Polyethyleneimine Market Share, Size, Trends, Industry Analysis Report, By Type (Linear, Branched); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 115

- Format: PDF

- Report ID: PM4951

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

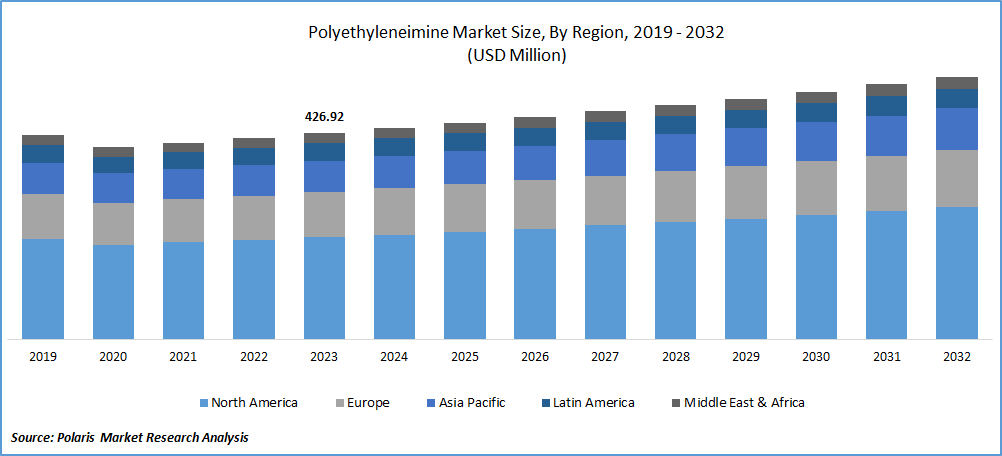

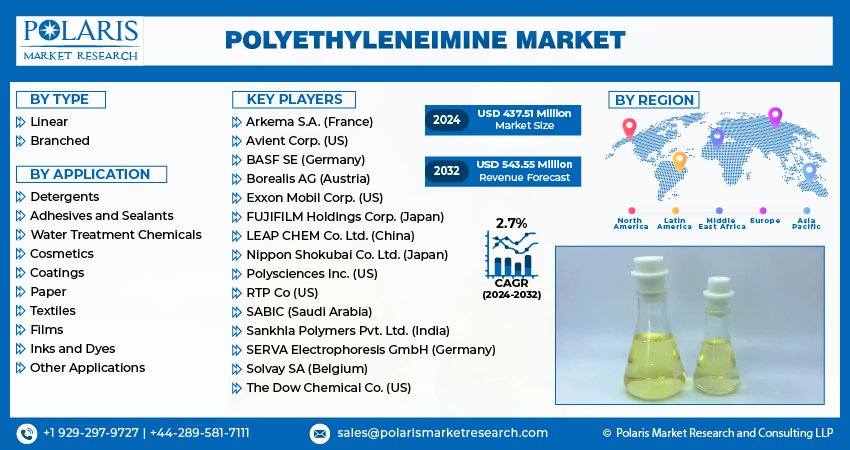

Polyethyleneimine Market size was valued at USD 426.92 million in 2023. The market is anticipated to grow from USD 437.51 million in 2024 to USD 543.55 million by 2032, exhibiting the CAGR of 2.7% during the forecast period.

Market Overview

The global polyethyleneimine (PEI) market is experiencing notable growth, driven by its versatile applications across various industries. Polyethyleneimine is a polymer with a high cationic charge density, making it valuable in numerous chemical processes and end-use applications. Its primary applications include water treatment, adhesives, detergents, and paper manufacturing. In water treatment, PEI is used as a flocculant and coagulant due to its ability to bind with negatively charged contaminants, enhancing purification efficiency. Additionally, in the adhesives sector, PEI's strong bonding capabilities improve adhesive performance in both industrial and consumer products.

To Understand More About this Research:Request a Free Sample Report

Several driving factors contribute to the expanding PEI market. Firstly, the increasing demand for clean and safe water has bolstered the use of PEI in water treatment processes, particularly in regions facing water scarcity and pollution challenges. As environmental regulations become stricter globally, the need for effective water treatment chemicals is expected to rise, further propelling the PEI market. Secondly, the growth of the adhesives industry, driven by the rising demand for lightweight and durable materials in automotive and construction sectors, enhances PEI's market prospects. PEI's ability to improve adhesive properties aligns well with industry trends towards high-performance materials.

Furthermore, advancements in the manufacturing of PEI, leading to cost-effective production processes and improved product quality, are likely to drive market growth. Innovations in application methods and formulations are also expanding PEI's utility across new industrial domains. Overall, the polyethyleneimine market is poised for sustained growth, underpinned by its broad applicability and the increasing demand for efficient and environmentally friendly solutions in various industrial processes.

Growth Drivers

Increasing Demand for Personal Care Products

The global polyethyleneimine (PEI) market is witnessing significant growth, fueled by the increasing demand for personal care products. Polyethyleneimine is valued in the personal care industry for its multifunctional properties, including its ability to enhance the performance of skincare and haircare formulations. PEI acts as a conditioning agent, film-former, and emulsifier, contributing to improved texture, stability, and efficacy of personal care products. The rising consumer preference for high-quality personal care products, driven by heightened awareness of grooming and hygiene, is a key factor propelling the demand for PEI. Additionally, the trend towards natural and safe ingredients in personal care formulations aligns with the use of PEI, as it can be effectively incorporated into eco-friendly and sustainable product lines. As the personal care industry continues to expand globally, the demand for polyethyleneimine is expected to grow, reinforcing its market position as a vital ingredient in personal care product formulations.

Rise in Water Treatment Procedures

Rising population is driving the demand for multiple products, specifically food and water, which will create demand potential for polyethylene-imine. As per the United Nations Children's Fund (UNCF), around 700 Mn people in the world will suffer from water shortages by 2023, while 50% of the global population is projected to register a water shortage by 2030. This trend is forcing nations to focus on alternative water sources around the world.

Additionally, according to the United States Environment Program (UNEP), in 2024, 2.4 Billion people will live in water-scarce countries. Nearly 58% of the water from homes is expected to be treated worldwide. Moreover, growing awareness about water treatment plants is likely to spur the deployment of new water filtering plants, thereby increasing polyethyleneimine utility over the study period.

Restraining Factors

Lower Biodegradability of Polyethyleneimine

The limited recycling efficiency of polyethyleneimine is likely to limit its utility in the long run. This is driven by growing government initiatives and policies to reduce environmental pollution and reduce thermoplastics, including polyethyleneimine, in the world. The changing climatic conditions, increasing greenhouse gas emissions, and rising soil pollution will further restrict market growth over the forecast period.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

Branched Segment is Expected to Witness the Highest Growth During the Forecast Period

The branched segment is anticipated to grow at a significant CAGR during the projected period, mainly driven by its use in biomedical applications due to its potential hemocompatibility along with its physicochemical properties. The increasing development of medicines and therapies using DNA and RNA drugs is expected to create significant demand for polyethyleneimine in the next few years. Additionally, the ongoing chemical modifications to enhance the characteristics of polyethyleneimine for several applications will further propel market expansion in the coming years.

The linear segment led the industry market with a substantial revenue share in 2023, largely attributable to its ability to offer surface adherence. This is mostly utilized in the inks and dyes, with the increasing consumer willingness to spend money on premium housing and office outlook. Moreover, it is also incorporated into gene therapy development, which will certainly drive its demand in the coming years.

By Application Analysis

Paper Segment Accounted for the Largest Market Share in 2023

The paper segment accounted for the largest market share in 2023. This is mainly attributable to its potential to alter cellulose fibers' surfaces, driven by its wet strength and water solubility. The enormous ability to offer longevity and quality in paper goods will essentially boost its addition to paper manufacturing activities. Moreover, the effectiveness of bonding paper with multiple substrates is likely to boost its integration into paper and packaging applications throughout the forecast timeframe.

The textile segment is expected to grow at the fastest rate over the next few years on account of the rapid increase in demand for premium-quality and water-resistant textiles. The proficiency in enhancing fabric properties and boosting color spread is stimulating polyethyleneimine polymer integration in the textile industry. The ongoing demand for durable textiles among consumers will further propel their demand and, thereby, production in the marketplace.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North American region held the dominant share in 2023. This is driven by the growing packaged foods among the nations, primarily the US and Canada. According to the statistics published by the Government of Canada, retail sales of packaged food products reached CAND 77.6 billion in 2023. This will promptly drive the use of packaging polymers, including polyethyleneimine, in the region. Moreover, increasing demand for water treatment chemicals, expanding the cosmetics industry, and growing demand for sealants and adhesives are projected to foster market growth.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing disposable income, which is boosting demand for personal care products and packaging equipment. The increasing construction activities are expected to drive polyethyleneimine market growth during the forecast period. According to the Times Property, by 2047, the real estate market in India is projected to reach USD 5.8 trillion. This will fuel the need for the required resources and materials in the marketplace, including adhesives and sealants.

Key Market Players & Competitive Insights

Strategic Expansion Activities to Drive the Competition

The polyethyleneimine market is fairly consolidated and is anticipated to witness competition among the market players. The increasing research investments, acquisitions, and partnerships to gain a competitive edge over their peers are facilitating a favorable market for polyethyleneimine. For instance, in July 2021, Diab completed the acquisition of a PEI thermoplastic foam manufacturing facility from Sabic to add recyclable polyetherimide (PEI) thermoplastic foam to its product portfolio.

Some of the major players operating in the global market include:

- Arkema S.A. (France)

- Avient Corp. (US)

- BASF SE (Germany)

- Borealis AG (Austria)

- Exxon Mobil Corp. (US)

- FUJIFILM Holdings Corp. (Japan)

- LEAP CHEM Co. Ltd. (China)

- Nippon Shokubai Co. Ltd. (Japan)

- Polysciences Inc. (US)

- RTP Co (US)

- SABIC (Saudi Arabia)

- Sankhla Polymers Pvt. Ltd. (India)

- SERVA Electrophoresis GmbH (Germany)

- Solvay SA (Belgium)

- The Dow Chemical Co. (US)

Recent Developments in the Industry

- In July 2022, BSB Nanotechnology and Dow announced a collaborative effort aimed at promoting the adoption of bio-based and low-carbon ingredients within the global Polyethyleneimine Market. Dow, a leading producer and supplier of raw materials for diverse industries like appliances, automotive, agriculture, chemical processing, electronics, oil and gas, and processed foods, partnered with BSB Nanotechnology to drive sustainability initiatives in the Polyethyleneimine sector. Dow Chemical Company, an American chemical and plastics manufacturer renowned globally, emphasizes its commitment to eco-friendly solutions and innovation across various sectors.

- In May 2022, Nippon Shokubai and Arkema initiated joint feasibility studies to establish a potential partnership for constructing an industrial facility dedicated to manufacturing LiFSI (lithium bis (fluorosulfonyl) imide). LiFSI serves as a critical component in battery cells for electric mobility applications. This collaboration underscores the companies' shared commitment to advancing sustainable energy solutions and supporting the growing demand for electric vehicles.

Report Coverage

The polyethyleneimine market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, application, and their futuristic growth opportunities.

Polyethyleneimine Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 437.51 million |

|

Revenue forecast in 2032 |

USD 543.55 million |

|

CAGR |

2.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Polyethyleneimine Market are Arkema S.A., Avient, BASF, Borealis, Exxon Mobil, FUJIFILM, LEAP CHEM

Polyethyleneimine Market exhibiting the CAGR of 2.7% during the forecast period.

Polyethyleneimine Market report covering key segments are type, application, and region.

The key driving factors in Polyethyleneimine Market are Increasing demand for personal care products

Polyethyleneimine Market Size Worth $ 543.55 Million By 2032