Plastic Pallets Market Share, Size, Trends, Industry Analysis Report

By Material (High-Density Polyethylene, Low-Density Polyethylene); By Type; By Application; By Region; Segment Forecast, 2023- 2032

- Published Date:Jul-2023

- Pages: 117

- Format: PDF

- Report ID: PM3477

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

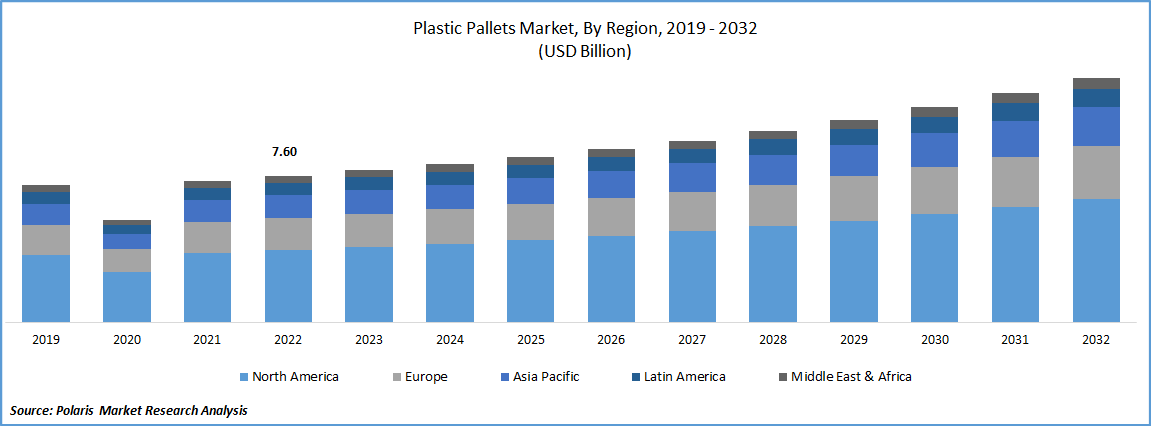

The global plastic pallets market was valued at USD 7.60 billion in 2022 and is expected to grow at a CAGR of 5.41% during the forecast period. The primary factors driving the market include the increasing demand for sustainable and durable packaging solutions, the adoption of advanced technologies like RFID in plastic pallets, and rising R&D activities and technical advances in the logistics sector. For instance, companies like Coca-Cola and Nestle are adopting plastic pallets as a more sustainable alternative to traditional wooden pallets. The automotive industry also relies on plastic pallets due to their durability and ability to withstand harsh environments. Furthermore, the pharmaceutical industry uses plastic pallets to ensure product safety and hygiene during transport and storage.

To Understand More About this Research: Request a Free Sample Report

A plastic pallet is a type of pallet used for storing, handling, and transporting goods and materials. It is typically made of plastic materials such as high-density polyethylene (HDPE) or polypropylene (PP), which offer several advantages over traditional wooden pallets. Plastic pallets are lightweight, durable and resistant to moisture, chemicals, and bacteria. They also have a longer lifespan than wooden pallets and can be easily recycled, making them a more sustainable option. Plastic pallets come in a range of sizes and designs to accommodate different types of goods and can be customized to meet specific needs. They are commonly used in industries such as food, pharmaceuticals, automotive, and logistics for their superior properties and efficiency.

The COVID-19 pandemic has had a significant impact on the market. On the positive side, the pandemic has led to an increased demand for hygienic packaging in the food and beverage industry, which has resulted in higher demand for plastic pallets. Additionally, the pandemic has increased demand for e-commerce, which has led to higher demand for plastic pallets for shipping and handling products. For instance, Brambles has experienced increased demand for its plastic pallets from the e-commerce sector during the pandemic, but also faced challenges due to supply chain disruptions and reduced demand from other industries. The pandemic has also led to supply chain disruptions and logistical challenges, which have affected the production and distribution of plastic pallets. Additionally, the economic impact of the pandemic has led to decreased demand in certain industries, which has resulted in lower demand for plastic pallets.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Plastic pallets market is experiencing growth due to the advantages that plastic pallets offer in terms of durability and lightweight, making them ideal for logistics across industries such as food, automotive, and chemical. Moreover, the introduction of the new technologies such as RFID in the plastic pallets has made it easier to detect & locate items through-out the supply chain, which is further contributing to their popularity. Companies such as CHEP, Rehrig Pacific, & Craemer Holding are some of the major players in the plastic pallet market, with CHEP being the largest supplier of pallets in the world. With the rise in R&D activities and technological advancements in the logistics sector, the market is expected to see further growth and opportunities in the coming years.

In addition to the above factors, the growth of the e-commerce sector and the medical industry is also expected to drive market growth in the forecast period. For instance, plastic pallets are being used in the transportation of medical supplies and equipment due to their hygienic properties and ease of cleaning. Overall, the plastic pallet market is expected to experience steady growth in the coming years, thanks to a combination of technological advancements, expanding industries, and increasing demand for sustainable and efficient logistics solutions.

Report Segmentation

The market is primarily segmented based on material, type, application, and region.

|

By Material |

By Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

High-Density Polyethylene Segment is Expected to Witness Largest Growth During Forecast Period

The market is currently dominated by high-density polyethylene (HDPE) pallets, which accounted for major market share in 2022. Companies like CHEP and Rehrig Pacific use HDPE pallets as they are easy to clean, resistant to solvents and corrosion, and offer strong impact resistance. These properties make HDPE pallets highly desirable for applications in food, pharmaceutical, and other industries. Additionally, as the industry moves towards more sustainable solutions, the demand for recycled HDPE pallets is expected to rise. Companies like PalletOne and Greystone Logistics have already started offering recycled HDPE pallets to cater to the growing demand for sustainable material handling solutions.

However, the demand for polypropylene (PP) pallets is expected to grow rapidly in the forecast period. Companies like ORBIS Corporation and Craemer Group use PP pallets, which are known for their durability and ability to withstand heavy-duty applications in close supply chains.

Nestable Segment Accounted for the Largest Market Share in 2022

The nestable pallet shows significant growth in the market and accounted for a major revenue share in 2022. Nestable pallets are a popular option in industries such as food and beverage, retail, and agriculture because of their cost-effectiveness and space-saving benefits. They are less expensive than rackable & stackable pallets. For instance, Rehrig Pacific offers a range of nestable pallets for various industries such as agriculture, food & beverage & retail.

However, because of their design, nestable pallets are not suitable for handling heavy loads in closed-loop supply chains. Despite this limitation, the increasing adoption of plastic pallets over wooden pallets for export applications due to their non-contamination properties is expected to drive demand for nestable plastic pallets in the future. Overall, nestable pallets are a cost-effective and practical option for industries looking to optimize their supply chain logistics.

Food & Beverages Segment is Expected to Hold the Significant Revenue Share in 2022

Over the forecast period, the food and beverage segment accounted for a major revenue share in the plastic pallet market in 2022. Agricultural companies and farmers use plastic pallets to handle fresh produce, while bakery, dairy, beverage, meat, and other food processing companies use them to store, handle, and transport raw and processed end products. Plastic pallets are becoming increasingly popular in the food industry because they do not have nails and splinters in their structure that can damage food products.

Moreover, wooden pallets are susceptible to bacteria, pests, and fungi, which can contaminate food products. As a result, food processing companies are shifting from wooden pallets to plastic pallets, which are more hygienic, easy to clean and reduce the risk of contamination. For example, Coca-Cola has implemented a sustainable packaging strategy, which includes using plastic pallets in its supply chain operations. The company has switched to plastic pallets from traditional wooden pallets to reduce the risk of product damage, improve hygiene, and enhance supply chain efficiency. Similarly, Nestle uses plastic pallets for the transportation of food and beverages to reduce the risk of contamination and increase the shelf life of their products.

The Demand in North America is Anticipated to Witness Significant Growth During Forthcoming Years

North America's dominance in the plastic pallet market can be attributed to the robust manufacturing industry, particularly in the United States. For instance, the U.S. is home to several major manufacturing companies such as General Motors, Boeing, and Ford, which drive the demand for plastic pallets. Additionally, trade agreements such as T-MEC (the new NAFTA) have helped to boost the demand for plastic pallets across the region.

Asia Pacific is expected to advance at the fastest CAGR over the forecast period. The increasing demand for plastic pallets from the manufacturing sectors in India, China, and Japan is driving the growth of the market in the region. Asia Pacific has been a hub for the manufacturing sector due to the presence of countries involved in the Trans-Pacific Partnership Agreement (TPP), a free trade agreement that has strengthened trade and manufacturing among countries in the region.

This has driven the demand for plastic pallets over the years. For example, China is the world's largest manufacturing economy, accounting for nearly 30% of the world's manufacturing output. As such, the increasing demand for plastic pallets in the manufacturing industry is expected to boost the region’s growth.

Competitive Insight

Some of the major players operating in the global market include Brambles, Rehrig Pacific, Schoeller Allibert, Craemer Holding, CABKA Group, Greystone Logistics., Polymer Solutions, ORBIS Corporation, Litco International, iGPS Logistics, Rotomolded Products, Buckhorn, Kamps Pallets, Enviro Pallets, and Plastic Pallet.

Recent Developments

- In Dec 2022, Orbis, a company based in Wisconsin, introduced a new reusable plastic pallet called the 40x48 Odyssey Low Profile pallet. It is designed to provide repeatable performance with automated equipment, with features like ergonomic handholds for manual handling, steel reinforcements, moulded-in frictional elements to prevent load shifting, and smooth surfaces free of nails and splinters that can damage automated equipment.

- In October 2022, ORBIS Corporation announced plans to expand its production facility in Ohio. This will add 30 percent more space to an existing plant located at 200 Elm St, allowing for increased production of the totes, bulk containers, & pallets.

- In July 2022, Allied Plastics expanded its distribution center by moving from an 85,000 square feet space to a larger one spanning across 173,000 square feet in Wilmot, US. The expansion was intended to improve productivity and increase the capacity for the storage and distribution of plastic products.

Plastic Pallets Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 7.88 billion |

|

Revenue forecast in 2032 |

USD 12.67 billion |

|

CAGR |

5.41% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Material, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Brambles Ltd., Rehrig Pacific Company, Schoeller Allibert, Craemer Holding GmbH, CABKA Group, Greystone Logistics, Inc., Polymer Solutions International, Inc., ORBIS Corporation, Litco International, Inc., iGPS Logistics LLC, Rotomolded Products Inc., Buckhorn Inc., Kamps Pallets, Inc., Enviro Pallets, and Plastic Pallet & Container, Inc. |

FAQ's

The plastic pallets market report covering key segments are material, type, application, and region.

Plastic Pallets Market Size Worth $12.67 Billion by 2032.

The global plastic pallets market is expected to grow at a CAGR of 5.41% during the forecast period.

North America is leading the global market.

key driving factors in plastic pallets market are adoption new technologies such as RFID in the plastic pallets.