Polyethylene for Drip Irrigation Pipes Market Size, Share, Trends, Industry Analysis Report: By Type (HDPE, LDPE, LLDPE, and Others), Pipe Type, and Region (North America, Europe, Asia Pacific, Middle East & Africa, And Latin America) – Market Forecast, 2024 - 2032

- Published Date:Oct-2024

- Pages: 116

- Format: PDF

- Report ID: PM5101

- Base Year: 2023

- Historical Data: 2019-2022

Polyethylene for Drip Irrigation Pipes Market Overview

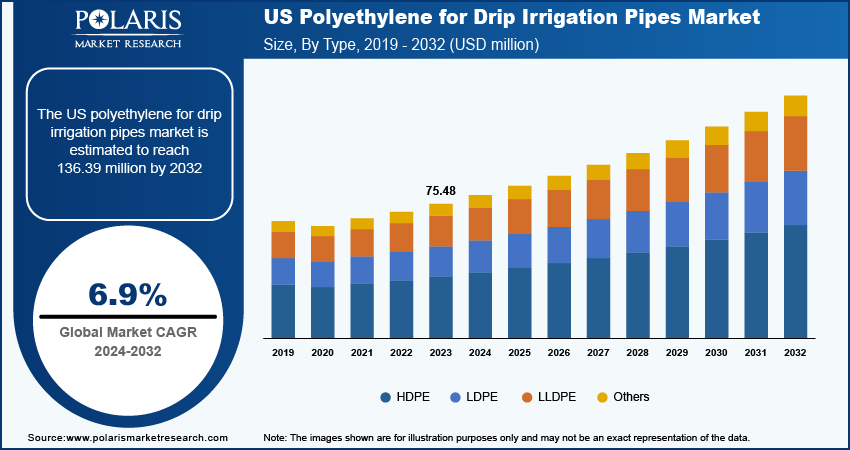

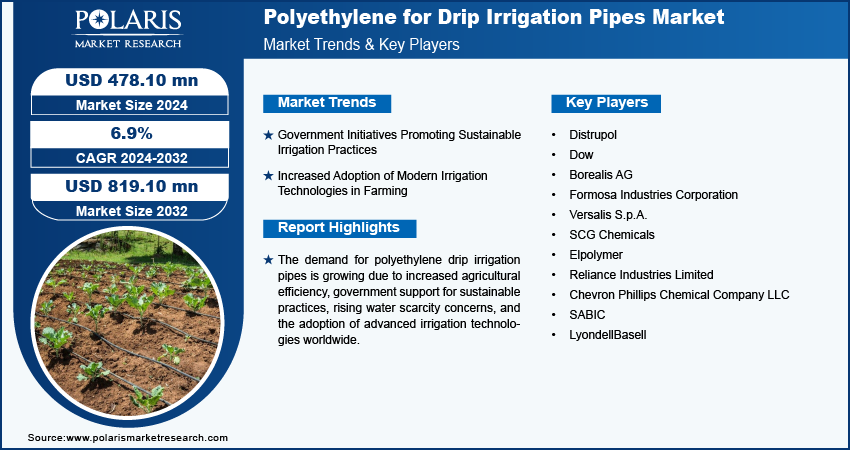

Global polyethylene for drip irrigation pipes market size was valued at USD 448.13 million in 2023. The market is projected to grow from USD 478.10 million in 2024 to USD 819.10 million by 2032, exhibiting a CAGR of 6.9% during the forecast period.

Polyethylene (PE) is a widely used material in the manufacturing of drip irrigation pipes due to its durability, flexibility, and resistance to corrosion and chemical exposure. PE is lightweight and cost-effective, making it an ideal choice for irrigation systems that need to operate efficiently in a variety of environmental conditions. Its ability to withstand high pressure and harsh weather conditions ensures that it performs well over time, minimizing the need for frequent replacements or maintenance. In the drip irrigation market, PE pipes play an essential role in delivering water directly to plant roots, optimizing water usage, and improving crop yields.

The demand for polyethylene in drip irrigation pipes is growing as more farmers and agricultural businesses shift toward modern irrigation techniques. Precision agriculture, which involves the use of advanced technologies and systems to monitor and optimize crop health, is driving the demand for PE pipes. Water scarcity and environmental concerns are increasing globally, and efficient water management through drip irrigation has become more critical. The following factors collectively contribute to the polyethylene in drip irrigation pipes market growth.

To Understand More About this Research: Request a Free Sample Report

The growing adoption of polyethylene for drip irrigation pipes is driven by its compatibility with precision agriculture practices. PE pipes work well with smart irrigation systems that use sensors and data analytics to optimize water use, reducing waste and improving agricultural productivity. The demand for PE pipes is expected to increase due to the rising popularity of sustainable farming, supported by government initiatives that enhance water efficiency and crop yields.

Key players in the market are driving the market demand by introducing innovative, durable, and environmentally friendly products. For instance, Dow’s FINGERPRINT DFDA-7555 NT Bimodal Polyethylene Resin, developed using Unipol II process technology, is designed for high-performance micro-irrigation systems. This resin improves crop yields, increases water productivity, and supports resource conservation. Such innovations are helping to meet the growing need for efficient drip irrigation systems while promoting sustainable agricultural practices.

Polyethylene for Drip Irrigation Pipes Market Drivers and Trends

Government Initiatives Promoting Sustainable Irrigation Practices

Government initiatives promoting sustainable irrigation practices are significantly driving the demand for polyethylene (PE) in drip irrigation pipes. Governments are promoting the use of efficient water management techniques in agriculture, such as drip irrigation systems. Water scarcity is a global concern, and these techniques help conserve water and boost crop yields. Policymakers are supporting farmers in optimizing water use by investing in advanced irrigation technologies. For instance, in August 2024, the USDA committed $400 million to support irrigation districts in implementing water-saving technologies, aiming to conserve 50,000 acre-feet of water across 250,000 acres.

Drip irrigation, a technology that delivers water directly to plant roots, is a game-changer in the agriculture industry. Its ability to significantly reduce water waste and enhance efficiency makes it an attractive choice for farmers. The demand for polyethylene pipes in drip irrigation is increasing as more farmers adopt innovative and sustainable practices. This benefits both the environment and also boosts agricultural productivity. Government support is instrumental in fostering a favorable market for PE products, aligning economic growth with environmental sustainability.

Increased Adoption of Modern Irrigation Technologies in Farming

Farmers seek to optimize resource utilization and improve crop yields, and innovative irrigation systems, particularly drip irrigation, are gaining popularity. This method delivers water directly to the roots of plants, minimizing waste and enhancing water efficiency, which is crucial in water-scarce regions.

The incorporation of smart irrigation technologies, such as sensors and data analytics, empowers farmers to monitor soil moisture and optimize water delivery with precision. This shift towards precision agriculture conserves water and also fosters sustainable farming practices, leading to a significant enhancement in overall productivity.

The demand for durable and efficient polyethylene pipes is growing as governments and organizations advocate for modern irrigation methods. This trend is expected to continue as more farmers transition to advanced irrigation technologies, ultimately supporting polyethylene for drip irrigation pipes market revenue.

Polyethylene for Drip Irrigation Pipes Market Segment Insights

Polyethylene for Drip Irrigation Pipes Market Breakdown by Type Insights

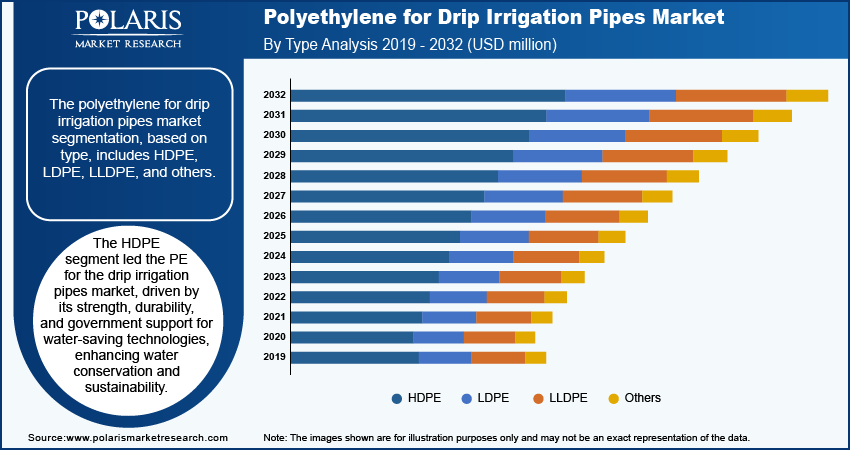

The polyethylene for drip irrigation pipes market segmentation, based on type, includes HDPE, LDPE, LLDPE, and others. In 2023, the HDPE segment dominated the market, accounting for around 50% of market revenue (226.16 million). High-density polyethylene (HDPE) plays a vital role in the drip irrigation pipes market due to its mechanical strength, environmental stress resistance, and durability. According to USDA reports, over 20% of the US farms use efficient irrigation techniques such as drip systems, which enhance water conservation and drive market growth for HDPE. Its resistance to chemical corrosion and UV degradation ensures a long lifespan, reducing replacement costs and promoting sustainability. Additionally, government programs such as the Environmental Quality Incentives Program (EQIP) and the Conservation Stewardship Program (CSP) support the adoption of HDPE systems, with EQIP allocated over $1.6 billion in 2021 for water-saving technologies. These factors collectively boost polyethylene for drip irrigation pipes market revenue.

Polyethylene for Drip Irrigation Pipes Market Breakdown by Pipe Type Insights

The polyethylene for drip irrigation pipes market segmentation, based on pipe type, includes flat and rigid. The flat is expected to register at a 7.0% CAGR over the forecast period. Flat pipes made from LDPE or LLDPE are gaining popularity in drip irrigation systems due to their efficient design and benefits. Their flat shape allows for easy storage and transportation, covering larger areas with fewer connections, which minimizes leak risks and simplifies maintenance. This design promotes uniform water distribution, ensuring adequate moisture for crops. The need for sustainable agricultural practices and cost-effective solutions in water-scarce regions drives the adoption of flat pipes. Furthermore, advancements in precision agriculture enhance their effectiveness, supporting higher yields and efficient water use, contributing to polyethylene for drip irrigation pipes market growth.

Polyethylene for Drip Irrigation Pipes Market Breakdown by Regional Insights

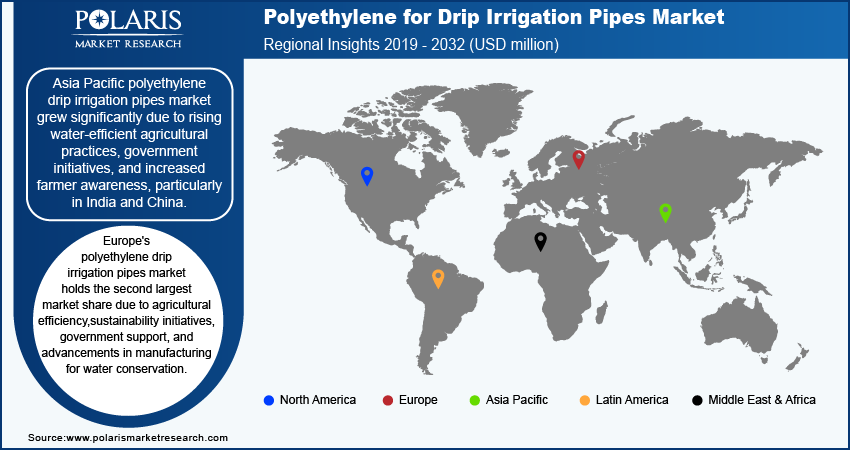

By region, the study provides market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific polyethylene for drip irrigation pipes market held the largest share in 2023, driven by the rising need for water-efficient agricultural practices. Asia Pacific polyethylene for drip irrigation pipes market has experienced significant growth due to the increasing demand for water-efficient agricultural practices. Countries, including India and China, are adopting these systems to tackle water scarcity while boosting agricultural productivity. Government initiatives, such as India’s Per Drop More Crop (PDMC) initiative and China’s Returning Grazing Lands to Grasslands program, promote modern irrigation technologies, enhancing water usage efficiency in agriculture.

Thailand and Vietnam are also leveraging polyethylene drip irrigation to support their growing agriculture sectors, recognizing its advantages in reducing water consumption and increasing crop yields. Increased farmer awareness of the economic benefits of drip irrigation further drives adoption, as polyethylene's durability and lightweight nature make it suitable for diverse climatic conditions. Moreover, companies such as Jain Irrigation and Netafim are expanding operations in the region, providing expertise in precision irrigation systems. Concurrently, these factors contribute significantly to the polyethylene for drip irrigation pipes market growth.

Europe polyethylene for drip irrigation pipes market holds the second-largest market share, driven by a focus on agricultural efficiency, sustainability, and strong governmental support for water conservation. Water scarcity in Southern Europe emphasizes the need for efficient irrigation systems. The EU's Water Framework Directive indicates that around 40% of Europe’s water resources are under significant stress. Policies such as the Common Agricultural Policy (CAP) provide financial incentives for farmers to adopt efficient irrigation systems, including PE technology. Advancements in PE manufacturing have led to pipes with enhanced durability, flexibility, and UV resistance. The increasing interest in precision agriculture is driving demand for high-quality PE products, highlighting the importance of integrating polyethylene in drip irrigation systems for efficient resource management and water conservation, creating significant polyethylene for drip irrigation pipes market opportunities.

Polyethylene for Drip Irrigation Pipes Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the polyethylene for drip irrigation pipes market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, polyethylene for the drip irrigation pipes market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global polyethylene for drip irrigation pipes market to benefit clients and increase the market sector. In recent years, the polyethylene for drip irrigation pipes industry has offered some technological advancements. Major players in the polyethylene for drip irrigation pipes market include Distrupol; Dow; Borealis AG; Formosa Industries Corporation; Versalis S.p.A.; SCG Chemicals; Elpolymer; Reliance Industries Limited; Chevron Phillips Chemical Company LLC; SABIC; and LyondellBasell.

Distrupol is a plastic manufacturing company offering about 4,000 polymer grades for applications like adhesives, automotive, and electronics. Their portfolio includes various polyethylene types and is strategically located in the UK, Ireland, Sweden, Finland, and Netherlands. In December 2023, Distrupol acquired distribution rights for the Hytrel, Zytel, and Bexloy brands from Celanese, covering the entire Europe, the Middle East, and Africa.

Borealis AG is a global chemical corporation specializing in plastics and base chemicals. It produces sustainable base chemicals through non-food waste and operates in multiple countries. OMV owns 75% of Borealis, with ADNOC holding the remaining 25%. In October 2023, the start-up of Baystar's new 625,000 metric ton-per-year Borstar polyethylene unit was established by Borealis and TotalEnergies, doubling production capacity at the Pasadena site in Texas.

List of Key Companies in Polyethylene for Drip Irrigation Pipes Market

- Distrupol

- Dow

- Borealis AG

- Formosa Industries Corporation

- Versalis S.p.A.

- SCG Chemicals

- Elpolymer

- Reliance Industries Limited

- Chevron Phillips Chemical Company LLC

- SABIC

- LyondellBasell

Polyethylene for Drip Irrigation Pipes Industry Developments

February 2024: Formosa Plastics accelerated the expansion of its petrochemical complex worth USD 9.4 billion after environmental clearance by court.

March 2023: Dow launched FINGERPRINT DFDA-7555 NT Bimodal Polyethylene Resin, produced using Unipol II process technology. This resin addresses the need for high-performing, reliable, and sustainable microirrigation systems, helping to improve crop yields, increase water productivity, and conserve resources.

August 2023: Chevron Phillips Chemical Company LLC partnered with QatarEnergy to develop an integrated polymers complex in Qatar valued at USD 6 billion.

Polyethylene for Drip Irrigation Pipes Market Segmentation

By Type Outlook

- HDPE

- LDPE

- LLDPE

- Others

By Pipe Type Outlook

- Flat

- Rigid

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polyethylene for Drip Irrigation Pipes Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 448.13 million |

|

Market Size Value in 2024 |

USD 478.10 million |

|

Revenue Forecast in 2032 |

USD 819.10 million |

|

CAGR |

6.9% from 2024 to 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD million, volume in Kilotons, and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global polyethylene for drip irrigation pipes market size was valued at USD 448.13 million in 2023 and is projected to grow to USD 819.10 million in 2032.

The global market registers a CAGR of 6.9% during the forecast period, 2024-2032.

Asia Pacific had the largest share of the global market.

The key players in the market are Distrupol; Dow; Borealis AG; Formosa Industries Corporation; Versalis S.p.A.; SCG Chemicals; Elpolymer; Reliance Industries Limited; Chevron Phillips Chemical Company LLC; SABIC; and LyondellBasell.

The HDPE category dominated the market in 2023.

The flat had the largest share in the global market