PLGA Market Size, Share, Trends, Industry Analysis Report: By Grade (Extrusion, Injection Molding, and Others), Composition, Type, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Nov-2024

- Pages: 120

- Format: PDF

- Report ID: PM5243

- Base Year: 2024

- Historical Data: 2020-2023

PLGA Market Overview

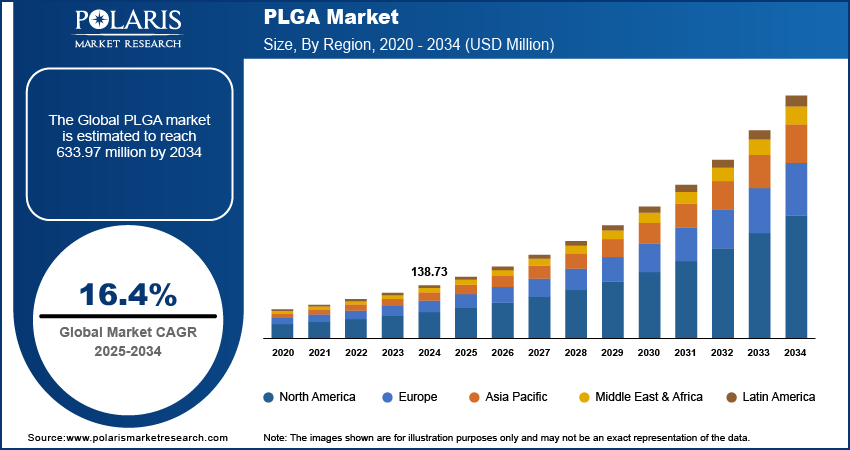

The PLGA market size was valued at USD 138.73 million in 2024. The market is projected to grow from USD 161.37 million in 2025 to USD 633.97 million by 2034, exhibiting a compound annual growth rate (CAGR) of 16.4% from 2025 to 2034.

Poly (lactic-co-glycolic acid) (PLGA) is a copolymer of polylactic acid (PLA) and polyglycolic acid (PGA). It is a biodegradable and biocompatible polymer widely used in medical and pharmaceutical applications.

The increase in global healthcare expenditure and the need for advanced medical treatments are driving the demand for PLGA. Additionally, governments and healthcare providers are investing in innovative technologies and materials like PLGA to enhance patient outcomes and reduce healthcare costs, further propelling the growth of the PLGA market.

To Understand More About this Research: Request a Free Sample Report

Regulatory approvals and guidelines recommending the use of PLGA in medical and pharmaceutical settings have facilitated market growth. The exceptional mechanical properties and biodegradability of PLGA make it an ideal scaffold material for promoting cell growth and tissue regeneration in tissue engineering, especially in bone regeneration, cartilage repair, and wound healing applications. These attributes have led to a surge in demand for PLGA, further contributing to the growth of the PLGA market.

PLGA Market Trends and Drivers Analysis

Rise in Accidental Cases

The growing number of accidental cases necessitating surgical interventions has resulted in an increased demand for PLGA. For example, in 2022, the United States witnessed 42,514 fatalities from motor vehicle crashes, leading to 12.8 deaths per 100,000 individuals and 1.33 deaths per 100 million miles traveled, according to the Insurance Institute for Highway Safety (IIHS). This surge in accidents has led to a heightened need for surgeries, particularly for PLGA, which is widely used to manufacture absorbable sutures that biodegrade within the body after completing their function. These sutures prevent the need for removal, reducing patient discomfort and the risk of infection. This escalating incidence of accidents is anticipated to boost the PLGA market share from 2025 to 2034.

Rising Incidence of Chronic Diseases

The increasing incidence of chronic diseases and the growing number of global surgical procedures further contribute to the rising demand for PLGA. For instance, according to the World Health Organization (WHO), there were an estimated 20 million cancer cases in 2022. Projections indicate that the number of new cancer cases will surpass 35 million in 2050, signifying a substantial 77% increase from 2022. This rise in cancer cases is expected to generate a heightened demand for surgical procedures, especially for PLGA, which is widely utilized in surgical applications like sutures, staples, and implants due to its biocompatibility and ability to safely degrade within the body. The escalating number of surgeries is directly linked to the increased requirement for PLGA-based products.

PLGA Market Segment Analysis

PLGA Market Assessment by End Use

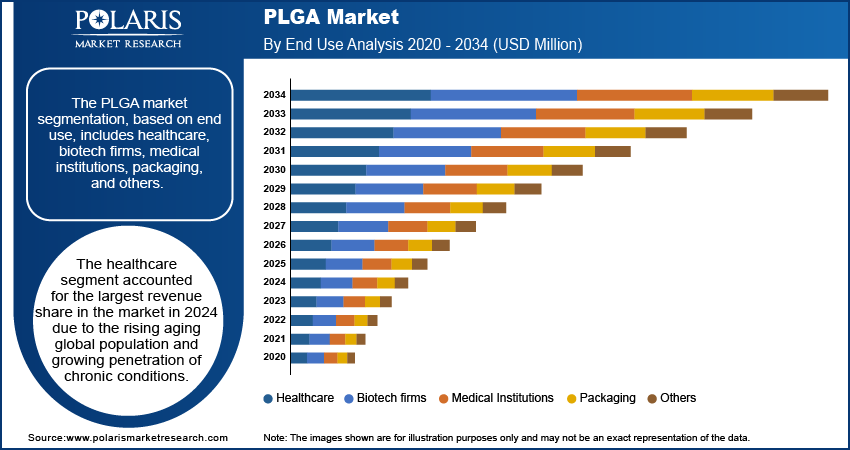

The PLGA market segmentation, based on end use, includes healthcare, biotech firms, medical institutions, packaging, and others. The healthcare segment accounted for the largest revenue share in the market. The aging global population, with longer life expectancies, necessitates more frequent medical attention and long-term care for age-related conditions, which is significantly driving the healthcare sector. Consequently, the rising prevalence of chronic diseases, such as diabetes, heart disease, and cancer, driven by lifestyle factors like poor diet and lack of exercise, requires ongoing management and treatment. Increased healthcare spending by governments and private entities, along with expanded health insurance coverage, has improved access to medical services. For instance, National Health Expenditure grew 4.1% to USD 4.5 trillion in 2022, or USD 13,493 per person, and accounted for 17.3% of GDP. With the increased healthcare spending due to the rising prevalence of chronic diseases and advancements in medical technology, there is a corresponding rise in demand for innovative medical materials like PLGA. Thus, the growing demand for healthcare significantly drives the PLGA market.

PLGA Market Evaluation by Application

The PLGA market segmentation, based on application, includes drug delivery, medical implants, tissue engineering, fracture fixation, gene delivery, surgical sutures, packaging, disposable cutlery, textiles, agricultural films, and others. The surgical sutures segment is expected to grow significantly from 2025 to 2034. The growing number of surgical procedures worldwide, due to an aging population and an increase in chronic conditions, is creating a greater need for surgical sutures. For instance, according to the American Chemical Society, approximately 27 million surgeries are performed annually in the United States, with 2.6% of cases resulting in surgical site infections (SSIs) caused by Staphylococci species. The nitric oxide-releasing PLGA copolymer exhibits potential as a suture material in eliminating surgical site infections caused by these strains. This technological advancement has led to substantial growth in the surgical suture segment.

Furthermore, patients' escalating expectations for rapid recovery and minimized postoperative complications are propelling the demand for advanced suturing solutions that promote more effective wound healing. Consequently, this trend is anticipated to stimulate growth in the surgical suture segment during the forecast period.

PLGA Market Share by Region

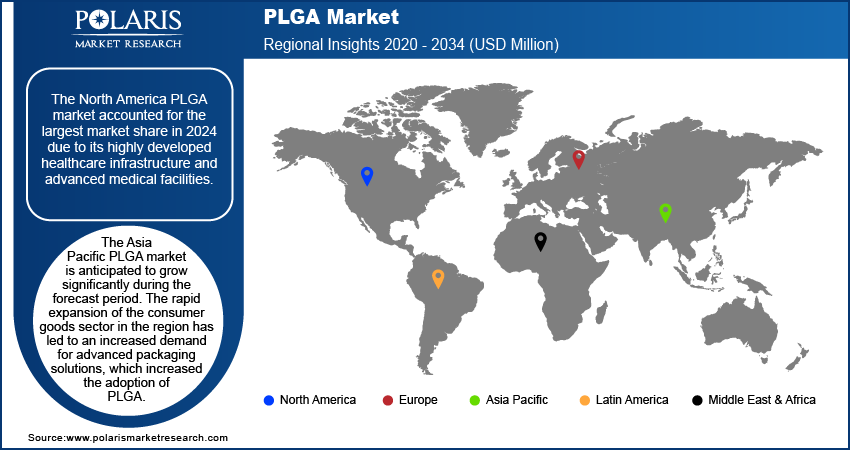

By region, the study provides PLGA market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America PLGA market accounted for the largest market share due to its highly developed healthcare infrastructure and advanced medical facilities, which drives significant demand for PLGA in various applications, such as drug delivery systems, tissue engineering, and surgical sutures. Also, the region is home to several pharmaceutical and biotech giants that actively utilize PLGA to develop advanced drug delivery systems and therapeutic solutions. Besides, there is a noticeable rise in the requirement for controlled and sustained drug release formulations, with PLGA being a favored choice due to its ability to provide such controlled release. For instance, according to the American Chemical Society, the combination of PLGA encapsulation, mesoporous silica nanoparticles, and folate-mediated targeting represents an advanced strategy for improving the delivery and efficacy of chemotherapy drugs like capecitabine. This strategy aims to provide a more targeted and effective treatment for pancreatic cancer while minimizing adverse effects and improving patient outcomes.

The US PLGA market witnessed the largest market share in 2024 due to significant industrial expansion across various sectors. Moreover, the continuous progress in polymer technology and biomedical engineering in the United States is improving the capabilities and expanding the potential applications of PLGA.

The Asia Pacific PLGA market is anticipated to grow significantly during the forecast period. The rapid expansion of the consumer goods sector in the region has led to an increased demand for advanced packaging solutions, particularly in areas such as food and beverages, pharmaceuticals, and personal care products. The properties of poly (lactic-co-glycolic acid) make it a suitable material for packaging that requires both durability and biodegradability. The region's rapid economic growth and urbanization are driving higher consumption of packaged goods, thus creating a need for advanced packaging solutions.

The growing e-commerce sector in Japan fueled by rising internet penetration and digitalization, is driving the demand for innovative packaging solutions, which led to increased adoption of PLGA. For instance, Japan's e-commerce market, valued at approximately USD 4 trillion, ranks as the fourth-largest globally.

PLGA Market – Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their offerings, which will help the PLGA market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including innovative product launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the PLGA market must offer cost-effective solutions.

The PLGA market is represented by established industry players and innovative startups, all competing to capitalize on the growing demand for eco-friendly production methods. Major companies dominate the market by leveraging extensive experience, technological advancements, and broad distribution networks. Major players in the PLGA market include Akina, Inc.; Ashland; Bezwada Biomedical, LLC.; CD Bioparticles; Corbion NV; Evonik; Jinan Digang Bioengineering Co., Ltd.; Merck; Mitsui Chemicals; and Nomisma Healthcare Pvt. Ltd.

Evonik Industries AG delivers specialty chemicals in North America, Europe, Asia Pacific, Africa, the Middle East, and Central and South America. It operates through Performance Materials, Nutrition & Care, Specialty Additives, Smart Materials, and Technology & Infrastructure segments.

CD Bioparticles is a company specializing in tailored drug delivery solutions. They are involved in a wide range of formulation and drug delivery technologies, including conventional liposomes, PEGylated liposomes, polymer microspheres, and nanoparticles, all designed to enhance drug delivery. CD Bioparticles recently launched DiagPoly PEI PLGA Nanoparticles, based on PLGA acid terminated with a lactide/glycolide. These positively charged nanoparticles, modified with PEI, are recommended for gene delivery and therapy.

List of Key Companies in PLGA Market

- Akina, Inc.

- Ashland

- Bezwada Biomedical, LLC.

- CD Bioparticles

- Corbion NV

- Evonik

- Jinan Digang Bioengineering Co., Ltd.

- Merck

- Mitsui Chemicals

- Nomisma Healthcare Pvt. Ltd

PLGA Market Developments

December 2020: Evonik announced the acquisition of LACTEL Absorbable Polymers from DURECT Corporation, expanding its biodegradable polymer portfolio and strengthening its position in the functional excipients and biomaterials market.

June 2023: Avantium N.V. and SCG partnered to develop CO2-based polymers using Avantium's Volta Technology platform. The aim is to scale up the production to a pilot level. This partnership will focus on creating polylactic-co-glycolic acid (PLGA), a recyclable, home-compostable, and marine-degradable polyester with excellent barrier properties against oxygen and moisture.

March 2023: Evonik and BellaSeno partnered to develop 3D-printed bone scaffolds using Evonik’s Resomer polymers for large and complicated bone defects. Their initial collaboration in 2019 focused on scaffolds for chest wall and breast reconstruction.

PLGA Market Segmentation

By Grade Outlook (Revenue – USD Million, 2020–2034)

- Extrusion

- Injection Molding

- Others

By Composition Outlook (Revenue – USD Million, 2020–2034)

- PLGA 50:50

- PLGA 55:45

- PLGA 65:35

- PLGA 75:25

- PLGA 85:15

- PLGA 12:88

- PLGA 10:90

- Others

By Type Outlook (Revenue – USD Million, 2020–2034)

- Dayglow Pigments

- Phosphorescent Pigments

- Other

By Application Outlook (Revenue – USD Million, 2020–2034)

- Drug Delivery

- Medical Implants

- Tissue Engineering

- Fracture Fixation

- Gene Delivery

- Surgical Sutures

- Packaging

- Disposable Cutlery

- Textile

- Agricultural Films

- Others

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Healthcare

- Biotech firms

- Medical Institutions

- Packaging

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

PLGA Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 138.73 million |

|

Market size value in 2025 |

USD 161.37 million |

|

Revenue Forecast in 2034 |

USD 633.97 million |

|

CAGR |

16.4% from 2025–2034 |

|

Base year |

2020 |

|

Historical data |

2020–2023 |

|

Forecast period |

2025–2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The PLGA market size was valued at USD 138.73 million in 2024 and is projected to grow to USD 633.97 million by 2034.

The market is projected to grow at a CAGR of 16.4% from 2025 to 2034.

North America had the largest share of the market.

The key players in the market Akina, Inc.; Ashland; Bezwada Biomedical, LLC.; CD Bioparticles; Corbion NV; Evonik; Jinan Digang Bioengineering Co., Ltd.; Merck; Mitsui Chemicals; and Nomisma Healthcare Pvt. Ltd.

The healthcare segment held the highest share in the PLGA market.

The surgical sutures segment is expected to register the highest CAGR during the forecast period.