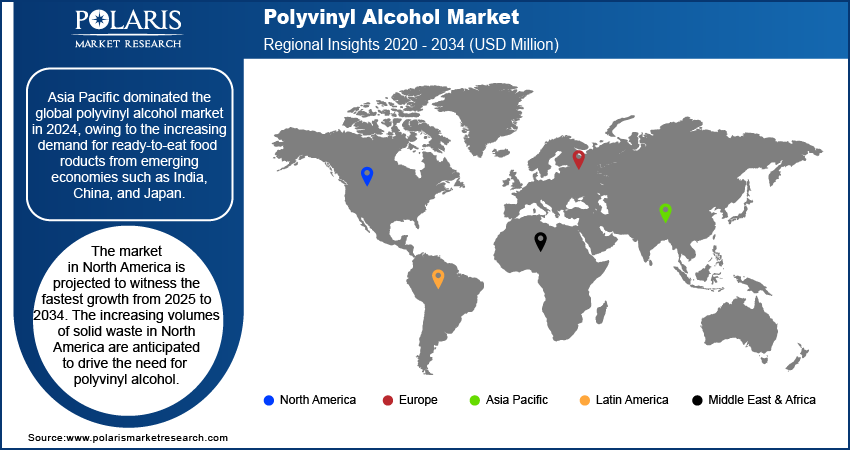

By region, the market report offers polyvinyl alcohol (PVA) market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the global market with a revenue share of 56.8% in 2024. The regional market growth is primarily fueled by the increasing demand for ready-to-eat food products from emerging economies such as India, China, and Japan. The presence of a large number of manufacturers and new end-use opportunities in major economies further contribute to the demand for polyvinyl alcohol in the region.

The North America polyvinyl alcohol market is projected to witness the fastest growth from 2025 to 2034. The increasing volumes of solid waste in North America are anticipated to drive the need for polyvinyl alcohol, as more sustainable packaging solutions are needed. In addition, the rising innovations in packaging and growing consumer demand for properties such as safety, technology, convenience, and sustainability are expected to fuel the regional market demand in the coming years.

Polyvinyl Alcohol Market – Key Players and Competitive Insights

The leading market players are focusing on research and development to cater to the evolving consumer needs. Also, they are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their market presence. To expand and survive in a highly competitive market, the polyvinyl alcohol market participants must offer innovative solutions.

In recent years, the market for polyvinyl alcohol has witnessed several innovation breakthroughs, with the top market participants providing solutions that help meet sustainability goals. The polyvinyl alcohol market research report offers a market assessment of all the leading players, including Anhui Wanwei Group Co., Ltd; Astrra Chemicals; Celanese Corporation; Chang Chun Petrochemical Co., Ltd.; Dow Dupont; Eastman Chemical Company; Japan VAM & Poval Co., Ltd; Kuraray Co. Ltd; Merck KGaA; Nippon Synthetic Chemical Industry Co.; OCI Corporation; Polychem Limited; Mitsubishi Chemical Corporation; Polysciences Inc.; Sekisui Chemical Co., Ltd; Sigma-Aldrich; Sinopec Sichuan Vinolyn; and Solutia, Inc.

List of Key Companies in Polyvinyl Alcohol Market

- Anhui Wanwei Group Co., Ltd

- Astrra Chemicals

- Celanese Corporation

- Chang Chun Petrochemical Co., Ltd.

- Dow Dupont

- Eastman Chemical Company

- Japan VAM & Poval Co., Ltd

- Kuraray Co. Ltd

- Merck KGaA

- Nippon Synthetic Chemical Industry Co.

- OCI Corporation

- Polychem Limited

- Mitsubishi Chemical Corporation

- Polysciences Inc.

- Sekisui Chemical Co., Ltd

- Sigma-Aldrich

- Sinopec Sichuan Vinolyn

- Solutia, Inc.

Polyvinyl Alcohol Industry Developments

March 2023: Chang Chun Petrochemical Co., Ltd. announced the development of a new copper foil plant in North America. According to the company, the plant is set to commence operations in early 2026 and will have a production capacity of 50,000 tons per annum.

February 2023: The Mitsubishi Chemical Corporation announced the establishment of its new facility at the Okayama Plant. The company stated that it plans to boost the production of its specialty polyvinyl alcohol resin brands, Nichigo G-Polymer and GOHSENX, with the strategic move.

Polyvinyl Alcohol Market Segmentation

By Grade Outlook

- Fully Hydrolyzed

- Partially Hydrolyzed

- Sub-Partially Hydrolyzed

By Application Outlook

- Food Packaging

- Textiles

- Paper

- Construction

- Polymerization Aids

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polyvinyl Alcohol Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,321.31 million |

|

Market Size Value in 2025 |

USD 1,401.82 million |

|

Revenue Forecast by 2034 |

USD 2,412.61 million |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 1,321.31 million in 2024 and is projected to grow to USD 2,412.61 million by 2034.

The market is projected to register a CAGR of 6.2% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key market players are Anhui Wanwei Group Co., Ltd; Astrra Chemicals; Celanese Corporation; Chang Chun Petrochemical Co., Ltd.; Dow Dupont; Eastman Chemical Company; Japan VAM & Poval Co., Ltd; Kuraray Co. Ltd; Merck KGaA; Nippon Synthetic Chemical Industry Co.; OCI Corporation; Polychem Limited; Mitsubishi Chemical Corporation; Polysciences Inc.; Sekisui Chemical Co., Ltd; Sigma-Aldrich; Sinopec Sichuan Vinolyn; and Solutia, Inc.

The partially hydrolyzed segment dominated the market in 2024.

The food packaging segment dominated the market in 2024.