Plate and Tube Heat Exchanger Market Share, Size, Trends, Industry Analysis Report, By Material Type (Titanium Alloy, Aluminium, Stainless Steel, Nickel Alloys and Copper); By End-User Industry; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4592

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

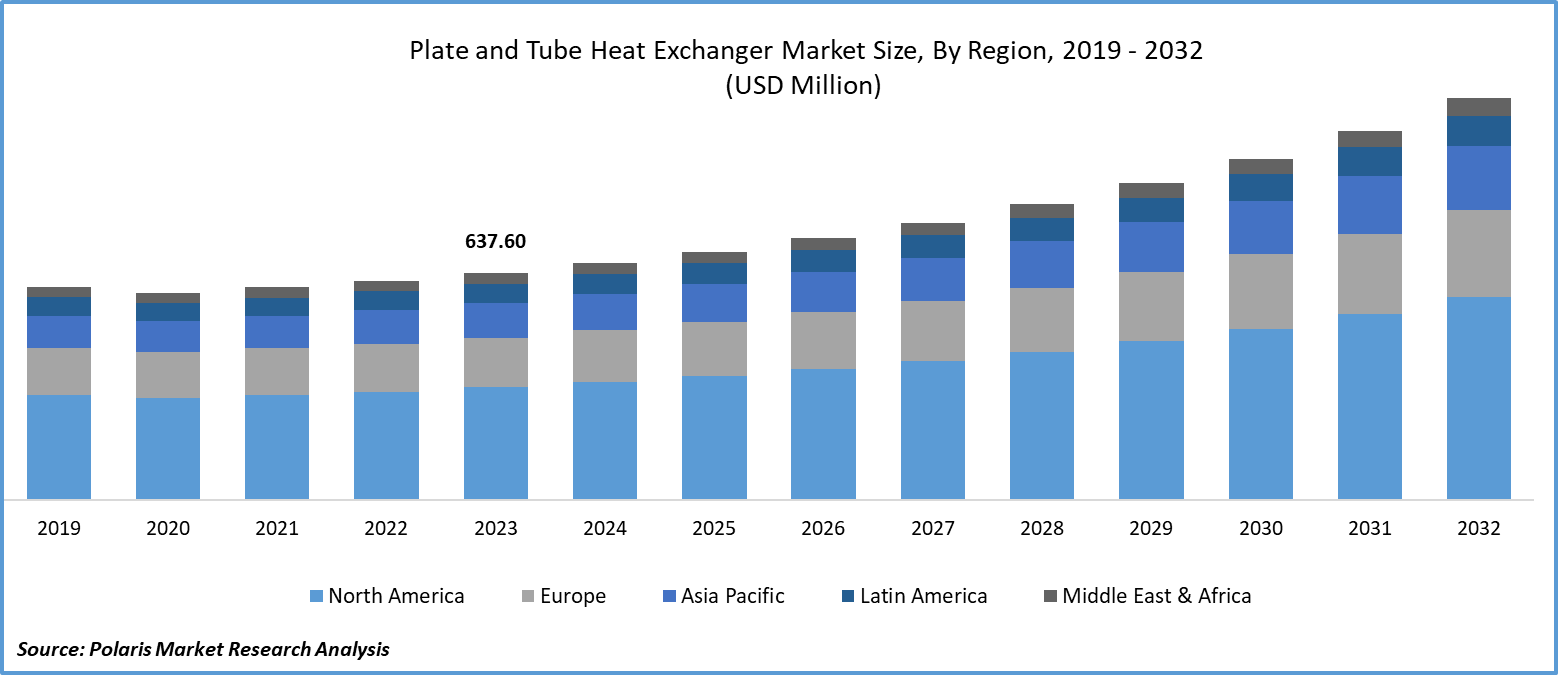

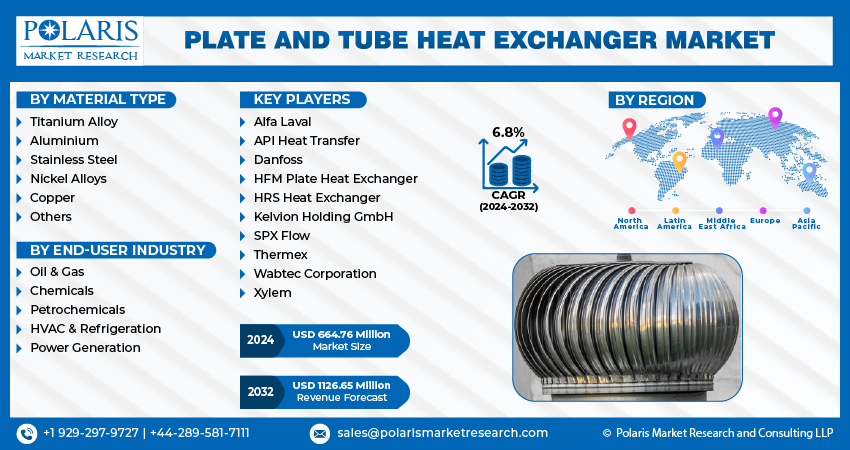

Global plate and tube heat exchanger market size was valued at USD 637.60 Million in 2023. The market is anticipated to grow from USD 664.76 Million in 2024 to USD 1126.65 Million by 2032, exhibiting a CAGR of 6.8% during the forecast period.

Plate and Tube Heat Exchanger Market Overview

Plate and tube heat exchangers are a state-of-the-art technology that is transforming heat transfer processes in numerous sectors. These cutting-edge systems maximize efficiency and versatility in a variety of industrial applications by integrating multiple heat exchange processes or materials into a single unit. Their adaptability enables customized solutions to meet the needs of certain industries, providing outstanding performance in vital areas, including HVAC, chemical processing, power generation, and more. These inventive heat exchangers, which prioritize increased efficiency and decreased environmental impact, open the door to increased operational efficiency, cost-effectiveness, and sustainability in a variety of industrial processes.

For instance, in June 2023, Alfa Laval launched a next-generation single-circuit brazed plate heat exchanger named AC900, which is specifically made for low-GWP, low-density refrigerants. It includes heat pump applications, industrial chillers, and chillers with screw compressors with capacities ranging from 300 to 600 kW.

Furthermore, in applications where space constraints and operating costs are critical, considerations including urbanization, infrastructure development, and the compact design of plate and tube heat exchangers are influencing their preference. The importance of plate and tube heat exchangers in fulfilling the changing demands of many sectors is further highlighted by the increasing global shift toward sustainable practices and the growing awareness of the advantages of heat recovery.

To Understand More About this Research: Request a Free Sample Report

However, the revenues from plate and tube heat exchangers are closely related to the amount of gas and oil consumed. The COVID-19 pandemic ban has severely harmed the oil and gas industry, and in 2020, the resumption of overflow manufacturing caused a sharp decline in petroleum prices. Nearly every industry was impacted by COVID-19's disruption of the supply chain and hindrance of various industrial activities. The majority of businesses have closed their doors due to a lack of employees.

Plate and Tube Heat Exchanger Market Dynamics

Market Drivers

Rising Stringent Energy Efficiency and Environmental Regulations is Projected to Spur Product Demand

The need for energy efficiency has grown as a result of environmental and regulatory requirements. The manufacturing sectors are under more pressure than ever to cut their energy consumption and CO2 emissions as a result of the Kyoto Protocol, which requires state parties to reduce their emissions of greenhouse gases. Since plate and tube heat exchangers don't transfer heat using non-renewable fossil fuels like coal or natural gas, they are significantly less harmful to the environment than alternative heating or cooling systems. Heat exchangers are being employed by governments and regulatory agencies, particularly in North America and Europe, to lower CO2 emissions and offer an energy-efficient alternative. Furthermore, end users are beginning to place greater value on sustainability and energy efficiency. Significant cost reductions are achieved by reducing energy usage with an effective heat recovery method.

Market Restraints

Preferences for Conventional Designs

The widespread preference for traditional heat exchanger designs across a range of industries is a reflection of trust in well-established protocols and dependability. Because certain types of heat exchangers, such as shell and tube or plate heat exchangers, have a track record of consistently delivering performance, businesses have long relied on them. This extensive expertise frequently decodes into a cautious approach when new technologies are being considered. Risk aversion is common in industries, particularly those with vital operations, and any possible interruption from switching to hybrid designs is seen as a risk that could impair operational effectiveness. Moreover, significant expenditures on the current infrastructure, which includes tools, instruction, and maintenance schedules that correspond with classic heat exchangers, support the inclination toward traditional designs.

This preference is further supported by the possible requirement for major infrastructure modifications and additional expenditures to accommodate plate and tube heat exchangers. Reluctance to adopt these technologies is also influenced by concerns about the performance and dependability of more recent hybrid designs, particularly in demanding operational environments. Overcoming these deeply ingrained preferences requires a thorough presentation of the indisputable advantages provided by plate and tube heat exchangers, which include increased efficiency, affordability, and versatility. It's critical to simultaneously solve issues with performance, dependability, and compatibility with current infrastructure.

Report Segmentation

The market is primarily segmented based on material type, end-user industry, and region.

|

By Material Type |

By End-User Industry |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Plate and Tube Heat Exchanger Market Segmental Analysis

By Material Type Analysis

The stainless steel segment is projected to grow at a CAGR during the projected period due to its wide range of beneficial characteristics and features such as cost-effectiveness, easy availability, high flexibility, and lightweight. In addition, plates and tubes made of stainless steel perform well financially and withstand corrosion well. They are appropriate for use with low-chloride-ion heat exchange media, such as mineral oil, river water, refined water, and edible oil. Stainless steel is used to create plate and tube heat exchanger plates.

By End-User Industry Analysis

The chemicals segment accounted for the largest market share in 2023 and is likely to retain its market position throughout the plate and tube heat exchanger market forecast period. Heat exchangers are essential to the efficiency and safety of chemical production processes because they regulate temperatures during reactions, distillation, and condensation. Because of their adaptability to a wide range of chemical compositions and operating temperatures, plate and tube heat exchangers are essential for preserving the exact temperatures needed for particular chemical reactions. These heat exchangers assist in the heating or cooling of different chemical substances or mixtures, maximize process efficiency, and help recover energy. Plate and tube heat exchangers provide an essential solution, guaranteeing increased productivity and safety within the chemical industry in light of strict quality standards and the necessity for dependable heat transfer systems in chemical processes.

Plate and Tube Heat Exchanger Market Regional Insights

The North America Region Dominated the Global Market with the Largest Market Share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the projected period. The US Department of Energy (DOE) reports that almost half of the energy used in the country goes towards operating residential and commercial infrastructure. HVACR systems and appliances consume the majority of this energy. In order to promote energy efficiency and reduce emissions, there are various regulations and programs in place, such as the Energy Policy and Conservation Act of 1975 (EPCA), DOE’s Appliance and Equipment Standards Program, and the Energy Efficiency Directive 2012/27/EU. These initiatives are increasing the demand for efficient HVACR equipment, including plate and tube heat exchanger systems.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the Strong industrial growth in the area, which is driving up the need for effective heat exchange solutions in industries including manufacturing, chemicals, power generation, and HVAC systems. Furthermore, the development of cutting-edge heat exchanger technology is fueled by the growing focus on energy efficiency and the strict environmental restrictions seen in nations like China, India, Japan, and South Korea. Asia Pacific's largest market is China. India is expected to grow at the fastest rate throughout the projection period.

Competitive Landscape

The Plate and Tube Heat Exchanger market outlook is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Alfa Laval

- API Heat Transfer

- Danfoss

- HFM Plate Heat Exchanger

- HRS Heat Exchanger

- Kelvion Holding GmbH

- SPX Flow

- Thermex

- Wabtec Corporation

- Xylem

Recent Developments

- In September 2023, Kelvion Holding GmbH boosted its production capabilities in order to fulfill the growing demand from numerous end-use industries at Sarstedt. Now, the plant is able to generate 150,000 more heat exchangers annually.

Report Coverage

The plate and tube heat exchanger market report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments, and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, material type, end-user industry, and their futuristic growth opportunities.

Plate and Tube Heat Exchanger Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 664.76 million |

|

Revenue Forecast in 2032 |

USD 1126.65 million |

|

CAGR |

6.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Material Type, By End-User Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global plate and tube heat exchanger market size is expected to reach USD 1126.65 million by 2032

Key players in the market are Alfa Laval, API Heat Transfer, Danfoss, HFM Plate Heat Exchanger

North America contribute notably towards the global Plate and Tube Heat Exchanger Market

Plate and Tube Heat Exchanger Market exhibiting the CAGR of 6.8% during the forecast period

The Plate and Tube Heat Exchanger Market report covering key segments are material type, end-user industry, and region.