Polyol Sweeteners Market Share, Size, Trends, Industry Analysis Report, By Form (Liquid, Powder); By Product; By Function; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: 2110

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

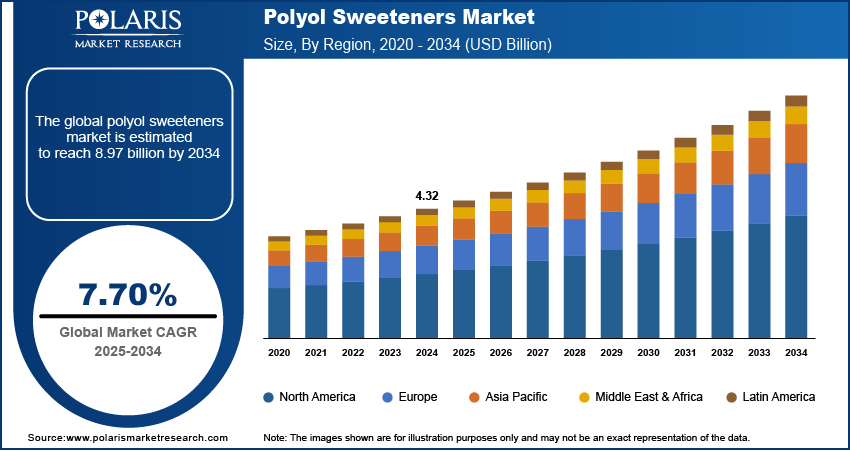

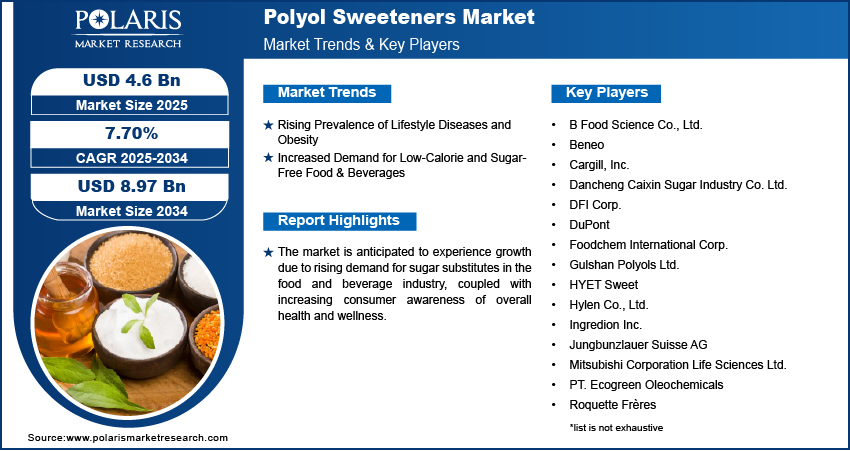

The global Polyol Sweeteners market was valued at USD 3,610.39 million in 2023 and is expected to grow at a CAGR of 5.9% during the forecast period.

The market is anticipated to experience growth due to rising demand for sugar substitutes in the food and beverage industry, coupled with increasing consumer awareness of overall health and wellness. Polyol sweeteners, derived from the fermentation or hydro-generation of carbohydrates found in bio-wastes like corn cob, birch bark, and pulp paper waste, play a significant role in meeting this demand.

Commonly known as sugar alcohol, this product is increasingly employed as a favorable "natural" ingredient across various applications, including food, pharmaceuticals, cosmetics, and other technical and chemical industries. The U.S. polyol sweeteners market is expected to experience significant growth, driven by increasing consumer demand for healthier and low-calorie food products. Additionally, the product finds utility as a binder, bulking agent, humectant, and chemical reactant in industries such as textile, tobacco, and paper.

To Understand More About this Research: Request a Free Sample Report

Sorbitol is derived through the catalytic hydrogenation of d-glucose, resulting in the formation of glucitol (d-sorbitol). It serves various purposes as a bulking agent, sequestrant, thickener, sweetener, and humectant across diverse applications. The pharmaceutical industry is expected to witness significant growth in the demand for sorbitol, attributed to its increasing use as a stabilizer and excipient in drug formulation, along with its role in the preparation of synthetic vitamin C.

Polyol sweeteners, including sorbitol, function as bodying agents in the production of elixirs, tonics, syrups, and pills. Moreover, these sweeteners are employed in the manufacturing of ointments, gelatin capsules, and emulsion ointments due to their effective plasticizing and humectant properties. In oral care, products like sugar alcohols, toothpaste, and mouthwash not only provide resistance to fermentation but also impart a refreshing sweetness to the final product.

Nevertheless, the overconsumption of sugar alcohol can lead to gastrointestinal symptoms, including gas and/or laxative effects. In this context, the unabsorbed portion of polyol sweeteners enters the large intestine in the human body, binding with water, initiating fermentation, and causing diarrhea and flatulence. The United States Food and Drug Administration (FDA) requires a laxative warning on products containing more than 10% sugar alcohol.

Industry Dynamics

Growth Drivers

Increasing Interest in Health-Conscious Sugar Alternatives

The global market for polyol sweeteners is experiencing rapid growth, fueled by an increasing demand for healthier alternatives to sugar. Sucrose, the prevalent table sugar, is known for its high-calorie content and is implicated in lifestyle disorders such as obesity, diabetes, cardiovascular disease, and tooth decay. Polyols, being sugarless sweeteners, are carbohydrates. These substitutes are commonly utilized in various products, including carbonated beverages, baked goods, powdered drink mixes, jellies, jams, and dairy items. They are also integral in the production of fruit juices, frozen desserts, chewing gums, and gelatines. Notably, sugary drinks, identified as the primary source of added sugars by the American Heart Association, are driving consumer preference towards sugar-free beverages, contributing to the growth of the global polyol sweeteners market.

Report Segmentation

The market is primarily segmented based on form, function, product, application, and region.

|

By Form |

By Function |

By Product |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

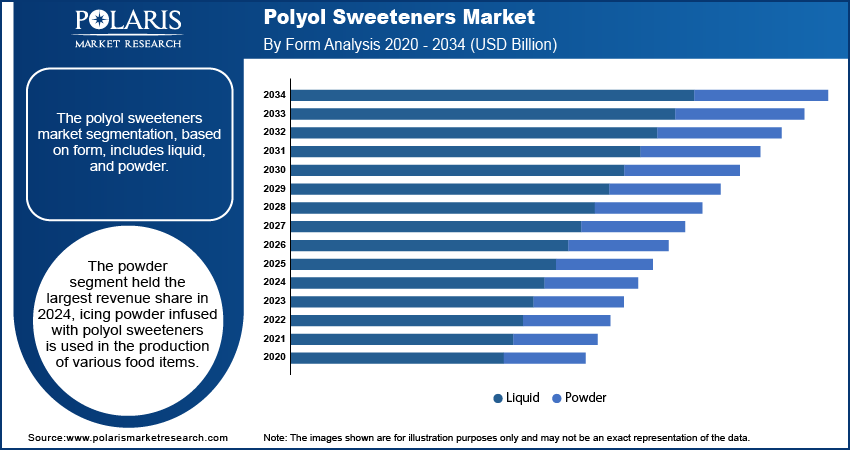

By Form Analysis

The Powder Segment Held the Largest Revenue Share in 2022

Icing powder infused with polyol sweeteners finds application in the production of various food items, including candies, chewing gums, and bakery goods. In its solid crystal form, this product is extensively employed as a component in pharmaceuticals.

The demand for powdered or crystallized sugar alcohols is anticipated to experience consistent growth in the forecast period due to their convenient handling, ease of transportation and storage, and extended shelf life, leading to reduced risk of spoilage. Powdered polyol sweeteners serve similar functions to their liquid counterparts and are commonly used as bulking and coating agents in the manufacturing of nutraceuticals and functional foods.

Crystallized and powdered sorbitol, xylitol, and maltitol function as food additives in mint tablets, polydextrose, and other sugar-free products, such as shrimp balls, frozen raw fish, roasted fish fillet, and dried squid thread, among various frozen aquatic items. The increasing demand for these products, coupled with the growing consumption of frozen foods in China and South Korea, is expected to drive the growth of this segment in the coming years.

Polyol sweeteners in liquid or syrup form exhibit excellent water solubility, making them ideal for the production of pharmaceutical and nutraceutical formulations. The increasing consumer awareness of low-calorie intake and the demand for naturally-derived sugar substitutes are expected to drive the popularity of liquid sugar alcohols.

By Application Analysis

The Food & Beverages Segment Accounted for the Highest Market Share During the Forecast Period

The increasing demand for bulk sweeteners like mannitol, isomalt, and sorbitol in the production of dairy items, frozen desserts, fruit spreads, and baked goods is expected to drive growth in this segment in the coming years.

Polyol sweeteners, including isomalt, sorbitol, erythritol, lactitol, polyglycitols, and maltitol, have received approval from the United States Food and Drug Administration (FDA) for use in food products either as food additives or as Generally Recognized as Safe (GRAS) chemicals. Among them, mannitol has interim food additive status, and xylitol is deemed acceptable for use in special dietary foods. This regulatory approval contributes to their increasing adoption in various food applications. Sugar alcohols are extensively employed in coating confectionery items like chewing gums and candies due to their unique non-hygroscopic properties. Polyols, such as sorbitol, mannitol, and xylitol, have lower calorie content and demonstrate similar sweetening properties to sucrose. The increasing popularity of sugar-free chewing gums, driven by evolving food consumption trends and dietary preferences, is expected to boost growth in this segment.

The personal care and cosmetics application segment is expected to demonstrate a consistent growth rate in the coming years. Increasing consumer preference for oral hygiene and dental health is anticipated to fuel the demand for oral care products based on polyol sweeteners, including mouthwash and toothpaste, thereby contributing to the growth of this segment.

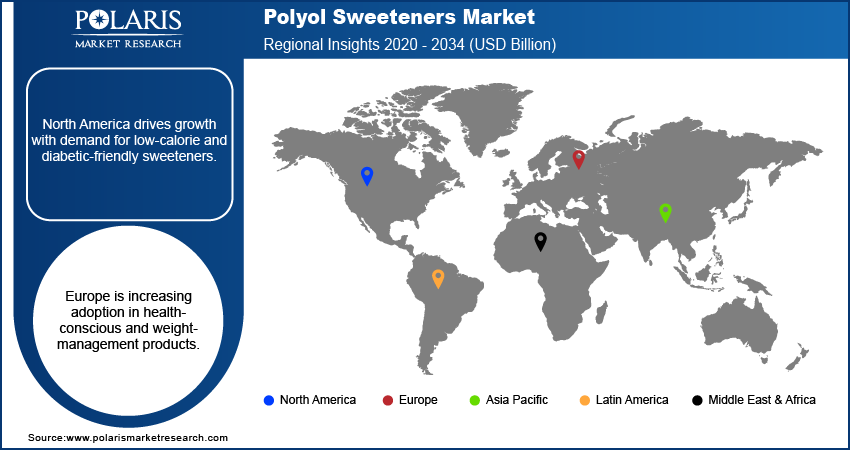

Regional Insights

North America Dominated the Largest Market in 2022

The increasing demand for clean-label products and the growing trend of consuming sugar-free food and beverages are driving the expansion of the polyol sweeteners market in the region. Anticipated contributions to market growth include the introduction of new products, such as sugar-free energy drinks, soda, and soft drinks containing these sweeteners by major beverage companies.

Europe is poised for robust growth in the polyol sweeteners market in the coming years, driven by the escalating use of sugar-free products. Initiatives from public health groups, which advocate for regulations aimed at curbing the ready availability of foods high in added sugars, are a primary driver of market growth in the region.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- B Food Science Co., Ltd.

- Beneo

- Cargill, Inc.

- Dancheng Caixin Sugar Industry Co. Ltd.

- DFI Corp.

- DuPont

- Foodchem International Corp.

- Gulshan Polyols Ltd.

- HYET Sweet

- Hylen Co., Ltd.

- Ingredion Inc.

- Jungbunzlauer Suisse AG

- Mitsubishi Corporation Life Sciences Ltd.

- PT. Ecogreen Oleochemicals

- Roquette Frères

- Shandong Futaste Co.

- Shijiazhuang Huaxu Pharmaceutical Co., Ltd.

- SPI Pharma

- Sukhjit Starch & Chemicals Ltd.

- Sweeteners Plus, LLC

- Tereos

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- Zibo Shunda Biotech Co., Ltd.

- zuChem

Recent Developments

- In March 2022, The Azcuba Sugar Business Group is dedicated to increasing its manufacturing capacity by approximately 1,100 tons of sorbitol this year. The company's sorbitol is predominantly utilized in the manufacturing of toothpaste, as well as various other applications such as the production of food, cosmetics, and pharmaceuticals.

- In March 2022, Drink Loud has launched its cannabis elixir in dispensaries across California, USA. The product, which contains 100 milligrams of cannabis, is packaged in a 1.8-ounce bottle using proprietary nanotechnology. The elixirs are sweetened with both sugar and xylitol, and they are gluten-free, vegan, and free from GMOs.

Polyol Sweeteners Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3,610.39 million |

|

Revenue forecast in 2032 |

USD 5,710.97 million |

|

CAGR |

5.9% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Form, By Product, By Function, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Polyol Sweeteners Market report covering key segments are form, function, product, application, and region

Polyol Sweeteners Market Size Worth $ 5,710.97 Million.

The global Polyol Sweeteners market is expected to grow at a CAGR of 5.9% during the forecast period.

North America is leading the global market?

The key driving factors in Polyol Sweeteners Market is Increasing Needs in the Food and Beverage Sector.