Polyolefins Market Size, Share, Trends, Industry Analysis Report: By Feedstock (Polyethylene, Polypropylene, Ethylene Vinyl Acetate, Thermoplastic Olefins, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 116

- Format: PDF

- Report ID: PM1520

- Base Year: 2024

- Historical Data: 2020-2023

Polyolefins Market Overview

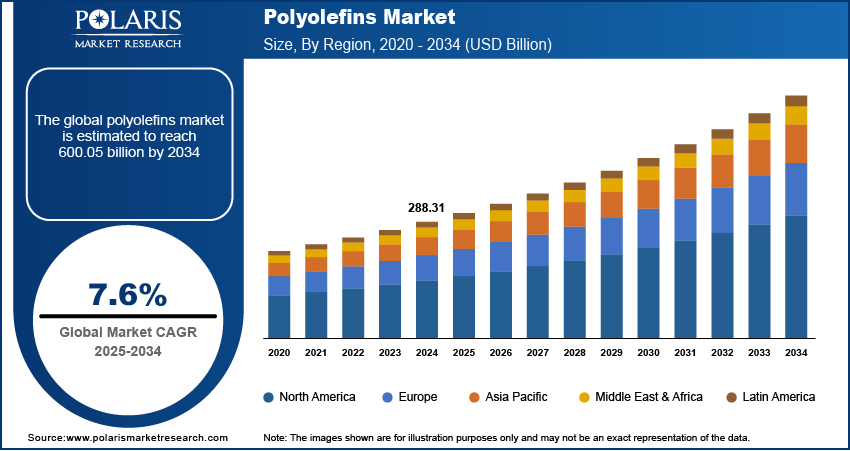

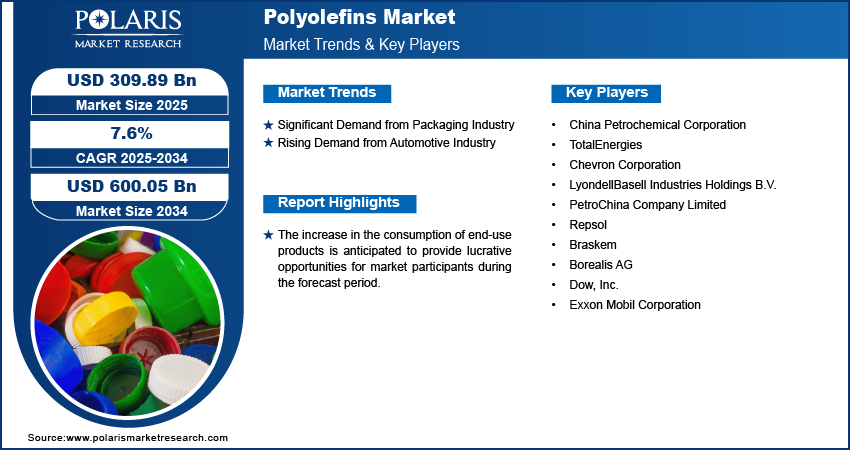

The global polyolefins market size was valued at USD 288.31 billion in 2024. The market is projected to grow from USD 309.89 billion in 2025 to USD 600.05 billion by 2034. It is projected to exhibit a CAGR of 7.6% from 2025 to 2034.

Polyolefins are a group of thermoplastics made from polymers of olefins, such as propylene and ethylene. They are among the most widely used synthetic polymers for manufacturing a variety of end-use products. Polyolefins are favored for a wide range of applications due to their favorable properties, such as lightweight and high chemical resistance, along with their lost cost of production.

To Understand More About this Research: Request a Free Sample Report

Several factors, including the development of the solar power industry and rising demand from the packaging sector in major economies, are driving the polyolefins market development. The implementation of favorable policies and regulations related to packaging and waste disposal is further encouraging the use of high-quality and innovative polyolefins for labeling and packaging products, thereby supporting market growth.

Leading market participants are constantly upgrading their product portfolios to meet the growing demand from various application sectors, such as film and sheet production and injection molding, which is anticipated to support polyolefins market expansion in the coming years. The increase in the consumption of end-use products, such as flexible packaging and bio-based products, is anticipated to provide lucrative market opportunities during the forecast period.

Polyolefins Market Dynamics

Significant Demand from Packaging Industry

Polyolefins, composed of polypropylene and polyethylene, are widely used for producing different packaging products such as containers, films, and bags due to their durability, lightweight, and cost-effectiveness. With the growth of e-commerce, there has been a surge in the need for packaging materials that are flexible and strong, making polyolefins an ideal choice. The increase in demand for innovative packaging materials such as polyolefins from the packaging industry drives the polyolefins market growth.

Rising Demand from Automotive Industry

Polyolefins are gaining popularity in the automotive industry owing to their favorable properties. They are lighter than other materials such as metal and rubber, which helps manufacturers reduce vehicle weight and improve fuel efficiency. Also, polyolefins are cost-effective to manufacture and can improve the comfort and safety of a vehicle. They are used in several vehicle parts, including the engine section, bodywork, and exterior and interior components. The rising applications of polyolefins in the automotive sector are a major polyolefins market revenue contributor.

Polyolefins Market Segment Insights

Polyolefins Market Outlook by Feedstock Insights

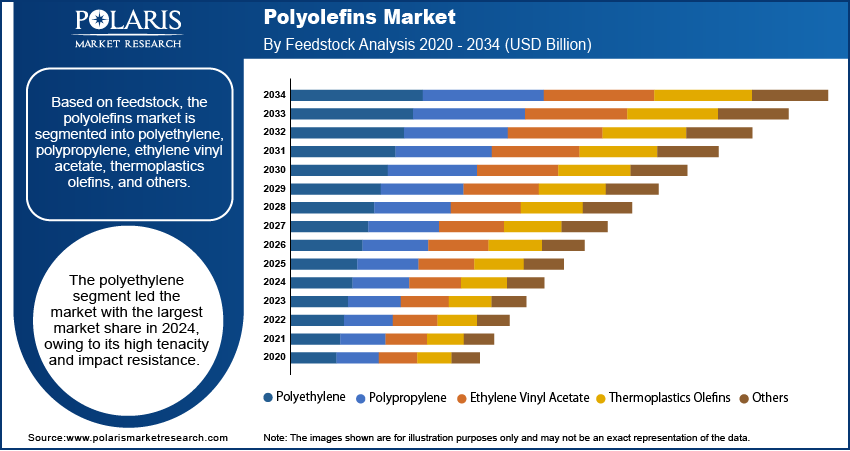

The polyolefins market, based on feedstock, is segmented into polyethylene, polypropylene, ethylene vinyl acetate, thermoplastics olefins, and others. The polyethylene segment led the market with the largest market share of 41.2% in 2024. Its high tenacity and impact resistance contribute to its strong market appeal. Products made from polyethylene have gained popularity, particularly among the middle-class population, driven by urbanization, rising disposable incomes, and significant advancements in material science. The segment’s robust growth is further supported by the strategic efforts of many market players and their well-established networks.

The polypropylene segment accounted for a significant market revenue share of 31.0% in 2024. Polypropylene has high tensile strength, making it strong enough to handle heavy loads. Also, it is resistant to fatigue, has excellent chemical resistance, and can withstand extreme temperatures and freezing. The ability to mold polyolefins into various shapes means it can easily produced in a living hinge, which is a thin piece of material that can be bent without breaking. Thus, the durability and versatility of polypropylene contribute to its high share in the market.

Polyolefins Market Assessment by Application Insights

The polyolefins market, based on application, is segmented into films and sheets, injection molding, blow molding, extrusion coating, fiber, and others. The films and sheets segment accounted for the largest polyolefins market share of 28.1% in 2024. Films and sheets made using polyolefins provide improved clarity and performance for the consumer goods industry. Also, they have stronger puncture resistance and are more durable than films and sheets made from other materials. Thus, the various benefits of polyolefin films and sheets contribute to their dominance in the market.

The injection molding segment is projected to witness significant growth from 2025 to 2034, owing to its ability to produce custom polyolefin materials. The rising demand for polyolefin injection molding from various end-use sectors such as automotive, healthcare, and packaging is also contributing to the robust growth of the segment. Growing awareness about the benefits of polyolefin injection molding among manufacturers is expected to further drive the segment’s growth in the global market.

Polyolefins Market Regional Analysis

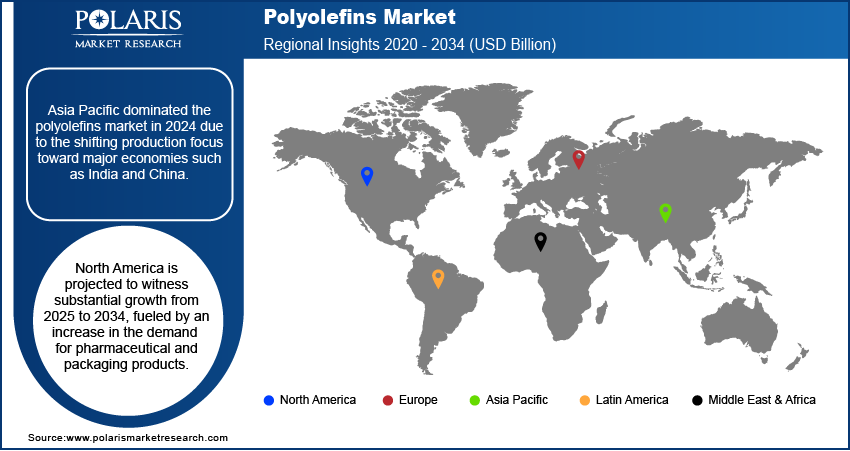

By region, the market report offers polyolefins market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market with a revenue share of 51.8% in 2024. The region is known for its easily accessible land and the availability of skilled labor at low costs. The shifting production focus toward major economies such as India and China drives regional market dominance. Further, the presence of rapidly growing industries, such as electronics and telecommunications, provides significant potential for polyolefin manufacturers in the region.

The polyolefins market in North America is projected to witness substantial growth from 2025 to 2034. The US plays a significant role by holding the largest share of the regional market. The North America polyolefins market is distinguished by an increase in the demand for pharmaceutical and packaging products, which is expected to drive the requirement for polyolefins in the region during the forecast period.

Polyolefins Market – Key Players and Competitive Insights

The polyolefins market is characterized by intense competition, driven by factors such as innovative product offerings, technological advancements, mergers and acquisitions, and other strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, offering, and customer service. Also, they make significant investments in R&D initiatives to introduce advanced polyolefins to cater to diverse consumer needs.

Several market participants are prioritizing the development of sustainable and eco-friendly polyolefins that comply with stringent government regulations. The polyolefins market research report offers a market assessment of all the leading players, including China Petrochemical Corporation; TotalEnergies; Chevron Corporation; LyondellBasell Industries Holdings B.V.; PetroChina Company Limited; Repsol; Braskem; Borealis AG; Dow, Inc.; and Exxon Mobil Corporation.

List of Key Companies in Polyolefins Market

- China Petrochemical Corporation

- TotalEnergies

- Chevron Corporation

- LyondellBasell Industries Holdings B.V.

- PetroChina Company Limited

- Repsol

- Braskem

- Borealis AG

- Dow, Inc.

- Exxon Mobil Corporation

Polyolefins Industry Developments

August 2024: Borealis, a global player offering sustainable plastic solutions, collaborated with Infinium, an eFuels company, to create low-carbon-footprint plastics using waste carbon dioxide emissions.

May 2024: Lummus Technology announced its collaboration with Sumitomo Chemical for licensing and commercializing Sumitomo Chemical’s LDPE/EVA and rPMMA technologies. According to Lummus, Sumitomo Chemical will leverage Lummus’ global marketing reach and engineering capabilities to deliver the technologies to a wider consumer base.

Polyolefins Market Segmentation

By Feedstock Outlook

- Polyethylene

- Polypropylene

- Ethylene Vinyl Acetate

- Thermoplastics Olefins

- Others

By Application Outlook

- Films and Sheets

- Injection Molding

- Blow Molding

- Extrusion Coating

- Fiber

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polyolefins Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 288.31 billion |

|

Market Size Value in 2025 |

USD 309.89 billion |

|

Revenue Forecast by 2034 |

USD 600.05 billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 288.31 billion in 2024 and is projected to grow to USD 600.05 billion by 2034.

The market is projected to register a CAGR of 7.6% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key players in the market are China Petrochemical Corporation; TotalEnergies; Chevron Corporation; LyondellBasell Industries Holdings B.V.; PetroChina Company Limited; Repsol; Braskem; Borealis AG; Dow, Inc.; and Exxon Mobil Corporation.

The polyethylene segment accounted for the largest market share in 2024.

The films and sheets segment accounted for the largest polyolefins market share in 2024.