Plastic Packaging Market Size, Share, Trends, Industry Analysis Report: By Material, Product, Technology (Injection Molding, Extrusion, Blow Molding, Thermoforming, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Jan-2025

- Pages: 116

- Format: PDF

- Report ID: PM1575

- Base Year: 2024

- Historical Data: 2020-2023

Plastic Packaging Market Overview

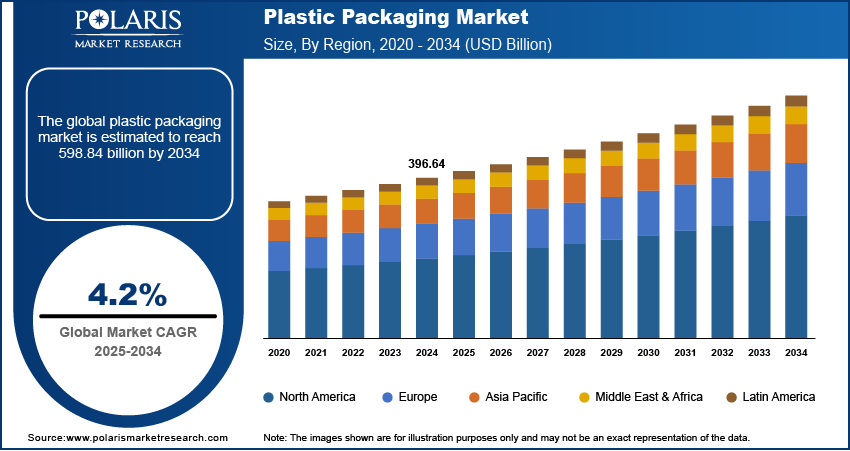

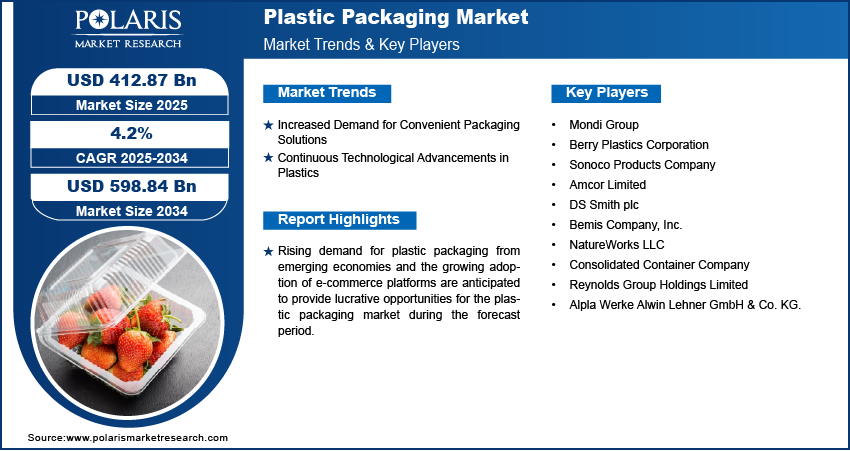

The global plastic packaging market size was valued at USD 396.64 billion in 2024. The market is projected to grow from USD 412.87 billion in 2025 to USD 598.84 billion by 2034. It is projected to exhibit a CAGR of 4.2% from 2025 to 2034.

Plastic packaging involves the utilization of plastic materials for the packaging of products. It protects goods from spoilage, breakage, and contamination during transit, storage, and distribution. Also, plastic packaging helps extend shelf life and acts as a medium to provide consumer information about the product.

To Understand More About this Research: Request a Free Sample Report

The increasing population and rising demand for packaged food and beverages are among the key factors driving the plastic packaging market demand. The food & beverages industry is increasingly using plastic packaging owing to its strength, durability, hygiene, and aesthetics. A variety of food products and consumer goods are being packed using plastic pouches, bags, and sachets for increased efficiency and brand appeal.

The rising use of flexible and functional plastic packaging in consumer goods and personal care products augments the plastic packaging market growth. The growing middle-income population, the cost-effectiveness offered by plastics, and the presence of diverse players are a few factors driving the adoption of plastic packaging.

The growing use of rigid packaging containers and canisters in the automotive and construction industries for transportation is the key trend anticipated to drive the plastic packaging market development. Growing demand for plastic packaging from emerging economies, increasing purchasing power of consumers, and growth of e-commerce platforms are anticipated to provide lucrative plastic packaging market opportunities during the forecast period.

Plastic Packaging Market Dynamics

Increased Demand for Convenient Packaging Solutions

With changing consumer lifestyles and preferences, consumers are increasingly seeking products that can be easily used, transported, and disposed of. Plastic packaging provides several light and durable options, such as single-serving packs, stand-up pouches, and re-sealable closures, that facilitate easy carrying and usage of goods. Further, the design flexibility of plastic packaging enables packaging manufacturers to offer solutions that resist gases, moisture, and light, thereby increasing the shelf life of products. Thus, the shifting preferences toward convenient packaging solutions boost the plastic packaging market expansion.

Continuous Technological Advancements in Plastics

The introduction of biodegradable plastics has enabled packaging providers to reduce waste and make the packaging recyclable. Also, nanotechnology is transforming plastic packaging technologies, providing several benefits. By enabling the manipulation of materials at the molecular level, nanotechnology helps enhance the barrier properties of plastics. Moreover, advances in manufacturing technologies have enabled producers to reduce costs and increase efficiency, making plastic packaging a more lucrative option for businesses across diverse sectors. Thus, continuous advances in technology are contributing to the plastic packaging market development.

Plastic Packaging Market Segment Insights

Plastic Packaging Market Outlook by Product Insights

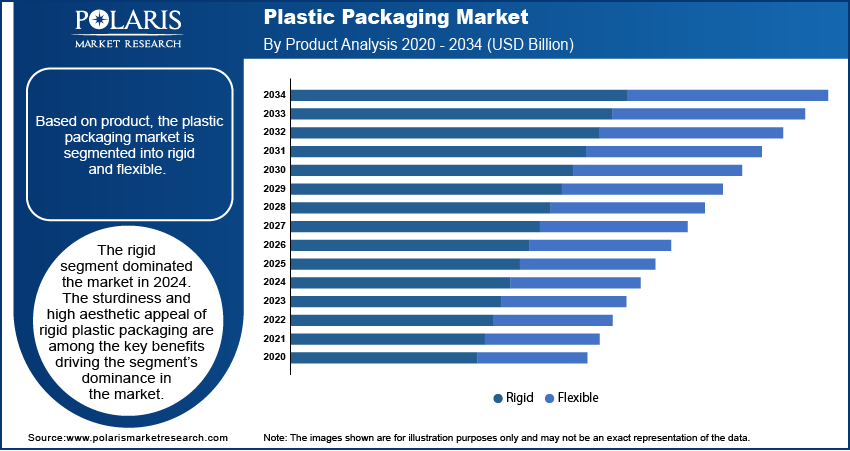

The plastic packaging market, based on product, is segmented into rigid and flexible. The rigid segment dominated the market with a revenue share of over 63.1% in 2024. The sturdiness and high aesthetic appeal of rigid plastic packaging are the key benefits driving the segment’s dominance in the market. Further, the excellent barrier to moisture, light, and oxygen provided by rigid packaging contributes to the higher share of the segment. The reusability of rigid packaging solutions such as bulk containers and other industrial products also contributes to their popularity.

Plastic Packaging Market Assessment by Application Insights

The plastic packaging market, based on application, is segmented into food & beverages, industrial packaging, pharmaceuticals, personal & household care, and others. The food & beverages segment led the market with a revenue share of 54.0% in 2024. Changing lifestyles and shifting food preferences have resulted in the growth of the packaging and processed food manufacturing sector, which in turn has boosted the demand for plastic packaging. Further, the rising consumption of alcoholic and nonalcoholic beverages contributes to the dominance of the segment in the market.

Plastic Packaging Market Regional Analysis

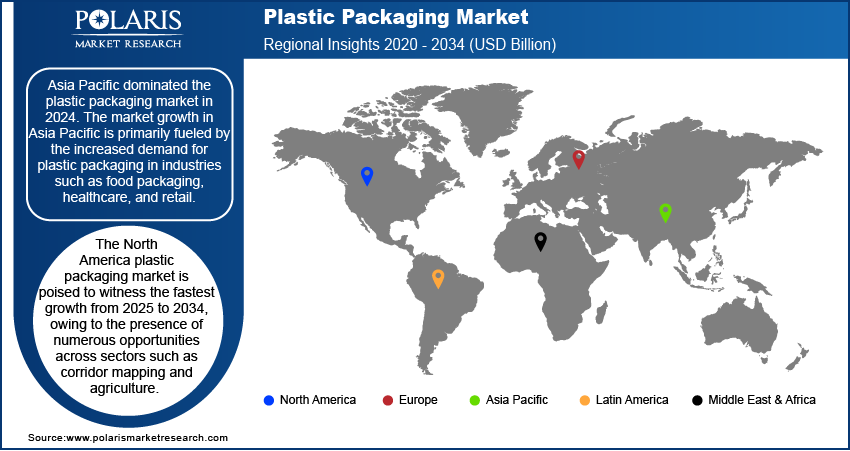

By region, the plastic packaging market report offers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market with a revenue share of over 46.0% in 2024. The plastic packaging market expansion in Asia Pacific is primarily fueled by the increased demand for plastic packaging in industries such as food packaging, healthcare, and retail, owing to its cost-effectiveness, durability, and affordability. Evolving consumer demands and technological advancements in packaging also contribute to the high adoption of plastic packaging in the region.

The plastic packaging market in North America is poised to witness the fastest growth from 2025 to 2034. The region presents numerous opportunities for plastic packaging producers across sectors such as corridor mapping and agriculture. The growing focus on the usage of biodegradable and recyclable plastic packaging to address environmental concerns is also likely to have a favorable impact on the regional market expansion.

Plastic Packaging Market – Key Players and Competitive Insights

The plastic packaging market is characterized by fragmentation. It has the presence of several small and medium-sized companies. The leading market players are making significant investments in R&D to extend their product lines. Also, they are undertaking several strategic initiatives, such as mergers and acquisitions, and partnerships, to improve their global reach. To expand and survive in a more competitive environment, market participants must offer innovative solutions.

In recent years, the plastic packaging market has witnessed several technological and innovation breakthroughs, with key players seeking to provide advanced solutions that help meet sustainability goals. The plastic packaging market research report offers a market assessment of all the key players, including Mondi Group; Berry Plastics Corporation; Sonoco Products Company; Amcor Limited; DS Smith plc; Bemis Company, Inc.; NatureWorks LLC; Consolidated Container Company; Reynolds Group Holdings Limited; and Alpla Werke Alwin Lehner GmbH & Co. KG.

List of Key Companies in Plastic Packaging Market

- Mondi Group

- Berry Plastics Corporation

- Sonoco Products Company

- Amcor Limited

- DS Smith plc

- Bemis Company, Inc.

- NatureWorks LLC

- Consolidated Container Company

- Reynolds Group Holdings Limited

- Alpla Werke Alwin Lehner GmbH & Co. KG.

Plastic Packaging Industry Developments

August 2023: DS Smith, a key provider of sustainable packaging solutions, announced the acquisition of Serbia-based packaging company Bosis doo. According to DS Smith, the acquisition will enhance its presence in Eastern Europe, especially in the FMCG sector.

June 2023: ALPLA UK announced the completion of the acquisition of iTEC Packaging. The company stated the acquisition will help expand its expertise as a packaging systems provider in the UK market.

Plastic Packaging Market Segmentation

By Material Outlook

- Polyethylene (PE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polystyrene (PS)

- Expanded Polystyrene (EPS)

- Polyvinyl Chloride (PVC)

- Bio-based Plastics

- Others

By Product Outlook

- Rigid

- Bottles & Jars

- Cans

- Trays & Containers

- Caps & Closures

- Others

- Flexible

- Wraps & Films

- Bags

- Pouches

- Others

By Technology Outlook

- Injection Molding

- Extrusion

- Blow Molding

- Thermoforming

- Others

By Application Outlook

- Food & Beverages

- Industrial Packaging

- Pharmaceuticals

- Personal & Household Care

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Plastic Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 396.64 billion |

|

Market Size Value in 2025 |

USD 412.87 billion |

|

Revenue Forecast by 2034 |

USD 598.84 billion |

|

CAGR |

4.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 396.64 billion in 2024 and is projected to grow to USD 598.84 billion by 2034.

The market is projected to register a CAGR of 4.2% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Mondi Group; Berry Plastics Corporation; Sonoco Products Company; Amcor Limited; DS Smith plc; Bemis Company, Inc.; NatureWorks LLC; Consolidated Container Company; Reynolds Group Holdings Limited; and Alpla Werke Alwin Lehner GmbH & Co. KG.

The rigid segment dominated the market in 2024.

The food & beverages segment led the market in 2024.