Polybutadiene Market Size, Share, Trends, Industry Analysis Report: By Type, Application (Polymer Modification, Tire Manufacturing, and Industrial Rubber Manufacturing), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 114

- Format: PDF

- Report ID: PM1508

- Base Year: 2024

- Historical Data: 2020-2023

Polybutadiene Market Overview

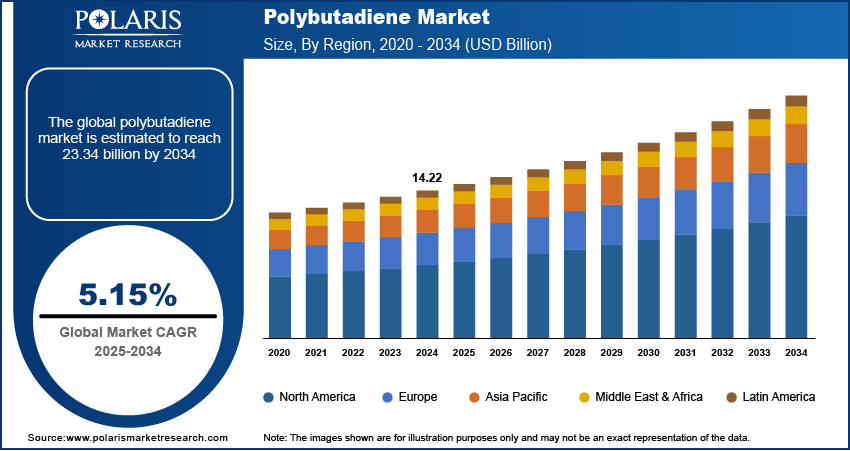

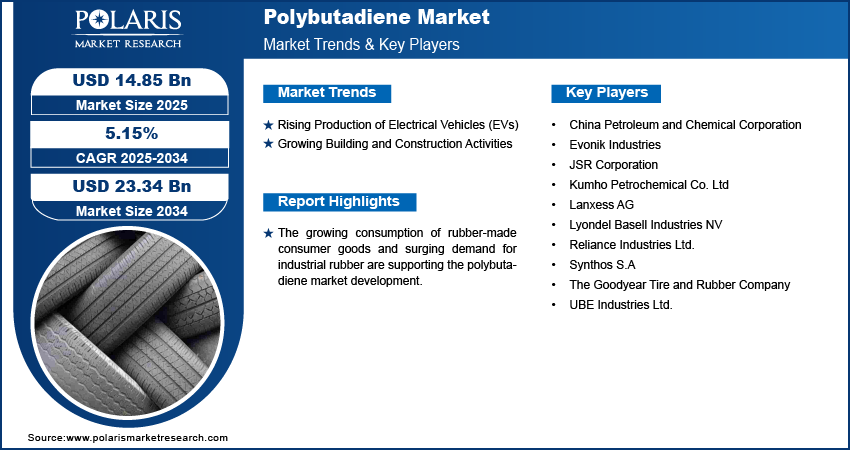

The global polybutadiene market size was valued at USD 14.22 billion in 2024. The market is projected to grow from USD 14.85 billion in 2025 to USD 23.34 billion by 2034, at a CAGR of 5.15% from 2025 to 2034.

Polybutadiene, also known as butadiene rubber (PBR), is a synthetic rubber made by polymerizing 1,3 butadiene molecules. It is known for its desirable characteristics, including high elasticity, excellent abrasion and cracking resistance, and low rolling resistance. Polybutadiene finds applications in tires, hoses, gaskets, footwear, sealants, and adhesives.

The increased motor vehicle production and growing demand for luxury cars are driving the polybutadiene market growth. Polybutadiene has high consumption in the automobile industry, with tire manufacturing using nearly 70% of the polybutadiene produced. Polybutadiene's exceptional resilience makes it an ideal material for golf balls and plush toys. High growth in the polybutadiene industry is a result of the automotive industry's high demand and increased motor vehicle production. Additionally, the rising demand for low-cost alternatives to natural rubber with better qualities is having a favorable impact on the market expansion.

To Understand More About this Research: Request a Free Sample Report

The growing consumption of rubber-made consumer goods and surging demand for industrial rubber are supporting the polybutadiene market development. Polybutadiene-based products are also being widely used in the adhesives and sealants industry due to their remarkable bonding properties. In addition, the market expansion is fueled by the growing emphasis on upgrading old aircraft with new, efficient models produced using lightweight materials like polybutadiene.

Polybutadiene Market Dynamics

Rising Production of Electric Vehicles (EVs)

The excellent abrasion resistance, high elasticity, and water resistance of polybutadiene, along with its exceptional rolling resistance and low glass transition temperature, make it the ideal material for manufacturing several automotive components, including automotive tires, adhesives, coating, and sealants. These properties help in improving the fuel efficiency of automobiles, including electric vehicles (EVs). As consumers get more eco-conscious, they prefer EVs over traditional combustion engine automobiles. Automobile manufacturers are responding to this shift by ramping up the production of EVs. Thus, the rising production and adoption of EVs are driving the polybutadiene market development.

Growing Building and Construction Activities

Polybutadiene is the preferred material for several construction applications, including roofing materials, sealants, adhesives, and coatings, due to its high resilience and capacity to tolerate extreme climatic conditions. There is a growing demand for strong, weather-resistant materials in order to improve the longevity and functionality of buildings. Additionally, a growing number of builders are choosing to use durable materials that help preserve the integrity of the infrastructure. Further, rising disposable incomes in emerging nations and the implementation of smart city projects are driving remodeling activities, thereby driving the polybutadiene market demand.

Polybutadienes Market Segment Insights

Polybutadienes Market Evaluation by Type Insights

Based on the type, the polybutadiene market is segmented into low cis polybutadiene, high cis polybutadiene, high vinyl butadiene, and high trans polybutadiene. In 2024, the high cis polybutadiene segment dominated the market with a 63% revenue share, driven by the growing automotive sector and increased emphasis on high-performance tires. The exceptional elasticity, robustness, and wear resistance of high cis polybutadiene make it the ideal material for producing tires that must last longer and perform better under various driving conditions.

The low cis polybutadiene segment is expected to register a significant CAGR of 4.1% during the forecast period. Low-cis polybutadiene is frequently utilized in the manufacturing of synthetic rubber products as it’s less expensive than high-cis polybutadiene. This makes it the desirable choice for producers willing to streamline their manufacturing processes while adhering to quality standards.

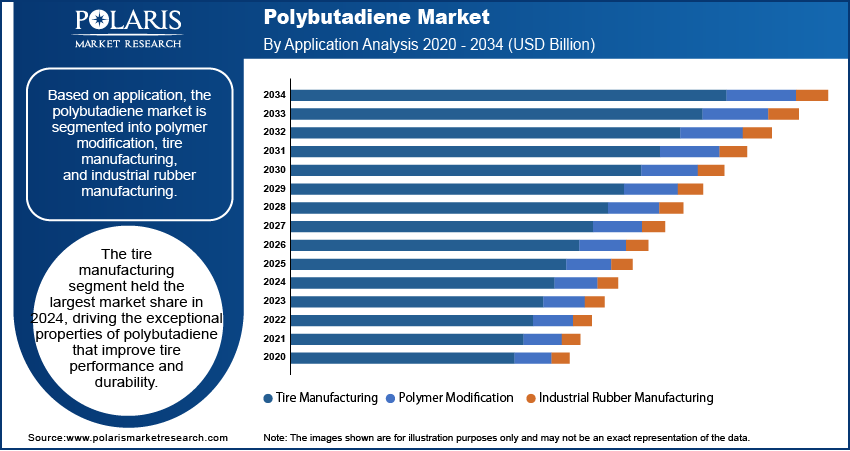

Polybutadienes Market Assessment by Application Insights

The polybutadiene market segmentation, based on application, includes polymer modification, tire manufacturing, and industrial rubber manufacturing. The tire manufacturing segment led the market with an 80.4% revenue share in 2024 due to the exceptional properties of polybutadiene that improve tire performance and durability. Polybutadiene helps automakers increase fuel efficiency and lower automobile emissions by enabling them to create lighter tire designs that retain structural integrity across various driving conditions.

The polymer modification segment is expected to register a CAGR of 4.0% during the forecast period. Polybutadiene is being increasingly used in polymer modification due to its ability to improve the flexibility and impact resistance of other polymers. The rising use of modified polymers in industries such as consumer goods, automotive, and construction is further contributing to the segment’s growth.

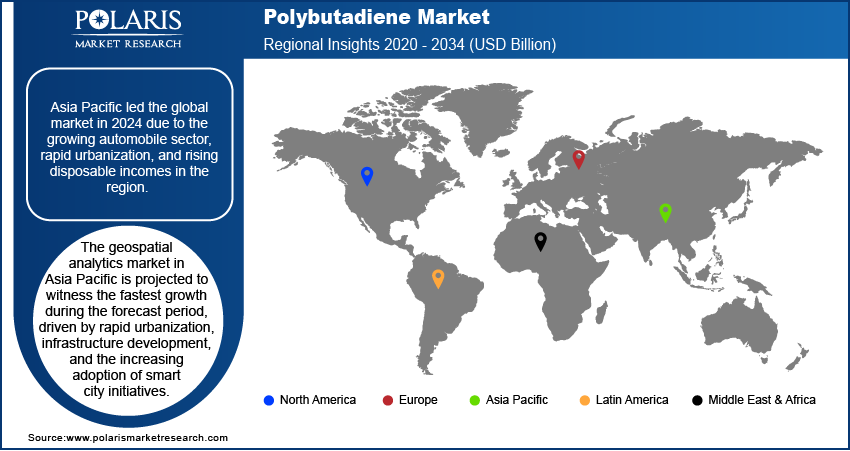

Polybutadiene Market by Regional Insights

By region, the report provides the polybutadiene market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2024, Asia Pacific dominated the market with a 41% revenue share. Rapid urbanization, rising disposable incomes, and the growing automobile industry are driving the demand for tires and other rubber products in the region. In addition, rising emphasis on industrialization and infrastructural development has created new applications for polybutadiene. Further, the shift towards sustainable materials and renewable energy is driving the adoption of polybutadiene-based products in industries like wind energy and construction.

The North America polybutadiene market is expected to expand at a CAGR of 4.3% during the forecast period due to the rapidly growing automotive sector in the region. Other factors driving the regional market growth include the presence of an established manufacturing infrastructure and a growing emphasis on fuel-efficient tires.

Polybutadiene Market – Key Players and Competitive Insights

The polybutadiene market is characterized by intense competition, driven by factors such as innovative product offerings, technological advancements, mergers and acquisitions, and other strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, offering, and customer service. Also, they are making significant investments in R&D initiatives to introduce advanced solutions to cater to diverse consumer needs.

Several market participants are prioritizing the development of sustainable and eco-friendly polybutadiene that complies with stringent government regulations. The polybutadiene market research report offers a market assessment of all the major players, including China Petroleum and Chemical Corporation, Reliance Industries Ltd., JSR Corporation, Lanxess AG, The Goodyear Tire and Rubber Company, Kumho Petrochemical Co. Ltd, Synthos S.A, UBE Industries Ltd., Evonik Industries, and Lyondel Basell Industries NV.

List of Polybutadiene Market Key Players

- China Petroleum and Chemical Corporation

- Evonik Industries

- JSR Corporation

- Kumho Petrochemical Co. Ltd

- Lanxess AG

- Lyondel Basell Industries NV

- Reliance Industries Ltd.

- Synthos S.A

- The Goodyear Tire and Rubber Company

- UBE Industries Ltd.

Polybutadiene Market Developments

- In May 2023, Sumitomo Corporation and KUMHO Petrochemical Co., Ltd. inked a memorandum of understanding (MOU) to create a long-term partnership for the development and further growth of the sustainable polymers and chemicals market in Asia.

- In February 2023, Arlanxeo announced the commencement of operations of its 65 kiloton-per-annum polybutadiene rubber production plant in southern Brazil. Located in Rio Grande do Sul's Triunfo petrochemical complex, this new facility demonstrates the company's commitment to enhancing its footprint in Latin America.

Polybutadiene Market Segmentation

By Type Outlook

- Low Cis Polybutadiene

- High Cis Polybutadiene

- High Vinyl Polybutadiene

- High Trans Polybutadiene

By Application Outlook

- Polymer Modification

- Tire Manufacturing

- Industrial Rubber Manufacturing

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polybutadiene Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.22 billion |

|

Market Size Value in 2025 |

USD 14.85 billion |

|

Revenue Forecast by 2034 |

USD 23.34 billion |

|

CAGR |

5.15% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The polybutadiene market was valued at USD 14.22 billion in 2024 and is projected to grow to USD 23.34 billion in 2034.

• The anticipated growth rate of the market is 5.15% from 2025 to 2034.

• In 2024, Asia Pacific held the largest share of the global market revenue.

• Kumho Petrochemical Co. Ltd, The Goodyear Tire and Rubber Company, UBE Industries Ltd., Synthos S.A, Evonik China Petroleum and Chemical Corporation, JSR Corporation, Reliance Industries Ltd., and Lanxess AG are some of the key players in the market.

• The tire manufacturing segment dominated the market in 2024.

• The high cis polybutadiene segment held the largest market share in 2024.