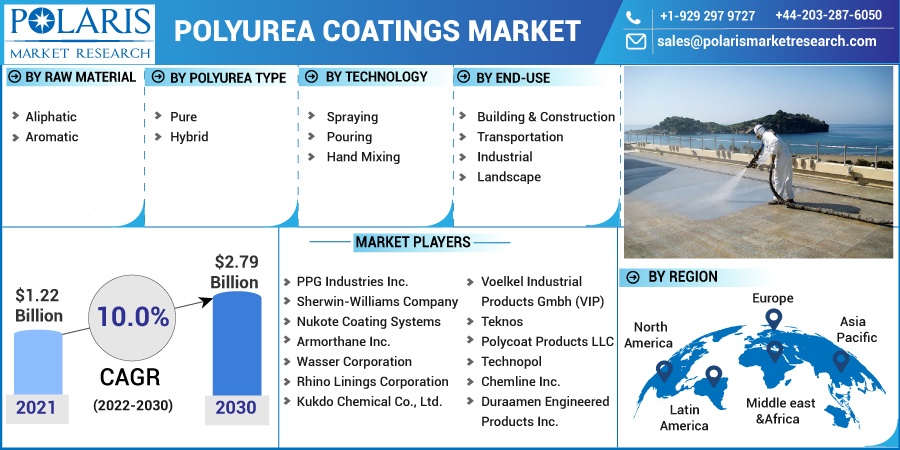

Polyurea Coatings Market Share, Size, Trends, Industry Analysis Report, By Raw Material (Aliphatic, Aromatic); By Polyurea Type (Pure, Hybrid); By Technology; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Aug-2022

- Pages: 115

- Format: PDF

- Report ID: PM2536

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

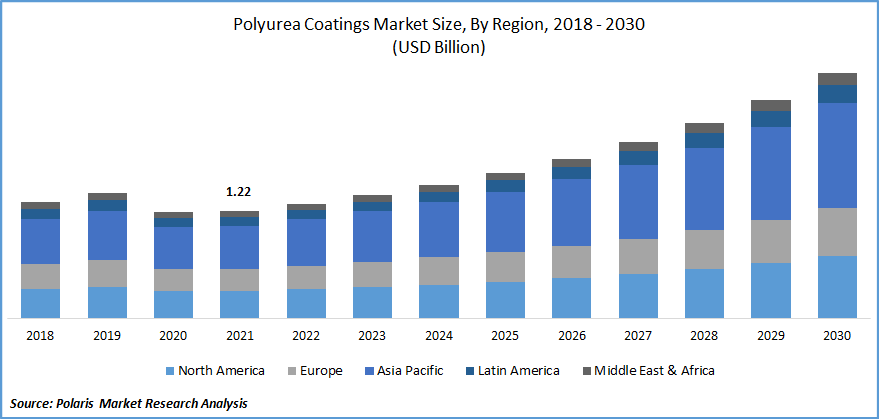

The global polyurea coatings market was valued at USD 1.22 billion in 2021 and is expected to grow at a CAGR of 10.0% during the forecast period. The growing demand for polyurea coatings is expected to be driven by the increasing penetration in the application industries owing to their superior properties such as moisture and chemical resistance.

Know more about this report: Request for sample pages

Polyurea coatings are replacing epoxy, polyurethane, and other protective solutions on account of their high-performance characteristics including fast setting and excellent abrasion and scratch resistance are expected to drive market growth. Furthermore, the growing demand for the product in the building & construction sector across multiple applications is expected to have a positive impact on the market growth.

The COVID-19 pandemic had a negative impact on the growth of the polyurea coatings market. The economic slowdown and negligible operations in the building & construction and industrial sectors led to a decline in the demand for the product across the globe. However, the activities resumed from the end of 2020 led to a steady increase in the demand for the product.

As the renovation and new construction projects in developing economies grew post the peak pandemic time steadily led to the demand for polyurea coatings in countries such as China, India, Brazil, and Mexico, among others. In addition, the growing industrial activities in the Asia Pacific are likely to complement market growth over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global construction industry is likely to be driven by Asia Pacific owing to the increasing government investment in public infrastructure and upcoming residential and commercial projects in India and China. Furthermore, the rising need for high-rise buildings and skyscrapers is likely to have a positive impact on the market growth for the product.

According to a recent report, the global construction industry is expected to grow by 85% to USD 15.5 trillion by 2030 with China, India, and the U.S. spearheading the growth accounting for around 57.0% of the overall revenue share. As a result, the demand for the product is expected to witness growth with rising penetration for polyurea coatings owing to their moisture and heat resistance.

Report Segmentation

The market is primarily segmented based on raw material, polyurea type, technology, end-use, and region.

|

By Raw Material |

By Polyurea Type |

By Technology |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Aromatic segment accounted for the largest share in 2021

Aromatic polyurea coatings market segment accounted for the highest revenue share in 2021 owing to low cost as compared to its counterpart along with high-performance characteristics of the product over polyurethane, epoxy, and other solutions. In addition, the increasing demand for automotive and industrial applications complements market growth over the forecast period.

Aliphatic polyurea coatings are expensive as compared to aromatic solutions; however, the need for a solution with better properties in terms of moisture and heat resistance, effective bonding, and controllable coating thickness based on requirements is expected to drive the demand for aliphatic polyurea coatings market.

Pure polyurea coatings are expected to spearhead the market growth

The demand for pure solutions is driven by the rising demand from the buildings & construction industry. The growing demand for the product as a base coat on several substrates including metal and wood is expected to drive the demand for the segment over the coming years. In addition, the growing need for environmental friendly products is likely to complement market growth.

Hybrid solutions to witness growth owing to their extensive use in piping and related applications. Furthermore, the growing infrastructural and industrial construction projects is expected to have an impact on the demand for the hybrids over the forecast period. In addition, increasing penetration of the segment in roof and tank coatings is expected to drive revenue growth over the forecast period.

Pouring technology is expected to witness faster growth as compared to its counterparts

The demand for pouring technology is expected to see a significant surge over the forecast period owing to the increasing adoption in Asia Pacific. The growing residential and commercial construction in the region and high demand for the technology in roofing and flooring applications is expected to drive market growth.

Rising need for accurate and speedy application of the products is expected to drive the demand for spraying technology. In addition, the growing demand for coating solutions in industrial and building & construction sectors is expected to have a positive impact on the market growth over the forecast period.

Building & construction segment is expected to account for the largest share in 2030

Building & construction segment is expected to dominate the market over the forecast period owing to the increasing adoption of polyurea coatings for roofing and flooring applications across residential and commercial sectors. The growing need for high-performing coatings and improved alternatives over polyurethane and epoxy is likely to have a positive impact on the revenue growth over the forecast period.

Automotive is expected to be one of the other significant applications for polyurea coatings

Asia Pacific is expected to dominate and witness the fastest growth over the forecast period

Asia Pacific is the largest region for polyurea coatings and is expected to witness faster growth of 10.8% over the forecast period owing to the initiatives taken by the governments across the countries. In addition, the growing building & construction projects in the commercial and residential sectors are expected to drive demand over the forecast period.

North America is expected to be the second largest region for polyurea coatings on account of the growing penetration of the product in residential construction for flooring and roofing applications. Furthermore, the renovation projects undertaken across the U.S. is likely to have a positive impact on revenue growth.

Competitive Insight

Some of the major players operating in the global market include PPG Industries Inc., Sherwin-Williams Company, Nukote Coating Systems, Armorthane Inc., Wasser Corporation, Rhino Linings Corporation, Kukdo Chemical Co., Ltd., Voelkel Industrial Products Gmbh (VIP), Teknos, Polycoat Products LLC, Technopol, Chemline Inc., Duraamen Engineered Products Inc.

Recent Developments

In February 2022, PPG Industries announced a USD 10 million investment in a novel 82,000-square-foot manufacturing facility and class A paint line at its Greenville, South Carolina, coatings services facility.

In July 2020, Nukote Coating Systems acquired Intuitive Coatings with full integration of the Ionyx product line into Nukote Premera product lines. The Ionyx product line will be manufactured along with other Nukote products and will continue as a premium Premera brand.

Polyurea Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.22 billion |

|

Revenue forecast in 2030 |

USD 2.79 billion |

|

CAGR |

10.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Raw Material, By Polyurea Type, By Technology, By End-Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

PPG Industries Inc., Sherwin-Williams Company, Nukote Coating Systems, Armorthane Inc., Wasser Corporation, Rhino Linings Corporation, Kukdo Chemical Co., Ltd., Voelkel Industrial Products Gmbh (VIP), Teknos, Polycoat Products LLC, Technopol, Chemline Inc., Duraamen Engineered Products Inc. |