Plastic Injection Molding Machine Market Share, Size, Trends, Industry Analysis Report, By Type (Hydraulic, Electric, Hybrid, Others); By End-Use (Automotive, Healthcare, Food & Beverages, Industrial, Consumer Goods, Electrical & Electronics, Others); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM2095

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

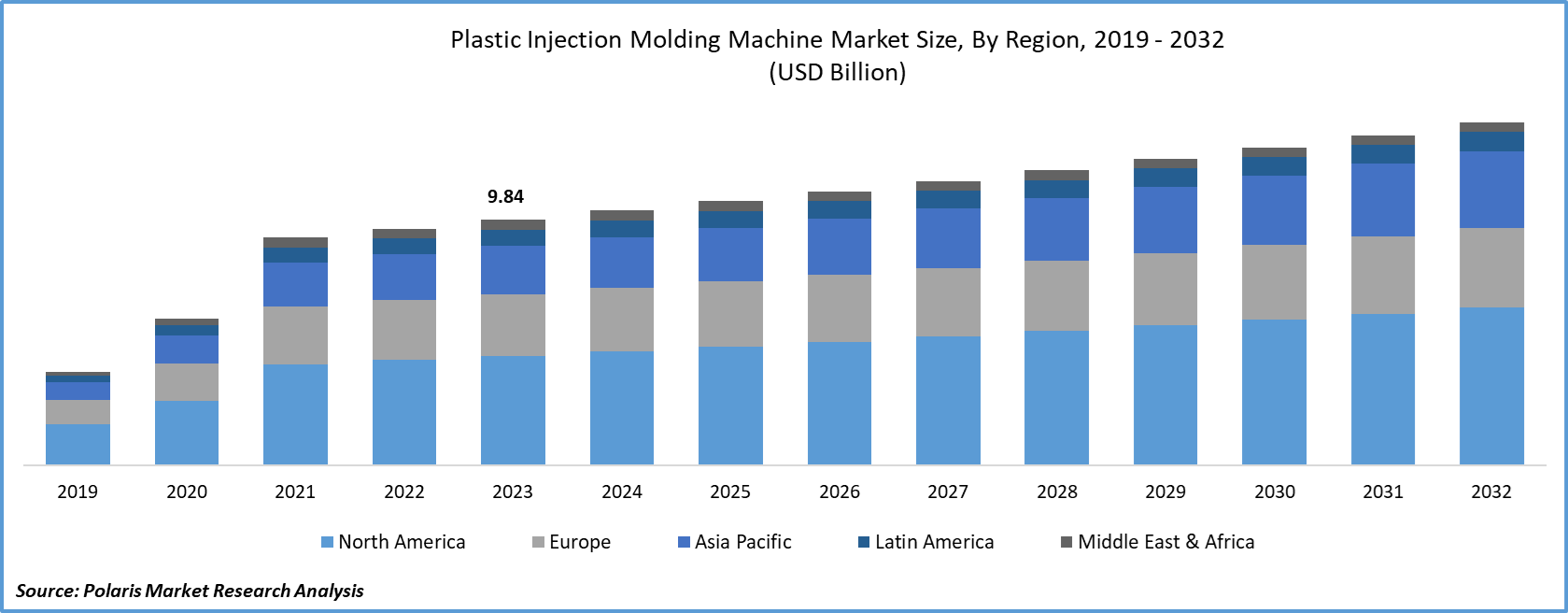

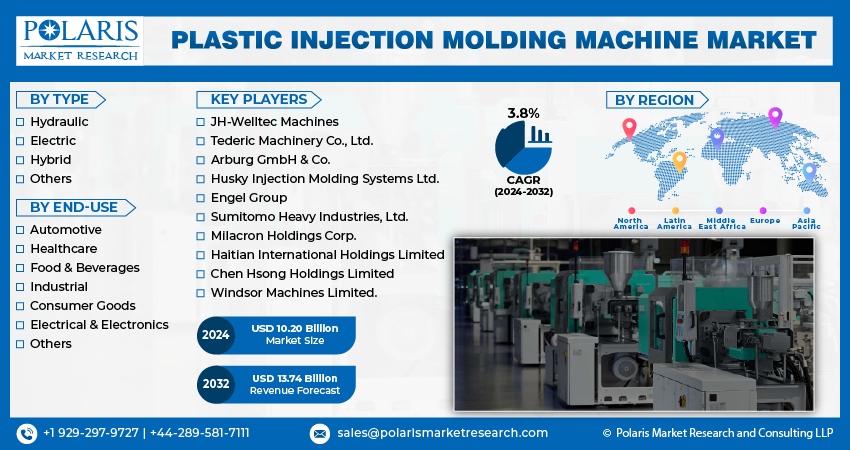

The global plastic injection molding machine market size was valued at USD 9.84 billion in 2023. The market is anticipated to grow from USD 10.20 billion in 2024 to USD 13.74 billion by 2032, exhibiting the CAGR of 3.8% during the forecast period.

These machines are used to manufacture plastic parts in numerous industries such as aerospace, automotive, and healthcare. This process utilizes customized molds to be filled according to specifications.

These plastic injection molding machines offer high precision, complex details, and durability. They use automation to manufacture cost-effective and high-quality products while minimizing wastage. The economic growth in countries such as China, Japan, and India and rising industrialization supplement the market growth. Global players are expanding into these countries to tap the market potential for plastic injection molding machine.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The demand for plastic injection molding machines has decreased during the pandemic due to supply-demand imbalances caused by the shortage of raw materials and disruptions in supply chains. The demand from the automotive, aerospace and defense, and consumer goods sectors has reduced during the pandemic owing to operational challenges, transportation delays, and travel restrictions.

The market for plastic injection molding machine has experienced logistic issues and workforce impairment. Manufacturing activities have also been halted due to various government regulations across the globe. Restrictions on imports of goods to curb the spread of the virus have further contributed to limiting the market growth for plastic injection molding machine.

Industry Dynamics

Growth Drivers

Increasing commercial activities across the globe drive the market growth for plastic molding machine. Greater requirement for mass production of high quality and complex components has increased the demand for these machines. The application of plastic molding has increased in healthcare, consumer goods, food and beverages, and automotive sectors owing to increased demand for higher efficiency and superior precision.

Growing investment in research and development, technological advancements, and application in diverse industries are some factors expected to be responsible for the market growth. Increasing adoption of these machines for enhanced efficiency in the use of raw materials, improved freedom of design, reduced production time, and higher productivity has accelerated the market growth for plastic molding machine.

The adoption of all-electric molding equipment has increased in North America owing to its digitally controlled high-speed servo motor that enables a faster, precise, and energy-efficient manufacturing process. This equipment results in higher quality parts, reduced labor costs, and improved profits. It allows consistent replication through digital controls with lower downtime and energy savings from 30% to 70%.

Electric injection molding equipment also works well for cleanroom applications and medical products owing to its higher precision. The equipment has tight precision, reduced scrap rates, and a cleaner process with no fluid leaks. It also offers quieter operation, higher rapid speeds, and shorter startup time. It is being used in diverse industries on account of its lower power requirements and reduced operating cost.

Report Segmentation

The market is primarily segmented on the basis of type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

The type segment has been segmented into electric, hydraulic, hybrid, and others. The demand for hydraulic equipment is anticipated to be high during the forecast period owing to its durability, higher efficiency, and lower costs associated with maintenance. This system uses hydraulic motors and pistons to process movements such as recovery and injection. It offers higher efficiency in the production of large volume parts and highly complex components. Hydraulic plastic molding equipment is priced lower than electric equipment. Spare parts of this equipment are easily available at lower costs. This equipment also offers better injection rates with precise injection and a high level of process stability.

Insight by End-Use

On the basis of the end-use, the market for plastic injection molding systems is segmented into automotive, healthcare, industrial, food and beverages, electrical and electronics, consumer goods, and others. The automotive segment held the highest market share for plastic molding equipment in 2020.

Growing modernization of vehicles, development of autonomous vehicles, the introduction of stringent vehicular regulations, and increasing penetration of luxury vehicles are some market factors influencing the plastic injection casting equipment industry. Mass production of complex components, growth in production volume of electric vehicles, increasing need for fuel-efficient vehicles, and greater need to reduce maintenance costs of commercial vehicles have supported the growth of this segment.

Geographic Overview

Asia Pacific dominated the global plastic injection molding machine market in 2020. Increasing urbanization, growing automotive industry, expansion of international players in this region, and technological advancements are some factors attributed to the growth of plastic injection casting equipment in this region.

Increasing application in the food & beverage and healthcare sectors in the developing countries of this region boosts the market growth for plastic injection molding equipment. The industrial growth in countries such as China, India, and Japan, rising automotive penetration, and the established electronics industry offer growth opportunities for plastic injection molding equipment.

Competitive Landscape

The leading players in the plastic injection molding machine market include JH-Welltec Machines, Tederic Machinery Co., Ltd., Arburg GmbH & Co., Husky Injection Molding Systems Ltd., Engel Group, Sumitomo Heavy Industries, Ltd., Milacron Holdings Corp., Haitian International Holdings Limited, Chen Hsong Holdings Limited, and Windsor Machines Limited.

Plastic Injection Molding Machine Industry Developments

- February 2024: Shibaura Machine Company announced the launch of its first medical-specific all-electric injection molding machine to the North American market.

- December 2023: Husky Technologies opened a state-of-the-art service facility in Jeffersonville, Indiana. According to Husky, the launch of the new facility confirms its commitment to service excellence and innovation.

Plastic Injection Molding Machine Market

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.20 billion |

|

Revenue forecast in 2032 |

USD 13.74 billion |

|

CAGR |

3.8% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2032 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 - 2032 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

JH-Welltec Machines, Tederic Machinery Co., Ltd., Arburg GmbH & Co., Husky Injection Molding Systems Ltd., Engel Group, Sumitomo Heavy Industries, Ltd., Milacron Holdings Corp., Haitian International Holdings Limited, Chen Hsong Holdings Limited, and Windsor Machines Limited. |