Polycarbonate Sheet Market Share, Size, Trends, Industry Analysis Report, By Type (Corrugated, Solid, Multi-Walled, Others); By End-Use (Automotive and Transportation, Construction, Aerospace and Defense, Industrial, Electronics, Others); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 111

- Format: PDF

- Report ID: PM2102

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

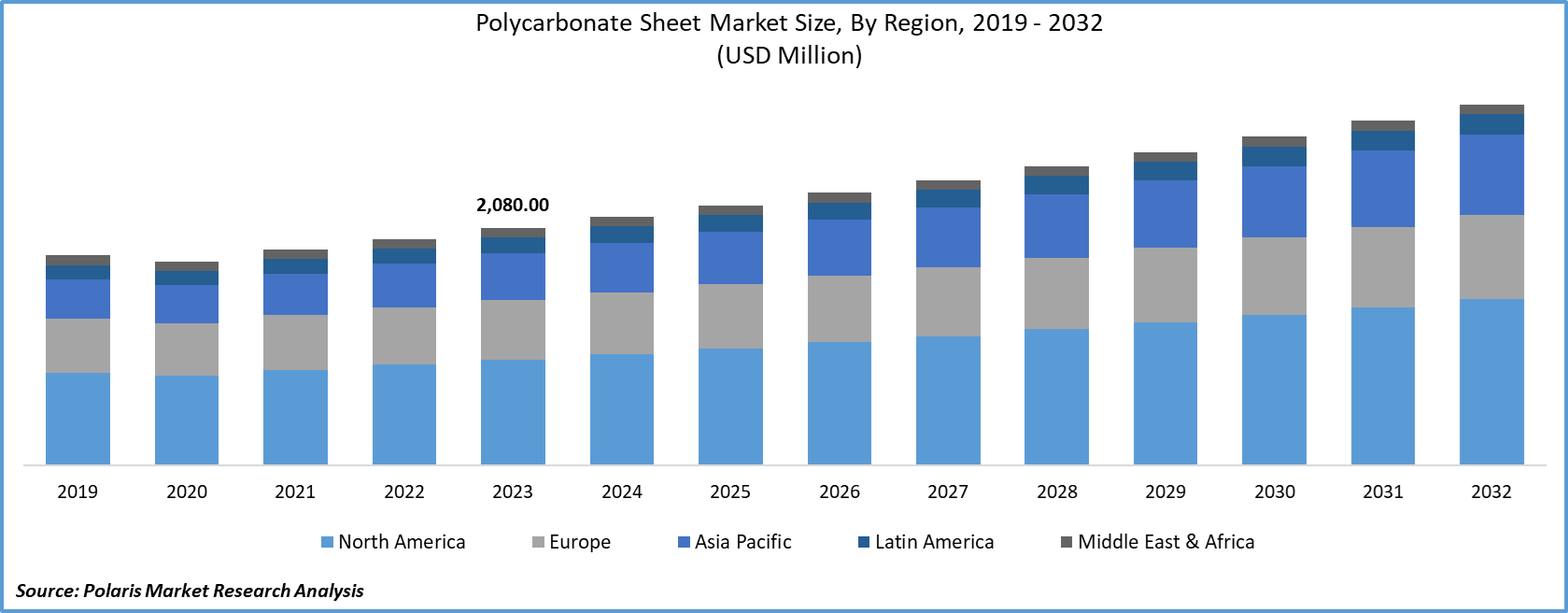

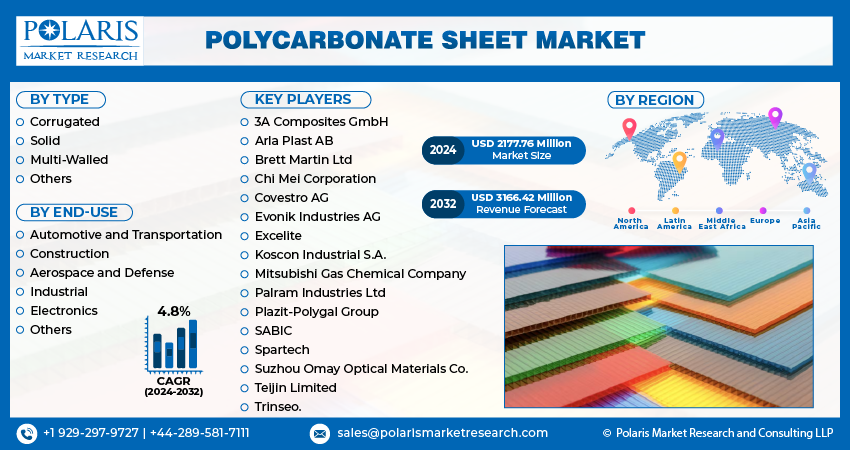

The global polycarbonate sheet market size was valued at USD 2080.00 million in 2023. The market is anticipated to grow from USD 2177.76 million in 2024 to USD 3166.42 million by 2032, exhibiting the CAGR of 4.8% during the forecast period.

Polycarbonate sheet is a clear thermoplastic material with high strength and flexibility. It offers properties such as toughness, low moisture absorption, high impact resistance, and superior chemical resistance.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The optical clarity and durability of polycarbonate sheets have increased its application in skylights, architectural glazing, face shields, machine guards, among others. It is also used in the development of eyewear owing to its lightweight, high impact resistance, and inherent UV protection. Polycarbonate sheet offers high insulating properties, which leads to reduced energy costs in building purposes. It is used in various medical equipment, automotive, food processing, and aerospace, among others.

The increasing application of polycarbonate sheets in diverse industries, growing investment in the construction industry, and development of public infrastructure are factors driving the market's growth. The growing need to decrease weight in automobiles for increased performance and demand for modernized vehicles has resulted in greater market demand from the automotive sector.

Technological advancements associated with the use of plastics and rising investments in R&D have been observed. Growth in industrialization and urbanization worldwide, increasing disposable income, and improving living standards have led to rising market demand for consumer goods and home appliances. The economic growth in countries such as China, Japan, and India and growth in construction and electronics industries accelerate the market of polycarbonate sheets.

The polycarbonate sheet market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Polycarbonate sheet is extensively used in the building and construction sector. It is utilized for a wide range of applications such as glazing, cladding, roofing, wall panels, and LED, among others. Polycarbonate sheet is increasingly being used as a replacement for glass in architecture as it enables entry of natural light in the building and can also be tinted to reduce interior cooling costs in warm months.

Polycarbonate sheet offers greater design flexibility and is used to develop complex shapes through thermoforming to form roof domes, barrel vaults, canopies, and translucent walls and signage. It also finds applications in security glazing for guard booths, prisons, and bank teller shields, owing to its high impact strength.

Know more about this report: request for sample pages

The growing need to build energy-efficient buildings, reduce energy costs, and use less toxic materials has increased the applications of polycarbonate sheets in this sector. Polycarbonate sheet also enhances energy efficiency and protects from IR radiation upon treatment with solar control technology.

The COVID-19 outbreak has restricted the growth of the market. Industries such as transportation, construction, aerospace, and electronics have all been adversely affected by the pandemic, resulting in reduced market demand for from these industries.

The polycarbonate sheets industry has been impacted by operational challenges, disruption of the supply chain, delayed installations, deferred maintenance, and workforce impairment. Manufacturing activities have been halted due to various government regulations across the globe. However, polycarbonate sheets have been used during the pandemic to produce barriers, face shields, temporary walls, sneeze guards, desk guards, hand sanitization stations, signage, and physical safety barriers.

The antimicrobial, scratch, chemical resistance, and UV stabilizing properties offered by polycarbonate sheets have increased their application to fight against the pandemic. The market is anticipated to gain traction post-COVID-19 on account of supportive government regulations, favorable environmental policies, development of energy-efficient products, and growing application of lightweight materials.

Report Segmentation

The market is primarily segmented on the basis of type, end-use industry, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Type Outlook

The type segment has been divided into corrugated, solid, multi-walled, and others. The solid polycarbonate sheet is used in diverse industries such as construction, and transportation among others. Solid polycarbonate sheet is utilized in building and construction as it is lightweight, durable, and offers a safe alternative to glass. It is utilized in glazing & safety glazing, sign faces, sound barriers, and skylights owing to its ability to transmit light and withstand force.

End-Use Outlook

On the basis of end-use industry, the market is segmented into automotive and transportation, construction, aerospace and defense, industrial, electronics, and others. The construction segment accounts for a major market share. In the construction sector, polycarbonate sheet is utilized in a wide range of applications for walls, roofs, cladding, and partitions.

Increasing investments in the construction sector, development of public infrastructure, rising adoption of energy-efficient buildings, and use of less toxic materials have increased the market demand for polycarbonate sheets. Governments across the globe are investing significantly towards developing sustainable and green buildings and offering incentives and schemes to promote their adoption.

Regional Outlook

Asia-Pacific dominated the global market in 2020. The market growth in countries such as China, India, and Japan, rising automotive penetration, and increasing construction and development activities drive the growth of this region.

Rising urbanization, growing research and development activities, and expansion of international players in this region further support the market growth. There have been rising applications of polycarbonate sheets in electronics, aerospace, and defense applications. Increasing environmental concerns and growing awareness regarding environmentally friendly and recyclable materials are factors expected to offer market growth opportunities of polycarbonate sheets in the region.

Competitive Landscape

The leading players in the polycarbonate sheet market include 3A Composites GmbH, Arla Plast AB, Brett Martin Ltd, Chi Mei Corporation, Covestro AG, Evonik Industries AG, Excelite, Koscon Industrial S.A., Mitsubishi Gas Chemical Company, Palram Industries Ltd, Plazit-Polygal Group, SABIC, Spartech, Suzhou Omay Optical Materials Co., Teijin Limited, Trinseo.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Polycarbonate Sheet Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2177.76 million |

|

Revenue forecast in 2032 |

USD 3166.42 million |

|

CAGR |

4.8% from 2024 to 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 to 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

3A Composites GmbH, Arla Plast AB, Brett Martin Ltd, Chi Mei Corporation, Covestro AG, Evonik Industries AG, Excelite, Koscon Industrial S.A., Mitsubishi Gas Chemical Company, Palram Industries Ltd, Plazit-Polygal Group, SABIC, Spartech, Suzhou Omay Optical Materials Co., Teijin Limited, Trinseo. |

We provide our clients the option to personalize the polycarbonate sheet market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.