Polyacrylate Market Size, Share, Trends, Industry Analysis Report: By Chemistry (Methyl Acrylate, Ethyl Acrylate, Butyl Acrylate, 2-Ethyl Hexyl Acrylate, and Others), Application, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 114

- Format: PDF

- Report ID: PM1501

- Base Year: 2024

- Historical Data: 2020-2023

Polyacrylate Market Overview

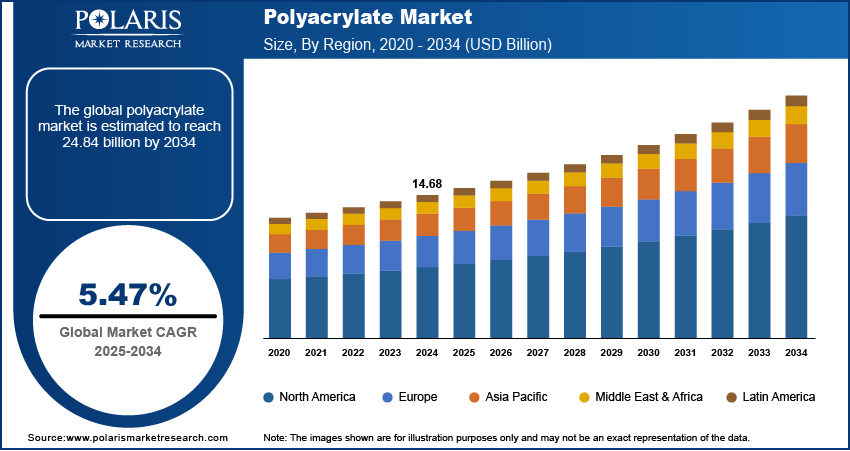

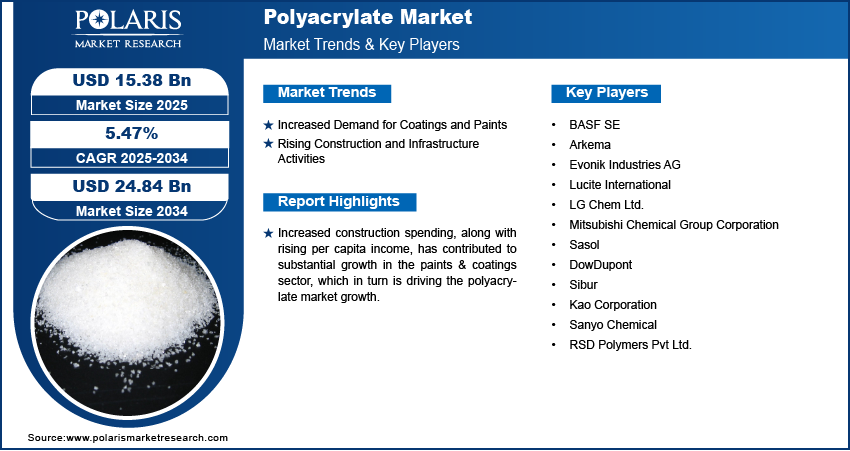

The global polyacrylate market size was valued at USD 14.68 billion in 2024. The market is projected to grow from USD 15.38 billion in 2025 to USD 24.84 billion by 2034, at a CAGR of 5.47% from 2025 to 2034.

Polyacrylate, also known as acrylate polymer or acrylic, is a synthetic resin derived from acrylic acid and its salts. The synthetic resin is known for its flexibility, transparency, and resistance to breakage. It is also weatherable, ozone-resistant, and has moderate heat resistance. The molecular weight of polyacrylates can range from 1,000 to 100,000 Da. Lower molecular weight polyacrylates are commonly used as scale inhibitors, while higher molecular weight polyacrylates act as dispersants.

Manufacturers are now investing in creating novel polyacrylate formulations that satisfy performance requirements and environmental regulations as a result of this global shift towards polyacrylates. This trend addresses market demand as well as encouraging advantages for companies that are willing to adapt. Polyacrylate is commonly used in paints, coatings, and adhesives as a thickening agent to modify the rheological properties of these substances. Increased construction spending, along with rising per capita income, has contributed to substantial growth in the paints & coatings market, which in turn is driving the polyacrylate market growth.

To Understand More About this Research: Request a Free Sample Report

Polyacrylate is one of the most widely used classes of polymers, driven by its diverse range of applications. As a water-soluble polymer, polyacrylate has a high capacity for water absorption, making it a crucial component in products such as diapers, superabsorbent materials, and water retention applications in agriculture. Polyacrylate resins are also essential for automotive coatings, which are produced in large quantities as well as in adhesives, sealants, and textiles. These applications have significantly contributed to the polyacrylate market expansion. Additionally, growing consumer awareness of sustainability and the rising demand for eco-friendly materials is driving the robust development of the market.

Polyacrylate Market Dynamics

Increased Demand for Coatings and Paints

Polyacrylates are essential in paints, coatings, adhesives, and building materials due to their unique rheological characteristics. Polyacrylate is used in paints, adhesives, and sealants. It is a key component of water-based paints. The global automotive sector is growing, and hence, there is an increased demand for polyacrylates in modern vehicles and their components. The need for paints and coatings is expected to grow as investments in infrastructure development increase and the global building and construction industry expands, thereby driving the polyacrylate market demand. There is a shift towards eco-friendly, water-based formulations in paints and coatings, thereby helping in the expansion of the polyacrylates industry.

Rising Use in Construction and Infrastructure Activities

Polyacrylates are primarily used as a concrete admixture to improve the workability of the mixture by reducing the required water content, ultimately enhancing the concrete's strength and durability by minimizing porosity and promoting internal curing. The ability of polyacrylates to absorb and retain water helps with internal curing, especially in situations where external curing may be limited. Polyacrylates can help minimize the separation of cement particles from the mix, resulting in a more homogeneous concrete. Polyacrylate latex-modified cement is used in grouting applications due to its excellent filling ability, adhesion, and resistance to water pressure. Consequently, there is a growing need for acrylate-based technologies in the building and construction sector, hence boosting the polyacrylates market expansion.

Polyacrylate Market Segment Insights

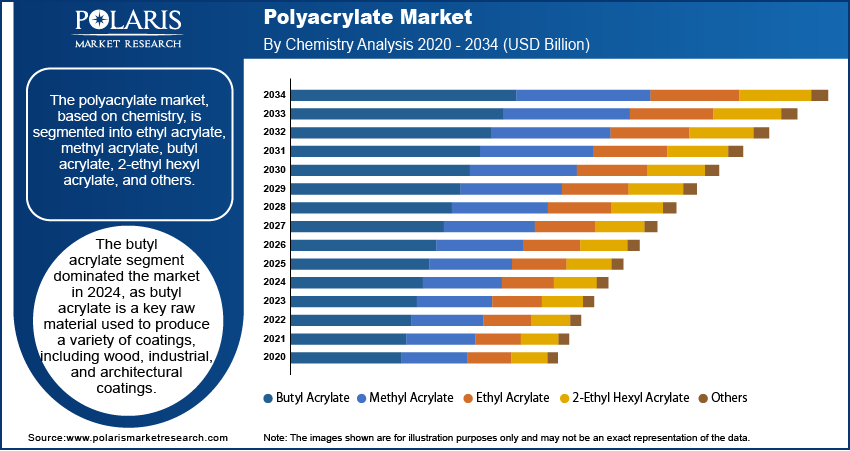

Polyacrylate Market Evaluation by Chemistry Insights

Based on chemistry, the polyacrylate market is segmented into methyl acrylate, ethyl acrylate, butyl acrylate, 2-ethyl hexyl acrylate, and others. The butyl acrylate segment dominated the market completely in 2024. Butyl acrylate is a key raw material used to produce a variety of coatings, including wood, industrial, and architectural coatings. The coatings are widely used across industries such as construction, automotive, and aerospace sectors. Butyl acrylate is also used to create pressure-sensitive adhesives, which are extensively applied in labeling, packaging, and medical settings. In the construction sector, it is used in the production of caulks and sealants, as well as heat-sealable coatings for food packaging. These versatile applications of butyl acrylate contribute to the segment’s leading position in the market.

Polyacrylate Market Assessment by End-Use Industry Insights

The polyacrylate market segmentation, based on the end-use industry, includes cosmetics & personal care, consumer goods, textiles, building & construction, automotive, packaging, bio-medical, and others. Consumer goods, among all of the segments, had the highest CAGR in 2024. Acrylates are commonly used in coatings for household appliances to enhance their appearance and provide protection. Acrylic coatings are primarily applied in the printing and packaging of consumer goods. In these applications, acrylic adhesives are commonly used, which are cured using various technologies, including amine, peroxide, light-emitting diode (LED), electronic beam (EB), and UV technologies. Pressure-sensitive adhesives using acrylic technology are also commonly applied in consumer goods, such as glass bottles and metal cans. These factors contribute to the segment’s dominance in the global market.

Polyacrylate Market Regional Analysis

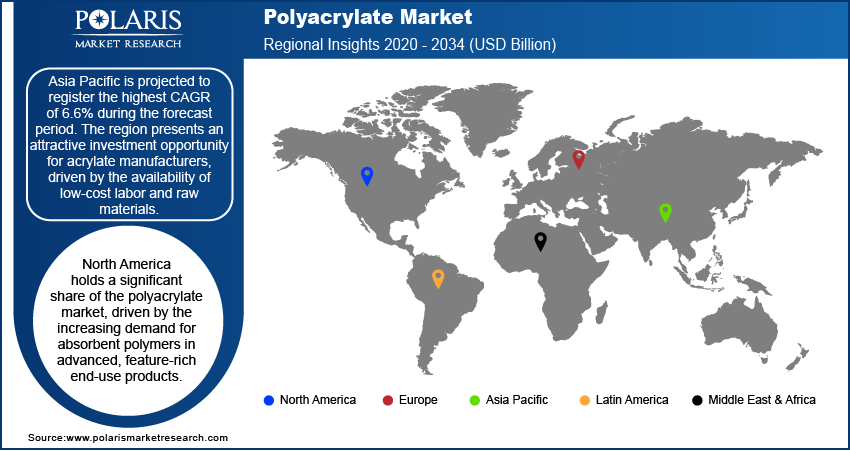

By region, the report provides the polyacrylate market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific is a major producer of acrylates and is anticipated to register the highest CAGR of 6.6% throughout the forecast period. The region presents an attractive investment opportunity for acrylate manufacturers, driven by the availability of low-cost labor and raw materials, as well as increasing public awareness about benefits of polyacrylates. Key regional market growth drivers include urbanization, industrialization, and population growth. Additionally, the expansion of sectors like healthcare and food packaging is driving the need for superabsorbent polymers in the region.

North America holds a significant share of the polyacrylate market, driven by the increasing demand for absorbent polymers in advanced, feature-rich end-use products. Key factors driving the regional market growth include substantial investments by major market players and the rising utilization of these polymers in the medical sector. Additionally, the growing demand for personal hygiene products in North America is fueling the expansion of the superabsorbent polymers sector, impacting the market demand favorably.

Polyacrylate Market – Key Players and Competitive Insights

The leading market players are introducing new, innovative products to cater to the evolving consumer needs. Also, they are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their market presence. To expand and survive in a highly competitive market, market participants must offer innovative solutions.

In recent years, the market for polyacrylates has witnessed several innovation breakthroughs, with the top market participants providing solutions that help meet sustainability goals. Among the leading companies in the polyacrylate market are Arkema, DowDupont, BASF SE, Kao Corporation, Sibur, RSD Polymers Pvt Ltd., Lucite International, Sanyo Chemical, LG Chem Ltd., Sasol, Mitsubishi Chemical Group Corporation, and Evonik Industries AG.

List of Polyacrylate Market Key Players

- Arkema

- BASF SE

- DowDupont

- Evonik Industries AG

- Kao Corporation

- LG Chem Ltd.

- Lucite International

- Mitsubishi Chemical Group Corporation

- RSD Polymers Pvt Ltd.

- Sanyo Chemical

- Sasol

- Sibur

Polyacrylate Industry Developments

In May 2024, the Indonesian division of NIPPON SHOKUBAI CO., LTD., NIPPON SHOKUBAI INDONESIA (NSI), received ISCC PLUS certification for superabsorbent polymers, acrylic acid, and acrylates. The company stated that it has established a global supply chain to manufacture and market the certified products in Belgium, Japan, and Indonesia.

In January 2025, Arkema, a prominent player in Specialty Polyacrylate Materials, unveils bio-based acrylic binders to reduce the carbon footprint of performance textiles. These binders aid the textile sector's initiatives to reduce their product's carbon footprint, promoting a more sustainable way of living.

Polyacrylate Market Segmentation

By Chemistry Outlook

- Methyl Acrylate

- Ethyl Acrylate

- Butyl Acrylate

- 2-Ethyl Hexyl Acrylate

- Others

By Application Outlook

- Plastics

- Fabrics

- Adhesives & Sealants

- Paints, Coatings, & Printing Inks

- Others

By End-Use Industry Outlook

- Cosmetics & Personal Care

- Consumer Goods

- Textiles

- Building & Construction

- Automotive

- Packaging

- Bio-Medical

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polyacrylate Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 14.68 billion |

|

Market Size Value in 2025 |

USD 15.38 billion |

|

Revenue Forecast by 2034 |

USD 24.84 billion |

|

CAGR |

5.47% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The polyacrylates market was valued at USD 14.68 billion in 2024 and is projected to grow to USD 24.84 billion in 2034.

The market is projected to grow at a CAGR of 5.47% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

BASF SE, Kao Corporation, Sanyo Chemical, RSD Polymers Pvt Ltd., DowDupont, Arkema, Evonik Industries AG, Lucite International, and LG Chem Ltd. are a few of the key players in the market

The butyl acrylate segment dominated the polyacrylamides market revenue share in 2024.

The consumer goods segment, based on end-use industry type, had a significant growth rate in the polyacrylamides market.